A surviving spouse is entitled to no less than a life estate in any property used as a homestead by the deceased spouse in texas. The key to this outcome is that no value is transferred until the moment of mother’s death.

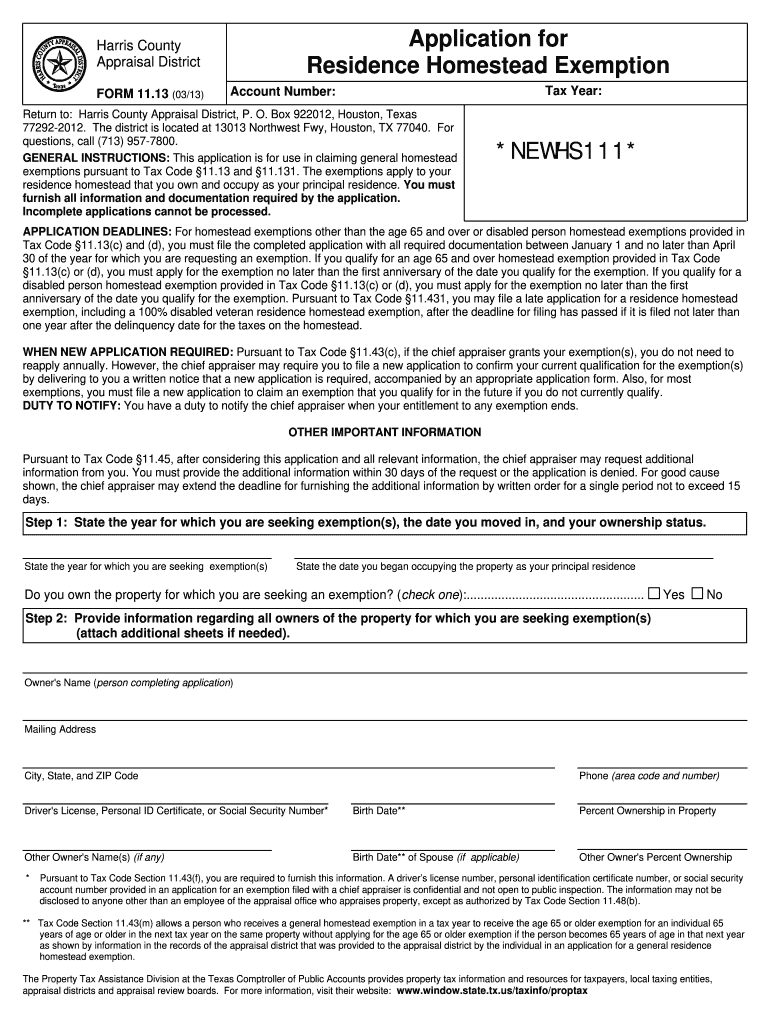

Tx Form 1113 2013-2022 – Fill And Sign Printable Template Online Us Legal Forms

A life tenant has the right to sell, lease, mortgage, or otherwise alienate the life estate in the property.

