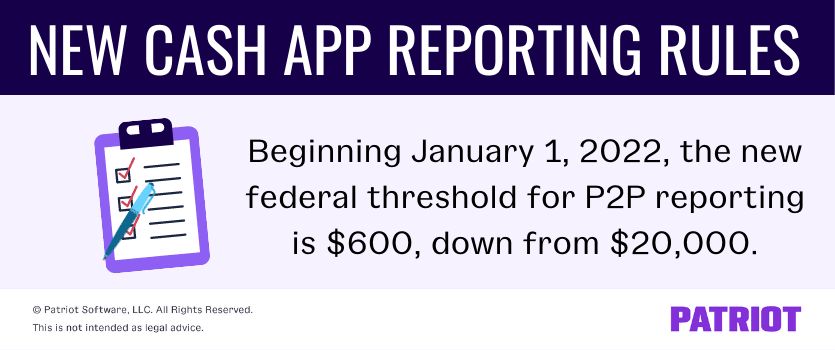

Before the new rule, business transactions were only reported if they were more than. But that doesn't mean you owe any additional taxes.

All About Forms 1099-misc And 1099-k Bookkeeping Business Business Tax Organization Solutions

The american rescue plan includes language for third party payment networks to change the way.

Does personal cash app report to irs. If you do get audited, the last thing you want to deal with is a messy pile of. Does cash app report personal accounts to irs reddit. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment.

There has been a flurry of furious cash app users this past week angrily responding to rumors of president joe biden’s new tax reporting plan requiring taxpayers to report all venmo and cash app income over $600. Cash app does not provide tax advice. A new law requires cash apps like venmo and cash app to report payments of $600 or more to the irs.

The biden administration has proposed, not approved, a plan for banks and other financial institutions including apps like venmo, paypal, and cash app, to report to the irs on money that goes in. 9:26 pm edt october 19, 2021. A new rule will go into effect on jan.

Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include. Starting january 1, 2022, cash app business transactions of more than $600 will need to be reported to the irs. Venmo is a payment platform owned by paypal, but it only operates in the u.s.

Here are some facts about reporting these payments. This means that you must account for this income and are responsible for reporting it to the irs. Like any application or service that deals in the exchange of currency for goods and services, paypal is responsible for reporting all transactions.

As long as your account is under your real name and correct address. It’s convenient, as you can also use it on your computer or in person since it’s attached to the user’s bank account or a debit or credit card. Yes you can use cash app for the tax refund deposit.

If you use cash apps like venmo, zelle or paypal for business transactions, some changes are coming to what those apps report to irs. It is your responsibility to determine any tax impact of your bitcoin transactions on cash app. Who’s covered for purposes of cash payments, a “person” is defined as an individual, company, corporation, partnership, association, trust or estate.

If you use cash apps like venmo, zelle or paypal for business transactions, some changes are coming to what those apps report to irs. Keep a separate cash app account for business transactions. Current tax law requires anyone to pay taxes on income over $600, regardless of where it comes from.

Tax changes coming for cash app transactions. Any errors in information will hinder the direct deposit process. Can you report on cash app?

This only applies for income that would normally be reported to the irs anyway. — cash apps, including paypal, venmo and zelle, will be subject to new tax rules starting jan. The irs won't be cracking down on personal transactions, but a new law will require cash apps like venmo, zelle and paypal to report aggregate business transactions of $600 or more to the irs.

The irs is behind on processing more than 5.5 million tax returns as oct. The internal revenue service (irs. Yes, regardless of whether or not you meet the two thresholds of irs reporting within irc section 6050w, you will still have to report any income received.

The payment app is a great option for users who want to send or receive cash fast through their smartphones. The new reporting requirement only applies to sellers of goods and. The irs plans to take a closer look at cash app business transactions of more than $600.

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Cryptocurrency News Crypto And Visa Pay With Crypto Irs 1040 Crypto Question Cryptocurrency News Visa Visa Card

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

New Rule To Require Irs Tax On Cash App Business Transactions Kbak

Business Ideas Less Than 10000 A Business Ideas To Startup In India Because Report Home B Bookkeeping Business Small Business Accounting Small Business Finance

Unique Sample Personal Financial Statement Excel Exceltemplate Xls Xlstemplate Xlsforma Personal Financial Statement Financial Statement Statement Template

Form 1040-sr Us Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Personal Financial Statement Personal Financial Statement Financial Statement Statement Template

Does The Irs Want To Tax Your Venmo Not Exactly

New Rule To Require Irs Tax On Cash App Business Transactions Wbma

Pin By Dominique Rogers On Organize Life In 2021 Tax Deductions Property Tax Being A Landlord

Changes To Cash App Reporting Threshold Paypal Venmo Zelle More

Getting A Loan With Chime Bank – Payday Loans More Payday Loans Payday Payday Loans Online

Pin By Jessica Hufford On Money Tax Prep Checklist Tax Checklist Tax Preparation

Changes To Cash App Reporting Threshold Paypal Venmo Zelle More

Does The Irs Want To Tax Your Venmo Not Exactly

New Irs Rule For Cash App Transactions Set To Go Into Effect Next Year

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeping Business