One thing to keep in mind. Mitigate it as much as you can by creating defensible space and otherwise protecting your home and property.

Mengenal Istilah Dalam Dunia Asuransi Versi Allianz Indonesia

Through this offering, reinsurers and program managers gain access to crucial insurance metrics, aggregate exposure data, ransomware scores, and information regarding emerging threats.

Aggregate exposure in insurance. A stat & a quote. Let’s say an insurance company sends you aggregate year loss table (ylt) data, but before pricing a reinsurance contract, you ask to get their exposure data and are able run a detailed loss analysis in air’s touchstone® platform, or otherwise you request and receive detailed losses via a company loss file (clf). This prudential standard requires a level 3 head to ensure that an aggregate risk exposure external to the level 3 group does not expose prudentially regulated institutions within the group to excessive risk.

The ultimate responsibility for the aggregate risk exposure policy of a level 3 group rests with the board of its level 3 head. The extent to which the monitoring of aggregate exposures is. Aggregate exposure means, with respect to any lender at any time, an amount equal to (a) until the closing date, the aggregate amount of such lender’s commitments at such time and (b) thereafter, the aggregate then outstanding principal amount of such lender’s term loans.

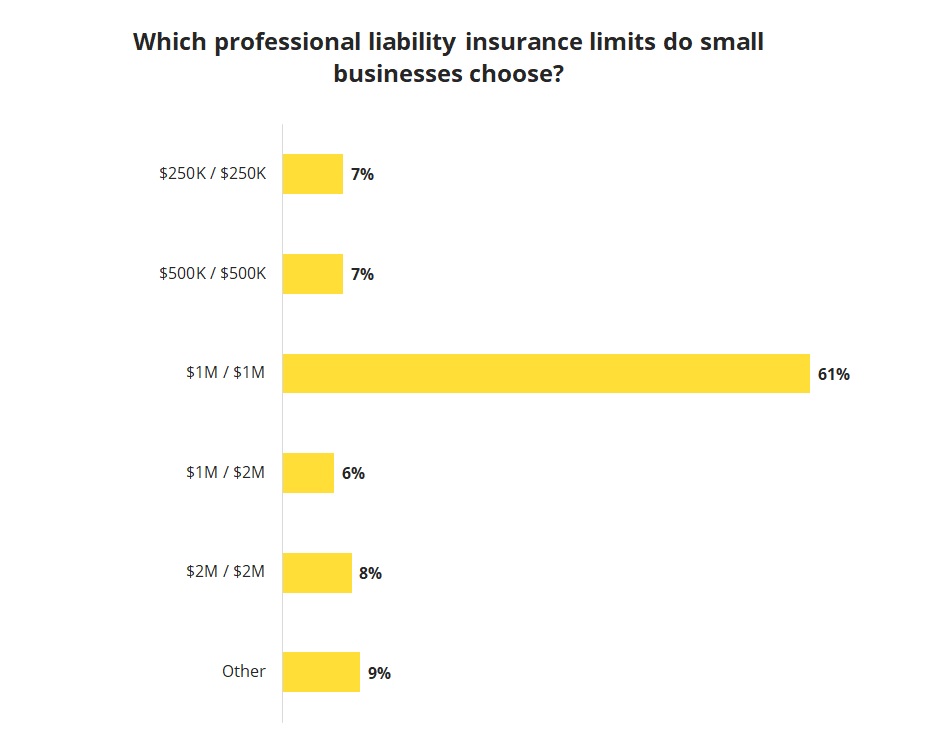

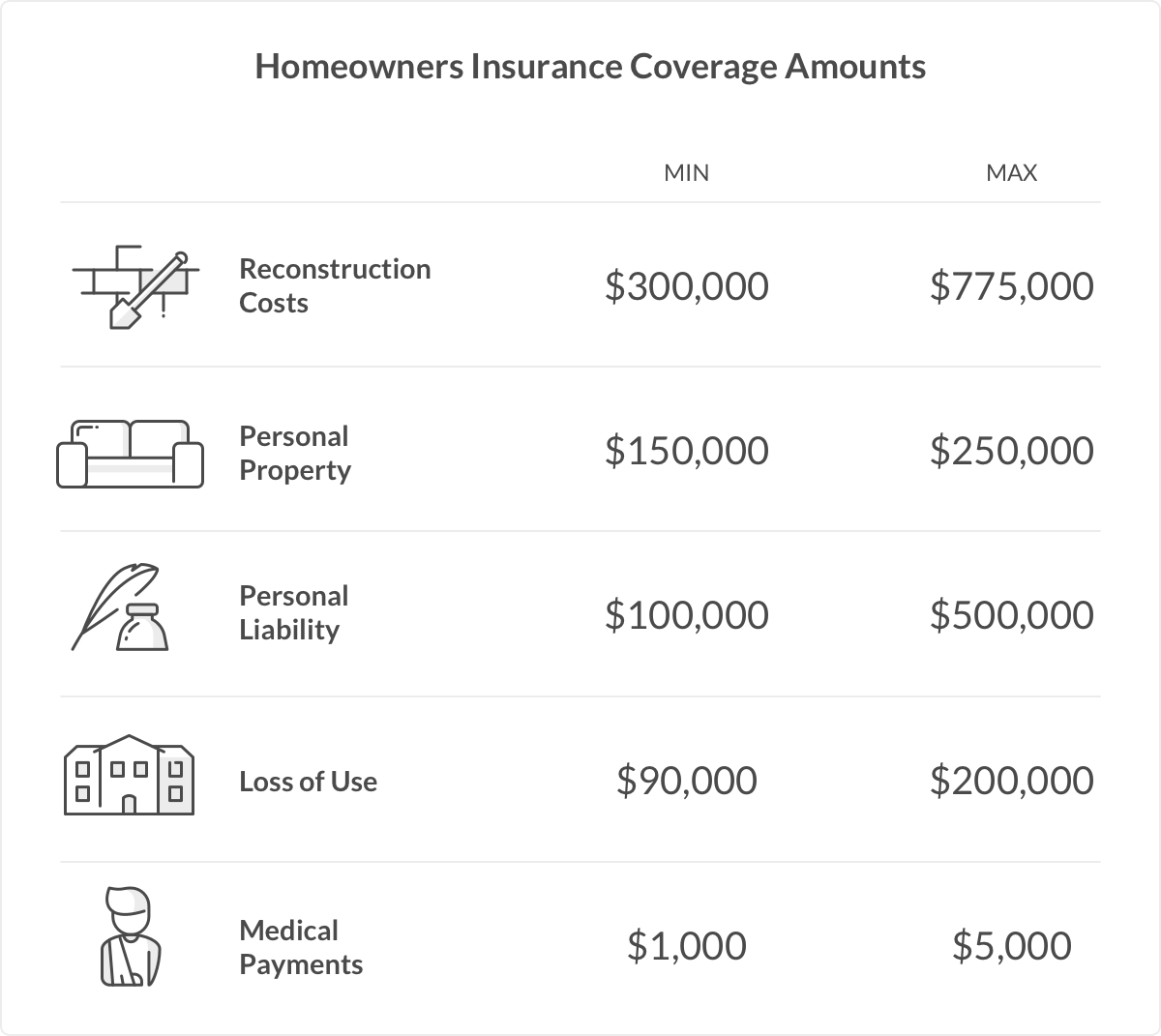

Aggregate risk exposure, or how a level 3 head must calculate an aggregate risk exposure, apra may take account of the following factors: Aggregate limits are commonly included in liability policies. He may also have a $100,000 aggregate limit of liability.

Aggregate exposure in insurance.aggregate exposure means, with respect to any lender at any time, an amount equal to (a) until the fifth amendment and restatement effective date, the commitments then in effect and (b) thereafter, the sum of (i) the aggregate unpaid principal amount of such lender’s term loans and delayed draw term loan. Her excellency the governor general in council, on the recommendation of the minister of finance, pursuant to section 1021. What is the liability accumulation peak aggregate in a given portfolio?

While the development of cat modelling. Ask about insurance premiums if you’re in the housing market. Could point to a benefit of the hurricane losses of 2005 it is.

