The amount spent for the rostered minister’s primary residence (down payment, mortgage, utilities, taxes, insurance, furnishings, maintenance, etc); Shall also receive a parsonage furnishings/maintenance allowance or housing allowance of $ for the year.

The Pastors Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazoncom Books

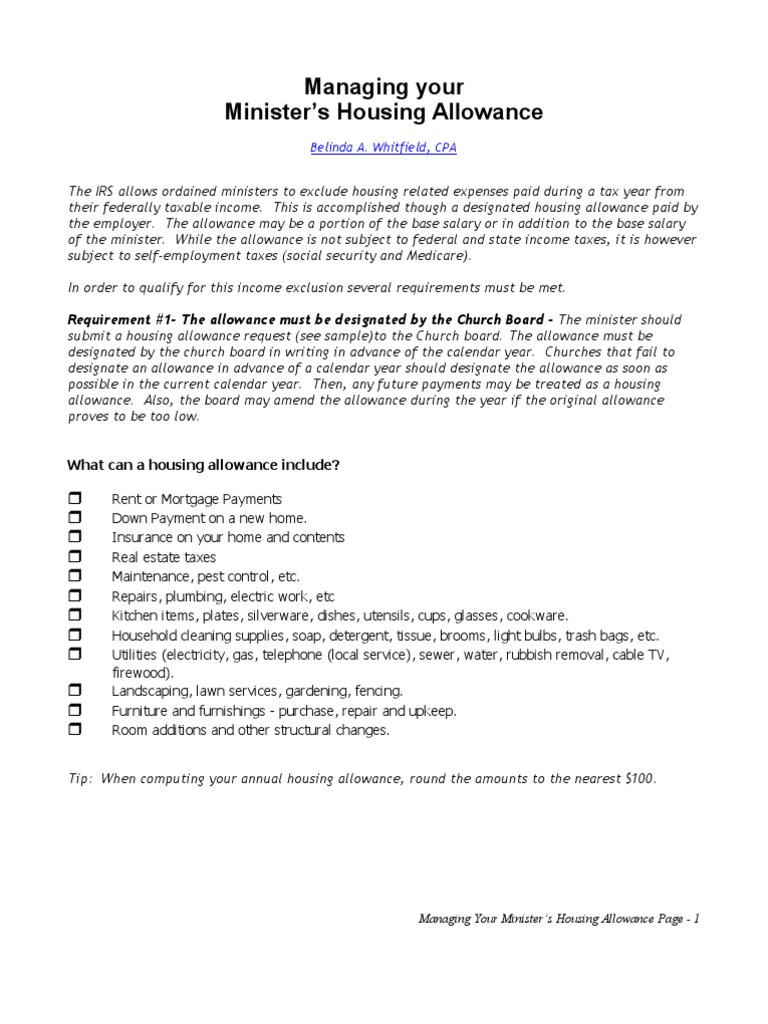

The housing allowance can only be used for qualifying expenses on your primary residence.

