This allows retired ministers to request that their distributions from their retirement account be designated as housing allowance. Building housing allowance into your tax strategy can create a stronger foundation for the years to come.

If you receive as part of your salary (for services as a minister) an amount officially designated (in advance of payment) as a housing allowance, and.

Housing allowance for pastors in retirement. If you’re a pastor, you know that your ministerial housing allowance is perhaps the biggest financial benefit of being in the ministry. At that time, though, your annual conference will At guidestone ®, we help active and retired ministers understand the benefits as well as the responsibilities of housing allowance.

Can i claim a clergy housing allowance in retirement? They must pay social security/medicare tax on the entire compensation of $65,000. It can be downloaded and attached to your session minutes, or simply incorporated into the language of.

Minister for tax purposes eligibility; It allows you to avoid paying taxes on all of your housing expenses, including things like cable television and landscaping. Irs regulations have long recognized this, and allow retired pastors (and other rostered church workers) to have a.

Housing allowance from a surviving spouse pension the housing allowance is designated unless with respect to pension a that represents compensation earned by the surviving spouse for. We also have a ‘housing allowance resolution’ drafted for you on our website; Also irs publication 517 at.

The exclusion applies to distributions of contributions made while you were serving under call, including their accumulated earnings. Providing housing for clergy is likely to have an impact on the church’s ability to minister to the whole country. Retired ministers may ask guidestone to designate up to 100% of their retirement income as housing.

Upon retirement, the irs allows credentialed ministers of all established church denominations to declare a housing allowance on distributions from their 403 (b) retirement accounts. The good news is that this housing allowance exclusion will not go away after you retire. To take a distribution with special housing allowance tax treatment, you must be at least age 59 ½ and receive a.

•the clergy housing exclusion (26 us code §107) is called by many names, yet each represents the same thing: For housing allowance purposes, the irs does not differentiate between an active and retired pastor. That’s why it is important to consult with an experienced tax professional who is knowledgeable about clergy tax laws and, more specifically, the retired minister’s housing allowance.

Therefore, current and retired pastors can receive a housing allowance. Nonetheless, pastors should only use it only in certain situations as no part can be claimed as a housing allowance in retirement. This can save you significant money.

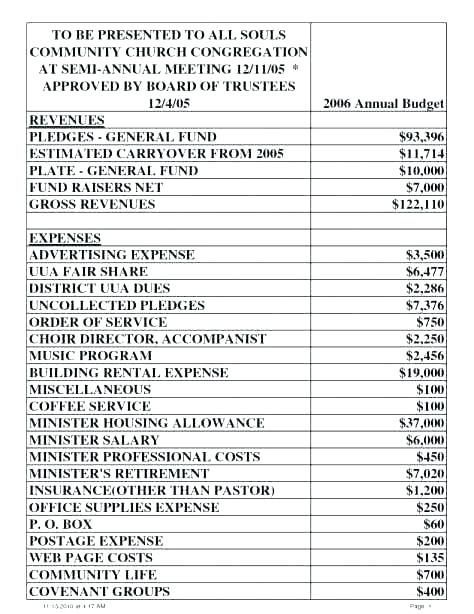

To be eligible, the pastor/clergy Housing allowance exclusion in retirement throughout their active ministry, most clergy exclude a housing allowance from their gross income when paying federal income taxes. Pension benefit, 13th check, and resettlement benefit) are designated as eligible for the clergy housing allowance exclusion by the board of trustees of the church.

But tax laws can be confusing and complicated. The fact that stipendiary clergy have to make arrangements to house themselves in retirement when they no longer have a house to enable them to carry out the duties of The code does not specify, however, if tax free housing allowances are permissible upon the retirement of pastors.

Housing allowance, the minister is responsible for reporting and paying federal income taxes on the correct amount of income. Responsibilities and limits of housing. Your pension distributions from the church pension fund clergy pension plan (e.g.

However, other retirement plan providers may not be able to provide this same benefit. Past services that were in the exercise of ministry. One for a pastor who lives in a manse, one for a pastor who rents, and one for a pastor who owns a house.

The mechanism by which clergy are permitted to exclude some or all of their income from being subject to federal income tax. That’s right—even retired pastors can! How to take a pastor housing allowance in retirement.

In retirement, clergy may still be eligible to claim the clergy housing allowance. The retired minister’s housing allowance may be able to save retired members of the clergy on their federal income taxes. Now, at retirement, he doesn't have a lot in the bank, a fairly low pension, and he has to somehow provide a place to live for himself and his wife.

If you are a retired pastor receiving annuity payments (or taking one or more lump sum distributions) from a wespath retirement program, you may qualify for a clergy housing allowance exclusion. For this reason, rbi has three online housing allowance worksheets available for you: That means the portion of your distributions used for housing expenses is excludable from gross income for income tax purposes.

If a clergy’s annual compensation is $65,000, and their church has designated a housing allowance of $15,000, they subtract that from their salary, bringing their taxable income for federal income tax purposes to $50,000.