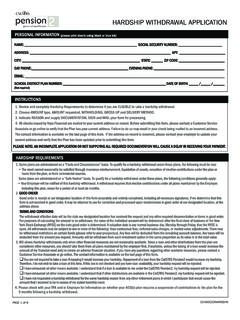

• not available for plans offering a qualified joint & survivor annuity (qjsa) payout option. Participants may speak with a retirement plan specialist to determine the type of hardship withdrawal, if any, that is permitted by the plan.

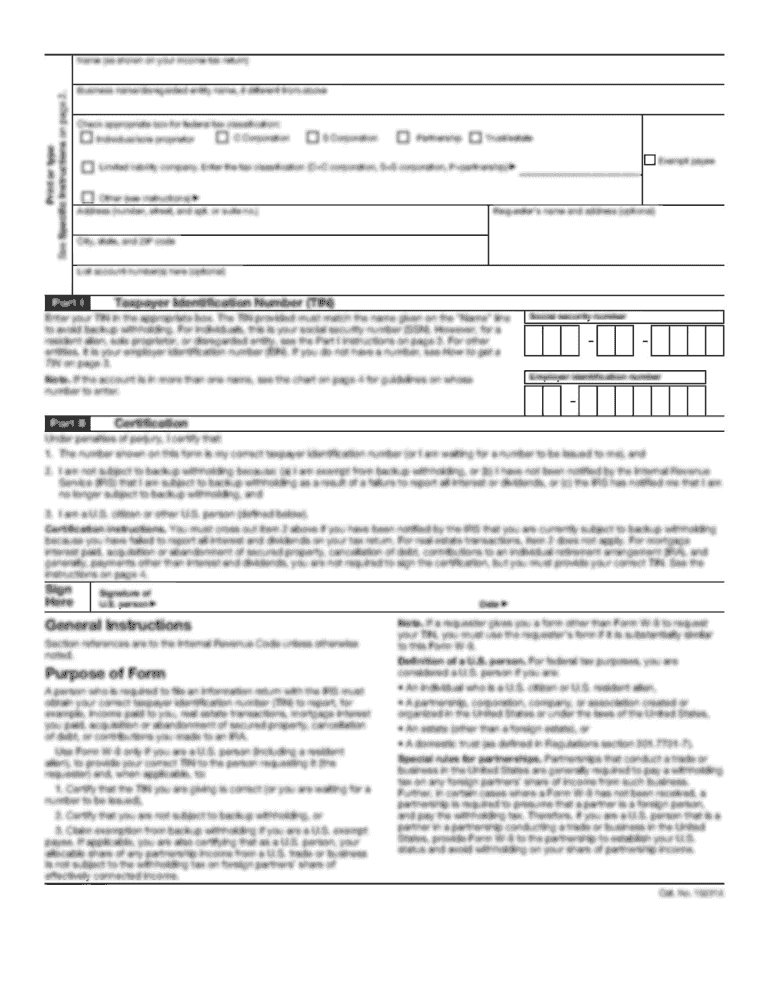

Hardship Withdrawal Request 401k Plan A What Is My Personal Information B What Is My Reason For This Hardship Withdrawal – Pdf Free Download

2 as defined by the internal revenue code and/or your plan’s provisions.

Empower retirement hardship application. • you want to request a hardship distribution, if your plan allows (use the. {{accucustomization.metatags.description}} {{(logon. + authentication.errormessage) | translate:authentication.errormessageparams}} {{logon.logontitle | translate}} Empower will not charge origination fees on any new plan loans and will suspend charges.

Participants applying for hardship withdrawals must attest to the need for a hardship withdrawal and the exhaustion of financial resources based on the criteria cited in #3 above. Hardship withdrawals are an optional provision that may or may not be drafted in 401(k) or 403(b) plan documents. Get empower retirement upload documents signed right from your smartphone using these six tips:

• empower works directly with participants to obtain missing information or additional supporting documentation. 1 withdrawals may be subject to ordinary income tax. None (10) participant enrollment form (15) participant enrollment form (20) participant enrollment form.

Withdrawals prior to age 59½ may be subject to a10% federal tax penalty. + authentication.errormessage) | translate:authentication.errormessageparams}} {{logon.logontitle | translate}} finance up to 80% of loan to value; Empower provides hardship approval • empower reviews all hardship requests on behalf of the plan administrator.

