A claim is submitted and then the insurance company takes action to reimburse the insured. Below is a brief discussion of these pros and cons as they apply to indemnity plans.

Dental Indemnity Insurance Explained

It gives customers the choice of selecting their own network providers (unlike dental hmo) and any cost incurred is footed by the customer.

Indemnity dental insurance pros and cons. Each type has its own pros and cons so it is important to determine your dental needs first and see which of the two will suit you to make sure that you will be able to. Every form of dental coverage has its advantages and disadvantages. If you have ongoing dental issues, such as receding gum lines, then dental insurance is probably a good deal to help offset any future costs.

What are the benefits of short term health insurance? This is just like a service of payment after service. An indemnity dental plan is sometimes called “traditional” insurance.

A lump sum hospital confinement benefit; Indemnity dental plan with benefit increases. Because there are no benefits and coverage, people with this type of insurance usually pay more.

Very affordable premiums that can cost substantially less, sometimes even half of what is charged for an affordable care act health plan. However, if you’re living in rural areas and the majority of the dental providers that are covered by ppo are inaccessible from your area, indemnity plan might be a. Before you purchase a dental insurance policy, though, evaluate the pros and cons.

Finding a dental insurance plan that covers orthodontics can be a challenge, and those that do typically require waiting periods that can span up to two years. Hospital indemnity insurance plans for those under the age of 65. Generally an indemnity plan allows patients to choose their own dentists, but it.

Most dental plans that are worth their salt will cover at least two annual exams and. Dental services are often paid up front by the insured. First, let's talk about the pros of having dental insurance.

This can save you time and money. As for basic and major services, the insurer covers 60% of the cost once you meet the deductible. For example, an indemnity plan, much like a ppo plan, covers 100% of preventative services.

However, there are some indemnity dental plans that increase benefits every year. Indemnity dental insurance has been associated with significant advantages and disadvantages based on the terms and execution of the plan. Another advantage of this type of plan is that your insurance company is going to pay for the majority of your usual dental costs.

No network limitations (for most indemnity plans) no requirement to get referrals for more advanced dental services; Below is a list of the pros and cons surrounding dental indemnity insurance so that you can determine if it's right for you and/or your family. Although the court ruling may provide more health insurance options for consumers, it poses hidden risks.

There is almost always a deductible to be met. The plan provides benefits and disadvantages for dentists, patients or owners and employers. The pros and cons of indemnity dental insurance.

