For preventive, therapeutic, treating, rehabilitative, personal care, or. Many people buy long term care insurance to protect their retirement assets from the high costs of needing care.

Allianz Long Term Care Insurance Life Insurance Blog

As a rule, premiums that are paid to private health services plans including medical, dental and hospitalization plans are considered to be eligible medical expenses by the canada revenue agency.

Is long term care insurance tax deductible in canada. Get the best quote and save 30% today! Ad compare top expat health insurance in indonesia. Long term care insurance can provide coverage if you become unable to care for yourself and need assistance to manage daily living activities.

Similar tax advantages exist at the state level, but. Financial consumer agency of canada. Get the best quote and save 30% today!

Furthermore, any premium, contribution or other consideration — including sales and premium taxes — that you pay to a private health services plan for yourself, your spouse or. Long term care isn't just for seniors. Unless you have access to a group disability plan through an association or your company, you'll have to purchase your own disability coverage.

The amount of the deduction depends on the age of the covered person. In certain provinces, based on your annual income, home care expenses may be partly or fully covered. O the premiums aren’t deductible.

Attendant care costs, including those paid to a nursing home, can be used as medical expense deductions on your tax return. This type of insurance allows you to remain independent and receive your care with dignity in the setting of your choosing, without having to burden a spouse or. Provided pursuant to a plan of care prescribed by a licensed health care practitioner.

If you require long term care, it might be tax deductible. $450 — under age 41 as of december 31, 2021. Life insurance individuals and businesses may not deduct life insurance premiums.

Only the portion of your monthly bill used to pay attendant care salaries can be deducted. If the amount you pay exceeds the limit, you can't deduct more than that stated limit. Ad compare top expat health insurance in indonesia.

You may become unable to care for yourself for 90 days or more at any point in your life. The breakdown should also take into account any subsidies that reduce the attendant care expenses (unless the subsidy is included in income and is not deductible from income). You need to include a detailed statement of the nursing home costs.

Pdf Research On Long-term Care Insurance Status Quo And Directions For Future Research

I Have Car Insurance Buy Health Insurance Cheap Health Insurance Rental Insurance

Use Hsa To Pay For Long Term Care Insurance Premiums Ltc News

Allianz Long Term Care Insurance Life Insurance Blog

Best Long-term Care Insurance Planning Strategies For 2022 Reduce Costs Get Tax Deductions Business

Hdfc Ergo Car Insurance Update 2021 Car Insurance Health Insurance Plans Insurance

The Tax Deductibility Of Long-term Care Insurance Premiums

Irs Reveals 2022 Long-term Care Tax Deduction Amounts And Hsa Contribution Limits Ltc News

Medicaid Is Never The Goal Or Solution For Long-term Care Planning Ltc News

Mutual Of Omaha Long Term Care Insurance Life Insurance Blog

Irs Reveals 2022 Long-term Care Tax Deduction Amounts And Hsa Contribution Limits Ltc News

