However, sometimes this process can take as long as a few months. Each letter has a unique deadline.

What Your Personal Injury Demand Letter Should Look Like – With A Demand Letter Sample

How long does an insurance adjuster have to respond to 1st party claims?

How long does an insurance adjuster have to respond to a demand letter. Acknowledgment they received your claim, disclaimer of coverage, and a reservation of rights. Insurance companies are not required to respond. How long a settlement takes after you’ve sent your demand letter varies from case to case.

Simply put, you should expect the insurance adjuster to respond in around 30 days, of course, bearing in mind as previously mentioned that this time isn't set in stone. If it seems to be taking an unreasonable amount of time for the insurance carrier to respond to your demand letter, it may have more to do with the adjuster's workload than with the legitimacy of your claim. Insurance companies are free to take their sweet time in responding to your letter, and they can even ignore it (and you) altogether.

Leave a friendly voicemail reminding the adjuster that you sent the demand over a month ago and you have not heard any response. In addition, the insurance company may deny your claim as you have to take legal action. Even in states where they do have an obligation to communicate with the victim within 30 days or some other period, the law does not impose a significant penalty when an insurance adjuster simply ignores a demand letter.

By drawing on experience in cases like yours, your attorney can make sure to include all pertinent information with a demand letter to minimize the carrier’s opportunity to stall by requesting more detail. Sometimes a simple reminder can result in action. Unfortunately, it’s impossible to determine exactly how long after a demand letter a settlement will take.

In most states, the insurance adjuster has no obligation to respond to your demand letter. How long does an insurance adjuster have to respond to a demand letter. You may also need help documenting the settlement negotiations, or establishing a claim and fair settlement amount.

In this video, alan discusses demand letters and how long an insurance company has to respond, something he has been asked many times before by clients and visitors to this site. More often, securing a settlement you and the insurance company agree upon will require a few months of negotiations. Some insurance adjusters will put off answering your demand letter, as your medical bills and lost wages can pile up.

When you're making a personal injury claim after any kind of accident, understanding the settlement process can be a bit tricky, especially since most people aren't that familiar with. Get a free initial consultation: Insurance companies can take weeks to respond to demand letters and in some cases may ignore them altogether.

How long does an insurance adjuster have to respond to a demand letter. In some instances, the insurance company may accept your initial demand amount and pay it immediately—although that is relatively rare. Thus, listed below are six helpful tips to dealing with unresponsive adjusters.

This is usually how things go after a demand letter is. | sackrin and tolchinsky, p.a. The insurer has 10 days of receiving the claim to notify the claimant that it received the letter.

A delay in an insurance company getting back to you about a demand letter could be due to a backup in the insurance adjuster’s workload or, could be due to the insurance company ignoring the demand all together. How long does an insurance company have to respond to a demand letter? Once you’ve written your demand letter and sent it on to the insurance company, the response time may vary.

Promptly notify the insurer if it has not complied with this request. Having said all of that, there is no law that requires the other side's insurance company to respond to your injury demand letter. And if you haven't heard from the insurer in 45 to 60 days, you can and should follow up.

You and your attorney cannot force an insurance company to respond to a demand letter, but you can take some steps to help speed up the response time. How long does an insurance adjuster have to respond? Typically, after your attorney has sent a demand letter to the insurance adjuster or other party, it can take anywhere from a few weeks to a couple of months to obtain your settlement.

Typically, you can expect an answer within a few weeks.

State Deadlines For Insurance Adjuster To Respond To First-party Claims

Why Is The Insurance Company Ignoring My Demand Letter

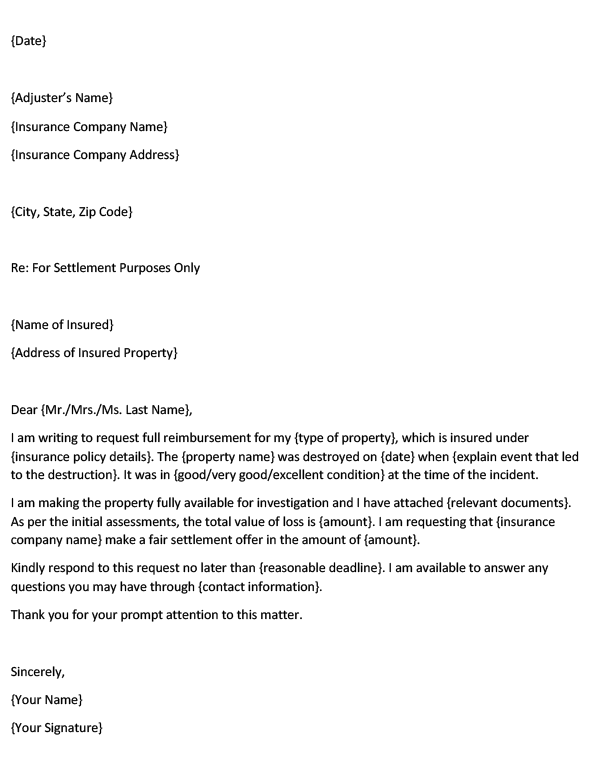

Demand Letter To Insurance Company For Property Damage – Word Pdf

How Long Before Insurance Company Makes An Offer – Ark Advisor

Car Accident Demand Settlement Letter Samples Templates

Sample Settlement Demand Letters

How Long Does It Take To Get A Settlement After A Demand Letter Is Sent

Counter-offer Letter To Insurance Company For Your Accident Claim

Free Personal Injury Demand Letter – Sample – Word Pdf Eforms

Car Accident Demand Settlement Letter Samples Templates

Free Demand Letter For Payment Templates Examples Word Pdf

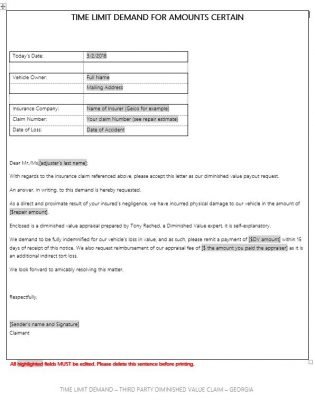

Sample Demand Letter For Diminished Value – Providing Louisiana Automobile Diminished Value Appraisals

How Long Does It Take The Insurance Company Take To Respond To A Demand Letter

Settlement Demand Letter Sample – Images Nomor Siapa

Insurance Companies Demand Letter Response Time

Free Insurance Company Demand Letter – Word Pdf Eforms

Diminished Value Demand Letter Diminished Value Of Georgia

How Long Does An Insurance Adjuster Have To Respond To A Claim