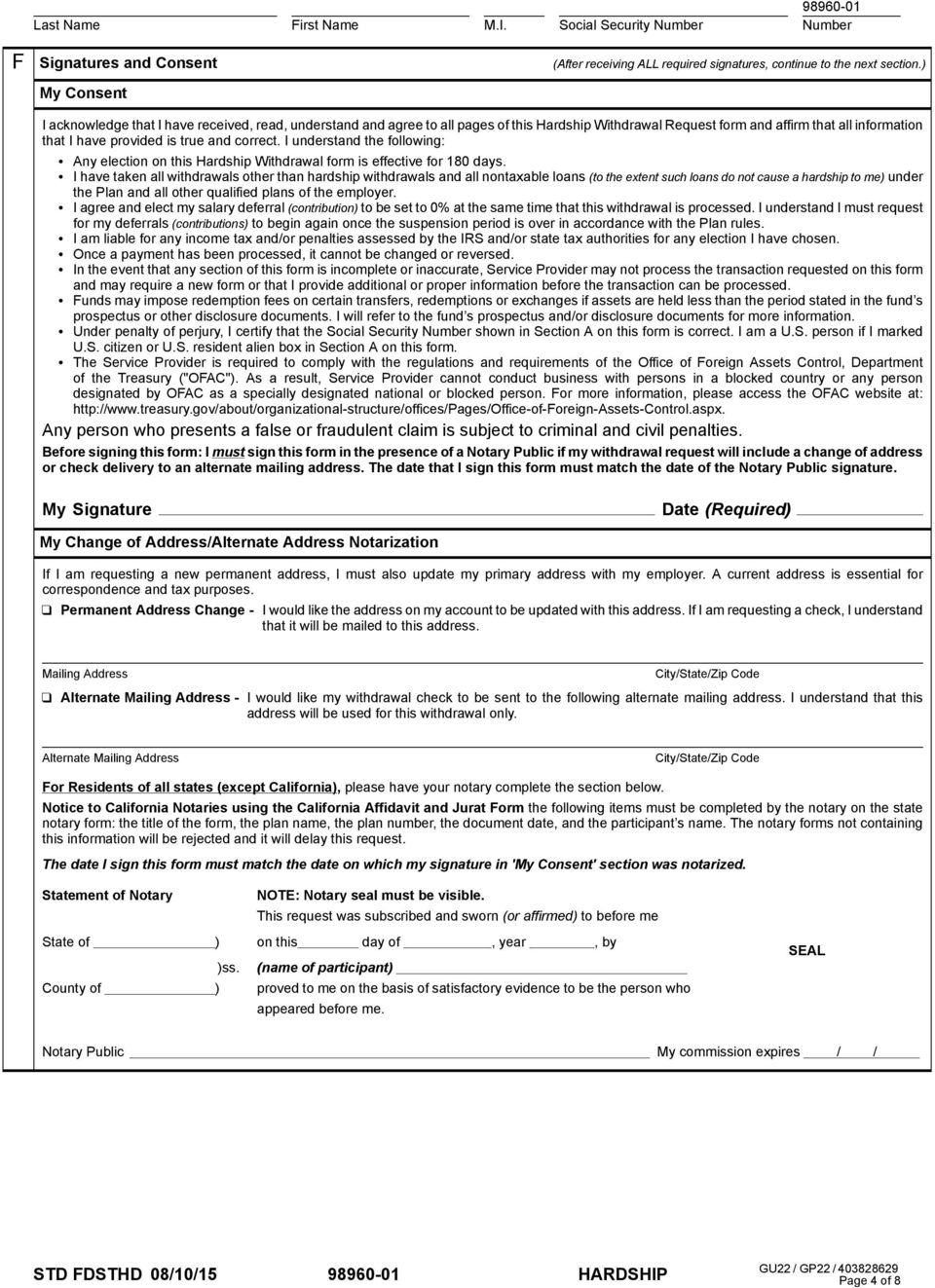

For active employees who have a qualifying hardship event. Supporting documentation is required to be provided with the hardship withdrawal application as specified in the attached hardship withdrawal checklist. I called and had another check sent, it's been 10 business days still nothing received.