Top 10 Long Term Care Insurance Pros And Cons Is Ltci Worth It For You

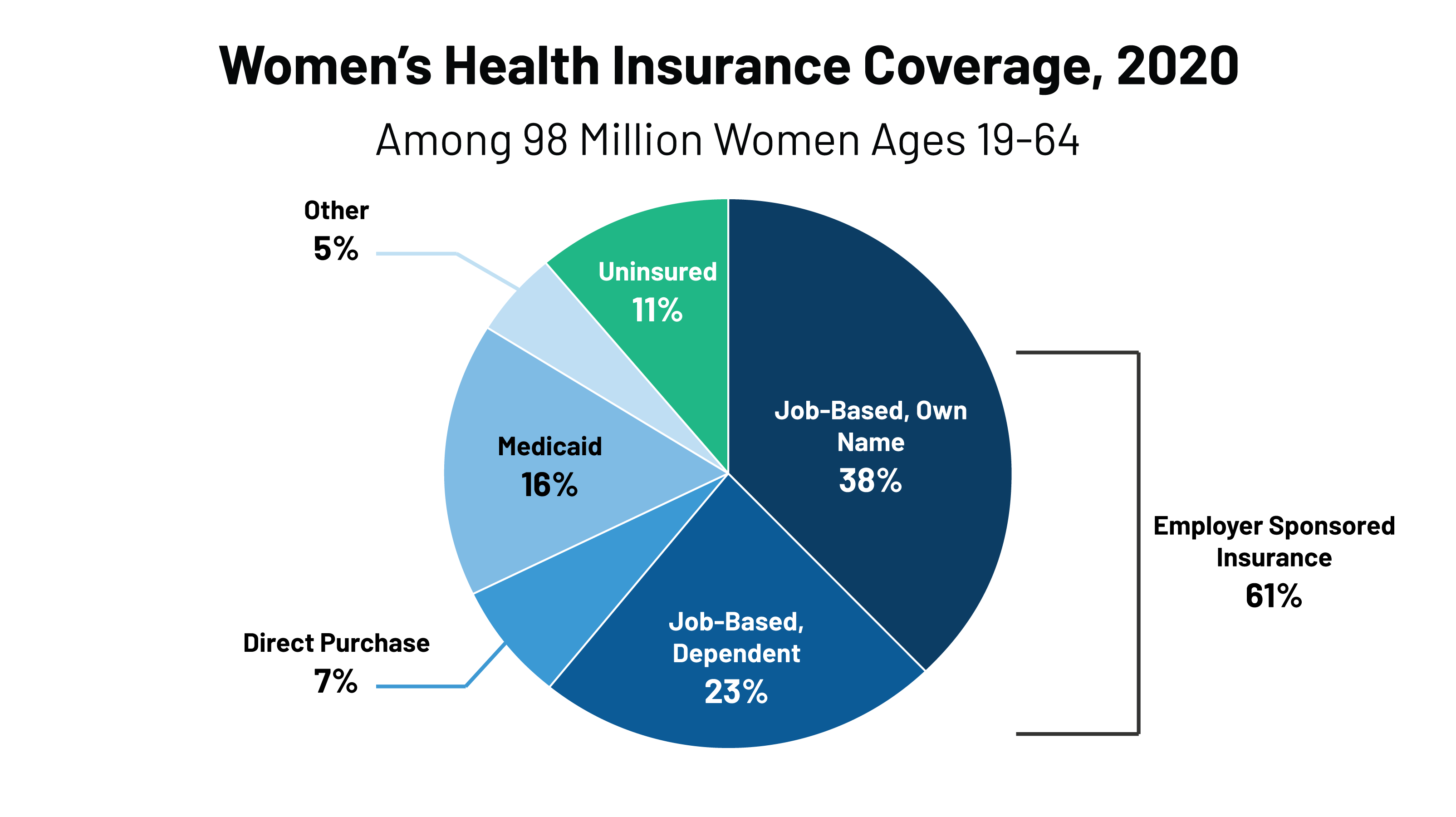

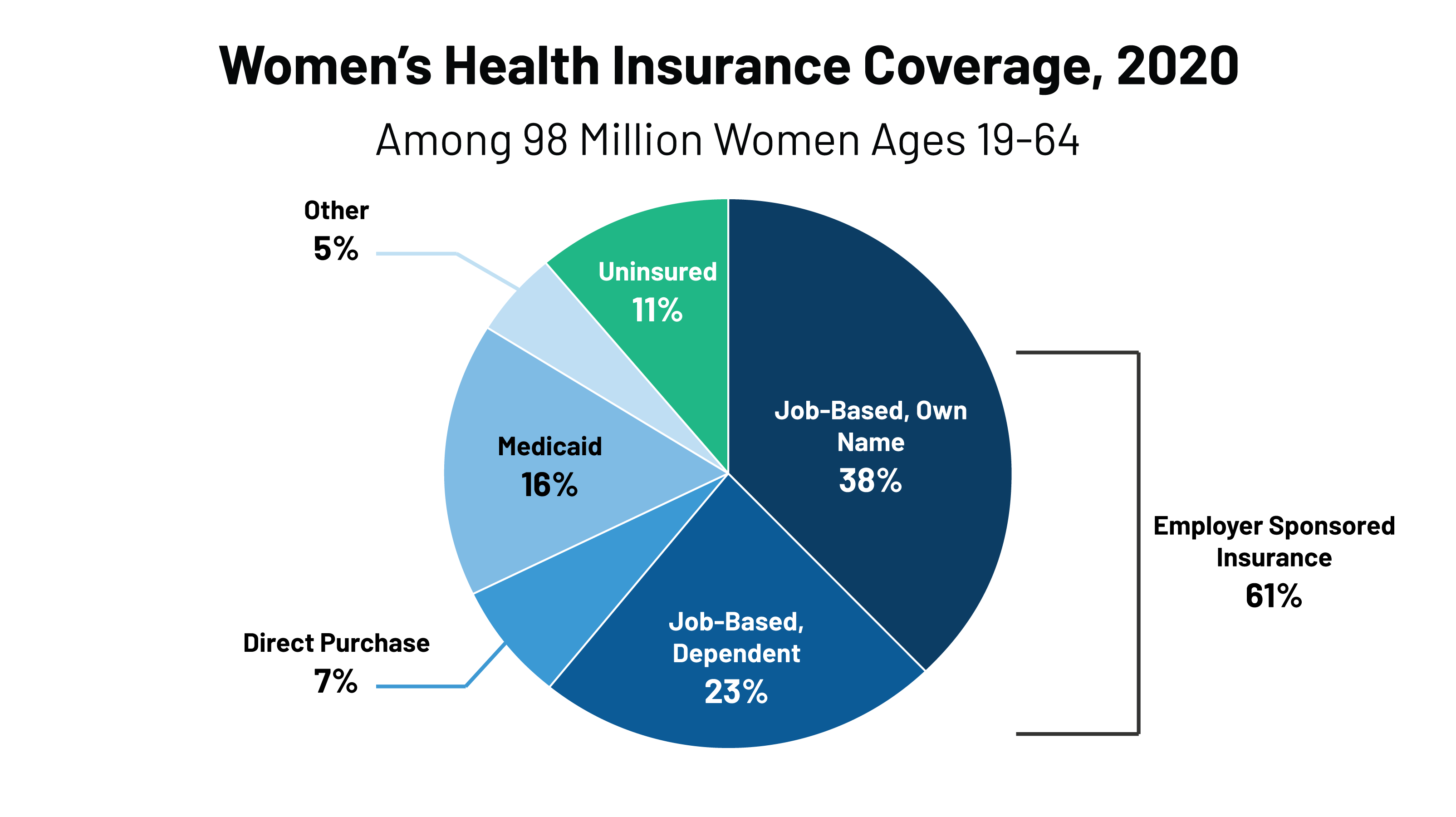

Womens Health Insurance Coverage Kff

Best Long-term Care Insurance Planning Strategies For 2022 Reduce Costs Get Tax Deductions Business

