The american rescue plan includes a new law that requires cash apps like venmo and cash app to report payments of $600 or more to the irs. Tax reporting for cash app.

Business Users On Cash Apps Will Begin Receiving Tax Forms Heres What You Need To Know Wjhl Tri-cities News Weather

Thereof, does cashapp report to irs?

Does cash app report personal accounts to irs. Does cash app report personal accounts to irs reddit. Current tax law requires anyone to pay taxes on income over $600, regardless of where it comes from. Yes, regardless of whether or not you meet the two thresholds of irs reporting within irc section 6050w, you will still have to report any income received.

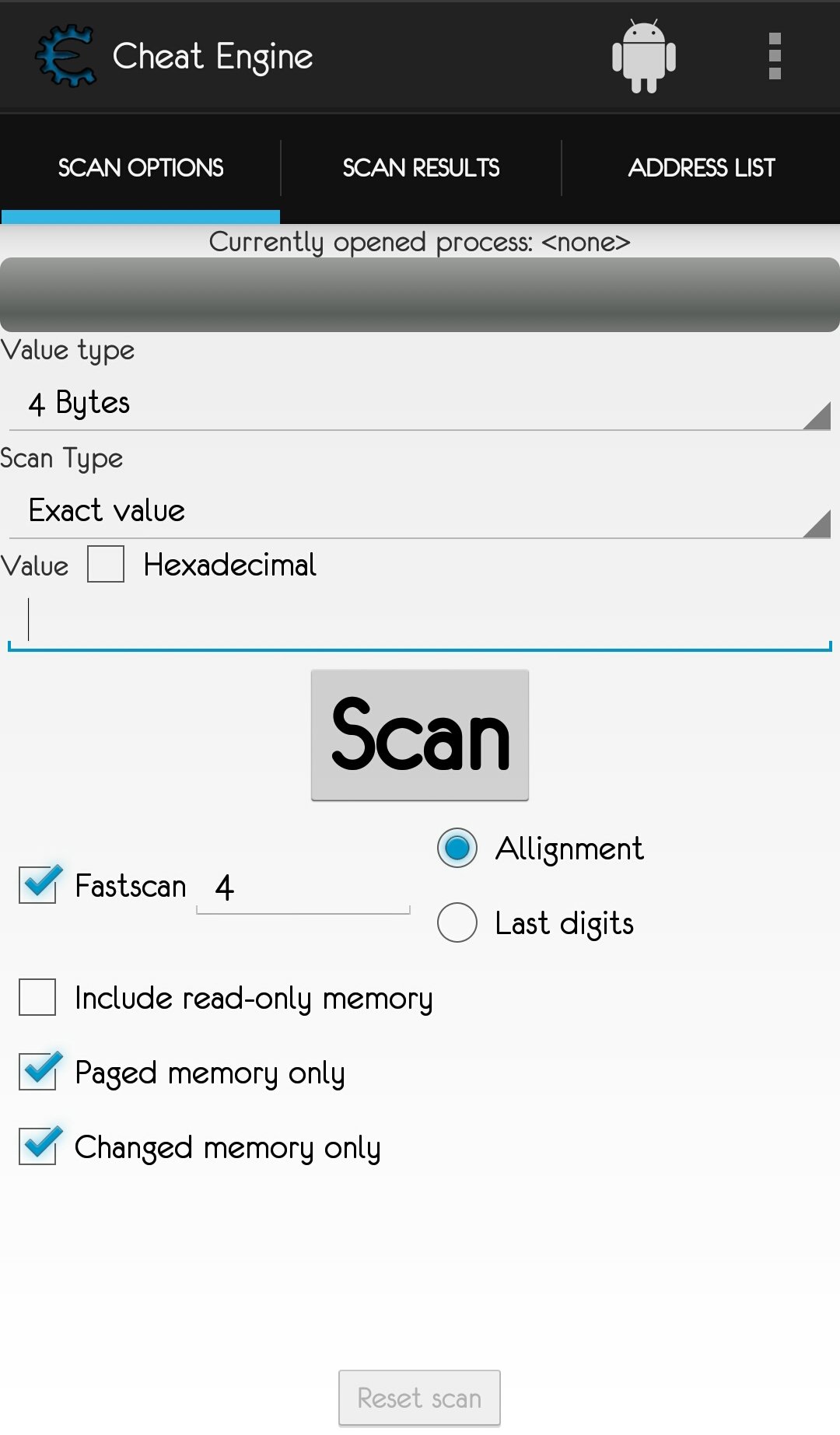

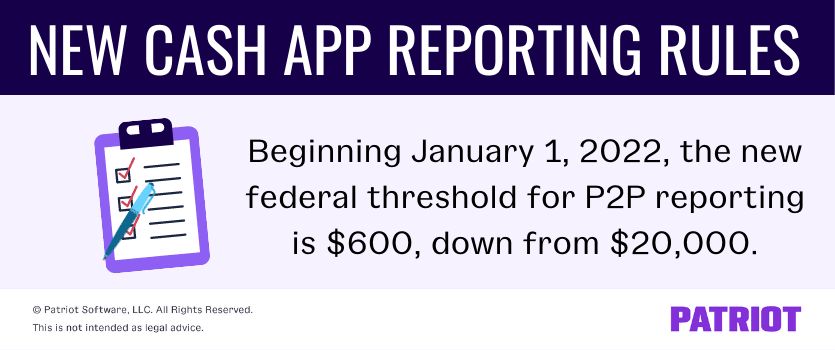

Starting in january, the threshold is being reduced dramatically, from $20,000 to $600, with no minimum number of transactions, rosenthal says. Log in to your cash app dashboard on web to download your forms. A new rule will go into effect on jan.

It allows you to easily split rent with your roommate, send cash to a. Tax changes coming for cash app transactions. If you use cash apps like venmo, zelle or paypal for business transactions, some changes are coming to what those apps report to irs.

Log in to your cash app dashboard on web to download your forms. Keep a separate cash app account for business transactions. Does cash app report to irs?

Tax reporting with cash app for business. 6:55 pm edt october 13, 2021 For any additional tax information, please reach out to a tax professional or visit the irs website.

For any additional tax information, please reach out to a tax professional or visit the irs website. Cpa kemberley washington explains what you need to know. Likewise, how much tax does cash app take?

