Through an executive bonus arrangement funded through a lafayette life insurance policy, you and your financial representative can find meaningful compensation incentive plans that are generally income tax deductible for your business. A key to the success of a business is the ability to recruit, retain and reward outstanding talent.

Uk Business Hierarchy Business Model Canvas Business Structure Business

Ad life insurance deals designed for expat individuals, couples & families in indonesia.

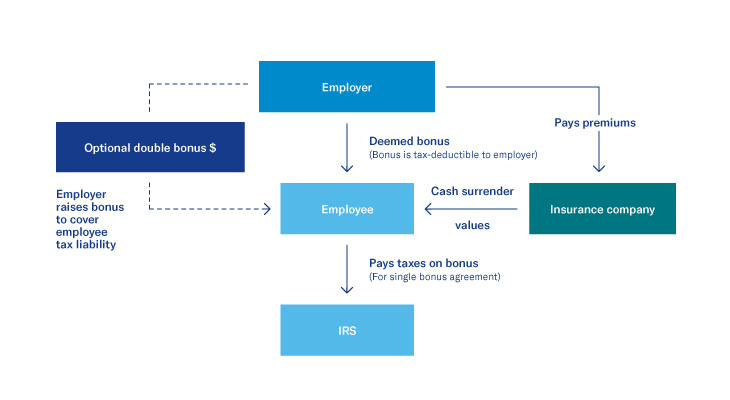

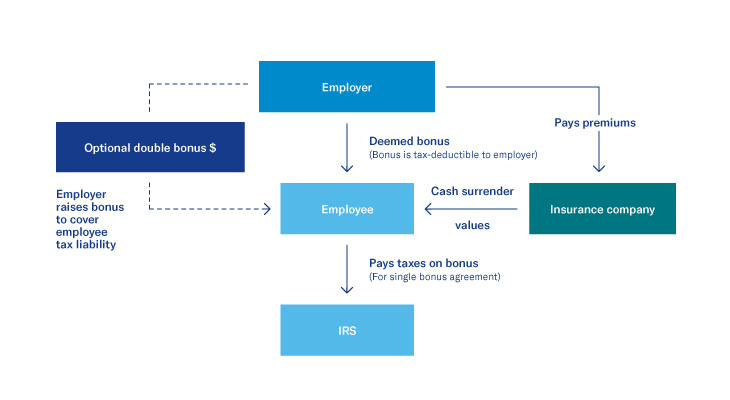

Executive bonus arrangement life insurance. Employer hereby agrees to make remittances of premiums directly to insurer on the executive’s behalf through payroll deduction from amounts to be paid to executive pursuant to a bonus arrangement approved by employer's board of directors on (date). Under a reba, key executives purchase a cash value life insurance policy on his or her. Under both of these plans, an employer selects a key employee to purchase life insurance on his/her life.

Quality employees may be an executive bonus arrangement. This tool gives your company a current income tax deduction through the payment of a bonus which the employee uses to pay the premiums on a cash value life insurance policy. In its simplest form, an executive bonus plan is one in which an employer pays the premiums on a permanent life insurance policy owned by an employee.

Ad life insurance deals designed for expat individuals, couples & families in indonesia. Any rights under, the life insurance policy at any time. The executive will be the owner of the policy and he or she has the right to name the beneficiaries of the policy.

