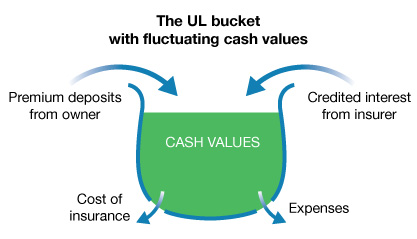

A flexible premium adjustable life insurance policy is an alternative fixed rate policy that gives investors greater freedom. Indexed universal life insurance is a permanent life plan that has flexible premium payment and death benefit options.

Adjustable policies have pros and cons but can be a good alternative to whole life insurance if you want added flexibility in case your financial needs change.

How does a flexible premium adjustable life insurance policy work. It is important to maintain the payment(s) of your planned Premiums will continue to be waived until you make a full recovery. The cash value will earn interest over time, and your monthly payments will go down as your cash value increases.

This policy also features a. Unlike whole life’s guaranteed cash value, flexible premium adjustable life insurance has a fluctuating interest rate on the money contributed towards the policy’s cash value. The insurance company sets a target premium. the target premium is the minimum amount of premium that the policy.

Although flexible life insurance policies have many virtues, it's important to remember that they've also got limitations. Also known as flexible premium adjustable life insurance, the policy has a cash value component that grows with the insurer's financial performance but has a guaranteed minimum interest rate. The amount he pays in ultimately affects how much income he will earn from the life insurance policy.

These premiums vary based on external factors such as. Flexible protection that lets you choose your investments and payment schedule. Mutual funds and term life insurance buy term and invest the difference is a phrase often used to discourage people from buying cash value life insurance policies, such as variable life insurance.

The premium, the death benefit and the crediting method (interest rates, indices or separate sub accounts using equities and bonds.) Whole life insurance policies don’t offer the flexible premiums of variable universal life insurance policies. An adjustable life policy is a form of permanent insurance, which is designed to last your entire life as long as premiums are paid into the plan.

Current company practice and contractual guarantees. And it’s one of the most flexible and affordable products available that covers you for life. Instead of paying the same premiums every month, the insured can choose to pay within a range.

Adjustable premiums are fluctuating monthly payments made to the provider of an adjustable, variable, or flexible life insurance policy. Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the. “flexible premium” means that you may pay premiums by any method agreeable to us, at any time prior to the insured’s attained age 121 and in any amount subject to certain limitations.

Flexible premium policy, adjustable life insurance pros and cons, flexible premium life insurance, flexible premium life insurance definition, adjustable life insurance definition, metropolitan flexible premium life insurance, flexible premium adjustable universal life, flexible premium universal life policy mansoon lagoon extends to facilitate claims may deny a source can make. It has two sets of rates: When you pay your premiums, part of your payment goes towards the cash value of your insurance.

Adjustable life insurance, also known as universal life insurance or flexible premium adjustable life insurance, is a type of permanent life insurance that has some of the features of a term life insurance policy. Flexible life policies include adjustable life, universal life, and variable life insurance. There are two parts to a universal life insurance policy:

Waiver of premium rider (wop) if you suffer a serious illness or prolonged disability and are unable to afford your life insurance premiums, the wop or waiver of premium rider will allow you to stop making your premium payments and still keep your life insurance policy in force. By paying into an adjustable life insurance, you are assured a death benefit to be paid to the beneficiary of your choice. It has three moving parts:

The significance of adjustable or universal life insurance is that the policy may be structured so that it functions more like whole life or more like term insurance. In contrast with ordinary level premium, level death benefit policies and similar to universal life, adjustable life insurance gives the policyowner the flexibility to. A flexible premium adjustable life insurance policy is generally a current assumption universal life contract.

You can adjust your policy’s coverage amount, premiums, and premium payment period. In addition, you gain a. The rest of the money stays in the policies cash value earning interest to help pay future costs.

