Learning drivers can usually be added to a parent’s or significant other’s car insurance policy there are some companies that will offer you your own learner permit car insurance, but these policies can be expensive and have restrictions. If you have a dui, farmers is cheaper.

Guide To Adding Your Child To Your Car Insurance Nextadvisor With Time

You can buy insurance in canada with a learner’s license.

Car insurance for learner's permit geico. The company recommends adding the learner driver to a licensed driver’s policy. What is a learner’s permit? And if the accident / insurance event occurs, the insurance company will bear all or all of the costs in full or in part.

Usually, car insurance companies extend the parents’ policies to include the permitted teen. Learner’s permit coverage you might not have to buy learner’s permit insurance depending on your situation. You can get a separate car insurance policy with a permit, and in certain circumstances you might have to.

Drivers with a learner’s permit need to be covered under an insurance policy. Although it is possible to obtain a new vehicle insurance policy using a learner’s permit only, there are more requirements than if you have a standard driver license. Young drivers with a permit might also acquire temporary car insurance if they live independently, but this depends on the regulations in your state and insurance policies.

A learner’s permit is basically the training wheels of driving. This means you can drive under their supervision without technically having insurance. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses.

This is another topic you’ll want to discuss with your insurance company. The age at which you can first apply for a. Geico auto insurance is cheaper based on demographics, credit history, and driving record.

Having insurance coverage while learning to drive provides protection in the event of an accident or another driving mishap. Learners permit insurance policies are expensive and average $650 per month. $25,000 per person and $50,000 per accident.

Certain car insurance companies will allow you to buy insurance with a learner's permit if you are getting your license within 30 or 45 days. Similarly, to help drivers save on car insurance for learner’s permits, geico offers discounts and makes it easy to add a new driver onto an existing policy. Auto insurance no license required, unlicensed driver insurance coverage, geico learners permit insurance, any driver car insurance, insurance with permit, does student driver need insurance, does geico insure unlicensed drivers, car insurance with a permit.

However, this does require you to be the dependent of someone with a current auto insurance policy. In fact, there are many companies that offer coverage. By double checking with the company on this at the start, you enable your insurer to consider any special circumstances that may require your teen to purchase a separate learner’s permit insurance.

If your teen goes five consecutive years without an accident, they could receive up to. In general, permit holders don’t need car insurance, in the classic sense; A carrier may ask a permit driver to obtain a full driver’s license within a specified time period, such as 30 days after issuing the policy.

Look into car insurance discounts for students. All motorists are required to carry the following minimum insurance coverage levels in south dakota: Good driving is the best way to get a solid cut in geico car insurance.

However, other car insurance companies require anyone of driving age (even if they don’t have a driver's license or learner’s permit) to be added to the policy as an excluded or included driver. Car insurance for a learner’s permit with geico, progressive, allstate, state farm, or usaa is similar. Teenagers are able to apply for temporary insurance policies until they become eligible for their license.

Both companies offer many discounts to lower auto insurance rates. Car insurance companies offer a wide variety of discounts some drivers. If you are wondering where to get car insurance for a learner’s permit, geico and state farm learner’s permit insurance is available as is learner’s permit insurance from progressive.

These are just a few companies and policies: Insurance options for teen drivers. Adding a teenage to a car insurance policy can be daunting, but there are steps you can take to help save money on premiums.

But even though drivers with a learner’s permit need insurance coverage, they usually don’t need their own car insurance policy. Auto life home health business renter disability commercial auto long term care annuity. Once the teen becomes a licensed driver, he or she will need car insurance—whether that means formally adding the teen to the parents' policy, or having the teen purchase his or her own policy.

Some car insurance companies have provisions within the policy to cover drivers with a learner’s permit. You can purchase a car insurance policy just with a learner's permit. The same applies to learner’s permits and state farm.

Do you need car insurance for a learner’s permit? Once you have that insurance policy in place, you can also purchase and register a car in most states — even if you are only 16 years old. Usually, car insurance rates for teen drivers are as low as $234.54 a month for girls and $246.19 a month for boys.

$25,000 per person and $50,000 per accident. Adding permit drivers to a family policy might be the most common way for learners to get insurance, but it's not the only approach. Car insurance for learners permit geico is a tool to reduce your risks.

Most states allow those with their learner’s permits who are still teens living at home to be covered by their parents’ or legal guardians’ insurance. Extended coverage if you received your learner’s permit, insurance companies usually allow your parents or legal guardian to extend the policy’s coverage to you with no. Geico offers eligible students good student discounts in most states, as well as discounts for members of certain student organizations.

Farmers and geico both have good financial and customer satisfaction ratings, although geico’s are slightly better. If your insurance company will not allow the teen driver to be covered under their parents policy, they must get a policy of their own.

