This includes falsifying your application. You could face criminal penalties.

.png)

Can You Sue Your Own Insurance Company The Button Law Firm Pllc

If the insurance company could still be sued after you collect compensation, it would have no incentive to settle.

:max_bytes(150000):strip_icc()/how-to-cancel-car-insurance-172f943d61104df6990735b6bd122659.png)

Can an insurance company drop you if you sue them. In fact, they can be quite a hassle, especially if the insurance company is trying to give you the runaround. However, insurance companies are required by law to timely pay out a properly filed insurance claim. Home in disrepair or requiring maintenance or renovation.

Insurance claims are usually not fun to deal with. If however, you are at fault in an accident, then your insurance company may attempt to raise your rates when your coverages are renewed. When you apply for coverage with a car insurance company, both you and the insurer sign a contract agreeing to certain terms.

It is hard to win against an insurance company because they have a lot of money and power behind them. Insurance companies may cancel or not renew a car insurance policy for a driver who has a heavy history of accidents and moving violations or for one with a dui/dwi conviction. An insurance company can sue you to recover costs and damages under the law.

Lawsuits for wrongful repudiation of an insurance policy can be based on breach of contract law. When someone chooses to later sue on the same claim, the insurance company and the legal system will all get involved very quickly. You should get an attorney.

You can sue your auto insurance company, but you need to be sure that you really have a case. For example, if extensive home damage has caused a lawsuit, but there is no dispute about what needs to be done to repair the kitchen, “the consumer can continue to work with the company to adjust that part of the loss.” Don’t go up against your insurance company alone.

The natural reaction to the client’s dilemma will be to conclude that you can’t fight a billion dollar insurer for that amount of money. There are five main reasons an insurance company might cancel or not renew your policy: However, there are rules about how long a company must cover you and what procedures they must follow in notifying you of a discontinuation of coverage.

They can't raise your rate for suing them. An accident or claim may bump you into a higher risk pool, which would then result in raising of rates, and sometimes into a risk group that is too high to be insurable by the company. Especially because it’s an improvement that will only make your home more secure and less susceptible to more severe damage.

Most health insurance companies will provide. People can sue to try to get money from the driver's insurance company. Tell them that you have received a summons and complaint (to learn more about insurance agents and what they do, see insurance agents:

The insurance company will want to delay paying your claim, especially if they have grounds for denying the claim. However, if they've already accepted a settlement, things can go downhill in a hurry. 6.) you can sue your insurance company if the carrier treats you unfairly.

If you have spoken with your insurance agent and think your policy has been illegally terminated, contact your state insurance department to file a complaint or dispute. In rare instances, and after several claims or tickets, your own insurance company may drop your coverage or increase your premiums to the point that you will have to seek new coverage. Yes, an insurance company can drop you at any time.

Posted on may 15, 2013. The following regulatory violations may support a lawsuit against your insurance company for treating you unfairly: You will not be held liable for statements that you did not understand.

There are generally three different approaches that a victim of a wrongful repudiated insurance policy can take based on. What’s more, when they refuse to pay for an auto insurance claim, they usually have a compelling reason for doing so. Insurance companies are known for low balling people when they don't have representation.

Can your auto insurance drop you after a claim has been filed? Without an experienced attorney you can expect the process of suing an insurance company to be long and difficult. The key is understanding what you should do if your insurer isn’t giving you results — or even denies or underpays the claim.

You’ve already had to deal with the events giving rise to the insurance claim in addition to the. Your insurance company may cancel you for nonpayment, or it may find your situation too risky and decide to cancel your policy. Yes, you can sue your insurance company, especially if you believe that the insurance company has acted in bad faith.

They may even file charges and demand repayment of past claims paid by them. If you’re at the point where you’re thinking of suing your insurance company for denying your claim or committing other misconduct, it’s time to look for a local insurance attorney who can defend your interests. If you have lost or cannot find these documents, call the agent who sold you the policy or look in the phone book and call the insurance company directly.

You should write to the insurance company and ask it to continue working with you on home or car insurance issues that fall outside the bounds of the suit. If a company finds evidence of fraud they can drop you immediately and do not have to pay any claims filed on the policy. It is unlikely your insurance would drop you.

Insurance companies and other defendants will insist on a signed release form. A false insurance claim can lead to jail, substantial fines, and a permanent criminal record. Home insurance companies can drop policies for reasons that run the gamut from changing business strategy to increasing risks in your area.

The determination by an insurance company to raise rates or drop an insured is all about determination of risk. Lying to your insurance company could seem like a good idea at the time, but in reality, it's a form of insurance fraud. If you fail to pay your health insurance premiums, the company will cancel your policy.

You can sometimes solve these problems, however, with the help of a lawyer before launching a lawsuit. Lastly, it makes little or no sense for an insurance company to drop your policy should you move forward with a lawsuit. Any car insurance company can drop you;

This includes your own insurance company and. In most states, suing an insurance company is sanctioned by the law if the company has wrongfully repudiated their insurance policy. Settlement agreements are meant to wrap things up.

Here are three tips you should put into action if your insurer is taking you for a ride. But insurance companies can still drop you if the information you provided is incomplete, inaccurate, or false.

