For an automobile allowance to be considered as acceptable stable income, the borrower must have received payments for at least two years. The housing allowance may be added to income but may not be used to offset the monthly housing payment.

Housing Allowance For Pastors Fannie Mae

A housing allowance is often a common and critical portion of pastoral income.

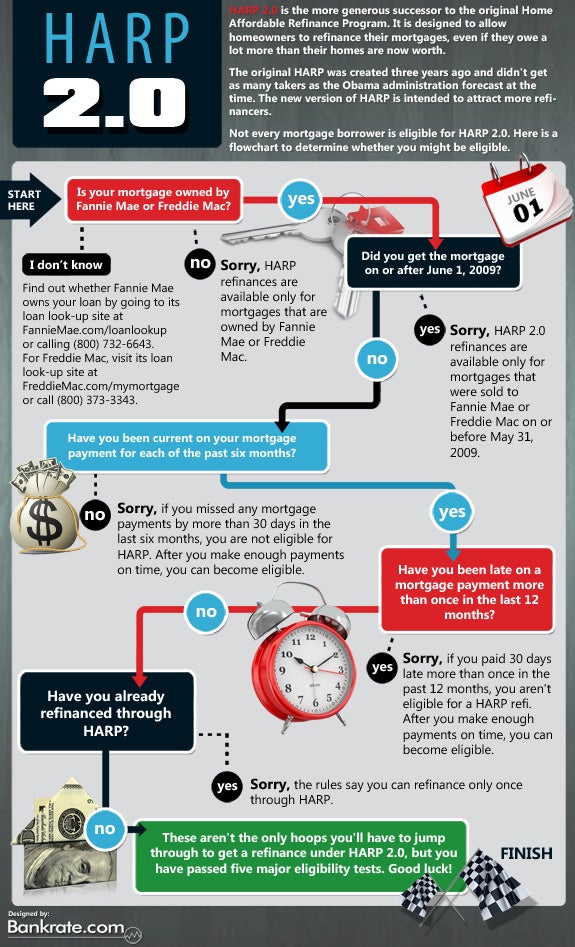

Housing allowance for pastors fannie mae. Fannie mae and freddie mac have long been known for the preferred loan when a 20% down payment is involved. A housing or parsonage allowance may be considered qualifying income if there is documentation that it has been received for the most recent 12 months and the allowance is likely to continue for the next three years. The lender must include all associated business expenditures in its calculation of the borrower’s total dti ratio.

It is time again to make sure you update your housing allowance resolution. The net worth deduction will not apply in future periods, which makes the timing of a large dta allowance reversal in 4q12 disadvantageous for fannie mae, as it would. _____ mortgage assistance application if you are having mortgage payment challenges, please complete and submit this application, along with the required documentation, to summit credit union via mail:

Designed for properties with an 80% of higher concentration of undergraduate students, fannie mae student housing loans begin at $1 million and have a ltv allowance of. The collaboration includes homesight of king and snohomish counties, the housing authority of snohomish county, and house key teacher, a mortgage program between fannie mae and the washington. As long as we can document the receipt of the housing income through a signed letter from the church/employer stating the actual breakdown of the pay and by providing copies of the checks received, we should be able to.

Column b the excess housing allowance exclusion allowed for california over the federal : The housing allowance may be added to income but may not be used to offset the monthly housing payment. Fannie mae revealed that more than 1 million of its borrowers are already in forbearance, but doesn’t expect that figure to stop growing any time soon.

Fill out the information boxes a, b, c, e, and f. For either the rental value of a home furnished or the rental Therefore, it is important to request your housing allowance and have it designated before january 1 so that it is in place for all of 2020.

If you receive as part of your salary (for services as a minister) an amount officially designated (in advance of payment) as a housing allowance, and. That means that if you only work ten hours a week at the church, then you cannot claim a $50,000 housing allowance. Even though it is not reported on the tax returns, a pastor’s housing allowance can be used in qualifying for a mortgage loan to purchase or refinance a home.

Include his base salary of $25,000, his unaccountable car allowance of $2,500, and the $6,000 social security tax allowance in box 1. The largest benefit of the income is that it is nontaxable income. The housing allowance may be added to income but may not be used to offset the monthly housing payment.

When and what types of income allowances are allowed with fannie mae. Fannie mae/freddie mac form 710 page 1 of 4 june 2021 loan number: The housing allowance may be added to income but may not be used to offset the monthly housing payment.

Both offer 3% down, allow. • housing exclusion for state‑employed clergy effective january 1, 2003, for clergy members employed by the state of california, up to 50% of gross salary may be allocated : Freddie mac continued to record a valuation allowance on a portion of its net deferred tax assets as of march 31, 2013.

According to tax law, if you are planning to claim a housing allowance deduction (actually an ‘exclusion’) for the upcoming calendar year, your session is required to designate the specific amount to be paid to you as housing. A housing or parsonage allowance may be considered qualifying income if there is documentation that it has been received for the most recent 12 months and the allowance is likely to continue for the next three years. The housing allowance for pastors is not and can never be a retroactive benefit.

Pastoral housing allowance for 2021. How to give or receive a down. A housing or parsonage allowance may be considered qualifying income if there is documentation that it has been received for the most recent 12 months and the allowance is likely to continue for the next three years.

It is a form of income to fully pay or at least offset a part of the expense to own or rent a home. Only expenses incurred after the allowance is officially designated can qualify for tax exemption. Flight or hazard pay, rations, clothing allowance, quarters’ allowance, and proficiency pay are acceptable sources of stable income, as long as the lender can establish that the particular source of income will

Your housing allowance is also limited to an amount that represents reasonable pay for your ministerial services. What is a clergy housing allowance. Our fha guidelines also work well for clergy and their scenarios, including pastoral housing allowance.