The true value of a whole life will improve if you get a better health rating. 107 rows the average cost of life insurance for a healthy, 30 year old is around.

Can A Nursing Home Take Your Life Insurance

For most families, term is the better.

Average monthly cost for 1 million dollar life insurance policy. When you break it down, you could be paying as low as $20 a month. We have worked with individuals, doctors, executives, and business owners for years who need large coverage amounts. We've found that the average cost of life insurance is about $147 per month for a term life insurance policy lasting 20 years and providing a death benefit of $500,000.

Depending on the underwriter you choose, you can get a million dollar insurance policy coverage for roughly $80 per month. For a basic $1 million general liability insurance policy, a business may pay anywhere between $300 and $1,000 a year depending on the above factors. The best companies include banner life, protective, and lincoln financial.

In this section, we’ve compared the monthly cost of a $50,000 whole life policy to a $50,000 guaranteed universal life policy. A medical test is used to determine your health rating. Both insurance policies offer level rates and fixed coverage until the age of 100 or later.

Of course, the size of your business matters. However, there are people who need a big policy to support their families. You can get this policy without an exam and in under 5 minutes.

The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. With coverage ranging from $100k to $1.5m, you can apply for a policy that protects your family and works with your budget. Assuming that 1 million will generate an average of 5% interest per year, this would equate to a sum of $50,000, the 1.5 million would net around $75k.

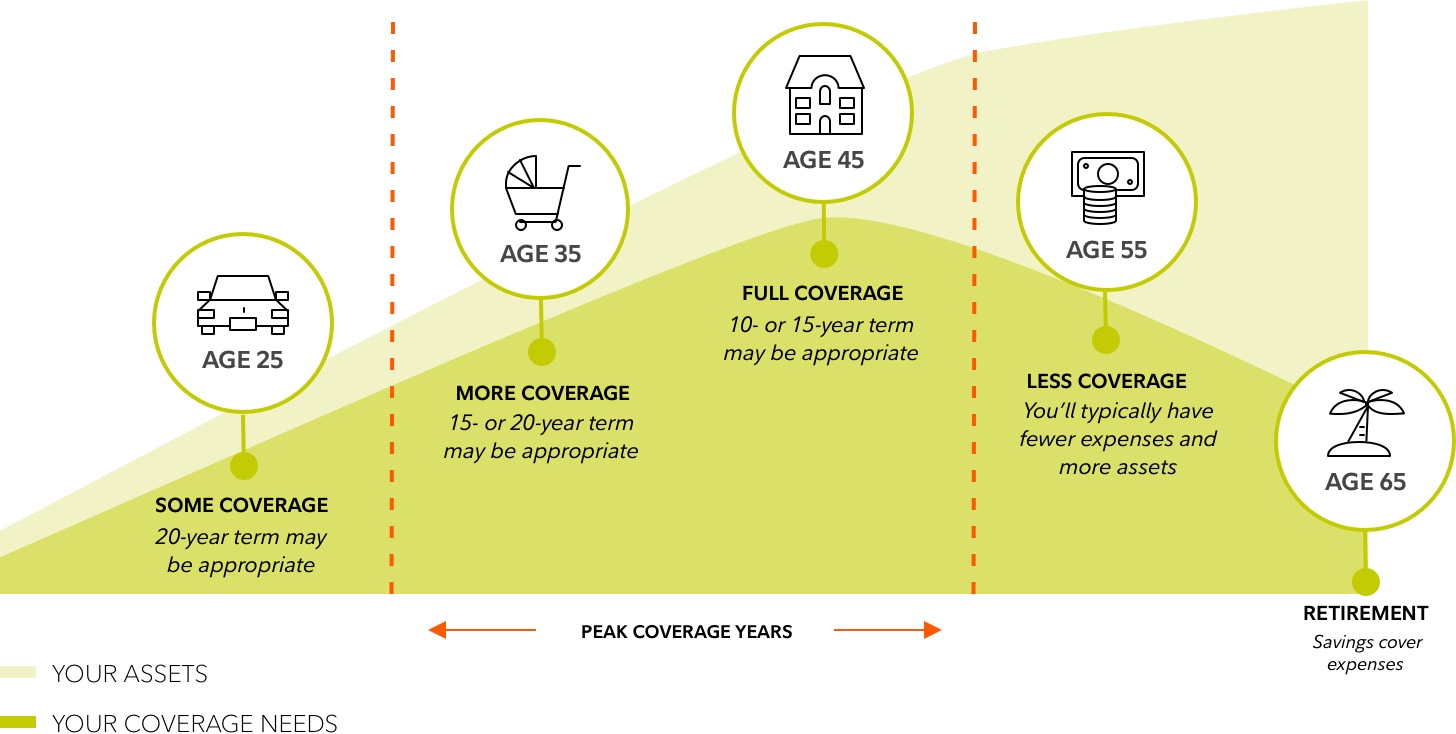

That means $1 million in life insurance until you are 65, covering all those years of buying a house, settling down, and having children. However your rate will vary according to the following factors. The rates displayed below are for applicants in excellent health.

How much coverage should i get. The best $1,000,000 whole life insurance rates are listed below based on a preferred plus rate class. So, for example, if you make $100,000 dollars per year, you should get a policy in the amount of $500,000 to $1,000,000.

