Yes, you can contest a life insurance beneficiary designation and you may be. A party can challenge a beneficiary’s right to recover under a life insurance policy by showing that the person who owned the policy (“decedent”) changed the policy’s beneficiary designation because of undue influence.

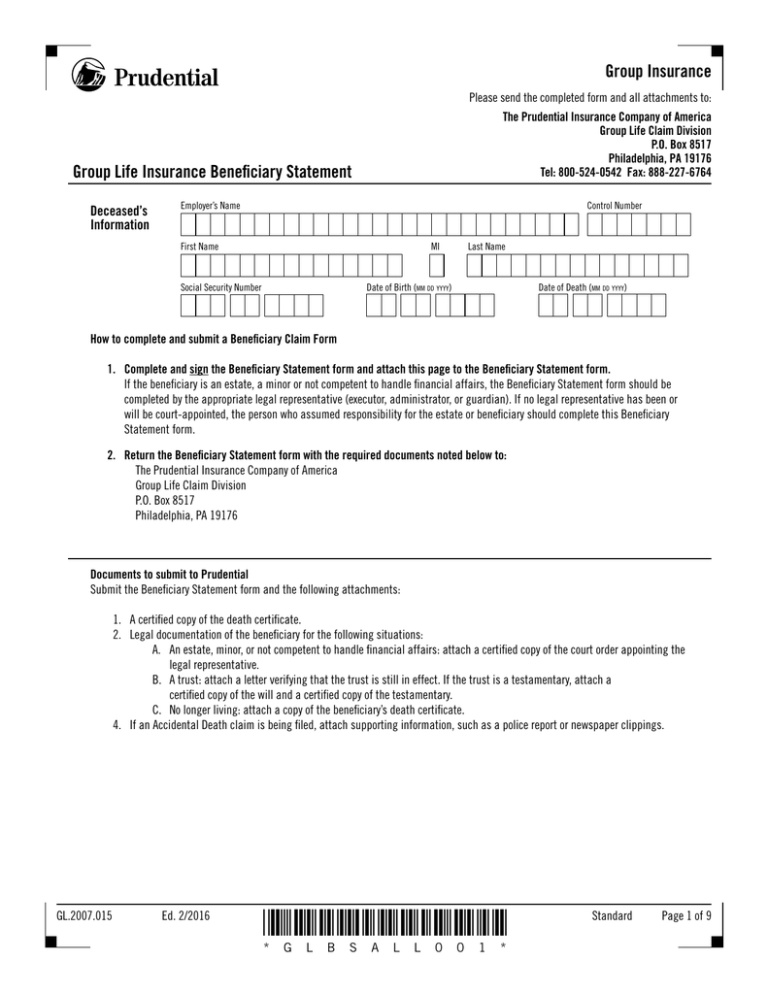

Group Life Insurance Beneficiary Statement

You can challenge a beneficiary designation if some factors apply.

Challenging life insurance beneficiary designation. If an unscrupulous family member, neighbor or caregiver obtains a form to change the beneficiary designation and simply forges the signature of the policy owner, the change is. The burden to prove the transfer of ownership or change of beneficiary designation is upon the person claiming the legitimacy of the gift. He signed a life insurance policy through his company, merill lynch, for the sum of.

Challenging a life insurance claim in california. For example, perhaps the deceased person was incompetent or under undue influence when they signed their legal documents. Beneficiaries named in a previous beneficiary designation, heirs of the estate, beneficiaries of a trust, the trustee.

No other formality is required. Challenging a life insurance beneficiary designation can be a complex, difficult, and heavily litigated process. An insured may designate a beneficiary of the proceeds of a policy of insurance.

There are many legitimate reasons for challenging the beneficiary on a life insurance policy. What happens, however, if the will is found to be invalid? Ad helping expatriates in indonesia to get the best international life insurance cover.

This makes it all the more important to enlist the help of an expert in either case. The main problem with challenging a beneficiary is that it can take years to resolve a dispute and the legal. A person with standing to challenge a beneficiary designation might include:

Tennessee courts recognize that it is difficult for a party to establish undue influence through direct evidence. Contesting & challenging life insurance payouts. Defending your designation as beneficiary in a life insurance beneficiary dispute is equally difficult.

Yes, this is one of the most common reasons. It's more difficult to contest a life insurance beneficiary than a will, because life insurance doesn't go through probate. Challenging a life insurance beneficiary designation can be a complex, difficult, and heavily litigated process.

The facts underlying moore v. However, if you can show that the deceased neglected. This can be done by a beneficiary designation that is signed by the insured.

Once the beneficiary is officially challenged, the insurance company will file what is called an interpleader action with the courts. Whether the decedent lacked mental capacity; At our law firm, we strive to get the most favorable result for our clients in the fastest and least expensive way engaging in negotiations and alternative dispute resolutions before commencing litigation.

Life changes by the policy holder including marriage, divorce, remarriage, adoption, childbirth; An insured may also designate a beneficiary of a policy of insurance in a will. Defending your designation as beneficiary in a life insurance beneficiary dispute is equally difficult.

Beneficiary changes near the policyholder’s end of life. A change to the beneficiary designation can be undone if undue influence, fraud, or trickery can be established. A loved one dies with a life insurance policy intact.

If the current beneficiary is named on the policy, you must prove that they either fraudulently added themselves, took advantage of a relative’s diminished capacity to have themselves added, or are. Contesting a life insurance beneficiary is difficult and may result in a legal battle. Ad helping expatriates in indonesia to get the best international life insurance cover.

To contest a beneficiary designation, you would have to show one or more of the following factors, as seen in vermylen v. New jersey so, here's the story, my brother recently passed away. The best way to deal with this sort of problem is to avoid it in the first place.

This allows the person who passes away to ensure that the individual named will receive the assets. I.e., was senile, delusional, or of unsound mind at the time the life insurance beneficiary designation was done or was subjected to fraud, coercion or undue influence during its signing and implementation. That spouse will remain listed as the primary.

Challenging a life insurance beneficiary designation my question involves insurance law for the state of: The supreme court of canada extended the circumstances where an irrevocable beneficiary designation made in a life insurance policy can be challenged after the death of the policy holder. Challenging a life insurance beneficiary is a complex and challenging undertaking.

One such example might be an heir that was born after the policy was written, and the policy was not updated to reflect the new family member. Typically challenges to a life insurance beneficiary claim are filed by family members of the decedent against the latter’s divorced spouse. When a family member passes away,.

Contesting beneficiary designations arises for a variety of reasons, among them:

Contesting A Life Insurance Beneficiary Designation – Life Insurance Lawyer

Contesting A Life Insurance Beneficiary Designation – Life Insurance Lawyer

Free Change Of Beneficiary Letter Free To Print Save Download

Can You Contest The Beneficiary Designation On A Life Insurance Policy Or Retirement Account – Dean

Beneficiary Archives – Ark Advisor

Can Power Of Attorney Change A Life Insurance Beneficiary

Contesting A Life Insurance Beneficiary Designation Boonswang Law

Life Insurance Beneficiary Uses Undue Influence On An Elderly Person

Contesting A Life Insurance Beneficiary Designation – Life Insurance Lawyer

How To Contest A Life Insurance Beneficiary 12 Steps

Free Life Insurance Proceeds Letter Free To Print Save Download

Contesting A Life Insurance Beneficiary Designation – Life Insurance Lawyer

You Can Challenge Beneficiary Designations As In A Will Contest

Contesting A Life Insurance Beneficiary Designation – Life Insurance Lawyer

Everything You Need To Know About Disputing A Life Insurance Beneficiary

Contest The Beneficiary Of A Life Insurance Policy In Florida 6 Points To Challenge The Beneficiary Of A Life Insurance Policy Florida Probate Lawyers Pankauski Hauser Lazarus

Beneficiary Archives – Ark Advisor

/ContestLifeInsurance-5451e5341e0b451290d26a0ab5309c70.jpeg)