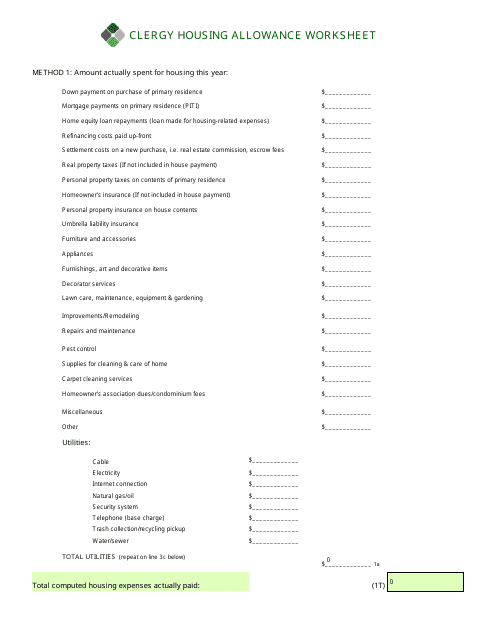

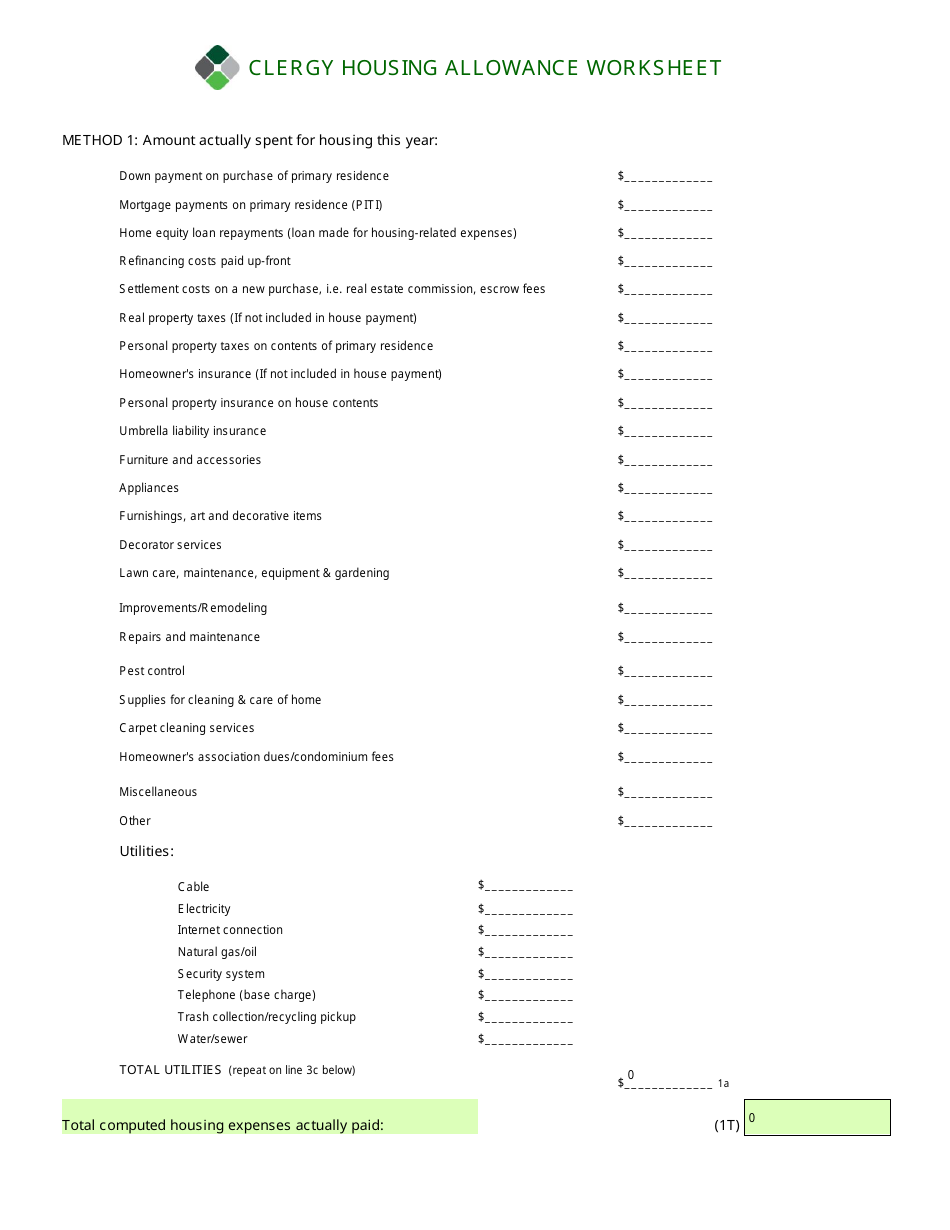

Clergy housing allowance items. The amount of housing allowance that can be excluded from taxable income is. By changing any value in the following form fields, calculated values are immediately provided for displayed output values. If a minister owns a home, the amount excluded from the minister’s gross income as a housing allowance is limited to the least of the following three amounts:

The amount actually used to provide a home. Miscellaneous expenses including improvements, repairs and upkeep of the home and its contents, snow removal, lawn mowing, light bulbs, cleaning supplies, etc. Now, the clergy housing allowance continues.” ministry settings should continue to designate housing allowances for clergy.

Someone once asked me if a storage unit used to hold household furnishings would count towards the housing allowance. For more information on a minister’s housing allowance, refer to publication 517, social security and other information for members of the clergy and religious workers. In other words, your taxable income is reduced by the permitted amount of the allowance.

