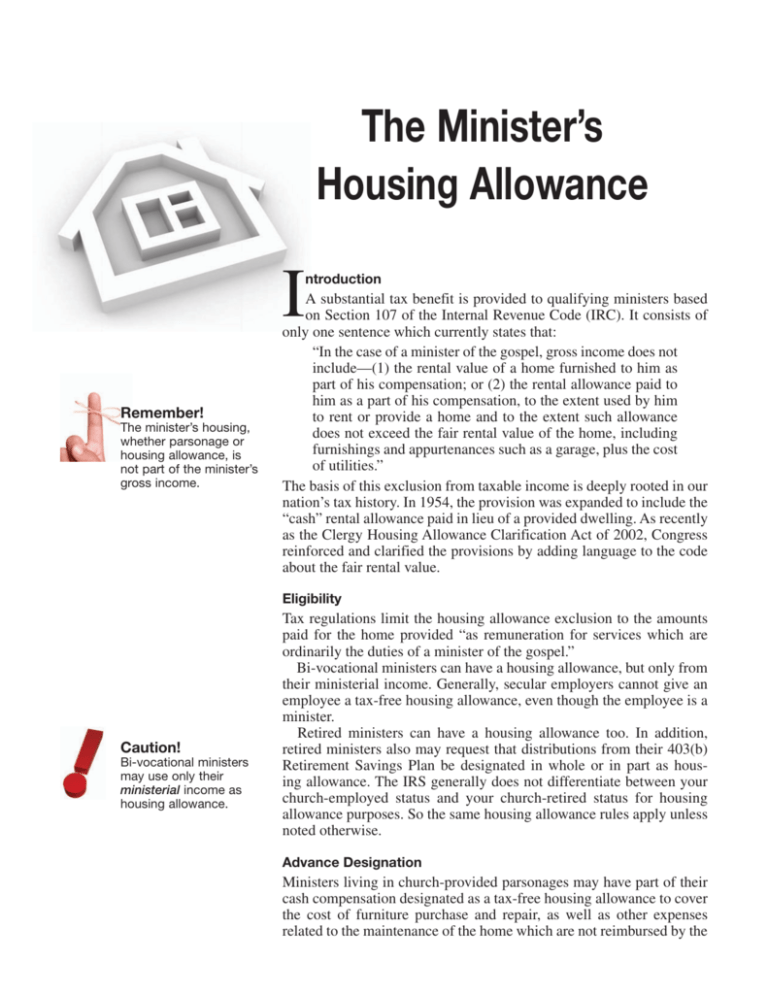

When a portion of compensation is received as housing allowance, federal and state taxes are directly reduced. (pastor only) housing allowance is an income tax concept unrelated to fair compensation.

The Pastors Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazoncom Books

Housing allowances cannot be designated retroactively.

