The cash surrender value is the amount of money an insurer will pay you if you surrender a permanent life insurance policy that has a cash value. To calculate your cash surrender value, take the total cash value (premiums you’ve paid minus the death benefit premiums) and subtract any surrender fees and charges the life insurance company charges (read the fine print on your policy).

Guaranteed surrender value of lic policy is 30% of the basic premiums paid.

How to calculate surrender value of life insurance policy. Since the surrender fees can be a significant value for you, it is recommended that you ask the insurer if you can withdraw the cash surrender value and use some portion of it to buy a less expensive policy before you decide to surrender your current life insurance policy. The surrender value factor will grow close to 100 percent of the total premiums paid when the life insurance policy progresses nears maturity. How to calculate the cash surrender value of a life insurance policy.

You need to provide some of the basic information to calculate the surrender value instantly. The cash surrender value of your policy equals its total cash value, minus any surrender fees you are charged. How do you pay the taxes?

For a life insurance policy, your premiums are the deposit. Types of the surrender value surrender value factor increases with the number of years of the policy. Then, subtract the fees that will be changed by the insurance carrier for surrendering the policy.

Essentially, you can get a rough estimate of your life insurance policy’s cash value by multiplying your monthly insurance payment by the number of months you’ve paid for your policy so far. Special surrender value is calculated as: Total cash value of your policy;

The amount of the cash surrender value above your premium payments is the interest. The surrender value of life insurance policy can be calculated easily using an effective online tool called surrender value calculator. (1) borrowing against the policy (you’ll have to repay with interest), (2) withdrawing some of your money, or (3) canceling the policy to receive the surrender value.

Of premiums payable) + total bonus received) * surrender value factor. For example, say that you are in the 25% tax bracket and you paid a total of $10,000 of premiums into your cash value (universal life insurance) policy. When one stops paying premiums after a certain period, the policy continues but with lower sum assured.

Also, surrender value differs slightly for insurance policies and annuities: Also, how is life insurance surrender value calculated? The regulations provide that this value is derived by computing the difference between the policy’s reserve value at the date of the last premium payment and the projected reserve

Your insurance provider may give you the option to have taxes withheld. How much is my cash surrender value worth? Special surrender value = (original sum assured * (no.

Therefore, in this case, the guaranteed surrender value is computed as cumulative premiums paid that get multiplied by the surrender value factor. With the steps shown in both the cases above, you can now quickly calculate the value of your surrender value. Permanent life insurance— you can access your cash value in three ways:

Assume percentage/surrender value factor is 40%. Surrendering a policy cancels your coverage. This way you will learn the total actual payout you would receive from surrendering a.

Then, subtract the fees that will be changed by the insurance carrier for surrendering the policy. Any surrender penalties for your policy ; The surrender value on a policy can be calculated as below:

Your permanent life insurance surrender value depends on a few different factors: The special surrender value will depend on a number of premium instalments paid by you, policy term and the bonus accrued (if any). To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy.

You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000. If not, you will need to make. Special surrender value = [{basic sum assured x number of premiums paid/ number of premiums payable} + accrued bonuses] x applicable surrender value factor

To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. An itr value is a value calculated from the policy’s reserve value at a particular point and time. Typically, the amount of cash surrender value increases as the policy’s cash value increases and the surrender period decreases.

Assume bonus collected is inr 40,000. The answer to the question of how to find cash value of life insurance policy is both simple and complex. Guaranteed surrender value is the amount guaranteed by the company to the policyholder in case of termination of the policy before maturity.

The special surrender value can be calculated: Your cash value is now worth $13,000, and you decide to surrender your policy. Special surrender value= {(15, 00,000*(4/15) +40000}*40% =inr 176,000.

You can access the surrender value calculator online on the website of an insurance company.

How Much Insurance Do I Need Dont Guess Ask A Expert Child Plan Insurance Retirement Planning

Sample Letter Format For Surrender Of Life Insurance Policy Life Insurance Policy Insurance Policy Life Insurance

Kerja Sampingan Dibawa Pulang Jogja Lowongan Kerja Sampingan Di Rumah Jogja Misalnya Saja Dibawa Kabur Atau Hilang Lecet Atau Rusak Jika Kendaraan Bisa Di In 2021

Life Insurance Maturity Accounting Entry In Tally Erp 9 Lic Maturity En Accounting Life Insurance Policy Life

Easy Method To Calculate Surrender Value Of Your Lic Policy Life Insurance Companies Surrender Life Insurance Policy

Free Net Worth Calculator For Excel Personal Financial Statement Net Worth Statement Template