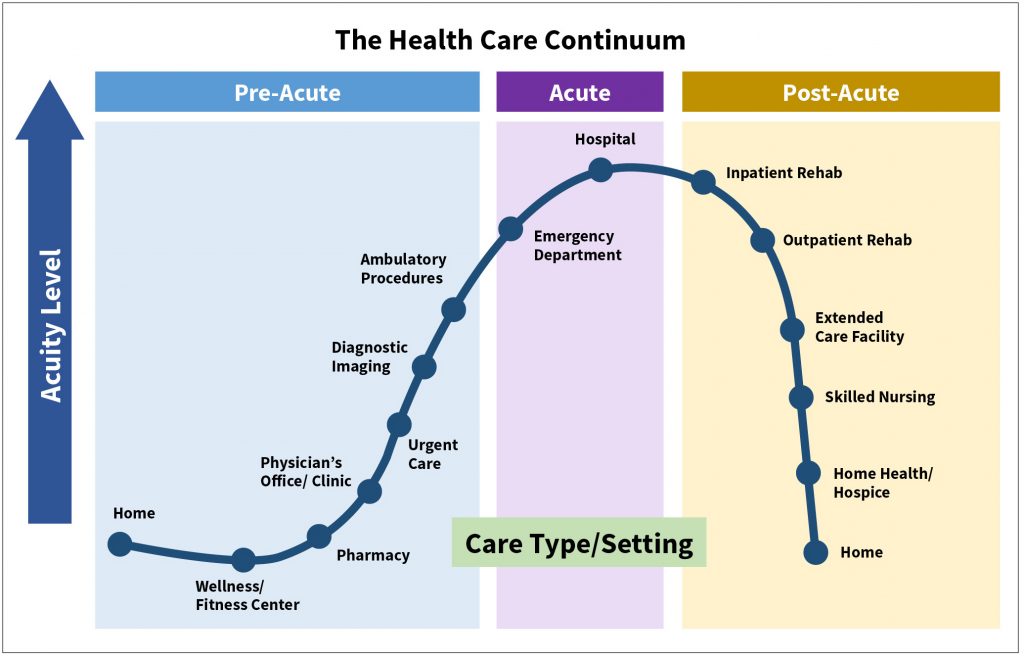

Realigning Ltciprivate Long-term Care Insurance And The Health Care Continuum Contingencies Magazine

Insurance Solutions Protect Your Income And Your Assets

Long-term Care Insurance Pros Cons In 2021 Breeze

Are Benefits From A Long-term Care Insurance Policy Taxable Ltc News