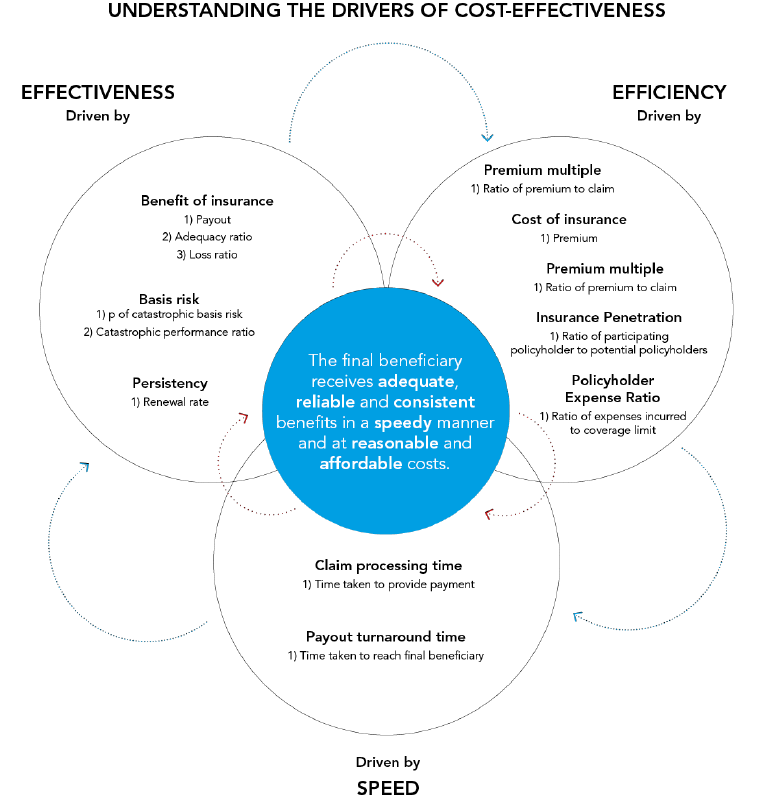

Next pra steps • continue thematic review in a systematic way • inform our understanding using the cyber and liability returns from 2019 insurance stress tests • continue to engage with industry on exposure management and reduce the risk of flying blind. (b) the characteristics of aggregate risk exposures, including their number, Aggregate excess insurance is an insurance policy that limits the amount that a policyholder has to pay out over a specific time period.

Aggregate financial exposure (insurance companies) regulations. Get to know your wildfire risk exposure. Emerging out of the catastrophe modelling world which itself only took off in the 1990s, following hurricane andrew, to be today dominated by the two major modelling providers rms and air.

More visible and their management more disciplined within. While not often used in property insurance, aggregates are sometimes included with respect to certain catastrophic. “effective aggregation management is an imperative.

As such, the aggregate index is delivering more “insurance” today than it was just a few years ago. Aggregate limit of liability clearly and briefly explained. Educate yourself about insurance alternatives.

Over exposure could result in a non renewal of yours and other home insurance policies in your area. But this duration has risen substantially in recent years, from a low near six years in 2019 to nearly seven years today. Aggregate — (1) a limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified period of time, usually a year.

(a) whether the level 3 group has been acting in a manner that is consistent with the aggregate risk exposures policy; Aggregate reinsurance pricing & supply set for examination: 1 that is, the index today offers around 15% more interest rate sensitivity than it did just a few years ago.

Exposure management has evolved as a discipline over the last 5 years. The risk aggregation platform provides insurers with the ability to manage net exposure by enabling review of premiums, policy numbers, or limits exposed in. Meanwhile, aggregate growth in planned premium for all other “standard” syndicates will be 13% for 2022, again including some exposure growth.

