It is also known as a. A guaranteed insurability rider, also called a gi rider, is a life insurance rider that allows the owner of a life insurance policy to buy additional life insurance with no underwriting.

What Are Life Insurance Policy Riders Paradigm Life Insurance

A ceo's personal assistant suffered injuries at home and as a result, was unable to work for four months.

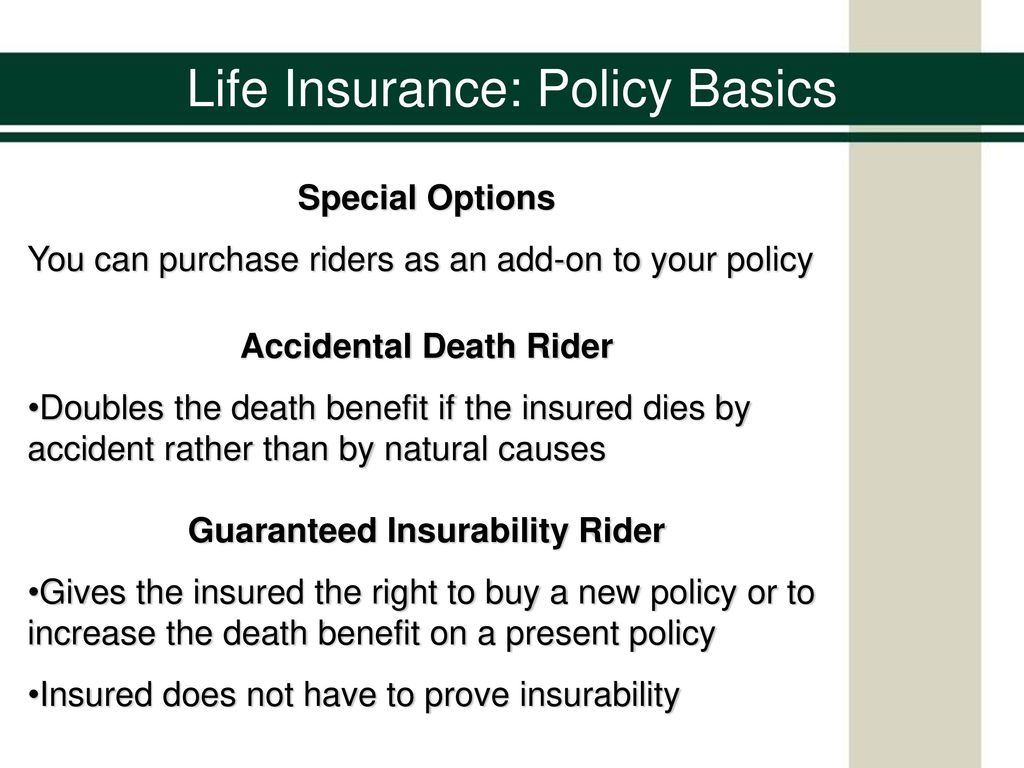

Guaranteed insurability rider disability. The ability to periodically increase the amount of coverage without evidence of insurability t was insured under an individual disability income policy and was severely burned in a fire. Guaranteed insurability rider (form nos. A guaranteed insurability rider, also called a gi rider, is a life insurance rider that allows the owner of a life insurance policy to buy additional life insurance with no underwriting.