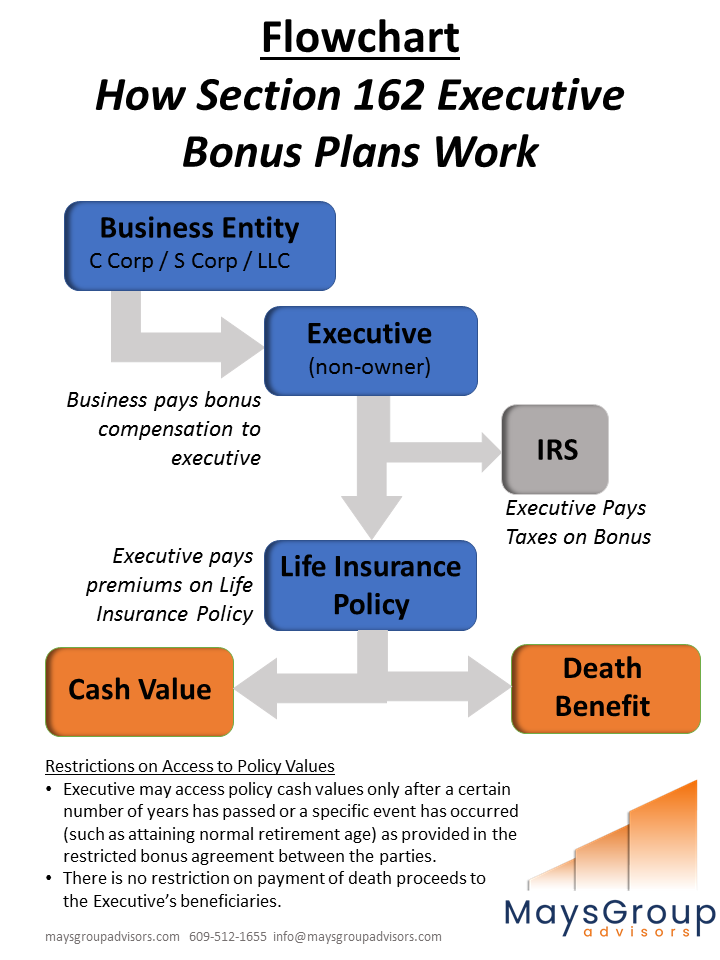

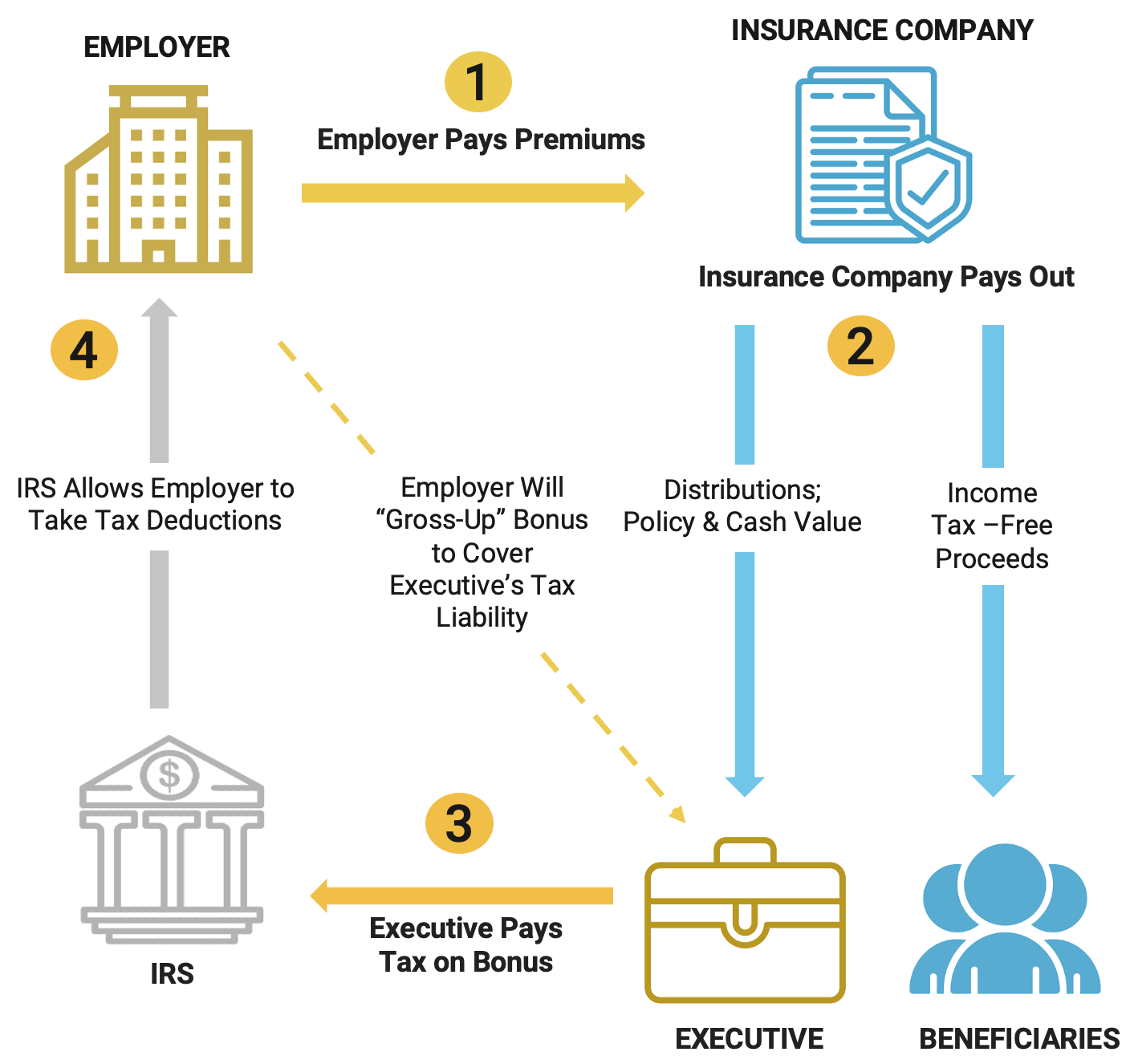

Executive bonus plan an executive bonus plan (also known as a “162 bonus plan”) is an arrangement in which you pay a bonus to an executive by paying the annual premium on a life insurance policy for the executive. The cost of losing a key employee ) here’s how a section 162 bonus plan works: A section 162 executive bonus plan is a way to attract, reward, and retain key employees using life insurance.

The benefits acquired through a life insurance policy that builds cash value are a combination of death benefit coverage and the policy’s potential accumulated cash surrender value. Business strategies executive bonus arrangements investment and insurance products: A section 162 executive bonus plan provides a way to give executives within a businesses or corporation additional benefits, typically funded with life insurance, as a way to further incentivize specific executives individually chosen by the company.

The need employers often seek additional incentives to motivate their executives, and. Executive bonus life insurance an executive bonus arrangement can be a powerful, yet simple way to provide a valuable benefit for company owners and key employees. It’s surprisingly simple to administer and use.

As an alternative, consider the executive bonus plan (aka “162 bonus plan”) and the restricted endorsement bonus arrangement (reba). The company can maintain control by including. An executive bonus or a restrictive executive bonus arrangement is a way for you to provide needed life insurance to a key employee and receive an income tax deduction for doing so.

The insurance premiums are then paid for by the employer in the form of a bonus to the employee. A restricted executive bonus plan funded with life insurance offers a hybrid arrangement that bridges the gap between a deferred compensation plan and a regular executive bonus plan. Under the executive bonus plan, the employer pays a bonus to the employee so the employee can purchase (and own) a fixed indexed universal life (fiul) insurance policy.

A restricted executive bonus arrangement (reba) can meet the employer’s goals of attracting employees, retaining them for long period of time, rewarding them for good performance, retiring them with adequate savings and receiving a current tax deduction. Insurance policies are owned by the executives and are paid for through cash bonuses to the executives. In this type of plan, the employer and executive enter into an agreement in which the employer pays the premium on the insurance policy via a cash bonus for the executive as long as he or she remains employed by the employer.