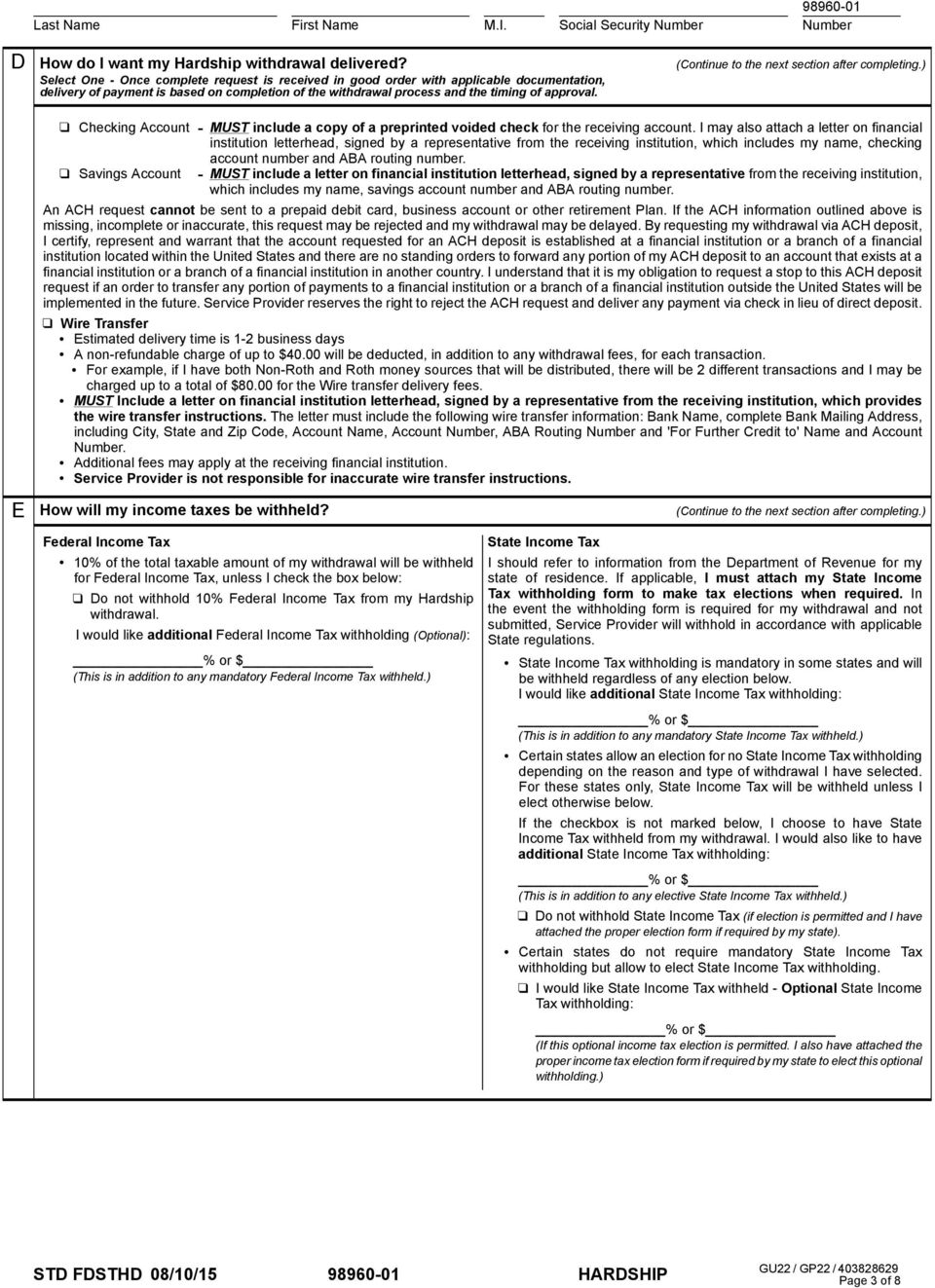

Object moved this document may be found here assumes a loan of $5,000 empower retirement will not process this form until it is received in good order. Income tax withholding applicable to payments delivered outside the u.s. All forms listed on this page are available for downloading and printing by clicking the links provided.

With an empower retirement education counselor. The retirement plan specialist can inquire about the amount available for hardship withdrawal based on the system calculation. Applications should be mailed to the following address:

Visit aahbenefits.org > access your 2020 benefits > login > retirement tile. The amount that you elect to withdraw may not exceed the amount of federal and state taxes that would apply as a result of the hardship distribution. Separation from service distribution request form.) • you want to request a hardship distribution, if your plan allows (use.

