When shopping around for this type of policy, make sure to be. Coverage can kick in after an equipment malfunction.

Equipment Breakdown Insurance Why Its Important To You And Your Business – Abex Affiliated Brokers Exchange Inc

Although you may hear the words boiler and machinery, they mean virtually the same as equipment breakdown.

Boiler and machinery insurance vs equipment breakdown. Chubb’s capacity, expertise and global risk management programmes make us a particularly effective solution provider for large industrial companies. Also known as boiler and machinery insurance, or mechanical breakdown insurance, equipment breakdown insurance helps cover: Boiler and machinery insurance (bm) provides coverage for physical damage to and financial loss from equipment breakdown.

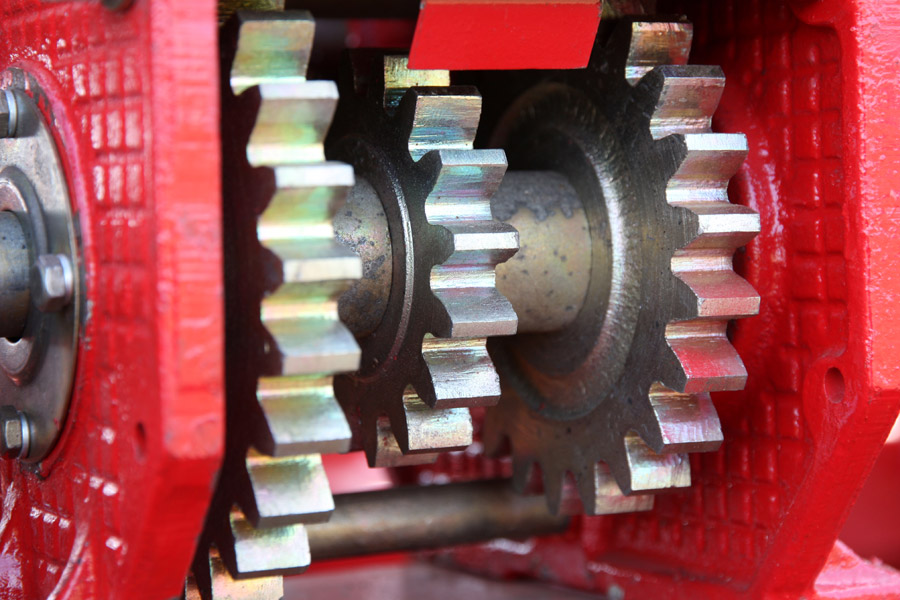

Boiler & machinery / equipment breakdown insurance. Standard policies cover equipment that fits into boiler or pressure vessels, energy transmitting or utilizing equipment (electrical or mechanical), energy supply equipment, or production machinery. Similarly, what is covered under machinery breakdown insurance?

If your equipment requires repairs or replacement due to internal issues, your equipment breakdown coverage can help mitigate some of those costs. In addition to material damage, equipment breakdown frequently results in substantial consequential loss such as business interruption, Some insurance companies also offer riders to cover additional risks to the machinery or other.

Boiler & machinery breakdown insurance. This coverage doesn’t require that the equipment breakdown resulted from a covered event in a property insurance policy, such as a fire. The cost to repair or replace damaged equipment, including time and labor.

However, some insurance companies still have the older version of this type of policy that may only cover a steam boiler. This coverage is a form of property insurance that protects against the mechanical breakdown and failure of boilers and other heating and cooling devices, machinery, and electrical apparatuses in a building. Necessary expenses incurred during the restoration period.

The boiler inspection and insurance company of canada (bi&i), a member of. Equipment breakdown coverage (also called “boiler and machinery” (b&m) coverage) is a form of property insurance that protects the association against financial loss from the sudden and accidental breakdown of important mechanical or electrical devices, or for physical loss or damage to these devices from covered perils such as fire, flood or lightning. It protects electrical systems, air conditioning and refrigeration, mechanical equipment, modern office equipment in addition to heating systems such as boilers.

Machinery insurance provides cover against a wide range of losses from breakdown of plant production equipment, electrical equipment, boilers, pressure vessels, heating and cooling equipment, etc. How are equipment breakdown, and boiler and machinery insurance different? Machinery breakdown insurance provides a security cover to the machines used by factories and industries.

This type of coverage now includes a broad range of modern technological equipment, well beyond just boilers and machinery. Similar to commercial property insurance, this specialized coverage can help give you peace of mind. Equipment breakdown insurance is a form of additional coverage that goes above and beyond your commercial property policy.

Travelers energymax 21 sm offers a broad package of specific coverages for nearly every equipment loss scenario. That’s why “equipment breakdown insurance” is a better description than “boiler and machinery insurance.” What is boiler and machinery insurance?