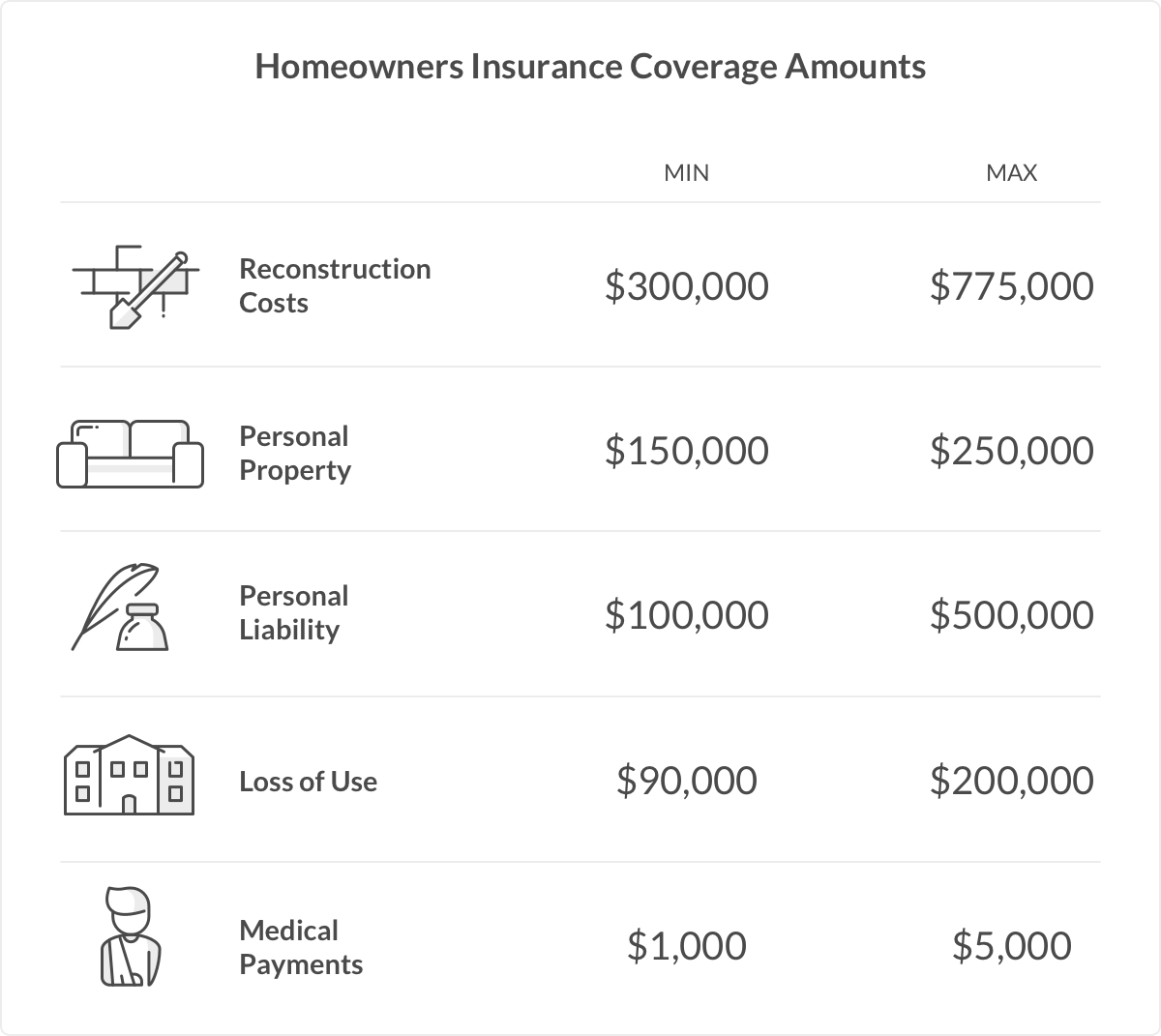

Insurance companies will often use aggregate limits to minimize their exposure to large losses. For example, a liability policy may have a $25,000 per claim limit and an aggregate limit of $100,000. Let's say a homeowner has a $25,000 per claim, or per occurrence limit on liability claims in his homeowners' insurance policy.

Meanwhile, aggregate growth in planned premium for all other “standard” syndicates will be 13% for 2022, again including some exposure growth. If the insured makes a single claim for $50,000, the insurance company pays only $25,000, the. Why exposure management matters to insurers.

Pdf The Relationship Between Insurance And Economic Growth Review And Agenda

Limit Of Liability – What You Should Know Insurance Dictionary By Lemonade

Pin By Rosangela Estefania On T In 2021 Vulnerability Level Of Awareness Homeland Security

Mcii Contribution To The Insuresilience Global Partnership And V20 – Munich Climate Insurance Initiative