A 162 executive bonus plan allows a business to provide life and/or disability income insurance to key executives using tax deductible dollars. An executive bonus arrangement, under internal revenue code section 162, is a bonus paid to an executive in the form of a life insurance premium. The employee then uses the.

The business purchases life insurance on the life of the executive. The employer takes out a life insurance policy on a key employee. What is a 162 executive bonus plan?

The executive bonus plan is a way for you to provide permanent life insurance as employee benefits to attract, retain, and reward key employees. The golden executive bonus arrangement (geba) can be a solution for rewarding and retaining your most valued executives. A helpful solution is an executive bonus arrangement.

Best Life Insurance For An Executive Bonus Plan 5 Amazing Benefits

Irc Section 162 Linked-benefit Executive Bonus Plans For Business Owners And Key Employees – Bsmg Brokers Service Marketing Group

Teacher Cv Template For Word Principal Resume Template And Etsy Teacher Resume Template Resume Template Teaching Resume

Section 162 Executive Bonus Plans – Mullin Barens Sanford Financial And Insurance Services Llc

Restricted Executive Bonus Plan A Simple Alternative To Deferred Comp Plans – Bsmg Brokers Service Marketing Group

Your Answer To The Bonus Question

Executive Bonus Plan – Insurance Globe

Hr Assistant Cv Template Hr Manager Resume Sample This Hr Manager Resume Sample Article Below Is Worth To Read Manager Resume Hr Management Resume Examples

Attract And Retain Executives With Tax Deductible Section 162 Bonus Plans Maysgroup Advisors

Departmental Budget Worksheet Excel Is Use For Almost Every Organization And Its Departments Budgeting Worksheets Budget Worksheets Excel Excel Budget Template

Section 162 Executive Bonus Plan Attract Retain Executives

Reward Key Employees With An Executive Bonus Plan

Section 162 Executive Bonus Plan Attract Retain Executives

Lovasco Insights Navigate These Unprecedented Times By Engaging Your Key Executives

Executive Bonus Plan – Insurance Globe

Restricted Executive Bonus Plan A Simple Alternative To Deferred Comp Plans – Bsmg Brokers Service Marketing Group