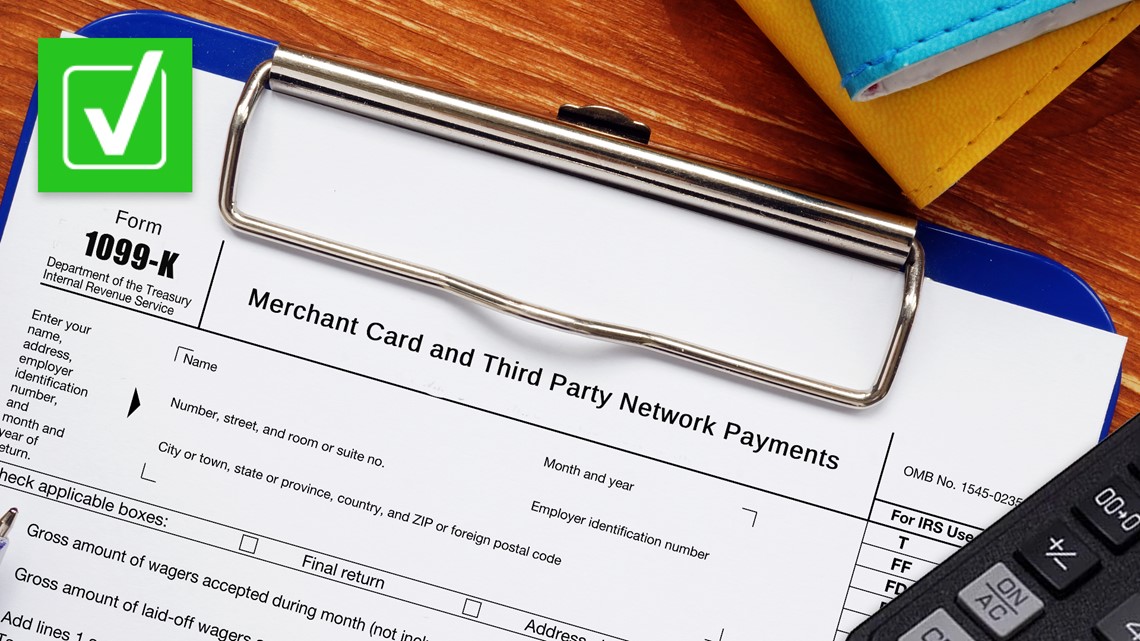

Certain cash app accounts will receive tax forms for the 2021 tax year. Users with cash app for business accounts that accept over $20,000 and more than 200 payments per year will receive a. If you do get audited, the last thing you want to deal with is a messy pile of.

The irs is behind on processing more than 5.5 million tax returns as oct. If implemented as is, the change would require financial institutions and cash apps to report to the irs aggregate inflow and outflow from most bank, loan and investment accounts that exceed $600. Certain cash app accounts will receive tax forms for the 2018 tax year.

Registration is a piece of cake, and you can use your contacts or email addresses to find your friends. But that doesn't mean you owe any additional taxes. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment.

There has been a flurry of furious cash app users this past week angrily responding to rumors of president joe biden’s new tax reporting plan requiring taxpayers to report all venmo and cash app income over $600. The irs plans to take a closer look at cash app business transactions of more than $600. The irs won't be cracking down on personal transactions, but a new law will require cash apps like venmo, zelle and paypal to report aggregate business transactions of $600 or more to the irs.

A seller would only need to report income to the irs if they had received $20,000 worth of payments per year and there were at least 200 transactions on their account. If you use cash apps like venmo, zelle or paypal for business transactions, some changes are coming to what those apps report to irs. This means that you must account for this income and are responsible for reporting it to the irs.

Like any application or service that deals in the exchange of currency for goods and services, paypal is responsible for reporting all transactions. This only applies for income that would normally be reported to the irs anyway. According to the cash app website, certain accounts receive 1099 tax forms.

The app is simply a digital wallet connecting to your payment methods. Starting january 1, 2022, cash app business transactions of more than $600 will need to be reported to the irs. These are just information reports.

5 Things To Know About Irs Plan To Tax Cash App Transactions

New Tax Law Requires Cash Apps Report Transactions Of 600 To The Irs Venmo Paypal Zelle Apple Pay – Youtube

Solved Your First Tax Season With Square – The Seller Community

Changes To Cash App Reporting Threshold Paypal Venmo Zelle More

Nowthis – If You Are Doing Business With Your Clients Using Third-party Apps Like Cash App Paypal Venmo Or Zelle You Should Know That The Irs Will Soon Require Businesses To Report

New Irs Rule For Cash App Transactions Set To Go Into Effect Next Year

Cash App Venmo Users Receive 1099-k For Payments Over 600 – Ohio News Time

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

New Rule To Require Irs Tax On Cash App Business Transactions Kbak

Changes To Cash App Reporting Threshold Paypal Venmo Zelle More

Who Can Track Cash App Transaction History Facts Decoded

New Tax Legislation Will I Get Flagged By Irs If I Receive Over 600 On Cash Apps Wfla

Please Report The Bitcoin Com Wallet To The Ios App Store For Fraud Bitcoin Bitcoin Wallet Bitcoin Transaction

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

New Rule To Require Irs Tax On Cash App Business Transactions Wciv

Why Some Payments Through Cash Apps Will Need To Be Reported To The Irs

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules