Spotme lets you make debit card purchases that overdraw your account with no overdraft fees. I know there’s some people looking for answers to this question, not necessarily to avoid over drafting, but to be able to access money when you don’t have it.

Venmo Debit Cards Credit Card Design Debit Card Design Cards

Unlock overdraft protection up to $200.

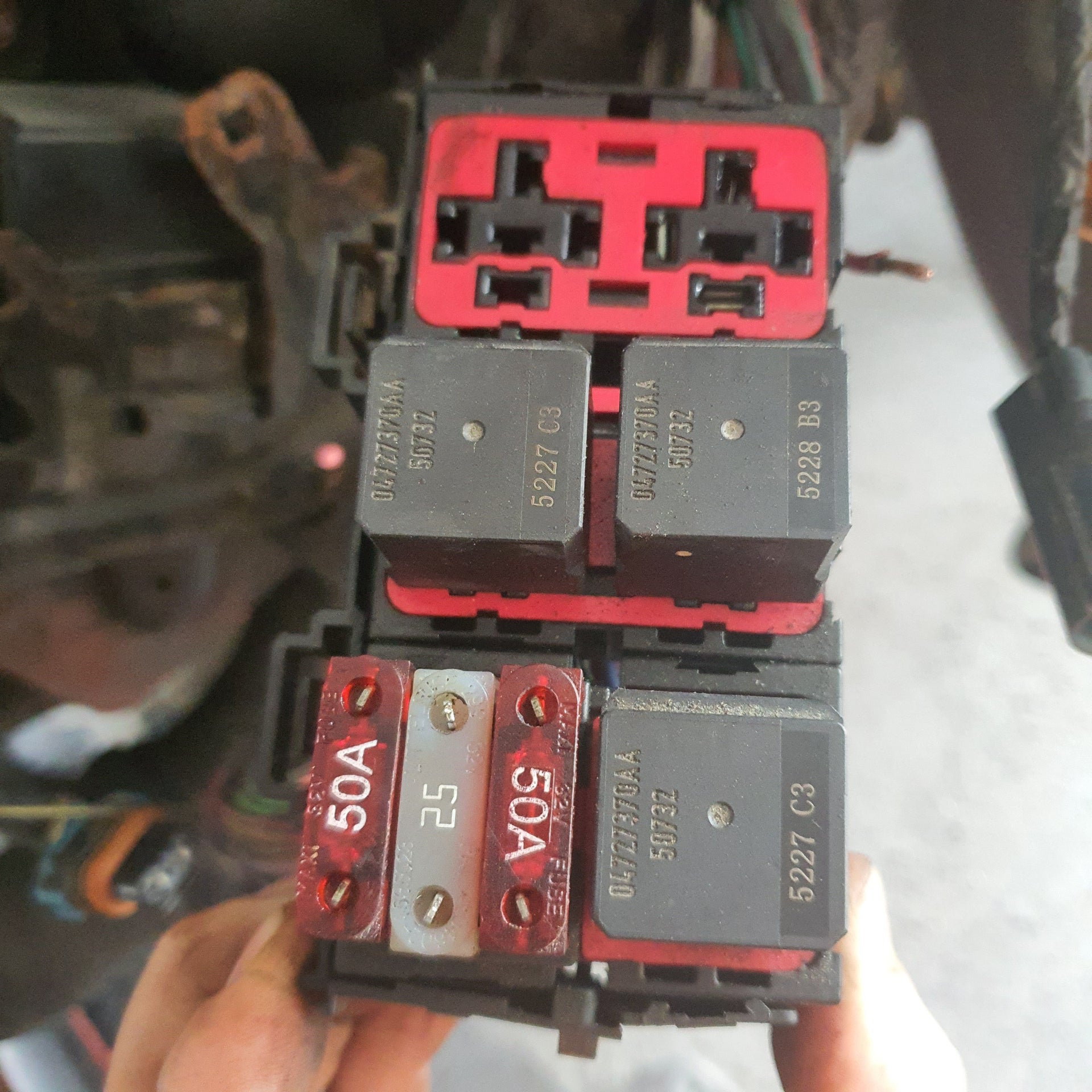

Can you overdraft cash app card at atm. If you choose to opt in to debit card and atm overdraft, you are usually allowed to make atm withdrawals and debit card purchases even if you do not have enough funds at the time of the. Cash cards work at any atm, with just a $2 fee charged by cash app. We’ll spot you when you need that little extra cushion to cover an expense.