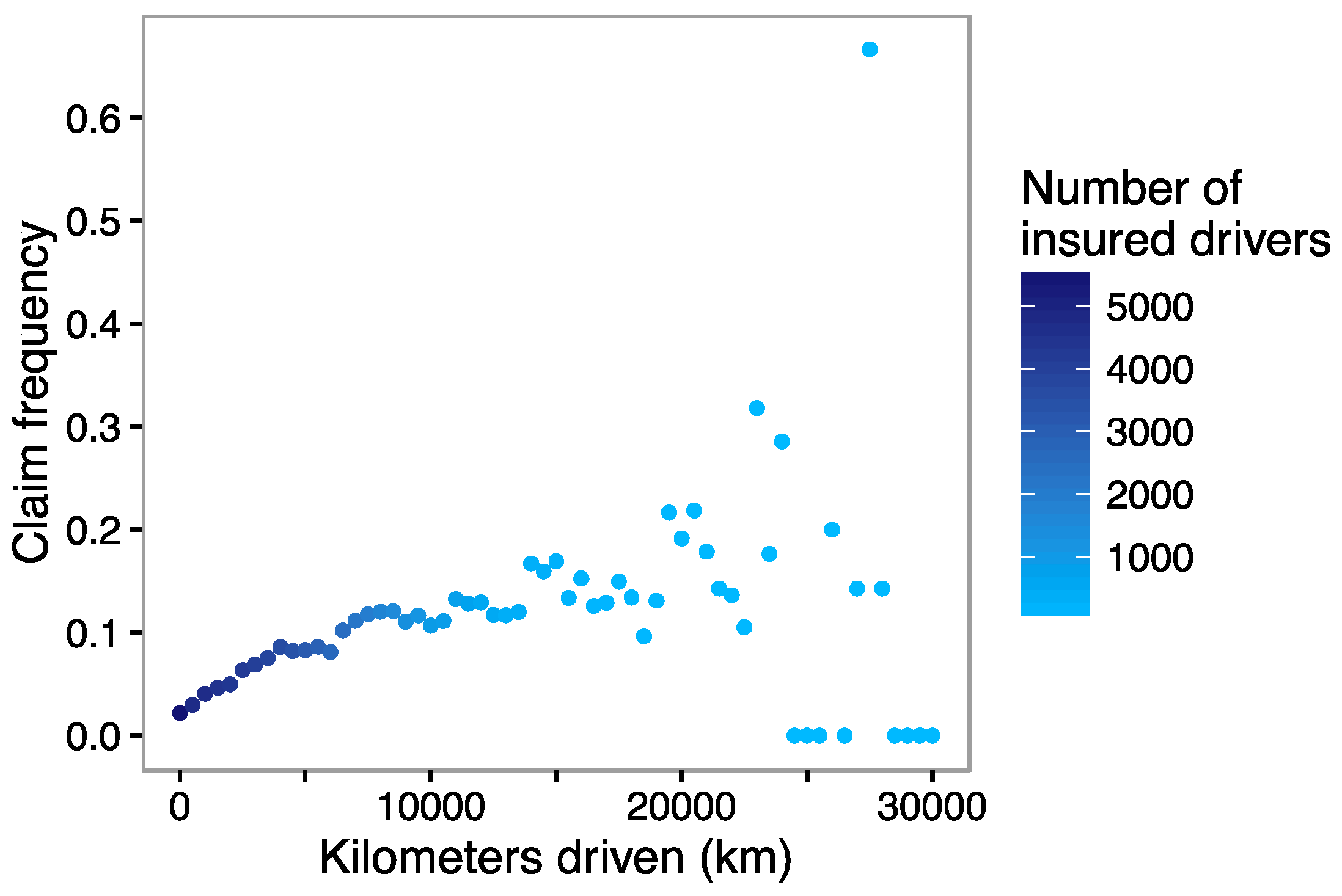

Risks Free Full-text Exposure As Duration And Distance In Telematics Motor Insurance Using Generalized Additive Models Html

Insurance Reinsurance – Transactional And Regulatory Practices Willkie Farr Gallagher Llp

Medical Service Agreement Template Sample Medical Services Medical Medical Information

Httpsbohoutiblogspotcom202008professional-pilot-car-insurancehtml Pilot Car Car Insurance Commercial Insurance

What Does An Aggregate Mean In Insurance Terms – Quora

Professional Liability Insurance Cost Insureon

Pdf Causal Relation Between Life Insurance Funds And Economic Growth Evidence From Malaysia

Decoding Climate Change – What Does It Mean For The Underwriter Swiss Re

Hazard Insurance What Does It Cover Hazard Insurance Homeowners Insurance Content Insurance

Why Energy Transfer Is A Top 5 Holding In My Portfolio Seeking Alpha Energy Transfer Energy Energy Infrastructure

What Is Finance Personal Finance Finance Personal Financial Advisor

Pdf Agricultural Index Insurance For Development

Limit Of Liability – What You Should Know Insurance Dictionary By Lemonade

:max_bytes(150000):strip_icc()/05_Cash_App-b81c9e32809e4ca980118e5b287bc00e.jpg)