The regular calculation method allows you to deduct your exact expenses, but requires more record keeping. If you are fortunate enough to have an entire room to dedicate to your home office, you can deduct the square footage of the entire room.

There are a few guidelines and things you should know.

Home office deduction worksheet 2020. The square meterage of her home office (20m2) in relation to her house (200m2) is 20/200 which is 10%. You can't claim a deduction for the following expenses if you're an employee working at home. That gives us depreciation of our home of $3,589.75 a year, but we can’t take the whole thing.

This amount will be your claim for 2020 (up to a maximum of $400 per individual). Self employed individual deductions excel. The actual expense method or the.

Two methods for calculating your deduction. Self employed contributions act seca. Read more to see what medical and dental expenses can be included in.

Record the date, amount, name and the type of your expense. Home office deduction worksheet 2020. Use our home office expenses calculator to help you work out your deduction.

If you work from home you can deduct a percentage of your mortgage or rent, insurance, taxes, utilities and more! The home office deduction calculator is an easy way to compute the deduction you can claim for carrying your business or profession from one corner of your home. Finally, please note that only certain expenses such as rent, mortgage interest and property taxes qualify for the deduction, and the deduction is limited to $10,000.

If your 2020 taxable income before the qbi deduction is less than or equal to $163,300 if single, married filing separately, head of household, qualifying widow (er), or are a trust or estate ($326,600 if married filing jointly), your sstb is treated as a. Tax year 2020 small business checklist. Most of the information here will change every year, except for the business percentage and the section related to depreciation.

Irs reminds taxpayers of the home office deduction rules. Exclusively and regularly as your principal place of business (see principal place of business, later); Home office for individuals or employees with a home office.

Home office deduction. accessed june 9, 2020. Therefore, you will not see a change to your federal refund. Remember, we can only take 20% of that.

Calculate your work from home deduction. Home office deduction use this worksheet to figure out your full home office deduction. The information will go on irs form 8829, which feeds into schedule c.

Little ones be trained in several approaches and interesting them with coloring, drawing, workouts and puzzles surely enables them develop their language skills. The irs allows a business owner who is claiming the home office deduction to calculate the deduction's size using one of two methods: We can take the $5,150 of the home office deduction we calculated above.

This spreadsheet will keep track of everything you need to be compliant! Employed home as an office 2020/21 due to the coronavirus, more people are working from home in the tax year 20/21; It is a fact that the irs allows expenses incurred on the portion of home and equipment or infrastructure necessary to carry out business to be deducted from the gross income of the homeowner or.

In order to take full advantage of the home office deduction, the space. Home office deduction at a glance. accessed june 9, 2020. To claim the home office deduction, a home office must be used regularly and exclusively for your business.

The claim is for a whole year, even if you have only worked one day from home. Your office is 10% (1 ÷ 10) of the total area of your home. 509 business use of home. accessed june 9, 2020.

For the 2020 tax year (filing in 2020), you can only claim mortgage interest on up to $750,000 worth of mortgage debt ($375,000 for married taxpayers filing separately). To qualify to deduct expenses for business use of your home, you must use part of your home: There is a simplified calculation method that deducts $5 per square foot, for up to $1,500.

With either method, the qualification for the home office deduction is determined each year. Simplified method as an alternative to computing the actual costs of your expenses, the irs offers a simplified method to make the home office deduction calculation easier. For the 2020 tax year (filing in 2020), you can only claim mortgage interest on up to $750,000 worth of mortgage debt ($375,000 for.

The irs has a home office deduction worksheet that will help you calculate this (scroll to the bottom of the document). For example, $1,000 of the $10,000 of mortgage interest moved from schedule a's list of itemized deductions to the 8829 form that tallies the home office deduction. Your eligibility may change from one year to the next.

Your business percentage is 10%. Irs issues guidance on section 179 expenses and section 168(g) depreciation under tax cuts and jobs act. accessed june 9, 2020. Home expenses related to your business may be eligible for deduction.

The irs wants to give you some of your money back, but uncle sam loves documentation. You can claim tax relief. Home office tax deduction worksheet excel.

Then we add on the $717.95 of depreciation for the year for a total deduction of $5,867.95.

Free Spreadsheet To Track Income And Expenses For Schedule C Free Spreadsheets Budget Template Online Budget

Small Business Tax Spreadsheet Business Worksheet Business Budget Template Spreadsheet Business

Keeping Track Of Expenses Spreadsheet Spreadsheet Template Business Spreadsheet Business Spreadsheet Template