Cost of a one million dollar term life insurance policy; Rule of thumb is, that you should get 5 to 10 times the amount of your yearly salary in life insurance. Million dollar whole life insurance cost.

I pay less than $50 a month for $1 million of life insurance, and i think i got a great deal Rates, coverage, and more ethos makes it easy to apply for a life insurance policy that fits your needs. You should think of this number strictly as a baseline — your own rates for life insurance will change depending on your age, the insurer you choose and the amount of coverage you purchase.

To do this, he requires a minimum 1 million dollar life policy to 1.5 million. Average cost of whole life insurance. Factors that can change your insurance premium costs include:

There are hundreds of life insurance providers in the united states and most of these companies offer 12 to 16 rate classes. Average monthly premiums, $1 million life insurance policy. While each company set’s their own risk classes and rates, the cost of a $5,000,000 term life insurance policy is primarily determined by these three factors:

Larger businesses tend to pay more for general liability insurance due to the increased. So, half a million dollars may be a sufficient amount of coverage.

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Life Insurance Guide To Policies And Companies

International Life Insurance Plans For Expats And International Citizens

How Much Does Million Dollar Life Insurance Cost Who Needs It

Pin By Gmz Solutions On Globelife Life Children Life Insurance

Northwestern Mutual Life Insurance Review Best For Smokers – Valuepenguin

Dave Ramsey – Heres A Breakdown Of Why I Recommend People Get 10-12 Times Their Annual Income In Term Life Insurance If The Worst Happens Alexs Family Can Take Care Of Some

Life Happens The Life And Health Insurance Foundation For Education Life Life Insurance Quotes Life And Health Insurance Life Insurance

How Does Whole Life Insurance Work Costs Types Faqs

Why Is Life Insurance So Important Fidelity Life

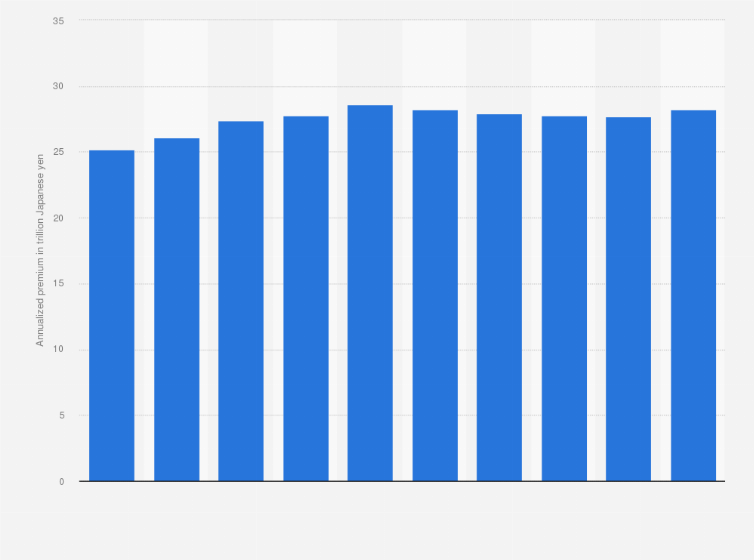

Japan Annualized Premium Of Individual Life Insurance Policies In Force 2020 Statista

8 Best Life Insurance Companies Of January 2022 Money

Term Life Insurance Financial Resources Coverage Options Fidelity

Life Insurance Is The Greatest Proof Of Love That We Can Leave Our Loved Ones Powerphrase Life Insurance Quotes Life Insurance Facts Life Insurance Marketing

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Average Life Insurance Rates Of 2021 Forbes Advisor

2021 Final Expense Life Insurance Guide Costs For Seniors

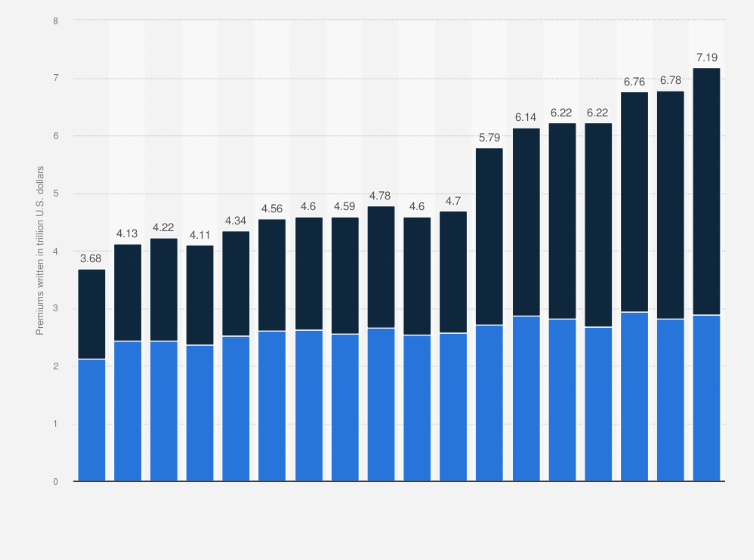

Life And Non-life Insurance Premiums Globally 2020 Statista

Term Life Vs Whole Life Insurance Understanding The Difference