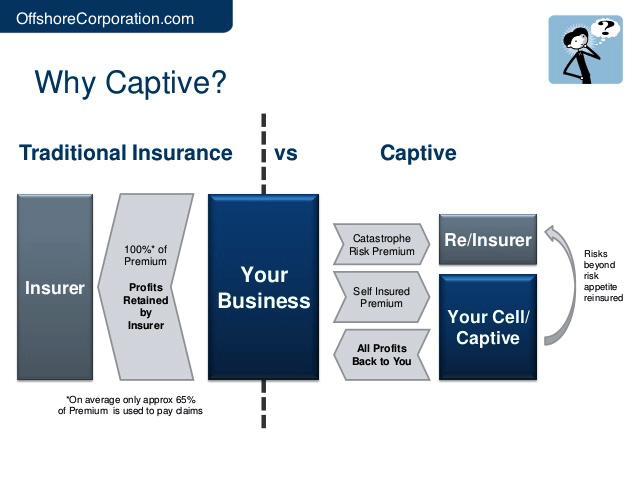

Alternatively, independent insurance agents are more like a retailer, like a supermarket or box store. A micro captive is a captive insurance company which has an annual written premium of less than $1.2 million.

Car Insurance Quotes Examples Quotesgram

Also, any amount of potential loss (risk) over the amount insured is retained risk.

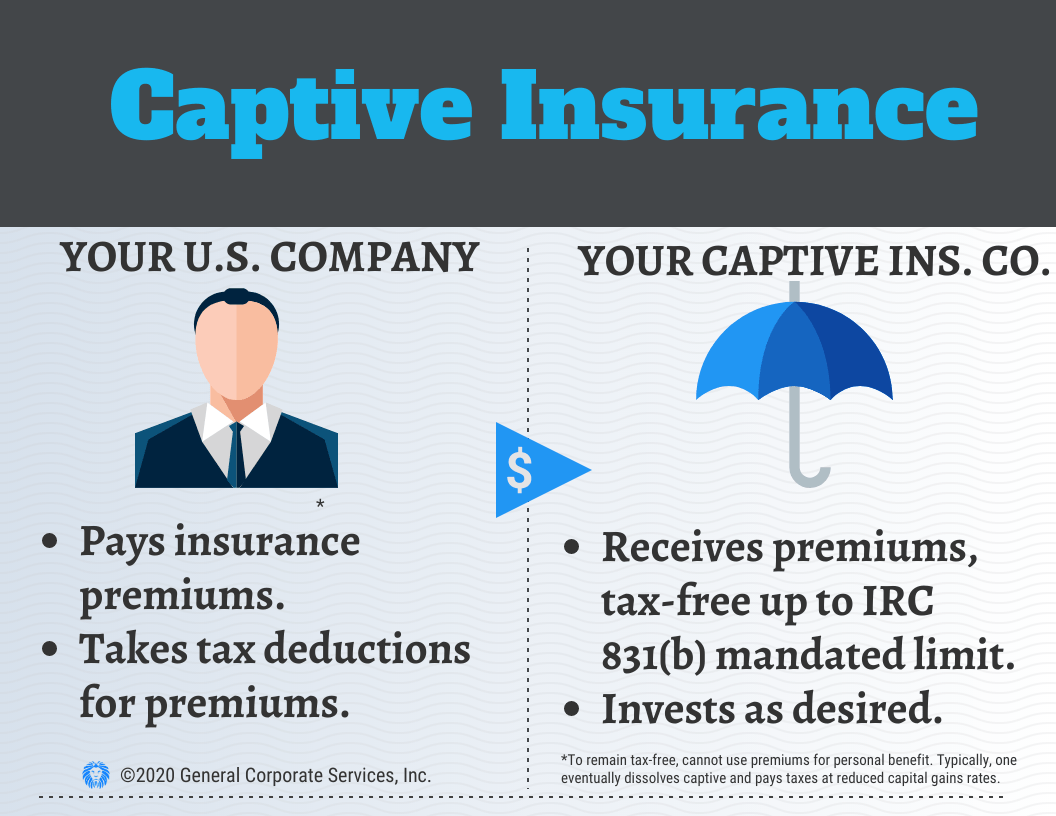

Captive insurance agent examples. A captive can also include risks that are generally excluded in traditional insurance policies. In the usa, micro captives are taxed under internal revenue code § 831 (b), which provides that a captive qualifying to be taxed as a u.s. By nature, a captive agent only sells insurance for a single company.

These points do not clearly distinguish the captive insurer from a mutual insurance company. Agency captives are owned by insurance agents in order to align interests of producing profitable business with their insurance companies and to create a new revenue source beyond commissions for the agency. Products and services are limited to the products of the represented carrier.