Car Insurance For New Drivers With Learners Permits

How Much To Add A Teenager To Car Insurance

Adding A Teen To Your Auto Insurance How To Save Money On Premiums

Best Car Insurance For Teens And Young Drivers In 2021 – Cnet

Is Health Care Insurance Really Beneficial To Everyone Minds Building Business Insurance Business Insurance Companies Auto Insurance Companies

Download Auto Insurance Card Template Wikidownload Document Fake Cards Free – Petermcfarlandus Id Card Template Card Templates Printable Card Template

Cheapest Car Insurance For First-time Drivers In 2022

.jpg)

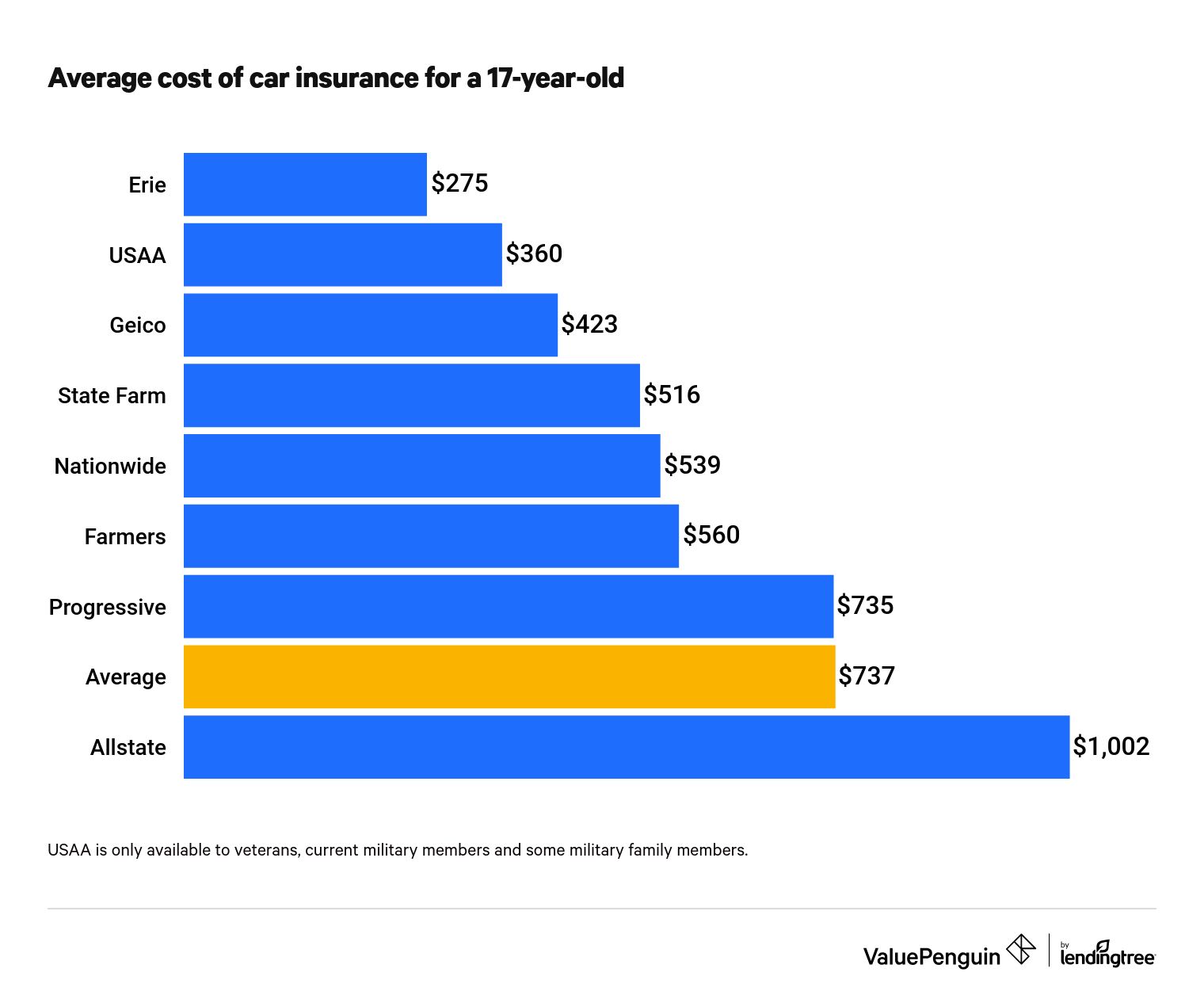

How Much Is Car Insurance For A 17 Year Old

How Much Is Car Insurance For A 17-year-old – Valuepenguin

Can You Get Car Insurance With A Learners Permit Bankrate

What To Look For In A Pre-purchase Inspection Carshopping Car Care Car Insurance Progressive Insurance

In 10 Minutes You Will Know The Truth About Bmw Car Insurance Usa Car Insurance

Get Car Insurance For No License Drivers Online – Free Quote

Get Car Insurance For No License Drivers Online – Free Quote

Cheapest Car Insurance For Teens In 2022

Can I Add Someone To My Car Insurance Who Doesnt Live With Me Clearsurance

How To Insure Your New Florida Driver – Florida Farm Bureau Insurance