Stipends are still considered taxable income, though. What is a health insurance stipend?

Western Reserve Life Insurance Great Life Insurance Group

The aca states that employer healthcare plans must meet criteria for minimum value and affordability.

Health insurance stipend taxable income. Other cons of a health insurance stipend include: Please note that health insurance stipends cannot exceed the amount included in the table above. It also cannot require employees to provide proof that they purchased a health insurance policy.

Health insurance stipends are one way to. Will the stipend be included in my monthly op&f benefit? If companies stop offering health insurance they must treat the stipends as taxable income…or else face fines of more than $30,000 a year per worker.

Traditional health insurance benefits are not taxable under any federal or state tax laws. Over 1 million hospitals, clinics and physicians worldwide. In 2021, minimum affordability means the employee’s total contribution to the group health care plan must not exceed 9.83% of their annual household income.

But in many cases, stipends are considered taxable income, so you as an earner should calculate the amount of taxes that should be set aside. What is the difference between a stipend and a reimbursement? If you pay for your own health insurance, you will be eligible to write off the premiums and out of pocket expenses, most of the time.

In most cases, this contribution is added onto employees’ regular paychecks, and it functions just like taxable income. The income received from the stipend is taxable since medical practitioners or doctors conduct duties that are almost equivalent to the rest of the doctors. Over 1 million hospitals, clinics and physicians worldwide.

For federal income tax purposes, the employer must withhold federal income tax at 37% in the tax year that the amount deferred is included in the employee's income. The overtime rate has to take into account not just the employee’s standard hourly rate, but all forms of compensation that are received. Employers must pay payroll tax on reimbursements totaling 7.65%.

Get an expat quote today. I am getting more and more questions from employers who, for one reason or the other, would like to essentially provide each employee a health insurance stipend that could be used to pay for coverage under the employer's group plan or, alternatively, for premiums for other coverage if an employee elects not to participate in the employer's group health plan. Student health plan costs are not included in box 2.

No, the stipend is not considered taxable income since the money is in a health reimbursement account managed by our partner, aon. Because stipends aren’t equivalent to to wages, an employer won’t withhold any taxes for social security or medicare. Is the op&f health care stipend taxable income?

If a section 83(i) election is made for an option exercise, that option will not be considered an incentive stock option or an option granted pursuant to an employee stock purchase plan. For 2020, health fsas are subject to a. One of the chief downsides to this approach is that the money is treated as taxable income for the employee.

But in many cases, stipends are considered taxable income,. Get an expat quote today. Because stipends are awards and not wages for services, social security and medicare taxes are not withheld.

Departments must remind postdoc scholars that this insurance stipend will be included in taxable income. Dental and vision insurance must be deducted from the payee’s stipend amount and are not included in the 4012 wage type. Let's take a look at the tax implications of health insurance stipends and the better option out there.

While this option is easy from a time and administration perspective, the value of these dollars will be greatly diminished because a health insurance stipend is considered taxable income. A chart showing the stipend levels can be found on the op&f website on the health care page here. If your employer provides a health fsa that qualifies as an accident or health plan, the amount of your salary reduction, and reimbursements of your medical care expenses, in most cases aren’t included in your income.

This includes the extra healthcare stipend compensation. Besides, their training and the work experience received on duty would lead them to become fully trained medical practitioners. Is a health stipend taxable?

(6.2% for social security and 1.45% for medicare) employees are taxed on the amounts received as income, usually between 20% to 40%. Businesses that provide a health insurance stipend must also pay payroll taxes on reimbursements. Due to the fact that a health stipend is taxable income, this additional compensation must be included in the calculation of overtime.

With a health insurance stipend, you, the employer, offer a fixed amount of money to your employees every month in order to help them purchase individual health insurance.

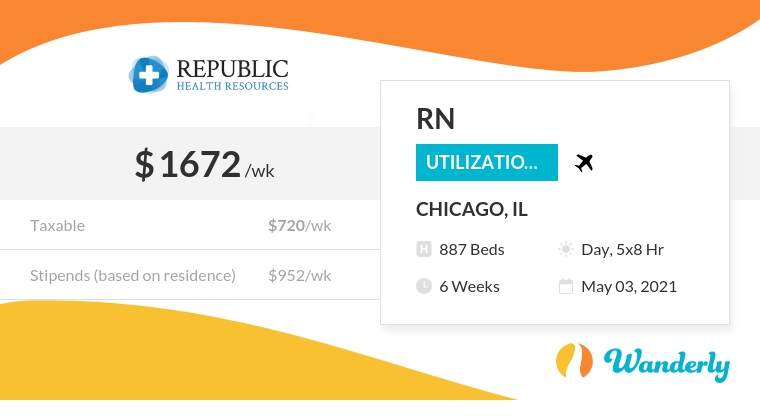

Wanderly Travel Nurse Jobs, Utilization Review, Chicago IL

Wanderly Travel Nurse Jobs, ICU, Bakersfield CA

Wanderly Travel Nurse Jobs, Case Manager RN, Nashville TN

Health Insurance Stipend Nanny MySts

Wanderly Travel Nurse Jobs, Telemetry, Fort Pierce FL