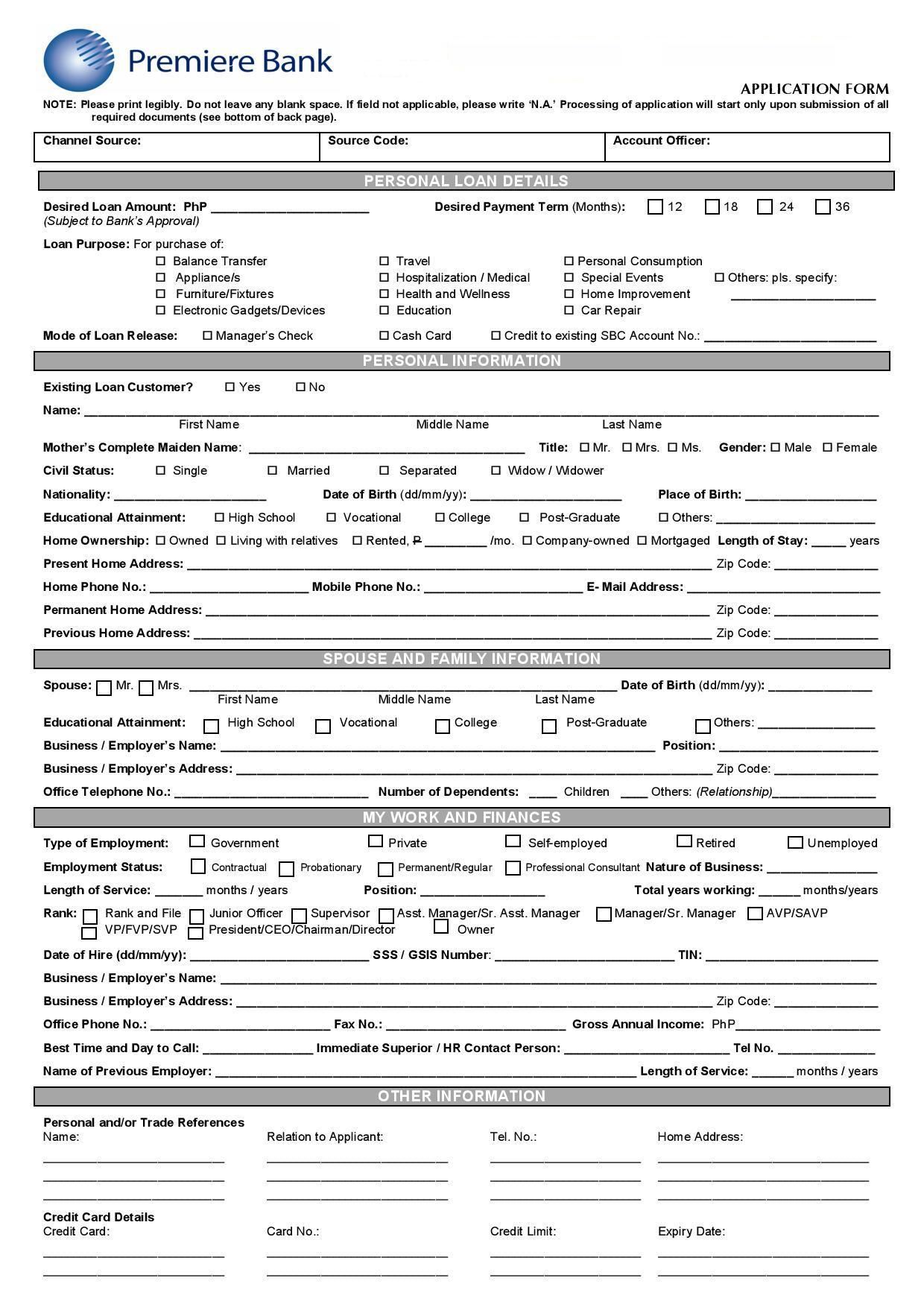

Basic Blank Personal Loan Formthey Try To Get A Loan For The Recording Session The Girl Wants To Set Up

Publication 530 2014 Tax Information For Homeowners Business Budget Template Business Tax Deductions Tax Deductions

Monthly Business Expense Worksheet Template Business Budget Template Business Expense Expense Business Budget Template Business Expense Small Business Expenses

5 Free Rental Property Expenses Spreadsheets – Excel Tmp Rental Property Rental Property Management Being A Landlord

Real Estate Lead Tracking Spreadsheet

Free Business Tracking Printable Templates Business Organization Printables Business Printables Business Template

Home Business Tax Deductions Are Just One Reason Of Many That A Home Based Business Is So Attrac Business Tax Deductions Small Business Tax Business Expense

Goodwill Donation Excel Spreadsheet If You Manage A Team Employee Or Busy Household It Is Si Donation Form Goodwill Donations Templates Printable Free

Business Plan Index Sample Continuity Hotel Template Card With Open Office Index – Busine Business Plan Template Word Startup Business Plan Basic Business Plan

Modals Of Probability Possibility And Deduction Games Worksheets And Songs Probability Teaching Grammar Worksheets

Hairdresser Bookkeeping Spreadsheet Bookkeeping Templates Spreadsheet Template Small Business Bookkeeping

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax

Home Office Business Deduction Worksheet Entrepreneur Quotes Iphone Wallpaper Motivational Quotes Badass Quotes Life Quotes

Free Monthly Timesheet Template Word Timesheet Template Templates Printable Free Time Sheet Printable

Some Dos And Donts Of Report Writing Writing Report Report Writing Writing Freelance Writing