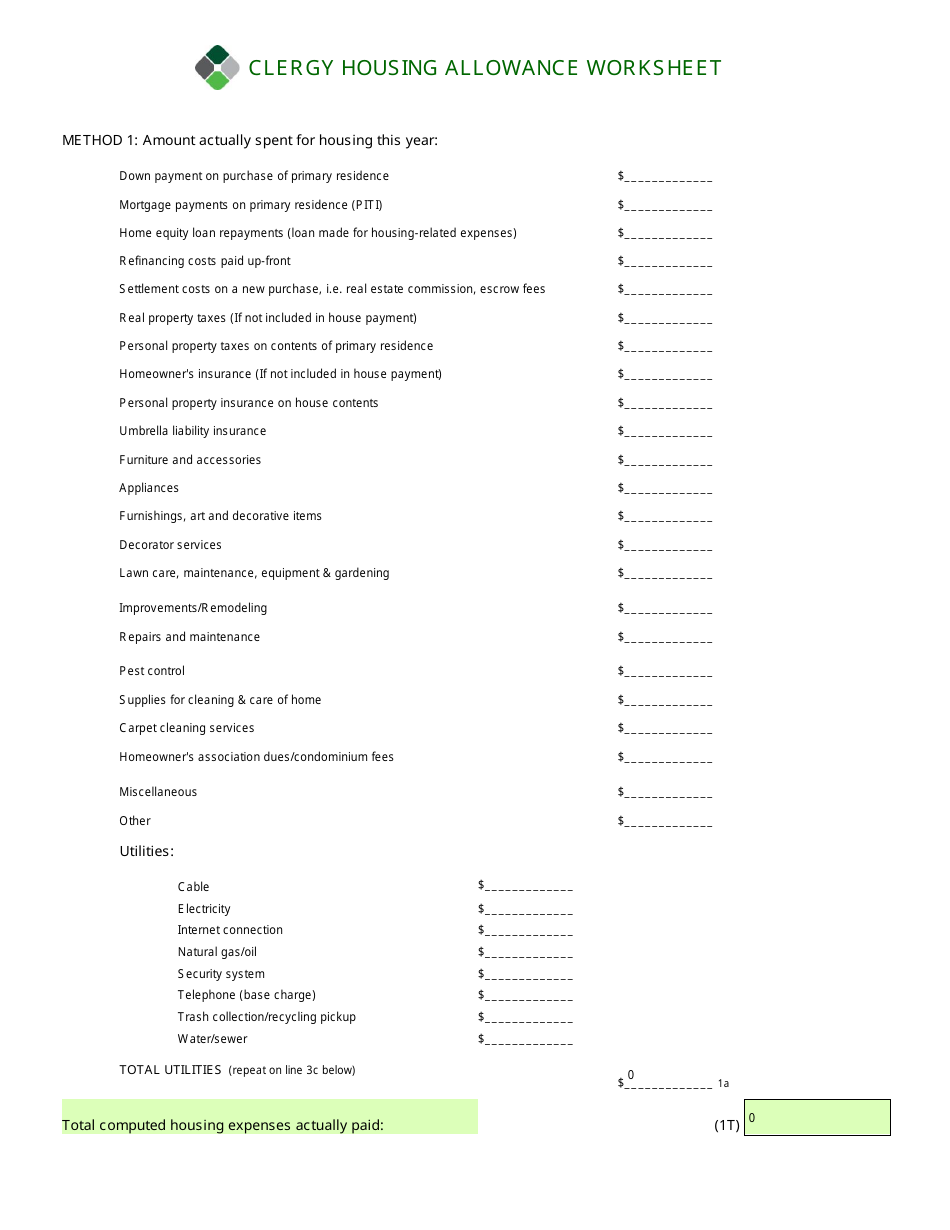

Housing allowance for pastors 2021. There you have it, the top 10 most viewed pastor’s wallet articles of 2021. Salary of $50,000, tax rate for 2021 is 12% for married filing jointly, and total housing expenses of $28,000 (rent/mortgage, insurance, taxes, utilities, furnishings, etc. When there is a housing allowance, the pastor determines the amoun t of compensation to be set aside for housing allowance (based on irs guidelines, publication 1828, available at.

This action should be taken in december of 2020 so that it will be effective for all of 2021. It is time again to make sure you update your housing allowance resolution. Their cash salary as a “housing allowance.” the amount of this allowance is not limited by a percentage of the base salary, but rather by the actual cost of housing related expenses such as utilities, repairs, interest, taxes and furnishings.

The housing allowance for pastors is not and can never be a retroactive benefit. (a) the amount designated as the housing allowance. • salary of $50,000 • taxed on $50,000 * 12% = $6,000 • owed income tax of $6,000.

Only expenses incurred after the allowance is officially designated can qualify for tax exemption. The housing allowance is one of the biggest financial benefits available to pastors. Pastoral housing allowance for 2021 pastors:

Use the form in “ sample housing allowance for pastors. The dollar limit on annual elective deferrals an It isn’t any wonder that half of this list addresses it.