Amount of hardship $ _____ or maximum available amount method of shipment (if requesting two day or overnight delivery, carrier information must be provided.) regular mail two day overnight carrier name _____ billing # _____ income tax. Documentation” included with this application.). Income tax withholding you may elect to have federal and state taxes withheld from your hardship distribution.

You may also order forms and publications by completing the form below. But you must pay taxes. Empower retirement will not process this form until it is received in good order.

• additional recordkeeping services fees may apply. Fees empower is waiving fees associated with new 401(k) loans and hardship withdrawals until further notice. If they are offered in the plan, then the plan administrator, or employer, is responsible for making sure that the hardship guidelines rules are followed, just as with any other fiduciary responsibility.

This retirement business is easily the worst i have ever dealt with. Unlike a 401 (k) loan, the funds to do not need to be repaid. • there is an annual maintenance fee.

Please contact your plan administrator and tax. The amount you request for hardship may not exceed the amount of your financial need. The 10% early withdrawal penalty does not apply to 457 plan withdrawals.

Hardship withdrawals for an unforeseeable emergency (definition) general in the event of an unforeseeable emergency which is beyond the control of the participant and which causes extreme financial hardship, a participant may request empower retirement services to distribute all or a portion of the participant's deferred compensation account. The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. I waited 11 business days, still never received my hardship withdrawal check.

Get hardship withdrawal signed right from your smartphone using these six tips:

Awards Are A Physical Representation Of Someones Work And The Gratitude That Is Felt For It Inspirational Quotes Encouragement Success Quotes

Empower Retirement Withdrawal 401k – Fill Online Printable Fillable Blank Pdffiller

Hardship Withdrawal Request 401k Plan A What Is My Personal Information B What Is My Reason For This Hardship Withdrawal – Pdf Free Download

Rise When You Fall Amazing Quotes Inspiring Quotes About Life Inspirational Quotes

Plan Features Questions And Answers – Massmutual Withdrawal Pdf4pro

Empower Retirement Waives Fees On New Loans Hardship Withdrawals

Hardship Withdrawal Request 401k Plan A What Is My Personal Information B What Is My Reason For This Hardship Withdrawal – Pdf Free Download

Empower Retirement Jobs And Careers Indeedcom

The Dos And Donts Of Combining Finances With Your Partner – The Dating Directory Combining Finances Relationship Blogs Finance

Hardship Withdrawal Request 401k Plan A What Is My Personal Information B What Is My Reason For This Hardship Withdrawal – Pdf Free Download

Hardship Withdrawal Request 401k Plan A What Is My Personal Information B What Is My Reason For This Hardship Withdrawal – Pdf Free Download

Strong Woman Empowerment Female Motivational Quote Gift Success Wall Art – Unstoppable Warrior – Printable Poster For Women Achievers 40636 Gift Quotes Affirmation Posters Positive Affirmations Quotes

Reaching Out Eytip Self-empowerment Llc Self Empowerment Outing Quotes Positive Quotes

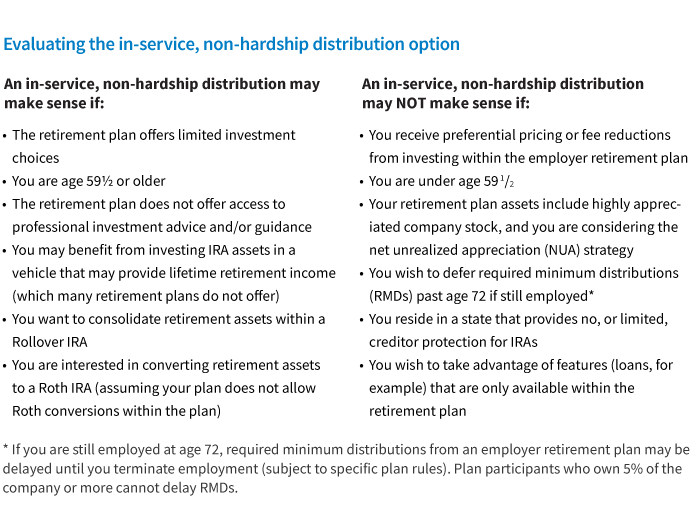

When To Choose A Non-hardship 401k Withdrawal Putnam Wealth Management

Empower Retirement Withdrawal 401k – Fill Online Printable Fillable Blank Pdffiller