What Is An Umbrella Policy Umbrella Insurance Umbrella Homeowners Insurance

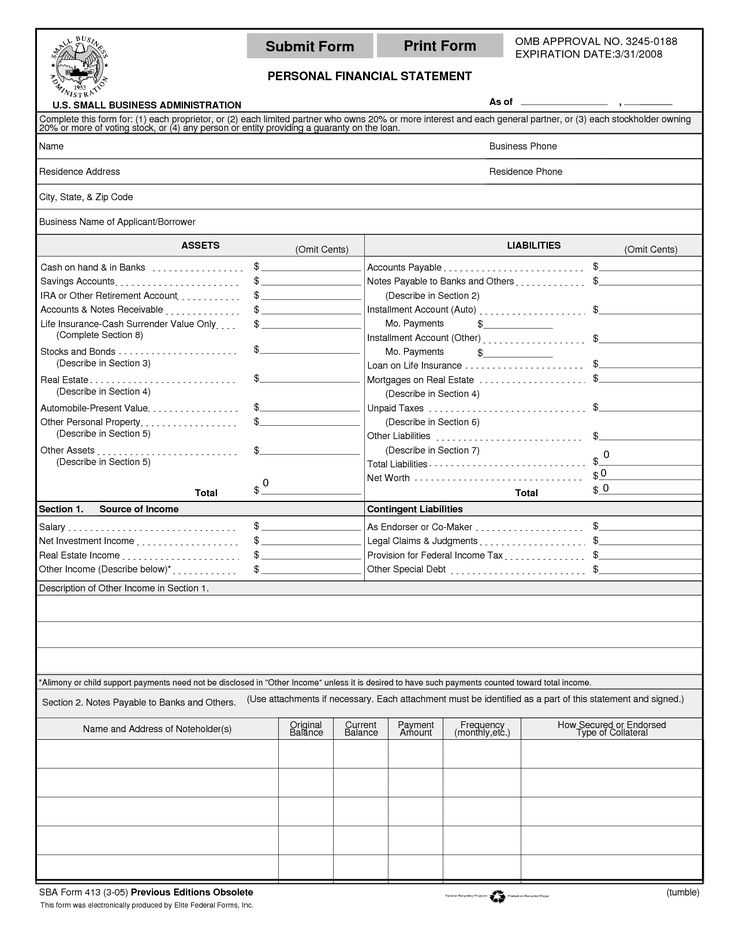

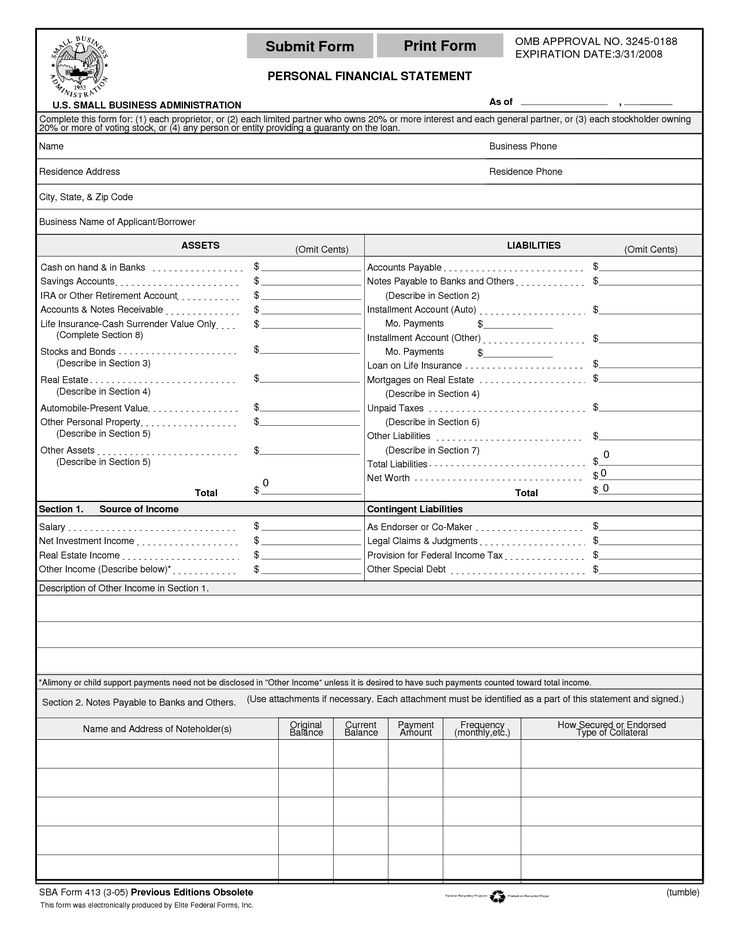

Personal Financial Statement Personal Financial Statement Financial Statement Statement Template

Personal Balance Sheet – How To Create A Personal Balance Sheet Download This Personal Balan Balance Sheet Balance Sheet Template Personal Financial Statement

Whole Life Insurance- What You Need To Know Whole Life Insurance Life Insurance Life Insurance Quotes

Sba Personal Ncial Statement Template Excel Spreadsheet Free Pertaining To Excel Fina Statement Template Personal Financial Statement Profit And Loss Statement

Existence Certificate Existence Certificate – Certificate Format Certificate Gurgaon

Lic Of India Agent Commission Chart – 2020 Life Insurance Quotes Life Insurance Marketing Ideas How To Pass Exams

Sample Letter Format For Surrender Of Life Insurance Policy Life Insurance Policy Insurance Policy Life Insurance

Use Personal Loan Interest Calculator To Get The Exact Loan Quote For You Personal Loans Interest Calculator Loan

Print Personal Financial Statement Form Print Form Personal Financial Statement Personal Financial Statement Statement Template Financial Statement

Notification Toggle Premium 312 Apk Free Download – Full Apps 4 U App Android Apps Free Mobile Data

Successful People Work To Create Wealth And Multiple Streams Of Income Passive Income Quotes Money Mindset Quotes Buddha Quotes Life