Your basis in the policy is $12,000. A withdrawal from a life insurance policy is not taxable provided it does not exceed your cost basis in the policy.

In most cases, your beneficiary won’t have to pay income taxes on the death benefit.

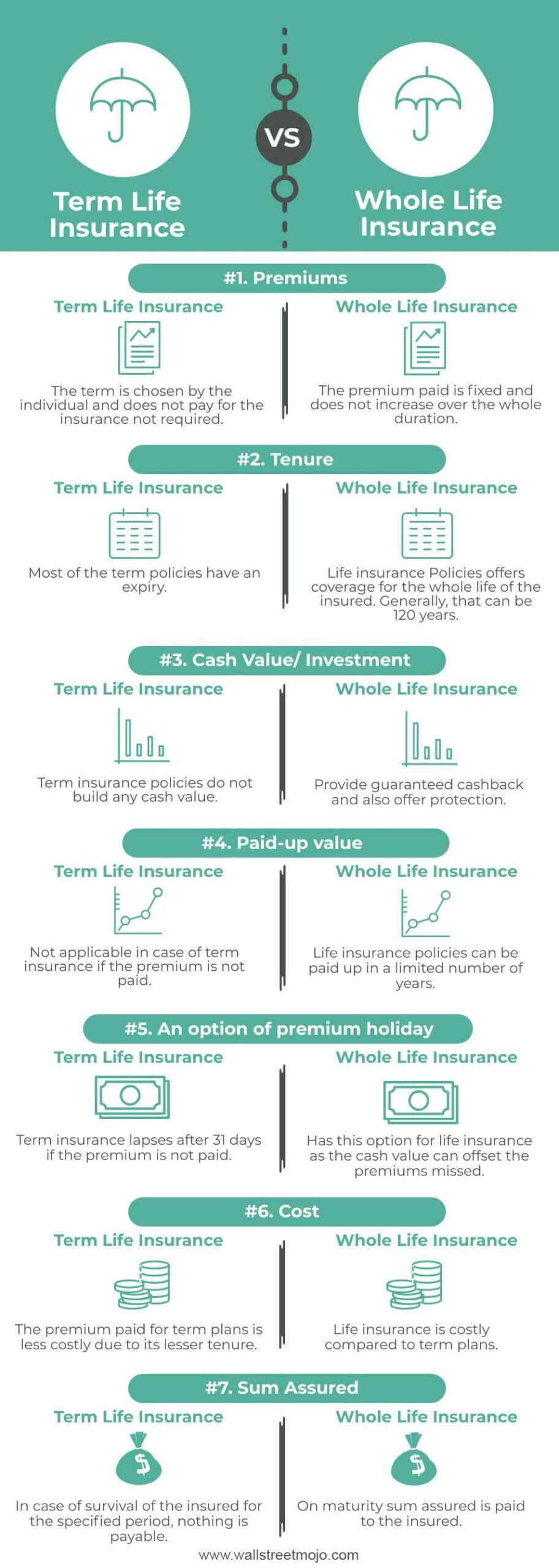

Cash value life insurance taxable. In summary, your life insurance policy receives favorable tax treatment versus investment vehicles such as mutual fund investments or annuities. Is cash value of life insurance taxable in canada? What is the difference between surrender value and cash value of a life insurance policy?

One of the reasons to buy cash value life insurance is to have access to the money that builds up within the policy. This means that as cash value grows inside a life insurance policy, you will not owe taxes on the interest or dividends earned on this cash value. Is life insurance cash value taxable income?

Cash value is the amount of money kept in your policy’s account as a result of premium payments over time while surrender value is the amount of money received by a policyholder who tries to obtain the cash value of a policy by terminating or cashing it out. Is life insurance taxable if you cash it in? In simple terms, the test analyzes the death benefit against the policy’s cash value.

As a general rule of thumb, when cash value remains inside a life insurance contract, it is not taxable. But there are times when money from a policy is taxable, especially if you're accessing cash. This means you can remove the already taxed dollars you used.