A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; Unlike other captive types, agency captives are not designed to provide underwriting profits directly to the insureds. Some examples of life insurance companies with large, captive agent field forces include northwestern mutual and.

Government agencies worldwide rely on captives as part of their programs for managing risk. Their company pays them bonuses for meeting some thresholds. The number of overall employees at the practice has increased over time because of the financial stability created by the captive, and the staff and professionals have gained a greater sense of control.

All of the steps would be the same, up to the point where you receive your quote. Reiss established the first captive insurance company in bermuda in 1962. Well known examples of captive agents or exclusive insurance agents include allstate, farmers, and state farm.

A captive agent is an agent that generally represents a single life insurance company. They provide guidance and resources, including product training, promotional campaigns, and. For example, as a captive agent, you’re not investing your time or expertise into your own business.

The main purpose of doing so is to avoid using traditional commercial insurance companies, which have volatile pricing and may not meet the specific needs of the company. Captive agents enjoy salary and commissions; Captive insurance companies represent a special case of risk retention.

Over the past 30 years, there has been significant growth in the captive market. There are additional benefits to creating a captive, but they should be ancillary to the primary purpose of risk management. State farm, farm bureau, and farmers when it comes to insurance, some of the most recognizable names are found in the captive agent sector.

Parent insurance companies or agencies often offer their captive agents financial support, usually by way of allowances, employee benefits, and funds for overhead expenses. Examples of captive insurance agents are those who sell for state farm, farmers, and allstate. If the total cost of your automobile insurance policy for one year is $1,000, and the agent is paid a 12% commission by the insurance company, the agent will earn $120 for selling you the policy.

So, without further delay, let’s look at the pro’s and con’s of the captive agent, the direct writer, and the independent agent. Faster results — with captive insurance agents, researching the market is a task businesses need. Some insurance companies sell only through captive agents and direct sales, while others also sell their products through independent agents.

Examples of captive insurance companies. You might spend years building a. Emerging risks that are difficult to insure within traditional insurance markets have acted as another driving force behind the growth in captive insurance.

Independent insurance agents are free to work with the insurance companies that they feel offer the best value for their niche market or the customer segment they choose to service. Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer's underwriting profits. Examples of insurance companies with captive agents include allstate, geico, and state farm.

Captives as well as the commercial insurance market, there is an incentive to a captive owner to diversify their portfolio of exposures. By creating their own insurance company, the parent. Insurance company will pay tax only on investment income.

A captive agent is an insurance agent who only works for one insurance company and is paid by that one company, either by salary, commission, or both. An example of a captive agent would be state farm. For example, by insuring trade credit insurance in the captive, in addition to say property and casualty, this creates an additional risk diversification which may support the captive’s capital requirements, particularly in a solvency

For instance, if a client doesn’t qualify for the products offered by the company, they cannot direct the client to another agency. In contrast to the example above, let’s look at the captive insurance agency. And as such, your hard work and effort improves your employer’s business.

Captive insurance companies have been in existence for over 100 years.

151 Catchy Insurance Advertising Slogans And Taglines Advertising Slogans Insurance Ads Insurance Marketing

Family First Life Us Family First One Life Life Insurance Agent

Design 31 By Webwooter Building Our Brand Through The Website Web Design Services Freelance Web Design Web Layout Design

Captive Agents Vs Independent Insurance Agent Know The Difference

Pin By Liz Morgan On Brett Insurance Marina Bay Sands Marina Bay Travel

Key Factors To Consider When Establishing A Captive Insurance Company Ocorian

Captive Insurance Company Formation – Irs Requirements

Insurance Journal Entry For Different Types Of Insurance

Example Insurance Quote Templates Custom Quote Form Home Insurance Quotes Insurance Quotes Home Quotes And Sayings

Insurance Agent Resume Writing Guide 20 Templates

Dream Come True Essay Essay Essay Writing Tips Writing Center

Captive Insurance Companies Valuescope The Valuation Experts

Insurance Agent Resume Examples Sales Resume Good Resume Examples

10 Best And Almost Free Tools To Create Mind Maps For Your Nonprofit Create Mind Map Mind Map Mind Mapping Tools

Pdf Captive Insurance Companies And The Management Of Non-conventional Corporate Risks

Insurance Agency Business Plan Template

Captive Insurance Definition Types Process Examples Explained Risk Management Parenting Organization Insurance

Offshore Captive Insurance Company Tax Benefits And Formation

Captive Insurance Companies Valuescope The Valuation Experts