The protection of the errors and omissions insurance or e&o policy can be triggered when, by the unintentional wrongful act of the insured, a client or a customer is financially damaged. Our goal is to provide you with excellent service by providing you e&o coverage promptly at a reasonable cost.

How To Get A Florida Real Estate License In 5 Steps Real Estate License Real Estate Infographic Florida Real Estate

Extensive coverage up to $3 million tailored specifically for real estate.

Is e&o insurance required for realtors in texas. Some states require real estate agents to have their own errors and omissions insurance: The designated broker must be individually licensed as an active texas real estate broker. If the designated broker does not own at least 10% of the entity, the entity must maintain e&o insurance in the amount of $1 million.

Are real estate agents required to have real estate e&o insurance? Financial damages due to a notarization error or omission filed against your nna bond. For example, a real estate agent might need to purchase a real estate e&o policy and provide a certificate of insurance before signing on with a broker.

An e&o policy can provide you protection for these and other possible losses and risks: Though e&o insurance is not required in texas, this policy provides crucial protection and some states require real estate agents to carry it. E&o insurance covers mistakes and oversights.

Require all renters to carry at least $300,000 in liability insurance on their renter’s policy. For many professions, e&o insurance could be required to get a professional certificate or license, or your clients might ask you to have coverage before they sign a contract with you. The texas association of realtors® strongly encourages members to maintain e & o insurance.

A notary e&o policy protects you should you make an unintentional error or omission when notarizing that financially harms the public. Errors and omissions insurance (e&o) many clients require proof of errors and omissions insurance before entering into contracts for professional services. Tenant screening and handling claims will likely fall under e&o insurance.

Whether you’re a home inspector, mold sampler, energy auditor, or mortgage field service professional, the need for superior e&o insurance is inevitable, so choose elitemga with coverages limits ranging from $100,000 up to $1,000,000, and prices starting at $1000 for the errors & omissions and general liability. Our individual coverages are the key to protecting you and. This policy, also called professional liability insurance, can help cover legal expenses if a real estate agent or broker is sued for unsatisfactory performance or a work mistake.

Realtors e&o insurance coverage can be purchased as a stand alone policy or as part of package. There are many lawsuits in which a texas realtor® may be involved that are not significant to texas realtors® or the real estate industry as a whole. Cres insurance is now a texas association of realtors® (tar) errors and omissions risk management partner.

Submission of a current franchise tax account status page, also known as “certificate of good standing” (must be. Coverage starting at midnight, care as soon as tomorrow. Certificate of insurance for a broker business entity (form id:

Provide you with an attorney. Fortunately, errors and omissions insurance can protect your. Pay for your legal fees.

With cres e&o + claimprevent®, enjoy more coverage and services for your e&o investment: Errors and omissions insurance—e&o for short—is a type of malpractice insurance coverage for real estate agents, brokers, and firms, so they can avoid having to pay legal costs out of pocket. As your texas realtors® risk management e&o partner, cres gives you more value from your errors and omissions insurance:

Nebraska, north dakota, new mexico, rhode island, and texas. When you purchase real estate e&o insurance, you enter into an agreement with an insurer for it to pay for your loses up to your policy limits as long as you pay your premiums. It pays for claims that come about due to.

Ad · see new 2022 insurance to see if you could save in texas. Insurance agents often need to have. A property manager could be sued for renting to an unqualified renter, or when someone claims he was unfairly denied a rental property.

Though e&o insurance is not required in texas , this policy provides crucial protection and some states require real estate agents to carry it. The package can include general liability. Victor is one of the largest and most experienced underwriting managers of specialty insurance programs in the world, serving more than 46,000 policyholders in.

Higher e&o limits to protect your assets, prevent claims. Ad · see new 2022 insurance to see if you could save in texas. You should obtain the advice of competent legal, employment, accounting, tax, business formation, real estate registration, risk management, and other professionals before you

Money or a money equivalent, such as lost opportunity to earn money). Remember though, that e&o coverage is needed to protect you from liability in your activities as an agent. Under this arrangement, the insurer agrees to:

Coverage starting at midnight, care as soon as tomorrow. Usually, this means an injury that can be translated into economic terms (i.e. An accusation of professional negligence, errors, or an unfulfilled promise related to your insurance services could lead to a client taking you to court.