(it may not encompass expenses incurred as the result of commercial properties or vacation homes.) A housing allowance may be based on the value of a furnished home (parsonage) provided by the congregation or an amount paid to the pastor within certain guidelines. Mortgage or rent payments in full (including principal, interest, escrow, & fees) home equity loans or lines of credit (to the extent used for housing) appraisals, closing costs, title insurance, points paid on mortgage or refinance

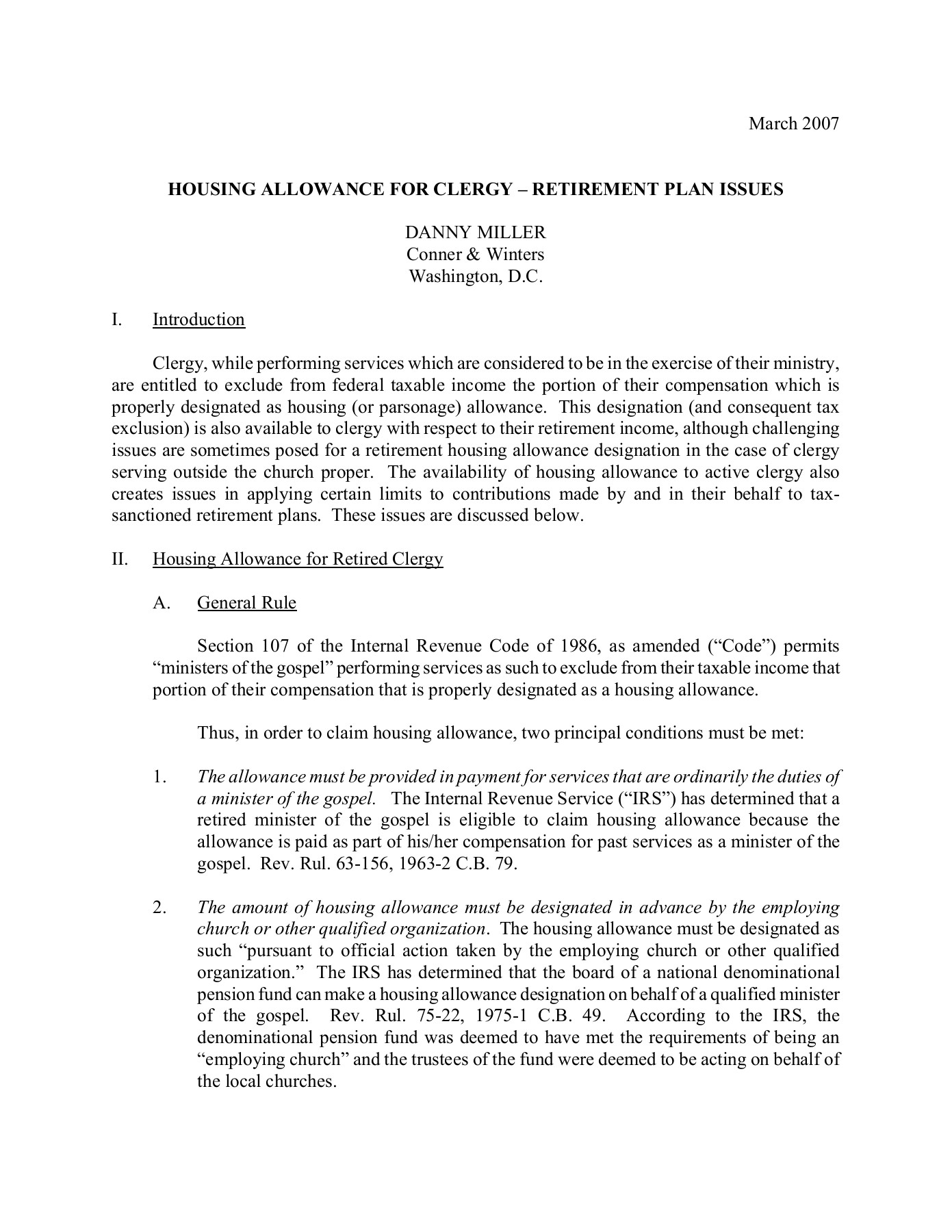

As a cleric, you are allowed to exclude your housing allowance from federal income tax. His allowable exclusion for a housing allowance is the lesser of the amount designated ($16,000), the fair rental value of the housing and furniture, plus utilities ($13,200 + $1,200 + $540 + $900 + $960 = $16,800), or the amount actually spent ($17,980). Use this calculator to help determine the amount that a member of the clergy can claim as a housing allowance.

