If there is no beneficiary cited on a life insurance policy (or the beneficiary is the estate), the proceeds are paid to the estate. Not everything you leave behind when you die will go through probate.

Are Life Insurance Proceeds Subject To Probate – Estate And Probate Legal Group Estate And Probate Legal Group

Whether or not a life insurance policy payout passes through probate depends on a number of factors such as whether or not the policy has any named beneficiaries, whether or.

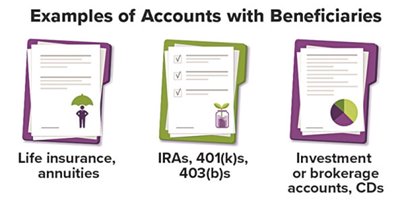

Do life insurance policies go thru probate. The best way to ensure that neither your death benefits nor your property get stuck in the probate process is to ensure your policy’s beneficiary designations are properly set. Retirement accounts—iras or 401 (k)s, for example— for which a beneficiary was named. If at least one of the designated beneficiaries survives the decedent, the life insurance proceeds pass directly to the beneficiary outside of probate.

When a life insurance policy has to go through probate, there are administrative headaches. Typically, the benefits of a life insurance policy will be given directly to the beneficiary that is named on the policy without having to go through probate. As we described in the probate steps above, debts and taxes must be paid before assets are distributed to heirs.

Does a life insurance policy have to go through probate? If you are a beneficiary of a home asset, it’s important that you take the steps ahead of time to understand the insurance policy and ensure that the property in question is covered properly through the probate process. This depends on the policy.

Payouts from life insurance policies rarely go through the process. Here are kinds of assets that don't need to go through probate: However, there are situations that would require a life insurance policy to go through probate.

If the beneficiary predeceases the insured, then the life insurance money then becomes an estate asset and is subject to florida probate. Does life insurance go through probate? The decedent's retirement accounts, such as 401(k)s or iras, name specific beneficiaries and do not pass through probate.

Bank accounts with someone listed as payable on death will transfer to that person upon the death of the owner. But there are bigger reasons to keep that policy out of the probate process. If you have no contingent beneficiary, the life insurance benefits will be paid to your estate, and they will have to go through probate.

The bank may require a death certificate before it. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) property held in a living trust. If there is a signed beneficiary form and the form says that the proceeds should pass to the estate, then again the funds would go through the probate process.

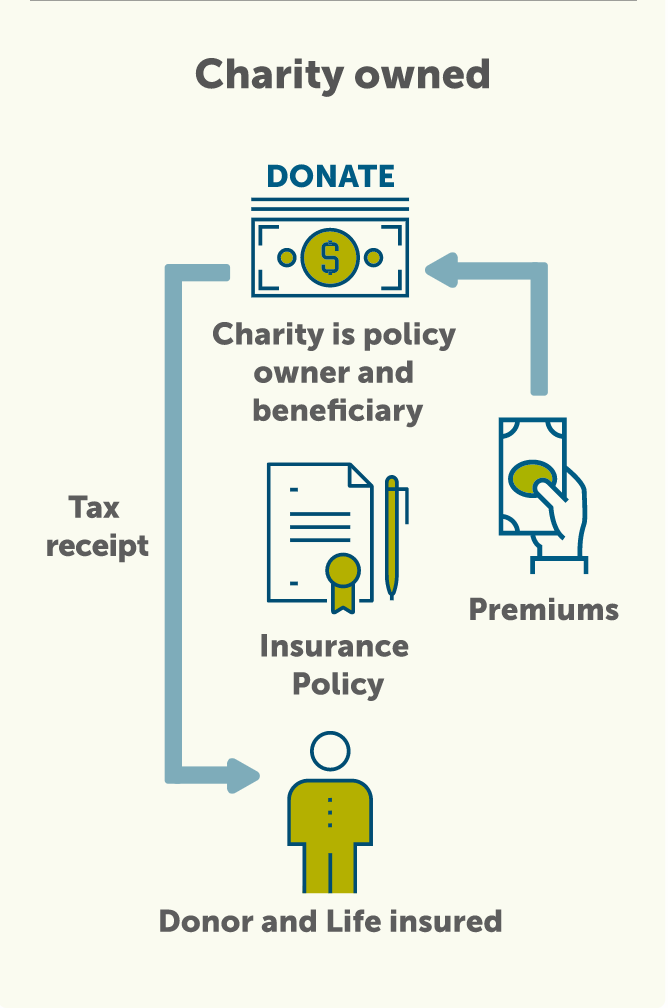

On the other hand, if the estate is set up as the beneficiary, or if the beneficiaries stated on the policy. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Therefore, life insurance with a named beneficiary does not pass through probate.

Do i need probate for life insurance payments? If no beneficiary outlives you, then the life insurance proceeds become probate estate assets, because the money is now officially the decedent’s money. The proceeds from life insurance policies do not pass through probate as long as your named beneficiaries are available to take the payout.