The debit card overdraft service is an optional service made available to eligible flare account customers by metabank. You can also withdraw cash using your cash card, up to $250 per day or $1,250 per month. You can also withdraw cash using your cash card, up to $250 per day or $1,250 per month.

This is to avoid you finding out you need more money later in the day and overdrawing it again, resulting in another fee. Once you have successfully activated free atm withdrawals, each qualifying deposit you. Can i overdraft cash app card.you can also withdraw cash using your cash card, up to $250 per day or $1,250 per month.you can apply to increase or reduce your arranged overdraft limit, as well as remove your arranged overdraft at any time via your internet banking or mobile.

Bank of america allows you to. Most banks and credit card companies will let you to do so but there are usually (high) fees for this service. But, you also have the option to use their overdraft protection feature.

If you choose to opt in to debit card and atm overdraft, you are usually allowed to make atm withdrawals and debit card purchases even if you do not have enough funds at the time of the. You won’t pay any atm fees over and above fees charged by the atm itself. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month.

Can i overdraft my account at the atm? They can do it through electronic transfers or go overboard at the cash register or the atm with their debit cards. Find your nearest cash deposit location in the go2bank app or visit a retail location near you.

Courtesy overdraft typically allows a customer to overdraw their account up to a specific dollar amount based on their account and their relationship with the bank. You can easily block your card in the app by toggling the “enable cash card” switch to “off”. Cash cards work at any atm, with just a $2 fee charged by cash app.

But you can deposit cash using the app at a retail store. No, it is not possible to deposit cash to a go2bank account using an atm. Atms that let you overdraft will allow you to withdraw cash even though you don’t have enough balance on your account.

Once you enroll and meet the eligibility requirements, you will be charged $20.00 for each transaction that overdraws your account by more than $10.00, up to a maximum of five (5) fees per calendar month. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Can you overdraft a debit card at an atm.

Retail service fee and limits apply. Or, you can deposit cash using your go2bank debit card at a retail store. $15 fee may apply to each eligible purchase transaction that brings your account negative.

Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid the fee. How to add money to cash app card

“just a friendly reminder that there are absolutely no overdraft fees with the cash app and cash card!… what is the maximum you can overdraft? Limits start at $20 and can be increased up to $200.*. With current, you can bank with no atm fees and instantly find a location near you on the atm locator map in our app.

If you absolutely need to overdraft your account at the atm, ensure you take the maximum limit, which is usually $300, to get one fee.

Squares Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Its Time To Do Money Robinhood Credit Card Design Mobile App Design Inspiration App Interface Design

Revolut Premium Cards 1440 1080 Credit Card Design Vip Card Design Member Card

2021 Can I Overdraft My Cash App Card At Atm Gas Station – Unitopten

Robinhood Launches No-fee Checkingsavings With Mastercard The Most Atms Techcrunch Savings Account Credit Card Design Savings

No Monthly Fees No Overdraft No Minimum Balance Requirements No Foreign Transaction Fees Signing Up Is Free Automatic Savings Banking App How To Get Money

Use Your Phone Instead Of A Card At The Atm Cnet News – Youtube

Cash App Cash Card Atm Withdrawal – Choose Checking Or Savings – Youtube

Cash App Use At An Atm – Youtube

Swagbucks Chime Offer Get 150 With New Account And Direct Deposit Visa Debit Card Banking App Online Bank Account

Pin By Sahadmukoone On Creative Video In 2021 Banks Ads Ads Creative Banking App

Pin On Freebies That You Dont Wanna Pass On

Cash App Overdraft Understand When Cash App Balance Go Negative

Chime Banking Signing Up Takes 2 Minutes Banking App Banking News Apps