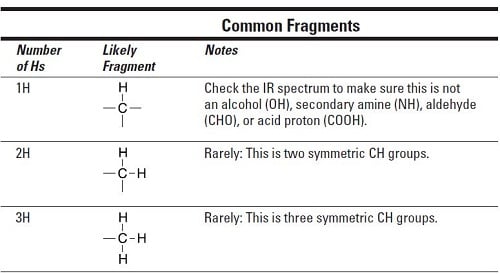

Most notable is the income test. Survivors pension is calculated according to the countable family income and the annual pension limit set by congress.

2022 Survivors Pension Rates Military Benefits

Capital gains and investment income.

Does social security count as income for va survivors pension. Other times, the survivor draws them based on the veteran’s earnings. Income not counted in magi: As such, it will be deducted dollar for dollar from the ssi federal payment amount, after a general exclusion of $20.

Ssi payments are not counted as income for va pension purposes, regardless of how much you are receiving in monthly ssi benefits. The above list is not all inclusive. Does social security count as income for va survivors pension?

I was under the impression pension payments did not count against the $18000 or so allowable earned income when taking social security. However, if that pension is suspended and you are no longer entitled to it, social security may be able to increase your benefit. Some retirement and pension plans also offer survivors benefits for.

There’s one more thing to know about how the va evaluates your income. Pension income does not count against the social security earnings limit, regardless of the pension's source. Deducting medical expenses from countable income.

The first $20 of your va benefit is not counted by the ssa. Long term care insurance, gifts, winnings from gambling, and inheritances are also considered income in a given year. First, let’s look at the income that does not count.

The cash left in the ira is considered an asset. We discuss inclusions in income for va pension in more detail below. Va benefits are considered unearned income and would reduce your ssi benefits dollar for dollar;

The va doesn’t consider ssi as. What is va survivors pension? Social security retirement, disability insurance (ssdi) or survivor’s benefits income.

Does va pension affect social security? Many survivors do not know that they can receive both dic benefits and social security benefits at the same time. Because veteran disability benefits are not explicitly excluded, they are counted when determining a household’s eligibility for snap.

However, the social security administration does count va pension benefits as part of your income to. Does social security count as income for va health benefits? This includes social security, pension, interest income, dividends, income from rental property, etc.

Thankfully, the social security administration makes it easy to understand for most types of income that you might normally receive. Va benefits are considered unearned income and would reduce your ssi benefits dollar for dollar; • va pension payments • welfare, supplemental security income (ssi), compensated work therapy (cwt), incentive therapy (it) earnings • withheld social security overpayments note:

The first $20 of your va benefit is not counted by the ssa. 7 if they earn between $25,000 and $34,000, 50% of the survivor benefit is taxable. The va official site has an application process for these pensions including the establishment of the maximum annual pension rate for the veteran or surviving spouse.

Countable income includes income from most sources as. The va doesn’t consider ssi as countable income when calculating benefit amounts. They receive dic benefits because the death is service connected and social security benefits for a separate reason (retirement, disability, etc.).

When a veteran or surviving spouse receives the a&a pension, the va considers a specific amount to be for the basic pension and the remaining amount for a&a. Ira and retirement account distributions; Income that does not count toward the earnings limit includes:

Ssa classifies va benefits as “unearned income,” since it does not come from paid employment. Social security benefits do count as income with respect to eligibility for va health benefits. Gross social security income and monthly retirement from employer pensions are considered income.

May be used to reduce other countable income for purposes of increasing pension benefits. If the person has any additional income but it’s below $25,000, benefits won’t be taxed. There are income caps and net worth limits which must also be observed.

Does social security count as income for va health benefits? For snap purposes, “income” includes both earned income such as wages, and unearned income such as supplemental security income (ssi) and veteran disability and death benefits. Since income does not matter for dic benefits,.

Alimony income finalized before january 1, 2019. While some states may disregard the pension in its entirety from medicaid’s income limit, other states may count the basic pension amount as income. List below the estimated annual income of the veteran or surviving spouse estimate total income (if married include spousal income):

Social security survivors benefits are designed to lessen the impact on a family when a breadwinner dies. Survivor benefits and lump sum death benefits from social security also count. $ all income must be included.

Earning a veterans pension from the va requires the applicant to meet age and disability requirements. For anything above $34,000, 85% is taxable.

Va Survivors Benefits And How To Qualify Cck Law

Supplemental Pension Benefits For Veterans And Their Survivors – Wiser Women

Survivors Benefits Va Form 21p-534ez Explained – Hill Ponton Pa

Can I Get Va Survivor Benefits And Social Security – Perkins Studdard

Va Survivor Benefits What Is Va Dic And Am I Eligible 2021 Updates – Va Claims Insider

Va Survivors Benefits And How To Qualify Cck Law

Can I Get Va Survivor Benefits And Social Security – Perkins Studdard

What Is Va Survivors Pension Benefits Cck Law

Va Survivors Pension Explained – Hill Ponton Pa

2022 Survivors Pension Rates Military Benefits

Va Survivors Pension Stateside Legal

Va Benefits For Veterans Survivors And Widows Explained – Hill Ponton Pa

Va Survivors Pension Stateside Legal

What You Should Know About Disability Survivor Benefits Social Security Disability Social Security Benefits How To Apply

Va Benefits For Veterans Survivors And Widows Explained – Hill Ponton Pa

2022 Va Pension Rates For Veterans And Survivors

Va Survivor Pensions Military Benefits

Va Survivors Pension Stateside Legal

Survivors Benefits Va Form 21p-534ez Explained – Hill Ponton Pa