You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of. Because the rmd is being donated directly to a charity, it does not count as taxable income to you.

Top 5 Faqs Regarding Ministers Housing Allowance – Baptist21

Unfortunately, that is still being figured out.

Housing allowance for pastors 2020. When housing and utilities are provided, an additional amount of clergy compensation may be designated as housing allowance (see below) to the extent allowable by the tax code. Pfaffe, cpa, llc 302 n. This worksheet is provided for educational purposes only.

Everyone wants a clear list of what is permissible and what is not allowed for the housing allowance. Minimum recommended housing allowance is the fair rental value (furnished) of suitable properties in the local market plus utilities and maintenance, but not less than 30% of the pastor’s cash salary. Ministers who own their homes can exclude the lowest of the following three amounts of income from the federal income tax if their ecclesiastical employer grants them a housing allowance:

Umc support has prepared a handy document titled “housing. We also have a ‘housing allowance resolution’ drafted for you on our website; • housing allowance provided for pastors:

A cleric can have a portion of his or her salary declared as a housing allowance, and thereby exempt the eligible amount from federal income tax. For this reason, rbi has three online housing allowance worksheets available for you: Only expenses incurred after the allowance is officially designated can qualify for tax exemption.

Websites providing accurate and useful information regarding pastors housing allowance 2020 are shown on the results list here. 3rd street, suite 107, watertown, wi 53094 Irc § 107 provides an exclusion from gross income for a “parsonage allowance,” housing specifically provided as part of the compensation for the services performed as a minister of the gospel.

A designated housing allowance must be recorded in the official records of the congregation or other employer and should be identified on budget forms. Thus, if the pastor does not spend the entire amount, the unspent amount is subject to federal and state income taxes only. There are different rules for retired pastors serving a church.

Local housing can be the greatest variable in costs from region to region within the cac. By amy monday, march 9, 2020. The housing allowance for pastors is not and can never be a retroactive benefit.