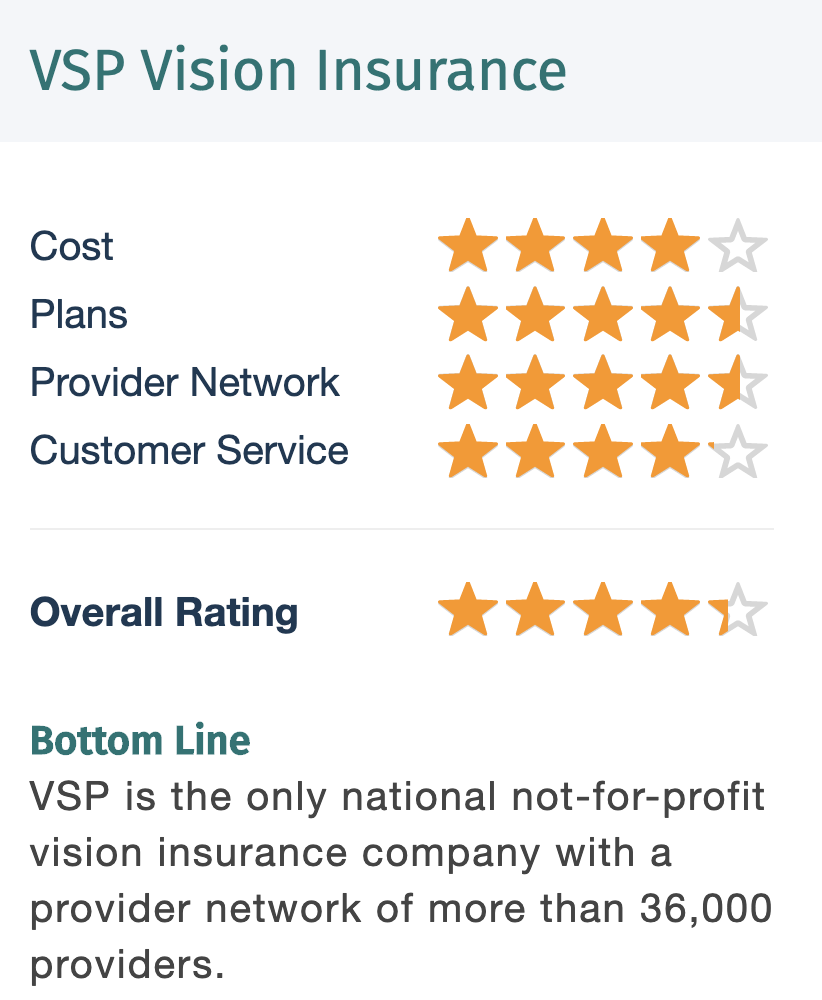

Dental insurance can also lower the cost of procedures like fillings, extractions, crowns, and root canals. Hidden risks of fixed indemnity plans. Premium savings can be used to purchase other forms of care like dental or vision coverage.

There are pros and cons to purchasing a dental policy, either from your employer or from an insurance marketplace like healthcare.gov. Extreme flexibility on dentist choice; Let's discuss in full detail the pros and cons of having dental insurance.

Fixed indemnity insurance comes with no deductible and will make a fixed payment to you if you suffer from the injury or illness covered by the policy. Indemnity plans accounted for 11% of the dental benefits market in 2010, down from 38% in 2001.3 in this type of plan an insurance company pays claims based on the procedures performed, usually as a percentage of the charges. One of the advantages of this type of plan is that you will not have to get referrals in order to see a specialist in the field.

Pros if you or your family have extensive dental health needs that go beyond the annual checkup and regular cleanings, dental insurance can help you save on costs, covering expensive dental care such as fillings, root canals and even orthodontics. Dental insurance works a little differently. For the person covered by the insurance plan, its terms offer the.

In some cases dental coverage won’t save you money at all, even if you’re getting dental care. Indemnity plans usually have the highest monthly premiums of any dental insurance plan. Dental indemnity plans are insured and/or administered by cigna health and life insurance company (chlic) or connecticut general life insurance company.

Dentists are paid by the insurance company a particular percentage of cost of services rendered.

Delta Dental Insurance Review Top Ten Reviews

Pin On Je Health Care Solutions

Infographic Student-centered Learning Student Centered Learning Student Center Student Learning

Making Sense Of Dental Insurance Leander Dental Care

5 Key Life Insurance Tips And Advice To Protect Your Family Life Insurance Facts Life Insurance Quotes Life Insurance Agent

Polymer Modified Bitumen Pmb Market Overview By Products Application Road Construction Roofing Others Comp Road Construction Grow Traffic News Finance

Best Dental Insurance Companies In 2021 Policyadvice

The Pros Cons Of Choosing The Right Dental Insurance Plan

Is Indemnity Dental Insurance Right For You

Ameritas Dental Insurance Policy Review Independent Health Agents

Making Sense Of Dental Insurance Leander Dental Care

Advantages To Indemnity Health Insurance Plans Di 2021 Asuransi Kesehatan Asuransi Perencanaan

What Is Indemnity Dental Insurance Spirit Dental Vision

8 Reasons Why A Discount Dental Plan Is Better Than Dental Insurance – My Family Life Insurance

Maklumat Pelayanan Eppid-bbppmpvboe

Pdf Effects Of Public And Private Health Insurance On Medical Service Utilization In The National Health Insurance System National Panel Study In The Republic Of Korea