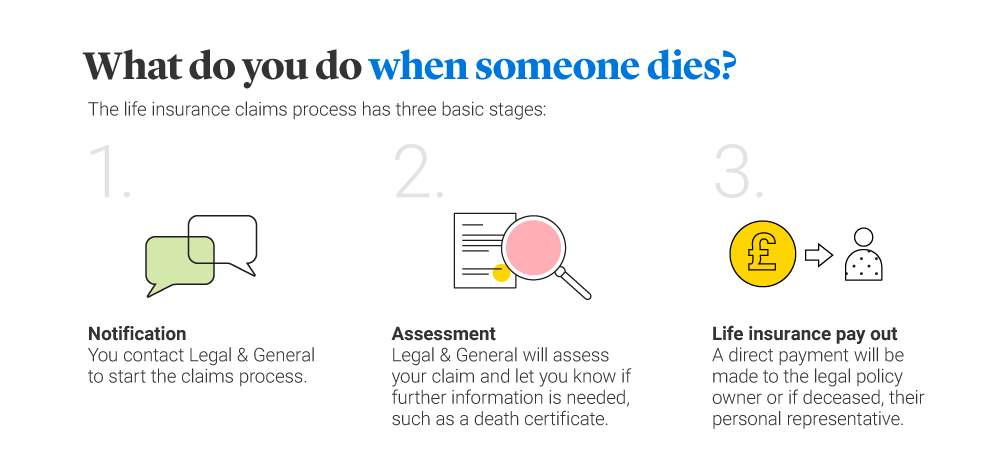

Life insurance policies, retirement accounts, securities and stocks don’t need to go through probate since they will have beneficiaries named who will automatically take ownership. When life insurance is part of an estate a life insurance policy has one or more designated beneficiaries if the decedent completed a beneficiary designation form for the policy before their death. A check is sent to the beneficiary shortly after the death claim and certified death certificate are sent to the life insurance insurance company.

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. That occurs if the life insurance policy at issue is made payable to “your estate” or when, under the terms of many policies, the only named beneficiary on the policy dies before you do. Here’s what you can do to make sure you are covered:

Not surprisingly, trouble can arise, such as if a beneficiary named in a life insurance policy is different from that in a decedent’s estate; It may be a distribution that was not intended. Life insurance that is left to a person as beneficiary does not have to go through probate.

Examples include life insurance policies, retirement accounts and even vehicles and bank accounts which have some designated as payable on death. Life insurance proceeds are generally not part of your estate if you have named a beneficiary to your life insurance policy. Generally, life insurance does not have to go through the probate process.

You can also designate beneficiaries of certain assets, ensuring they transfer without going through probate. After your death, your beneficiaries deal directly with the insurance company to receive the money. If the life insurance policy was set up so that it would go to a named beneficiary, by law they will not need probate.

Another situation in which your life insurance benefits may need to go through probate is if the named beneficiary is a minor child. However, if a beneficiary is not named, the money will just go into the deceased’s estate, if the policy value is over the threshold, probate may be. If your life insurance beneficiary is a minor child.

It is viewed as an entity separate from the deceased person. Usually, life insurance death benefits are paid out directly from the insurer to the beneficiary or beneficiaries without going through probate. If there’s a will, then it would get distributed per the terms of the will.

The funds would pass to the trustee whose powers as trustee would spring to life upon the probating of the will. Any life insurance policies in the decedent's name also avoid probate, with proceeds going directly to the designated beneficiaries. Understand what assets need to go through probate in your state.

The answer to these questions:

Should A Will List Life Insurance Policy Information Legalzoomcom

Protecting My Family Universal Life Insurance Life Insurance Marketing Life Insurance Quotes

How To Find Out If Someone Has Life Insurance

How Do Life Insurance Pay-outs Work Legal General

Pin On Insurance And Investments

How To Get Started On Your Estate Plan My Daily Bubble Estate Planning How To Plan Life Insurance Policy

Sample Assignment Of Promissory Note

Life Insurance Is Tax Free Well Mostly And Usually But Not Certainly Not Always Life Insurance Life Insurance Premium Life Insurance Policy

Life Insurance And Tax How To Save Your Money Empire Life Empire Life

Pdf Download Whats Wrong With Your Life Insurance By Norman F Dacey Free Epub Life Insurance Health Care Insurance Insurance Industry

Trust Lawyer California Trust Services And Litigation Attorneys – Keystone Law Group Life Insurance Policy Life Insurance For Seniors Universal Life Insurance

Choosing Life Insurance Beneficiaries Aig Direct – Blog

Are Life Insurance Benefits Subject To Probate In California Legalzoomcom

Hdvest Blog Attach News Web Design Blog Layout Design Blog Article Design

Plan For Wealth Life Insurance Marketing Ideas Life Insurance Quotes Life Insurance Facts

Do Life Insurance Proceeds Go Through Florida Probate

Nomedicalinfograph Life Insurance Companies Life Insurance Policy Life Insurance

Life Insurance Beneficiary Mistakes To Avoid – Community First Credit Union