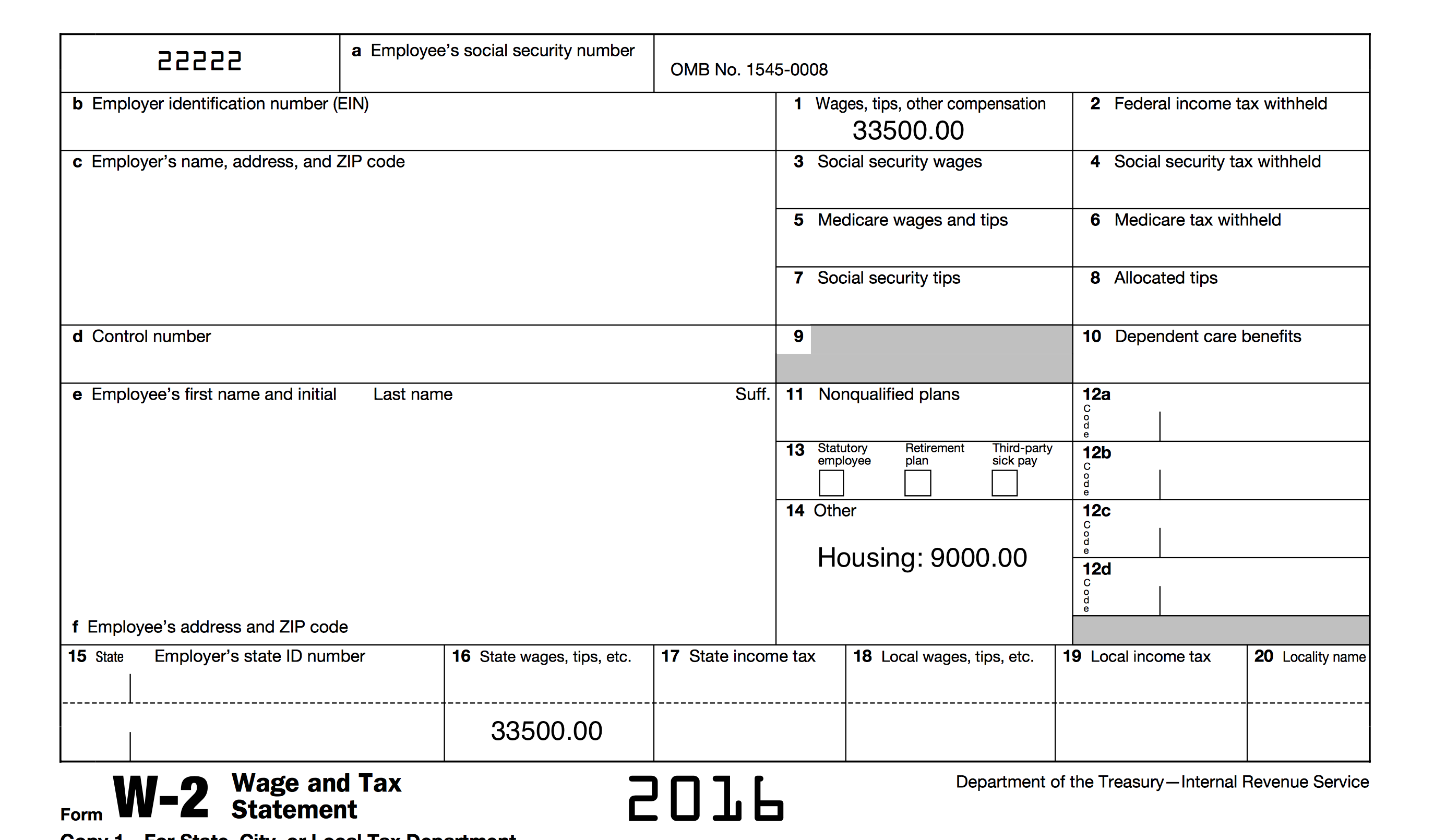

If your employee will be claiming the clergy residence deduction on their personal income tax and benefits return, they may get a letter of authority from a tax services office to reduce the. This is an excerpt from the pastor’s wallet complete guide to the clergy housing allowance, now available for purchase on amazon. To enter the housing allowance:

Therefore, it is important to request your housing allowance and have it designated before january 1 so that it is in place for all of 2020. Note that under section 107 of the internal revenue code, clergy pension distributions can also be declared as a housing allowance. A retired pastor should designate all of the salary as a housing exclusion.

Please note that designation of housing for tax purposes only affects taxes for , and not the pastors. This is of particular concern in high housing cost areas, He has unpaid pto days.

Clergy housing allowance clarification act of 2002; Scholarship enrollment, scholarship details will be also included. For those who have reached 70 ½ and must take required minimum distributions, you have the option of donating your rmd to charity rather than claiming the income for yourself.

One for a pastor who lives in a manse, one for a pastor who rents, and one for a pastor who owns a house. Therefore, it is important to request your housing allowance and have it designated before january 1 so that it is in place for all of 2020. The housing allowance for united methodist clergy is designed as an exclusion from income, not a deduction, as it relates to federal income tax.

Clergy housing allowance worksheet tax return for year 200____ note: The fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. It can be downloaded and attached to your session minutes, or simply incorporated into the language of.

It should be noted that the housing allowance is an income tax concept and is actually unrelated to fair compensation. That the allowance 1) represents compensation for ministerial services, 2) is used to pay housing expenses, and 3) does not exceed the fair rental value of the home (furnished, plus utilities). The fair rental value of the parsonage (furnished, plus utilities) is $10,000 per year.

If you receive as part of your salary (for services as a minister) an amount officially designated (in advance of payment) as a housing allowance, and. Pastors housing allowance 2020 : The housing allowance for pastors is not and can never be a retroactive benefit.

31, 2019 for compensation in 2020). Only expenses incurred after the allowance is officially designated can qualify for tax exemption. I refer to housing allowances in the hourly calculation of unpaid hours pto our parish priest goes.

Housing Allowance – Fill Online Printable Fillable Blank Pdffiller

Pastoral Housing Allowance For 2021 – Pca Rbi

Ministers Housing Allowance Open Bible East

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church – The Pastors Wallet

The Pastors Wallet Complete Guide To The Clergy Housing Allowance – Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazoncom

Retirement Benefits And Housing Allowance For Ministers Of The Gospel Wels Bpo

Clergy Housing Allowance Worksheet – Fill Out And Sign Printable Pdf Template Signnow

Church Pension Group Clergy Housing Allowance

2020 Housing Allowance For Pastors What You Need To Know – The Pastors Wallet

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet – The Pastors Wallet

The Pastors Wallet Complete Guide To The Clergy Housing Allowance By Amy Artiga

2020 Housing Allowance For Pastors What You Need To Know – The Pastors Wallet

How Much Housing Allowance Can A Pastor Claim – The Pastors Wallet

Pin On Examples Billing Statement Template

The Pastors Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazoncom Books

Video Qa How Do You Get The Housing Allowance For A Pastor – The Pastors Wallet

The Pastors Wallet Complete Guide To The Clergy Housing Allowance – Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazoncom