The credit may not reduce your tax liability below the minimum tax due See other tax deduction including medical expense deductions.

Tax Deduction For Linked Benefit Long-term Care Insurance

Long term care insurance may be deductible for state income tax purposes.

Is long term care insurance tax deductible in new york state. Designing your long term care insurance policy ; If the amount you pay exceeds the limit, you can't deduct more than that stated limit. When you prepare and efile your 2021 tax return , enter the qualified long term care premium dollar amount during the tax interview and the tax app will show it on schedule a of.

The irs has released the 2021 deduction limits for individuals and business owners. Additional legislation was passed increasing the tax credit for long term care insurance premiums from. The premiums paid for this insurance qualify for the credit even if the policy is not approved by the new york state superintendent of financial services.

Its purpose is to help new yorkers financially prepare for the possibility of needing nursing home care, home care, or assisted living services someday. Long term care insurance tax deduction for 2021; New york state allows favorable state tax treatment of premiums paid for policies which qualify under the federal law and meet new york minimum standards.

The credit is not refundable; The amount of the deduction depends on the age of the covered person. Long term care insurance inflation protection;

Additional legislation was passed capping the tax credit for long term care insurance premiums at $1,500 and making the tax credit only applicable to tax returns wherein adjusted gross income is below $250,000 for taxable years beginning in 2020. The tax reform bill of 2018 made long term care insurance premiums even more deductible. New york state tax credits.

Best long term care insurance reviews; Traditional or hybrid long term care life insurance policies; You can get a credit for 20 percent of the premiums you paid, though the following conditions apply:

New york state tax credits. Any qualified policy covering long term care services that was approved in new york and issued before january 1, 1997, also qualifies. State long term care partnerships | policies & programs ;

Additional legislation was passed increasing the tax credit for long term care insurance. There are a ton of pros and cons associated with long term care insurance, but one pro i just learned about was its possible positive result on your state income tax return. You may also use your health savings account to withdraw.

Long term care premium tax credit legislation was passed in 2000 and took effect in taxable years beginning in 2002.

Criteria For Federal And New York State Income Tax Deduction For Long Term Care Insurance

Long Term Care Insurance Tax Free With Health Savings Account Hsa – Long Term Care University – 021521 – Skloff Financial Group

Long-term Care Insurance – Donahue Horrow

Tax Deductions For Long Term Care Insurance Premiums – 2021

Ltc Tax Guide – Comfort Long Term Care

Best Long-term Care Insurance In 2022 Retirement Living

/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png)

Form 1099-ltc Long-term Care And Accelerated Death Benefits Definition

Use Hsa To Pay For Long Term Care Insurance Premiums Ltc News

Is Long-term Care Insurance Tax-deductible Breeze

Long Term Care Infographics Visually

The Tax Deductibility Of Long-term Care Insurance Premiums

Long Term Care Insurance Claims

Long Term Care Rider Vs Chronic Illness Rider Top Benefits Of Each

Tax Deduction For Linked Benefit Long-term Care Insurance

How Much Does Long Term Care Insurance Cost In 2021

New York Life Long-term Care Insurance Reviews With Costs

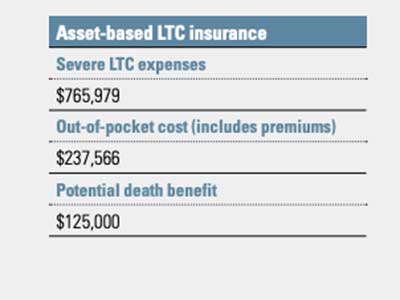

How Hybrid Life Insurance Pays For Long-term Care Forbes Advisor

Top 10 Best Long Term Care Insurance Companies

Are Benefits From A Long-term Care Insurance Policy Taxable Ltc News