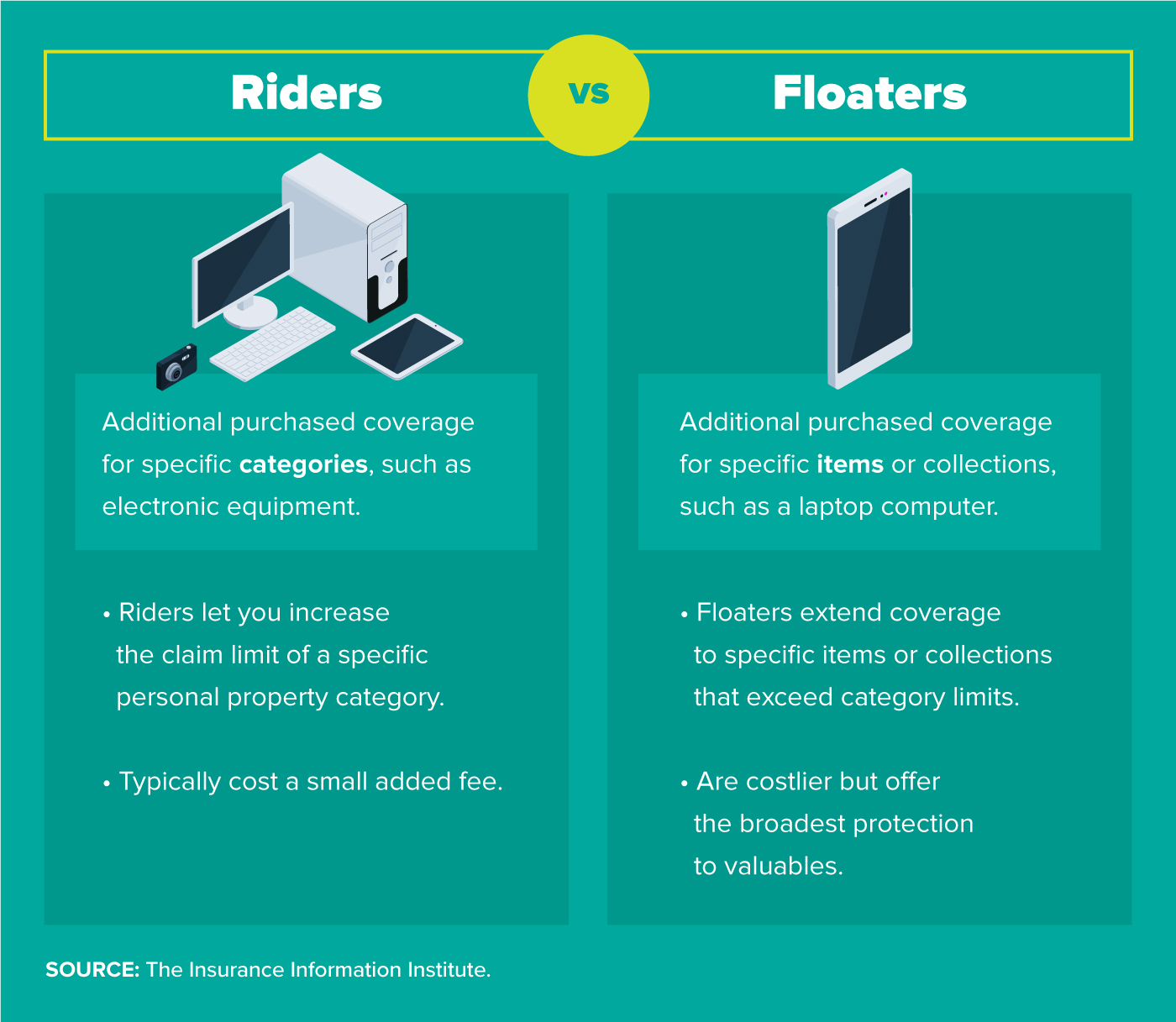

A guaranteed insurability rider lets the policyholder buy additional coverage for their policy at a later date with no further underwriting. A rider is an additional benefit to a life insurance policy beyond the death benefit. Keeps pace with inflation by allowing your monthly benefit to increase once you have been disabled for 12 consecutive months, in accordance with the consumer price index and subject to an annual maximum of 10 per cent.

Fundamentally speaking, a disability income insurance policy helps to replace your income if you become disabled and are unable to work. Riders are sometimes added at a cost, or sometimes they may be a free benefit included with the contract. Guaranteed insurability rider on each disaster protection strategy, the reliable insurability rider ought to be entirely reasonable.

There are minimum and maximum benefit amounts. A guaranteed insurability rider is available on specific life insurance policies. Because you never know how your health or life may change.

For example, a prolonged illness or sudden disability in the future could make buying life insurance substantially more expensive, or worse, make you uninsurable. For even more security, you can consider pairing a guaranteed insurability rider with a waiver of premium for disability rider. Maximum benefits range from $2,000 to $2,500 a month.