Machinery and equipment breakdown insurance also covers your lost business income while your machines are damaged. Our expert risk control professionals help our customers prevent and manage risk exposures that could lead to. Equipment breakdown insurance isn’t complex.

Also known as “boiler and machinery” (bm) insurance, equipment breakdown coverage can help pay to repair or replace damaged equipment for covered losses. Most machinery and equipment, including electronic devices, can also be covered. The equipment breakdown rider is an endorsement for commercial lines package policies, available to a number of property and casualty insurers in canada.

The current designation of equipment breakdown insurance encompasses a wide variety of machinery and systems failure. However, the former has largely fallen out of use, since ‘equipment breakdown’ is a more appropriate term for today’s coverage. Boiler and machinery insurance, also called equipment breakdown insurance, covers the cost of repairing or replacing the damaged equipment and business losses incurred from the equipment not functioning.

The cost to repair or replace damaged equipment, including time and labor. The coverage can vary from. This insurance covers accidental breakdown and physical damage of the machinery, the cost of repairs or replacement of the damaged machine parts.

Boiler and machinery insurance essentials. Equipment breakdown covers many types of equipment. It is an easy way for brokers to include equipment breakdown insurance in the commercial lines packages with these insurers.

The two insurances aren’t quite identical, however. Boiler and machinery insurance and equipment breakdown insurance are interchangeable; Boiler and machinery insurance policies are often similar to equipment breakdown insurance policies, and the two generally have the same purpose of protecting against malfunction.

The chance that you rely on only this type of equipment is rare. Boiler & machinery breakdown business insurance coverage is available on all types of machinery, manufacturing equipment and plants across various industries. Machinery breakdown insurance provides a security cover to the machines used.

Boiler and machinery insurance vs equipment breakdown.

Electronic Equipment Insurance Akademi Asuransi

95 Reference Of Auto Insurance Renewal Questionnaire

Why Do I Need Equipment Breakdown Coverage Hsb Canada

Machinery Breakdown Insurance Coverage Claim Exclusions

Equipment Breakdown Coverage In Massachusetts The Feingold Companies

Equipment Breakdown Travelers Insurance

Equipment Breakdown Insurance Private Client Insurance Services

How To Protect Your Business From Coverage Gaps Related To Equipment Breakdowns

Equipment Breakdown Insurance Machinery Insurance Allen Financial

Machinery Breakdown Insurance Msig Indonesia

7 Questions For Karen Caulfield On Equipment Breakdown Risk Insurance

Equipment Breakdown Coverage For Business Ufg Insurance

Why Do I Need Equipment Breakdown Insurance

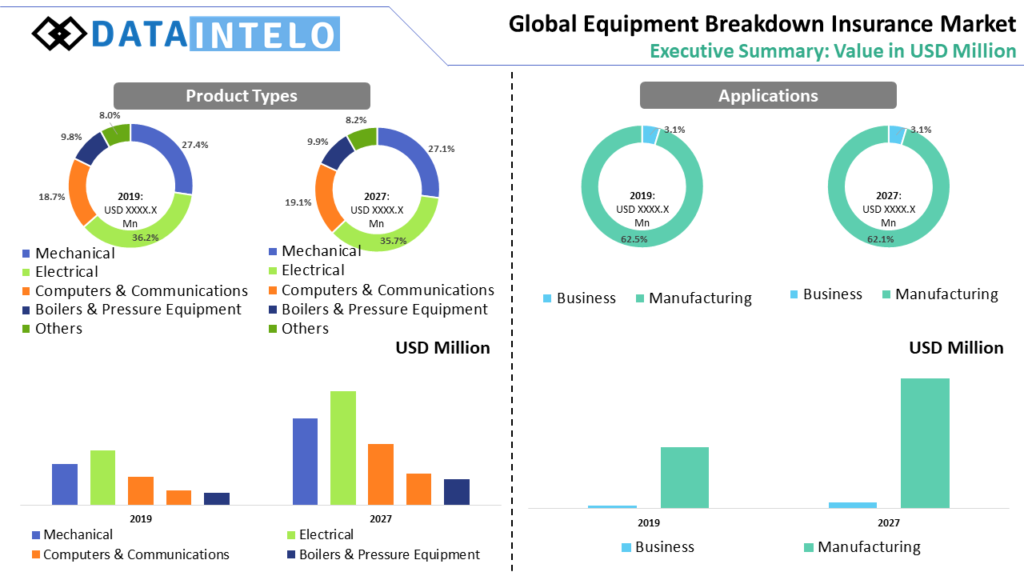

Equipment Breakdown Insurance Market 2020 Global Forecast To 2027

Boiler And Machinery Insurance – Commercial Global Insurance

/boiler-3391538_1920-bb9e5b3f6fb94430a0c4e94abb61dfba.jpg)

Boiler And Machinery Bm Insurance

Equipment Breakdown Insurance Is Much More Than Insurance – Teague Insurance