You should think of this number strictly as a baseline — your own rates for life insurance will change depending on your age, the insurer you choose and the amount of coverage you purchase. Life insurance premiums are primarily based on your age, health, and your life insurance product.

Guide To Universal Life Insurance Nextadvisor With Time

This cost range is based on the information you gave us, and applies to term life.

1 million life insurance policy cost canada. Whether you’re 18 or 80 you can apply, including temporary residents with a. But it won’t cost twice as much. Cover outstanding debts, expenses, leave legacy with a life insurance plan.

At this age, many policy options are still available, including 10 and 15 year term life insurance. Get covered regardless of health condition. Permanent policies such as whole life or universal life insurance coverage are available as well.

Let’s take a look at the cost of life insurance for 70 to 75 year olds, as well as the best policy options available for seniors over 70. In this section, we’ve compared the monthly cost of a $50,000 whole life policy to a $50,000 guaranteed universal life policy. Yes, a $1 million policy will cost more than a $500,000 policy.

This means no medical exams or needles, and being able to get protected quickly. As such, there would be no requirement to. Based off these numbers, the suggested coverage amount for each would be $1,200,000.

I’ll illustrate the cost of a $100,000 policy across various ages and risk classes. Affordable, flexible term life insurance at your pace. Read more in our full canada life insurance review.

Like all life insurance policies, permanent policies are also tied to health and age—the younger you purchase one, the less it will cost you. The approximate cost of canadian life insurance: Can convert into canada life permanent life insurance policy;

The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. Quick and easy to apply. A $4 million dollar term life insurance policy is not simply just twice the cost of a $2 million dollar life insurance policy, its actually far more complicated than that.

Affordable, flexible term life insurance at your pace. Coverage up to $1 million on all other plans. A $100,000 term life insurance policy is one of the most affordable options.

Assuming that 1 million will generate an average of 5% interest per year, this would equate to a sum of $50,000, the 1.5 million would net around $75k. We've found that the average cost of life insurance is about $147 per month for a term life insurance policy lasting 20 years and providing a death benefit of $500,000. Both insurance policies offer level rates and fixed coverage until the age of 100 or later.

We do this by helping you find the best insurance company for your needs instead of trying to fit you into a “one size fits all” type of policy. 107 rows a $1 million policy will be more expensive than a $250,000 or. The cost of a life insurance policy is determined by a number of factors such as gender, age, health status, and the policy coverage and term length you choose.

Get up to $500,000 in coverage for no medical or up to $1 million on all other plans. Any big carrier should with an a+ rating should be good. No medical plans up to $750,000.

Payments start in the second month, applicable on monthly payment plans. These factors could significantly impact the dollar amount needed. Limited digital policy or access to online account features;

When the size of the death benefit is considered, the larger policy will always be. Average cost of whole life insurance vs gul insurance for males Call in and we can do a quick quote based on your age and health class in about ten minutes in about ten minutes.

The rates displayed below are for applicants in excellent health. Minimum $100,000 coverage or $500 annual premium required; One of the twins lives.

At a minimum, departments must provide a qualitative assessment of the costs and benefits. Guaranteed acceptance life insurance is available to people who have health issues and who could otherwise be declined due to those health impairments. Personally, i have a $2.5 million policy and banner life ended up being the cheapest for me (took my policy out when i was 33 years old).

For this example, we didn’t include additional debt, current savings and investments, or if they have a life insurance policy they plan to keep. Prior to that, i had a $1.5 million policy with transamerica. To do this, he requires a minimum 1 million dollar life policy to 1.5 million.

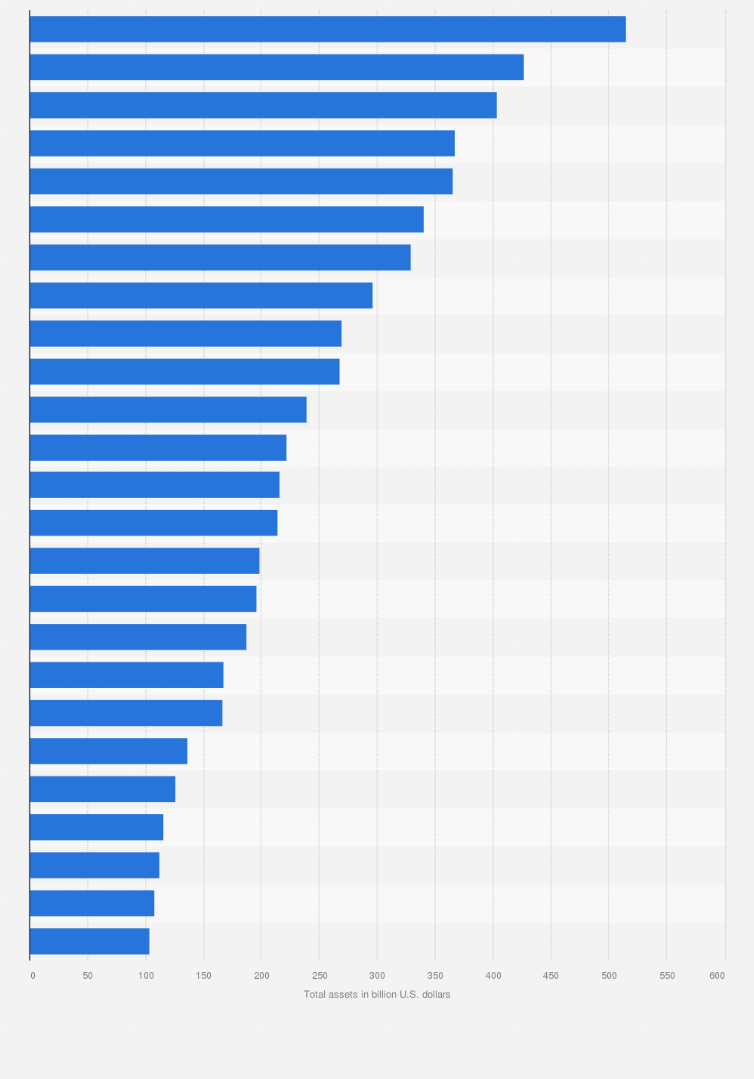

Largest Us Life Insurers By Assets 2020 Statista

A Presentation By Sheiletta Created With Haiku Deck Free Presentation Software That Is Simple Beauti Life Insurance Quotes Presentation Business Presentation

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

The Myth Of Americans Poor Life Expectancy Life Insurance Policy National Life Universal Life Insurance

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Life Insurance Is More Affordable Than You Think Life Insurance Cost Term Life Term Insurance

Best Life Insurance For Seniors

5 Tips For Selling Your Life Insurance Bankrate

In Mortgage Term Insurance Quotes You Can Designate Who You Want As Beneficiary And They Will Life Insurance Quotes Content Insurance Life Insurance Calculator

International Life Insurance Plans For Expats And International Citizens

Types Of Life Insurance Bankrate Life Insurance Facts Life And Health Insurance Life Insurance Agent

Gerber Grow-up Plan And Life Insurance Review – Valuepenguin

Life Insurance Canada A Guide To Get You On The Right Track How To Save Money Life Insurance Policy Life Insurance Companies Life Insurance Broker

How Does Life Insurance Work Forbes Advisor

How Does Whole Life Insurance Work Costs Types Faqs

Pin By Alexander Demchenko On Insurance Infographics Commercial Insurance Infographic Money Financial

Guide To Buying Life Insurance For Parents – Elderly Burial

How Much Does Million Dollar Life Insurance Cost Who Needs It In 2021 Life Insurance Cost Life Insurance Policy Life Insurance Companies