Learn more about the guaranteed insurability benefit. The terms and conditions of a. The policyholder can upgrade the measure of the advantages on specific birthday celebrations, when he was a youngster or at the introduction of a child without the confirmation of insurability (in other words, the.

A guaranteed insurability option is a rider to an insurance policy that requires the insurance company to renew the policy for a specific duration regardless of changes to the health of the policyholder. What does a guaranteed insurability rider provide a disability income policy owner? A guaranteed insurability rider lets you increase the coverage on your life insurance policy without taking another medical exam.

What does a guaranteed insurability rider provide a disability income policyowner? There are many life insurance riders you can choose from to add additional layers of protection onto your life insurance policy. With this guaranteed renewable, rates can still increase.

A ceo's personal assistant suffered injuries at home and as a result, was unable to work for four months. With the guaranteed insurability rider, an individual may get more insurance coverage at any moment throughout their term plan without having to pass any more checks. The guaranteed insurability rider ensures that you will be able to buy additional insurance in the future if your need for coverage increases.

Additional amounts will have the same benefit period and elimination period as the policy. A guaranteed insurability rider allows the insured to periodically increase the amount of benefits payable under the policy. Cost of living adjustment rider :

In this scenario, you will receive student loan rider benefits for 10 years. Rider benefits are only paid for. Commonly shortened to gio rider (for guaranteed insurability option ), this popular feature enables you to tailor your coverage to your individual needs and preferences as your life changes over the years.

The guaranteed insurability riders, also known as the future purchase option, future increase option, guaranteed purchase option, or guaranteed increase option rider, allows the insured of a life or disability insurance policy to purchase additional coverage without going through a new medical exam. Essentially, this rider renews the policy each and every year so long as premiums are paid on time. Among the very best life insurance riders for young adults is the guaranteed insurability rider, aka the guaranteed insurability benefit option, aka policy purchase option rider, and any other names the top life insurance companies give it.

A guaranteed insurability rider allows the insured to periodically increase the amount of benefits payable under the policy. R i1601 and r i1609 ny) the guaranteed insurability rider gives the insured the option to increase their base policy monthly benefit by purchasing additional amounts of insurance. What is a guaranteed insurability option rider?

With both riders, you can increase your coverage regardless of future health issues and ensure your policy premiums are covered should you become disabled and unable to make payments. The guaranteed insurability rider may be attached to a permanent life insurance policy and allows the owner to purchase additional life insurance at specified intervals in the future for specified amounts (subject to minimums and maximums) without the insured having to provide evidence of insurability. What does a guaranteed insurability rider provide a disability income policyowner?

Minimum monthly amounts range from $100 to $500. This rider allows you to purchase additional insurance at particular dates, and it is subject to minimums and maximums. Though different, guaranteed renewable is something else everyone should consider when shopping for disability income insurance.

A guaranteed insurability rider, sometimes known as a guaranteed purchase option rider, gives you the ability to increase your policy’s death benefit without going through a new medical screening, netting you more affordable pricing. This removes the hassle of reapplying. The guaranteed insurability rider (gir) allows the insured to buy additional disability income coverage without proving evidence of insurability.

What is a guaranteed insurability rider?

Life Insurance Riders – Custom Life Insurance Efinancial

Life Insurance Policy Basics – Ppt Download

What Is A Life Insurance Rider Progressive

Term Life Insurance – Best Rates In Jacksonville 904-385-2006

What Are Insurance Riders Moneycom

Add An Extra Feature To Your Policy By Opting For A Rider

Whole Life Insurance Product Disclosure 6326

Guaranteed Insurability Rider A Great Addition For Young Adults And Children

2013 Pearson Education Inc All Rights Reserved9-1 Chapter 9 Life And Health Insurance – Ppt Download

Guaranteed Insurability Rider Considerations Protective Life

How Does The Guaranteed Insurability Rider Work The Insurance Pro Blog

Guaranteed Insurability Rider 3 Reasons You Should Consider It

/insurance-d9c977214d1f42b7bdfaf337d368e71e.jpg)