Payment apps like venmo, zelle, cash app, and paypal would fall under that category. A new rule will go into effect on jan.

New Tax Law Requires Cash Apps Report Transactions Of 600 To The Irs Venmo Paypal Zelle Apple Pay – Youtube

Questions about taxes using cash app/venmo/zelle etc starting january.

Cash app venmo zelle tax. No, venmo isn't going to tax you if you receive more than $600. Some social media users have criticized the biden administration, internal revenue service and the u.s. Common p2p platforms you can use to transfer money digitally include:

Using a cash app for splitting meals, rent or groceries would not be taxed. For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law. If you use venmo, paypal or other payment apps this tax rule change may affect you.

Did you hear, perhaps on tiktok or elsewhere, about a “new” tax on money you receive through apps like venmo, cash app, zelle, and paypal? The irs plans to take a closer look at cash app business transactions of more than $600. Will venmo, cash app and zelle users have to pay a new tax?

My apprentice just told me that starting in january anything over 600 bucks on cash apps will now be taxed and that person will be sent a 1099 form. If you use cash apps like venmo, zelle or paypal for business transactions, some changes are coming to what those apps report to irs. The american rescue plan act:

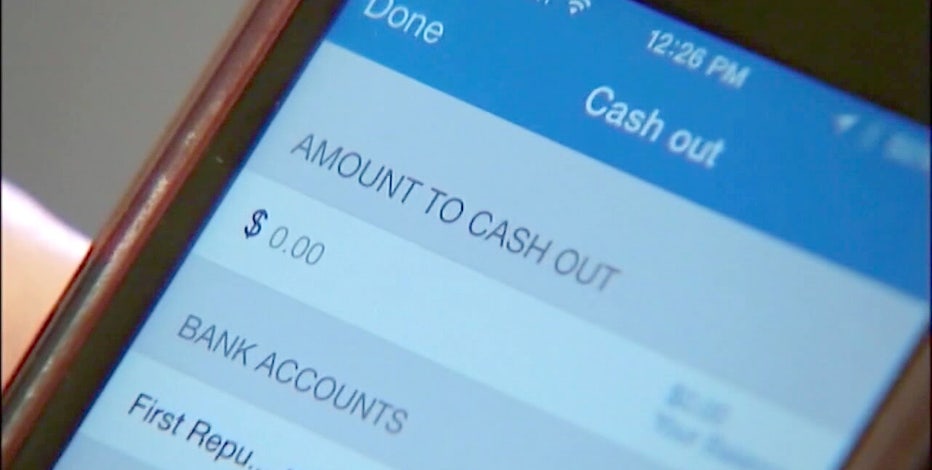

A taxable source of income is included in your. If you're among the millions of people. Is the irs really about to tax your venmo, paypal, and cash app transactions?

Users were stating that people who deposit $600 or more annually from smartphone apps like paypal and venmo will be taxed for that income. the post has since been deemed false by independent. Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include. It's not a new tax, but the irs is looking closely at transactions that are $600 or more.

This is the irs’s description of the form: Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services.

Let’s suppose you’re a small business owner or freelancer, and you get paid from a digital payment service like paypal, venmo, zelle, cash. By jeanne sahadi, cnn business. P2p apps are also called payment service apps, payment apps, and cash apps.

Tax changes coming for cash app transactions. Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. Money parents send their children would not be considered taxable either, in most cases.

Money parents send their children would not be considered taxable either, in most cases. The american rescue plan act will be effective on january 1, 2022. Consumers and businesses send these money transfers directly from their bank account, debit card, or credit card through a p2p app.

The short answer is that if it’s not income, you won’t owe taxes on it. A recent piece of tiktok finance advice has struck terror into the hearts of payment app users, claiming that anyone who receives. The change begins with transactions starting january 2022, so it doesn’t impact 2021 taxes.

Venmo, zelle $600+ now taxed! Is it true that if you get more than $600, you’ll have to report it to the irs as income? Using a cash app for splitting meals, rent or groceries would not be taxed.

Updated 3:49 pm et, tue november 9, 2021.

Tax Changes Coming For Cash App Transactions

Nowthis – If You Are Doing Business With Your Clients Using Third-party Apps Like Cash App Paypal Venmo Or Zelle You Should Know That The Irs Will Soon Require Businesses To Report

Venmo Cash App And Other Payment Apps To Report Payments Of 600 Or More – Crossroads Today

No Venmo Isnt Going To Tax You If You Receive More Than Us600 – Tech

Federal Government To Ask For Taxes On App Transactions Over 600

Cash App Venmo Users Receive 1099-k For Payments Over 600 – Ohio News Time

New Tax Law Irs Wants To Tax Cash App Venmo Zelle Transactions Small Business -princedonnell – Youtube

Changes To Cash App Reporting Threshold Paypal Venmo Zelle More

Threshold For Cash App Payments Drastically Lowered For Tax Payments – Radio Facts

Payment Apps Must Now Report Transactions Of 600 Or More

New Rule To Require Irs Tax On Cash App Business Transactions Wciv