The clergy housing allowance can make a big difference in your taxes. The mechanism by which clergy are permitted to exclude some or all of their income from being subject to federal income tax. (1) rent, principal payments, or down payments plus the cost of buying the home;

As indicated above, up to 100 percent of compensation can be designated as housing allowance, but this does not necessarily mean that this is the amount which can be excluded from income taxes. Excludible housing expenses include rent, mortgage interest, utilities, repairs, and other expenses directly relating to providing a home. Regulations do specifically state that expenses for groceries, paper products, personal toiletries, personal clothing, and maid service cannot be used.

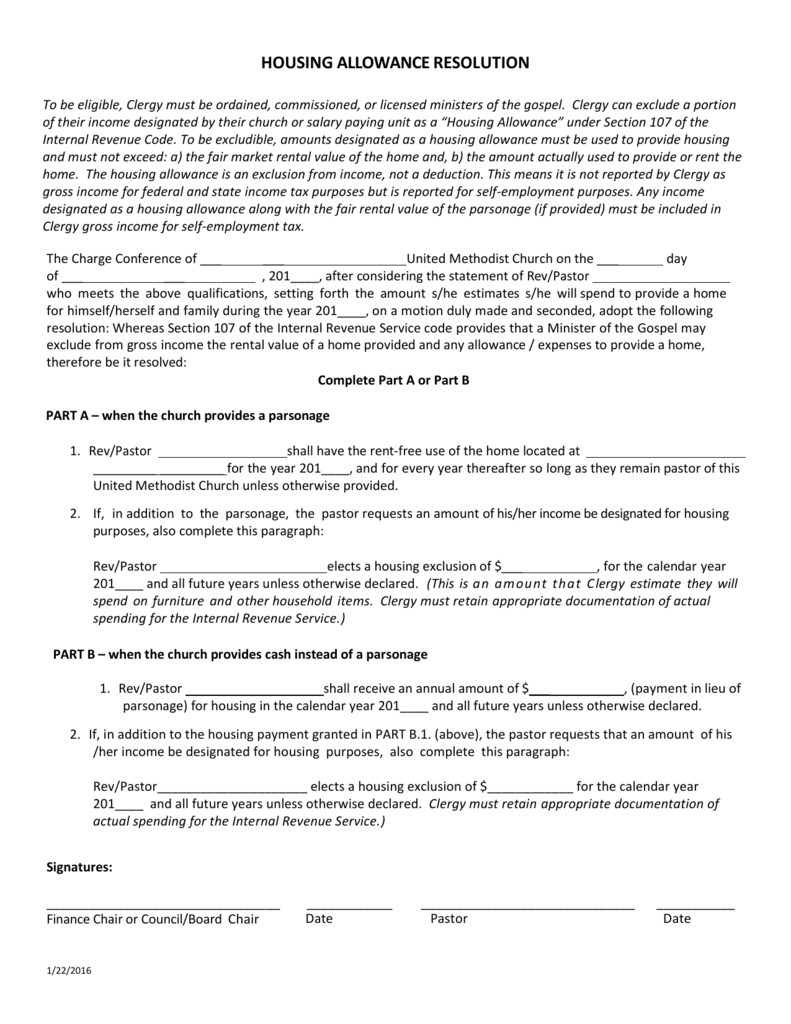

In that case, at most $5,000 of the $10,000 housing allowance can be excluded from the pastor’s gross income in that calendar year. The amount officially designated as a. To be eligible, the pastor/clergy

•the clergy housing exclusion (26 us code §107) is called by many names, yet each represents the same thing: Click the view report button to see all of your results. A housing allowance may include expenses related to renting, purchasing (which may consist of down payments or mortgage payments) and/or maintaining a clergy member’s current home.

The housing allowance exclusion only applies for federalincome tax purposes. The amount, officially designated in advance, as housing allowance by the rostered minister’s congregation; You may legitimately include the following:

Clergy housing allowance exclusion items home: The amount excluded can't be more than the reasonable compensation for the minister's services. What is the minister’s housing allowance?

