Once you purchase a car insurance policy, it is advised to keep tabs on the insurance. Secondly, car insurance provides a layer of protection against the uncertainties of the road.

Your boss likely asked you directly because the easiest way for employers to verify someone’s car insurance is to ask them for proof of insurance.

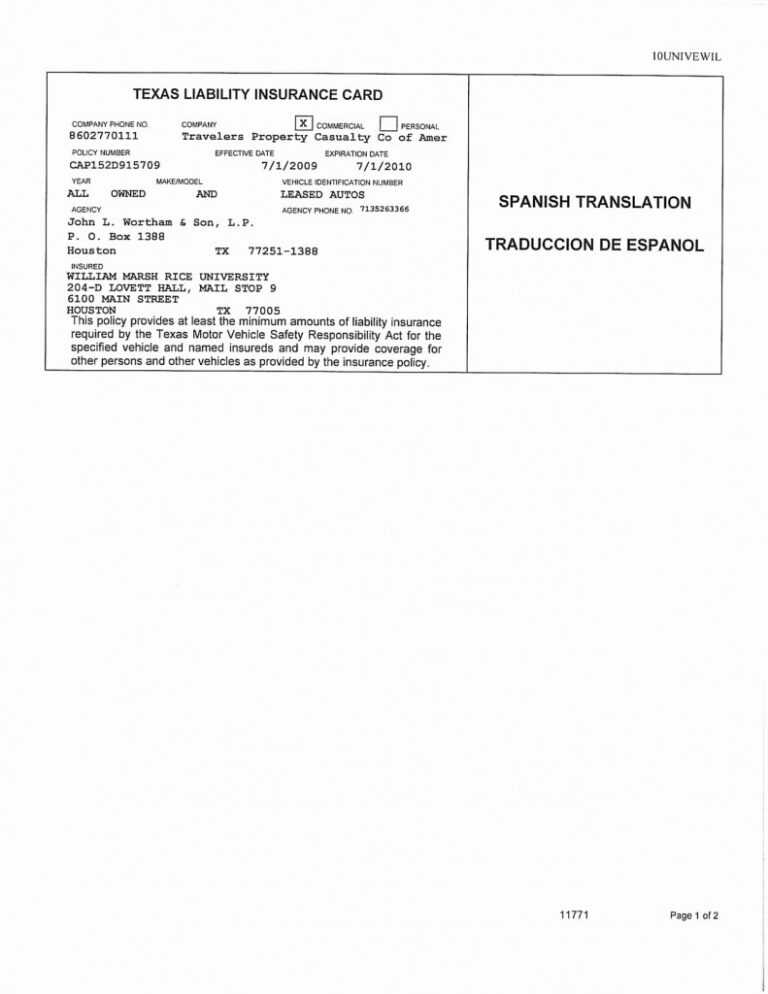

How to verify car insurance. Enter your vehicle number and verify the expression as given in the image. If you need to find out if someone has auto insurance coverage, you can request information on a person’s auto insurance if you have a valid reason. Select whether you want to conduct the search using your policy number or your vehicle’s registration number.

If you’re unsure whether you or a loved one has coverage, check bank statements to see if there are any payments to car insurance companies. Keeping a check on your car insurance policy is as important as purchasing a comprehensive insurance policy for your car. Select either single or fleet.

Retain all the required records, such as the name, accident location (if known), accident date, cell phone number, email id, registration number of the vehicle, and address. Gather information about the auto insurance that you want to verify. The first method is to visit the concerned regional transport office and check by providing the requisite details.

If the vins match, then the information may be wrong in our database. Check your glove box for proof of car insurance, such as your car registration. After you enter the information, your policy details will be displayed on the screen.

Last 5 digits of vehicle identification number (vin) change information. The request can be made to a police officer simply by providing the license plate number and an incident report as you would with a hit and run. Sometimes you can also verify auto insurance coverage with an insurance lookup by vin, but typically the best bet is to call your insurance company or agent directly and have them do an auto insurance lookup for you.

With so many ways to access your policy, you should know how to check if a car has insurance. The motor insurance database is a handy tool for checking if your own car is insured as well as any car that is owned by a third party. As a result, more than 5% of auto insurance policies have an invalid vin on file.

There are two methods through which you can check a car’s insurance status offline. The procedure for verifying the condition of car insurance is clear and quick to follow: Some states let you verify coverage online through the the state department of public safety.

Firstly, third party insurance is compulsory. Ask niid | check policy by pin. Firstly, you'll be required to enter the requisite details like your policy number, date your policy was issued on and its expiry date.

A quick glance at your old banking statements and car insurance paperwork can also help you determine if a car has insurance coverage. The request can be made to a police officer. Steps to verify your niid database insurance policy.

The only other way for employers to gather employee insurance information would be through the police , the dmv , or the state department —all of which have the right to deny requests for information. Keep all the details required such as name, location of the accident (if known), date of the accident, mobile number, email id, vehicle registration number and the address. Dial *565*11# on any phone and follow the prompt to verify your motor insurance buy 3rd party motor insurance © 2022 all rights reserved |.

Under the law, the department may contract with a private vendor to. Select car policy you want to check. Vehicle identification numbers (vins) play an essential but often overlooked role in auto insurance policies.

It is important for every policyholder to keep in mind the status of their car insurance. Do not enter special characters or spaces. Any changes in the car insurance cost over the past year will be highlighted along with the.

The second method involves calling up your car insurance provider and checking the insurance details by providing your car’s registration number. Every insurance policy has an expiry date, most need to be renewed on an annual basis. If you need to find out if someone has auto insurance coverage, you can request information on a person’s auto insurance if you have a valid reason.

Multiple ways to check your car insurance status online. Lightning fast coverage verification for auto insurance you can verify car insurance coverage by either calling your agent or customer service, or going online. There will also be instructions on niid.

Click on ‘vahan search’., can i look up someone’s insurance policy? A few ways to find out if you have car insurance include: If you are concerned that you have forgotten to renew your car insurance and that it has lapsed, then use this free service to see whether your car is insured or not.

If the vins do not match, contact your insurance agent to correct the problem. Compare the vin on your insurance policy to the one physically located on your vehicle (usually on the driver's side dashboard). Montana law requires the department of justice, in cooperation with the insurance commissioner, to establish an accessible motor vehicle insurance verification system to verify a motor vehicle operator ' s compliance with insurance requirements (mont.

While policyholders are required to provide their vehicle’s vin when purchasing a new policy, many insurers don’t verify the provided information. Check bank statements for canceled checks or automatic payments. Having car insurance is crucial.

Below are the steps you must follow to check your car or bike insurance status online: Specifically, get the name of the policyholder, their address and phone number, the name of the insurance provider, the policy number, and the expiration date of the policy. Call the dmv and ask for insurance information to check if a car has insurance and with which company.

Free Printable Release And Waiver Of Liability Agreement

ESD Exempt Seller Disclosure C.A.R. Business Products