The broad answer to this question is no! If you decide to cancel your life insurance policy, these dividends, interest or any capital gains become taxable income.9 oct. Depending on the type of cash value life insurance you purchase and how much you fund it, there can be taxable income situations.

If you have a cash value life insurance policy, you can generally access the money through a withdrawal or loan, or by surrendering the policy and ending it. Summary of life insurance being taxable. For example, lets say over 20 years, you paid $1000 per year, totaling $20k.

Is withdrawing cash value from a life insurance policy taxable? For example, you have a cash value life insurance policy with a cash value of $18,000. Withdrawals are generally treated as coming out of your policy basis first.

Cash value inside the life insurance contract. The cash value of a whole life insurance policy is taxable in certain events, such as when using the policy as collateral for a loan or if the policy is surrendered. You withdraw money from cash value.

But if you want to cash in your policy, it may be taxable. This means that you can take money from the account or take out a loan against the account, subject to potential decreased death benefits, loan interest accruals and/or tax ramifications of a loan if a policy lapses. It’s one of the perks of purchasing a life insurance policy.

In most cases, your beneficiary won't have to pay income taxes on the death benefit. Basis is considered the premium you paid in. Use a tax calculator to check your withholding, figure out how much money to set aside for taxes, or to check if you need to make an estimated tax payment.

With cash value life insurance, your premium payments go three places: If the cash value is too high compared to the death benefit, the irs generally requires the provider to increase the death benefit in order to comply with the. This means that if you make a withdrawal over and above your basis in the policy, a portion of the withdrawal will be considered taxable income.

Also, is cash surrender value of whole life insurance taxable? Once of the many tax benefits of life insurance with cash value is the ability to take a first in first out withdrawal from the policy. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

The taxable portion of a life insurance policy cash out is ordinary income subject to the same income tax rates as your wages, investment income, and other taxable income. But if you want to cash in your policy, it may be taxable. There are choices you can make with some policies that create current income taxes on the gains.

Yes, no, maybe depending on how your policy is structured. Accordingly, the cash from a life insurance policy loan is not taxable when received, because no loan is taxable when you simply borrow some money! In this example, the cash value is $35k.

A cash value accumulation test (cvat) is used to determine the merits of a life insurance policy. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Founder, denverwest insurance professionals, inc., the cash surrender value in life insurance is only taxable on the amount over your basis.

/CashandCurrentAssetsontheBalanceSheet-56fb84885f9b58298683abc8.jpg)

Cashing In Your Life Insurance Policy

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Term Life Vs Whole Life Insurance Which Insurance Is Better

Do Beneficiaries Pay Taxes On Life Insurance

Whole Life Insurance Definition

Check Out This Simple Overview Of Whole Life Insurance Wholelifeinsurance Topwholelife Quotes Online Finance Insurance Tax Savings Dividends Investin

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

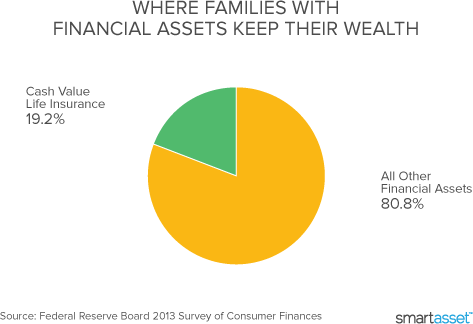

What Is Cash Value Life Insurance Smartassetcom

Is Life Insurance Taxable Forbes Advisor

Whole Life Insurance – Definition And Meaning – Market Business News

Cash Value Vs Surrender Value Whats The Difference

What Is Cash Value Life Insurance Smartassetcom

When Are Life Insurance Proceeds Taxable – Valuepenguin

Whole Life Insurance – Definition And Meaning – Market Business News

How Does Whole Life Insurance Work Costs Types Faqs

How Does Cash Value Life Insurance Work – Valuepenguin

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

Understanding Taxes On Life Insurance Premiums