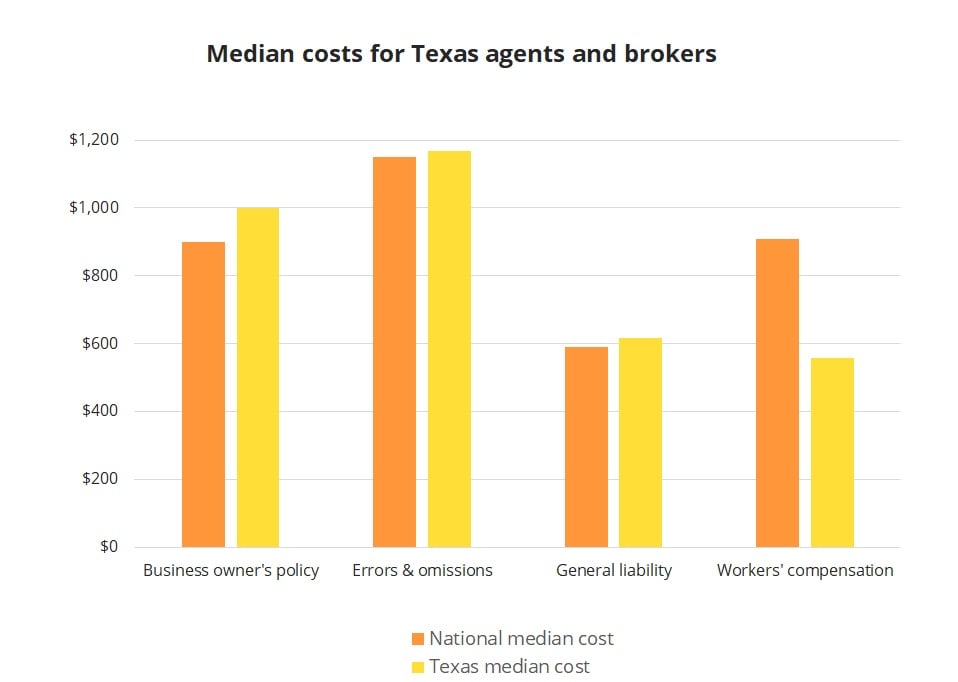

Texas e&o insurance for real estate agents and brokers (for states other than texas, please select from our menu above.) we offer e&o insurance (errors and omissions) to texas real estate agents and brokers. This form is to be used as proof that the business entity maintains errors and omissions insurance if the designated broker does not own at least 10% of the business entity. The texas realtors® strongly encourages members to maintain e&o insurance.

Commercial or business property coverage, and the standard bop form. How property managers can reduce their risk. As an insurance professional, you realize how devastating a legal battle can be.

Top 6 Providers Of Real Estate Eo Insurance Costs – Bravopolicy

Professional Liability Insurance Definition Professionalliabilityinsurance Liability Insurance Professional Liability Liability

7004 Peters Southlake Tx 76034 Stucco Homes Luxury Property Property

How To Become An Escrow Officer In Oregon Escrow Officer Oregon

Youve Worked Hard To Achieve Your Status – We Work Hard So You Can Keep It Liability Insurance Professional Liability Insurance

Alaska License Requirements – Us Home Inspector Training Home Inspector Home Inspection How To Become

How To Make A 360 3d Virtual Real Estate Tour With Iphoneandroid Real Estate Education Real Estate Real Estate Client

What Is Eo Insurance An Attorneys Guide To An Eo Policy

3 Ways Errors Omissions Insurance Can Protect Real Estate Agents Next Insurance

Errors And Omissions Insurance For Real Estate Agents

Egging Toilet Papering How To Clean Up After Halloween Pranks Halloween Pranks Pranks Clean Up

Errors And Omissions Insurance For Real Estate Agents

Always There For Me – Gcaar Real Estate Sales Promo Ad Real Estate Advertising Real Estate Branding Risk Management

Prices Chef Corpus Christi Texas Corpus Christi Texas Corpus Christi Corpus Christi Tx

We Are All Connected In The Universe No Business Here Sustained Without Peoples Support I Would Take A Min Helping People Supportive We Are All Connected

Home Insepctors Insurance – Preferred Guardian Insurance 18383 Preston Rd Ste 330 Dallas Tx 75252 972-331- Guardian Insurance Over The Years Couple Photos