Insurance Bad Faith Law – Can I Sue My Health Insurance Company

Why Do Insurance Companies Offer Such Low Settlements

What To Know If You Refuse A Car Accident Settlement Ny

Insurance Fraud Laws And Penalties Criminaldefenselawyercom

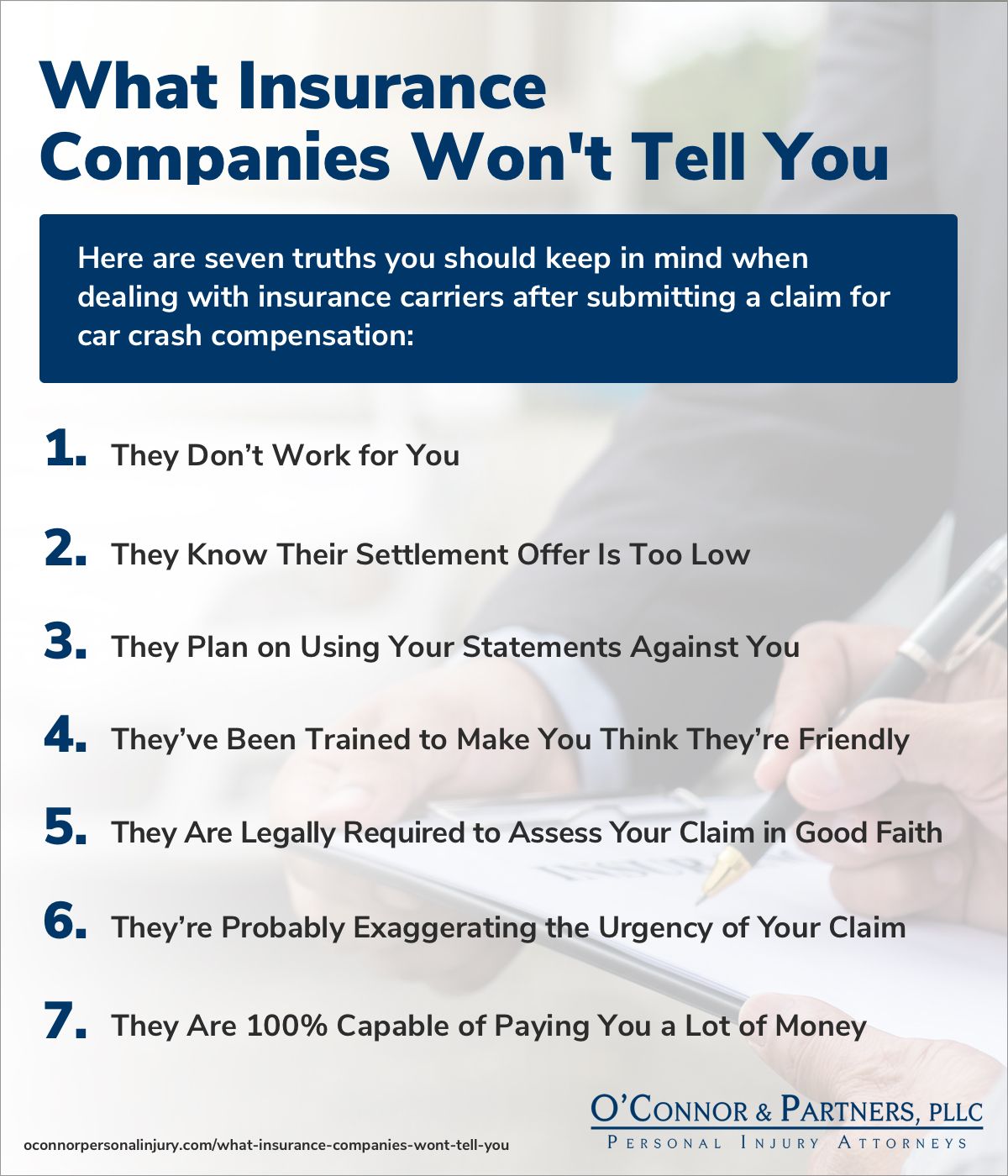

7 Things Your Insurance Adjuster Doesnt Want You To Know

Frequently Asked Questions After An Auto Accident Infographic Auto Accident

Dropped By Your Insurer Where To Go For Help In California – United Policyholders

What Happens If Your Insurance Company Goes Out Of Business Forbes Advisor

Internasional Morse Code International Morse Code Morse Code Coding

/GettyImages-944975896-1e117f457b9f4b72a623b9befa6a3c3e.jpg)

Can Your Insurance Company Cancel Your Policy Without Notice

Why Do Car Insurance Companies Cancel Policies Kelley Blue Book

Uk Expats Insurance Car Insurance Vehicle Logos Insurance

How To Make A Claim Against Someone Elses Car Insurance Forbes Advisor

What Happens If You Lie To The Insurance Company About An Accident Scholle Law

Can My Insurance Company Drop Me – Cohen Law Group Orlando Attorneys

What Do I Do If The Other Driver And Insurance Company Denies Liability – Lamber Goodnow Injury Lawyers Chicago