Paper products (plates, napkins, etc., not toilet paper) personal toiletries;

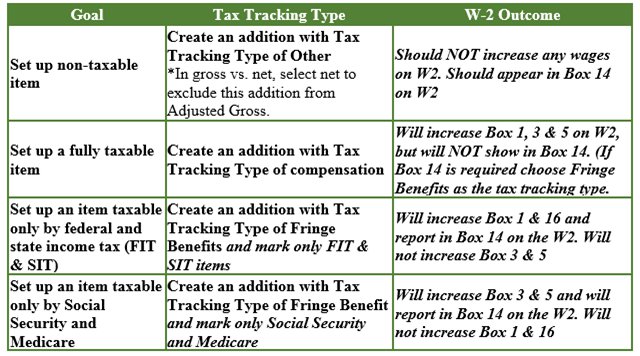

Payroll Set-up Housing Allowances For Clergy Members – Insightfulaccountantcom

Managing Your Ministers Housing Allowance Pdf Expense Transaction Account

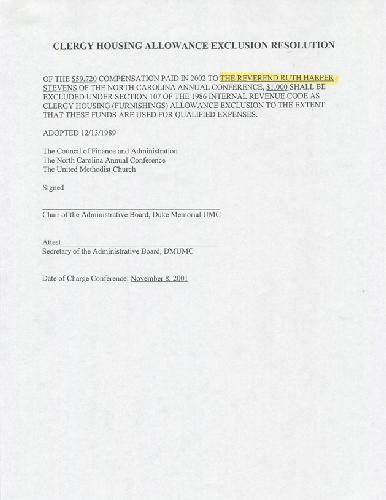

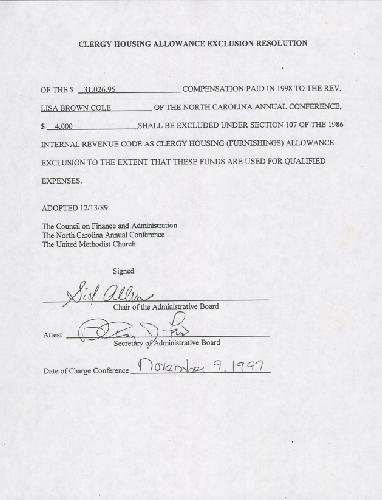

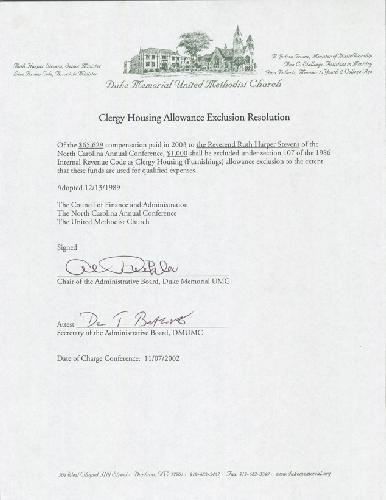

Clergy Housing Allowance Exclusion Resolution

Clergy Housing Allowance Exclusion Resolution

What Expenses Qualify For The Ministers Housing Allowance – The Pastors Wallet

Clergy Housing Allowance Exclusion Resolution

Clergy Housing Allowance Worksheet – Fill Out And Sign Printable Pdf Template Signnow

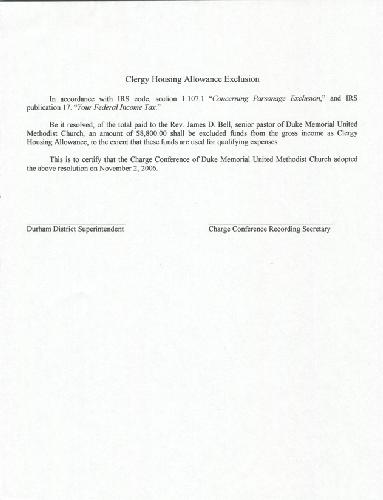

Clergy Housing Allowance Exclusion

The Ministers Housing Allowance

Housing Allowance Worksheet – Clergy Financial Resources Download Fillable Pdf Templateroller

Financialleadershipcovchurchorg

Church Pension Group Clergy Housing Allowance

Housing Allowance For Clergy B Retirement Plan Issues – Flip Ebook Pages 1-12 Anyflip

Clergy Housing Allowance Worksheet 2010-2022 – Fill And Sign Printable Template Online Us Legal Forms

Housing Allowance Worksheet – Clergy Financial Resources Download Fillable Pdf Templateroller

Housing Allowance Worksheet – Clergy Financial Resources Download Fillable Pdf Templateroller