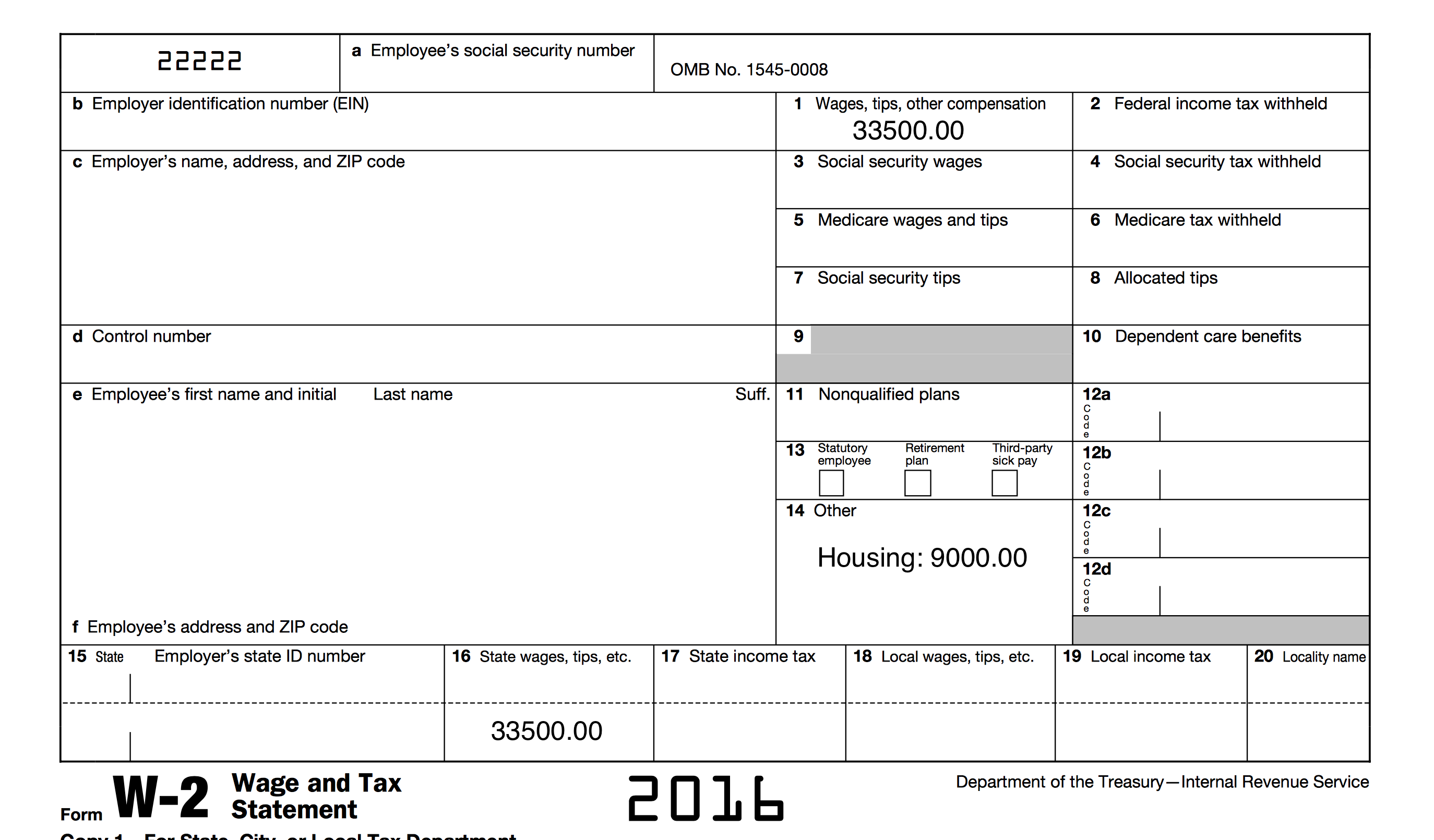

It is simply a matter of designating part of a minister’s salary as a housing allowance. It designated $20,000 of this amount as a housing allowance. (b) the amount of actual housing expenses, or.

The amount that can be excluded is the lesser of: Therefore, it is important to request your housing allowance and have it designated before january 1 so that it is in place for all of 2020. What is the maximum housing allowance for pastors in namibia?

Congregations may further choose to provide for some or all of the remaining social security taxes (7.65% for 2021). According to the irs, the actual housing allowance for the pastor is the smallest of the following: At the end of 2020, a church board determined that pastor t's compensation for 2021 would be $50,000.

Now, the clergy housing allowance continues.” ministry settings should continue to designate housing allowances for clergy. Therefore, it is important to request your housing allowance and have it designated before january 1 so that it is in place for all of 2020. Only expenses incurred after the allowance is officially designated can qualify for tax exemption.

Churches/charges providing a housing allowance in lieu of a parsonage should follow the conference requirement, paying no less than 20% and not more than 40% of the conference average compensation (cac). Social security taxes (7.65% of salary plus housing allowance for 2021). A housing allowance is a portion of a minister’s salary that is designated for that minister’s housing needs and excluded from the minister’s gross income for income tax purposes.

Designating a housing allowance for 2021 the amount of a housing allowance is set. If your pastor owns a home, have the church designate a portion of the pastor’s 2021 compensation as a housing allowance. Housing allowance for pastors 2021 read more »

Enter “excess allowance” and the amount on the dotted line next to line 1. The payments officially designated as a housing allowance must be used in the year received. Www.irs.gov) and submits it to the church council.

The housing allowance for pastors is not and can never be a retroactive benefit. The irs considers any seca as salary and should be reported as such by the pastor. Include any amount of the allowance that you can't exclude as wages on line 1 of form 1040, u.s.

According to tax law, if you are planning to claim a housing allowance deduction (actually an ‘exclusion’) for the upcoming calendar year, your session is required to designate the specific amount to be paid to you as housing allowance prior to the. These are 2020 amounts that increase to $105,000 for joint filers and $66,000 for a single person or head of household for 2021. Agrees to pay its pastor total compensation of $45,000 for 2021 and designates $15,000 of this amount as a housing allowance (the remaining $30,000 is salary).

Clergy tax return preparation guide for 2020 returns income of $104,000 for joint filers and $65,000 for a single person or head of household. (1) the amount properly designated in writing as the housing exclusion before payments to clergy begin; The pastor’s salary as housing allowance.

However, under these irs rules, ministers of word and sacrament (ministers of word and service are not eligible for

Housing Allowance Battle Likely Bound For Supreme Court – Covenant Companion Covenant Companion

Housing Allowance Letter To Employee Jobs Ecityworks

Update On The Ministers Housing Allowance Garbc

Pin On Examples Billing Statement Template

Housing Allowance Worksheet – Clergy Financial Resources Download Fillable Pdf Templateroller

Four Important Things To Know About Pastors Housing Allowance – Churchstaffing

Clergy Housing Allowance Worksheet – Fill Out And Sign Printable Pdf Template Signnow

Video Qa How Do You Get The Housing Allowance For A Pastor – The Pastors Wallet

Housing Allowance – Fill Online Printable Fillable Blank Pdffiller

Designating A Housing Allowance For 2021

Pastoral Housing Allowance For 2021 – Pca Rbi

Top 5 Faqs Regarding Ministers Housing Allowance – Baptist21

Video Qa Changing Your Ministers Housing Allowance – The Pastors Wallet

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church – The Pastors Wallet