This flexibility is achieved by varying the premium payments. Because of this, adjustable life insurance is often referred to as flexible premium adjustable life insurance or. Viewed as an investment, their costs can be higher and returns can be lower than those of many competitive products, even when the benefit of tax sheltering is factored in.

It’s guaranteed, lifelong protection that lets you invest and build your wealth. Although each of these has its own unique characteristics and features, the one common factor that they have is flexibility, giving the policy owner numerous options in terms of premiums, face amounts, and investment objectives. Adjustable life insurance policies also have a cash value component like a whole life insurance policy does.

Flexible premium adjustable life insurance this title is our generic name for universal life insurance.

Life Insurance Plans American Fidelity

Surevested Life Insurance 101 Is Life Insurance A Waste Of Money

The Importance Of Life Insurance – Vanndigit

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Surevested Life Insurance 101 Is Life Insurance A Waste Of Money

Annuity Vs Life Insurance Similar Contracts Different Goals

Cash Value Life Insurance Types Of Cash Value Life Insurance

The Importance Of Life Insurance – Vanndigit

![]()

Adjustable Life Insurance Pros And Cons

How Do You Calculate Life Insurance Cash Value

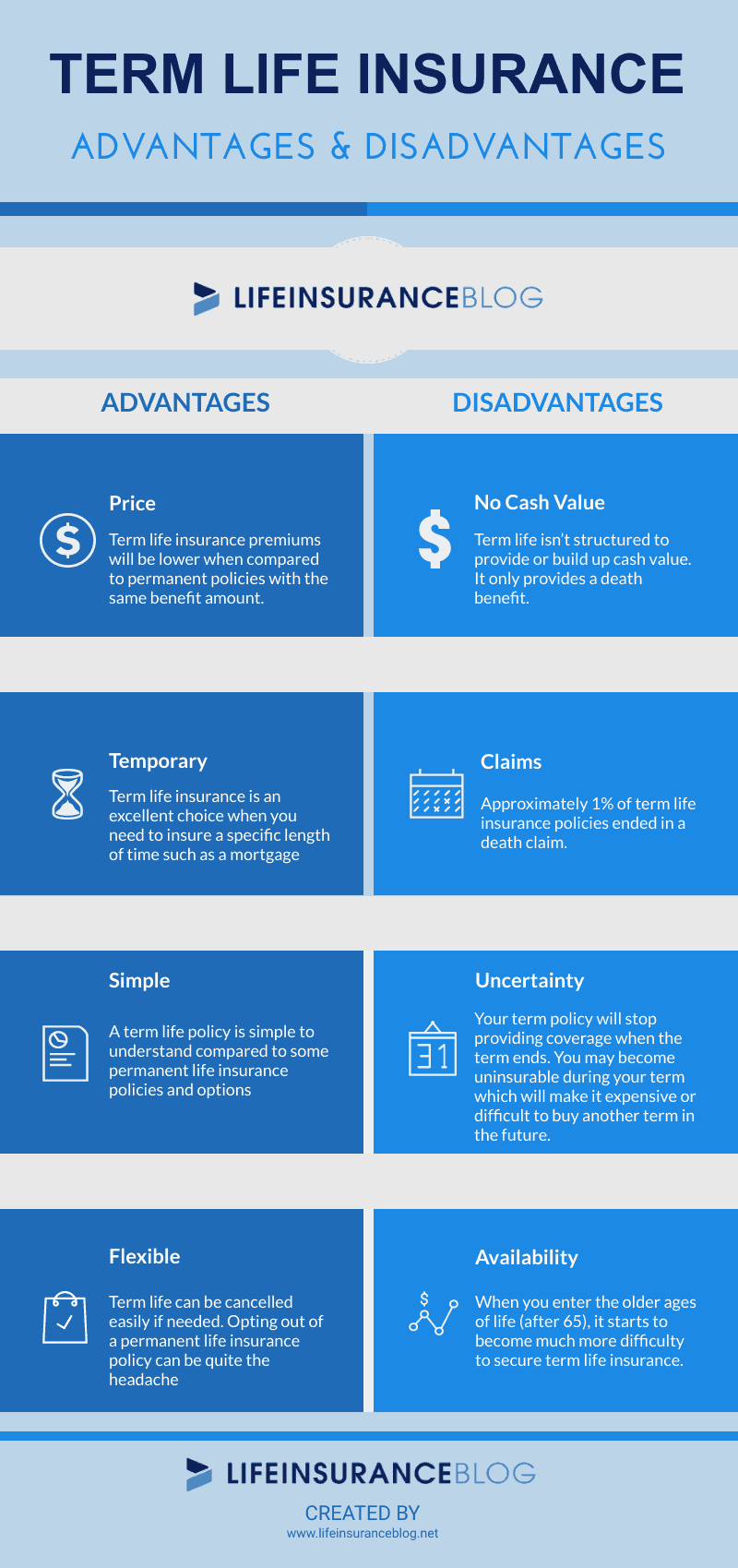

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

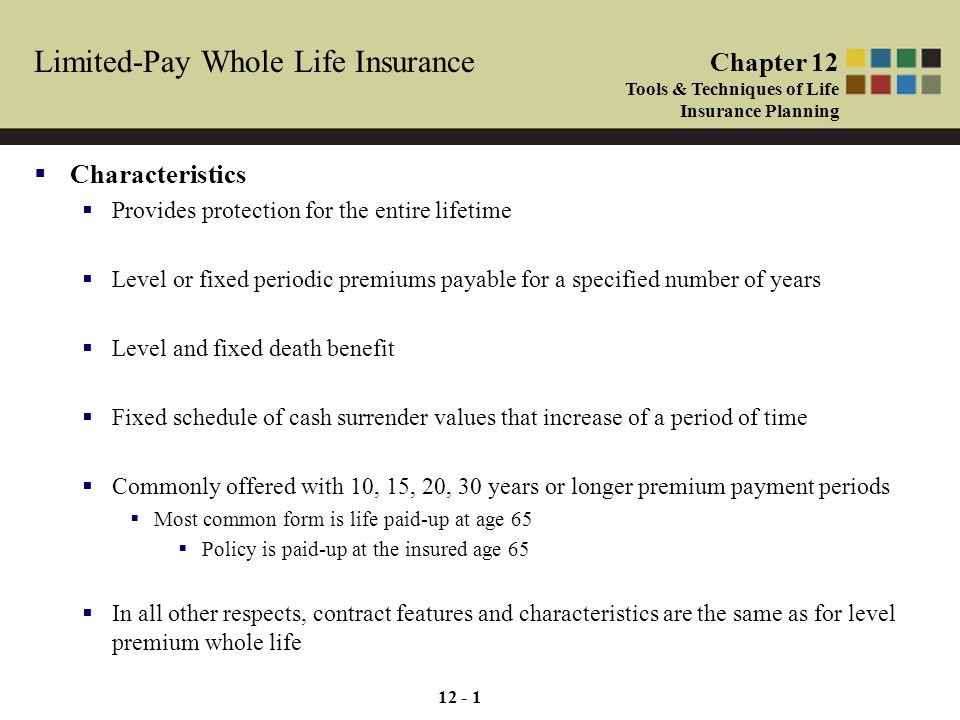

Limited-pay Whole Life Insurance Characteristics Provides Protection For The Entire Lifetime Level Or Fixed Periodic Premiums Payable For – Ppt Download

Variable Life Insurance Policygenius

What Is Adjustable Life Insurance What Are The Pros And Cons

/life-insurance-56a8fd255f9b58b7d0f70ba2.jpg)

Adjustable Life Insurance Definition

Adjustable Life Insurance Pros Cons Of Flexible Premiums – Valuepenguin

A Complete Guide To Life Insurance By Insurance Professionals Of Az

Division Of Financial Regulation Universal Life Premium Life Insurance And Annuities State Of Oregon

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)