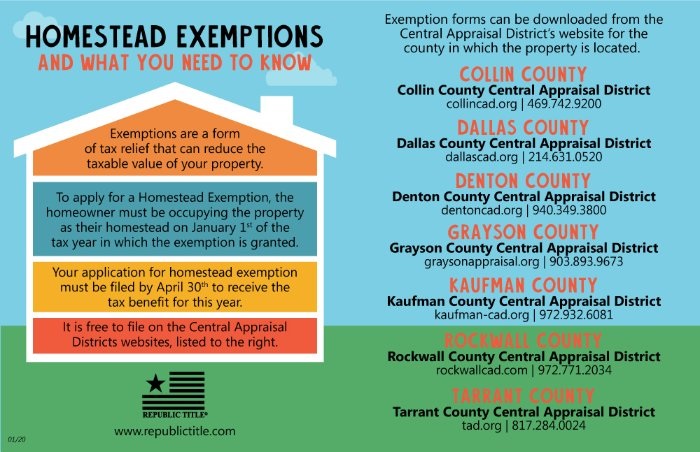

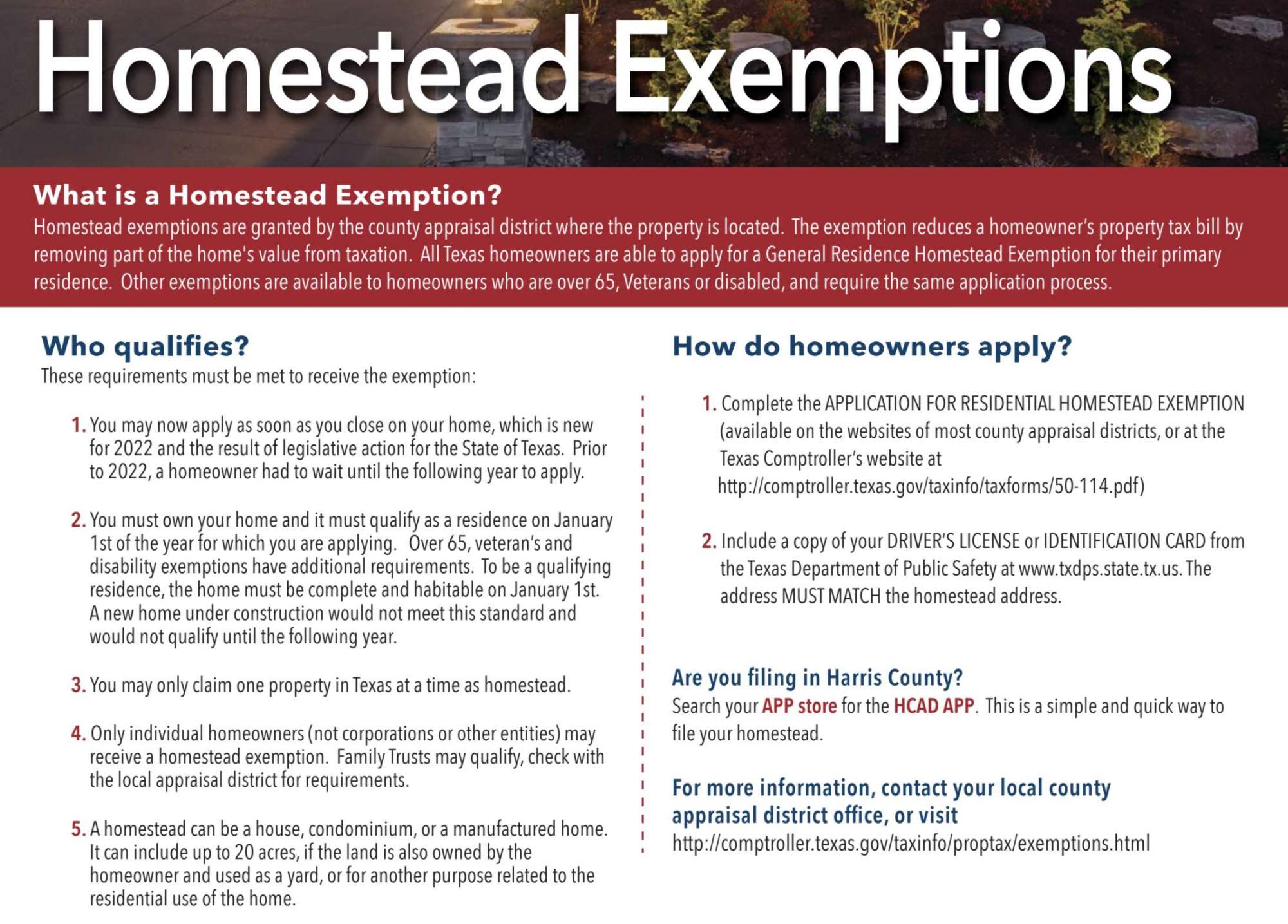

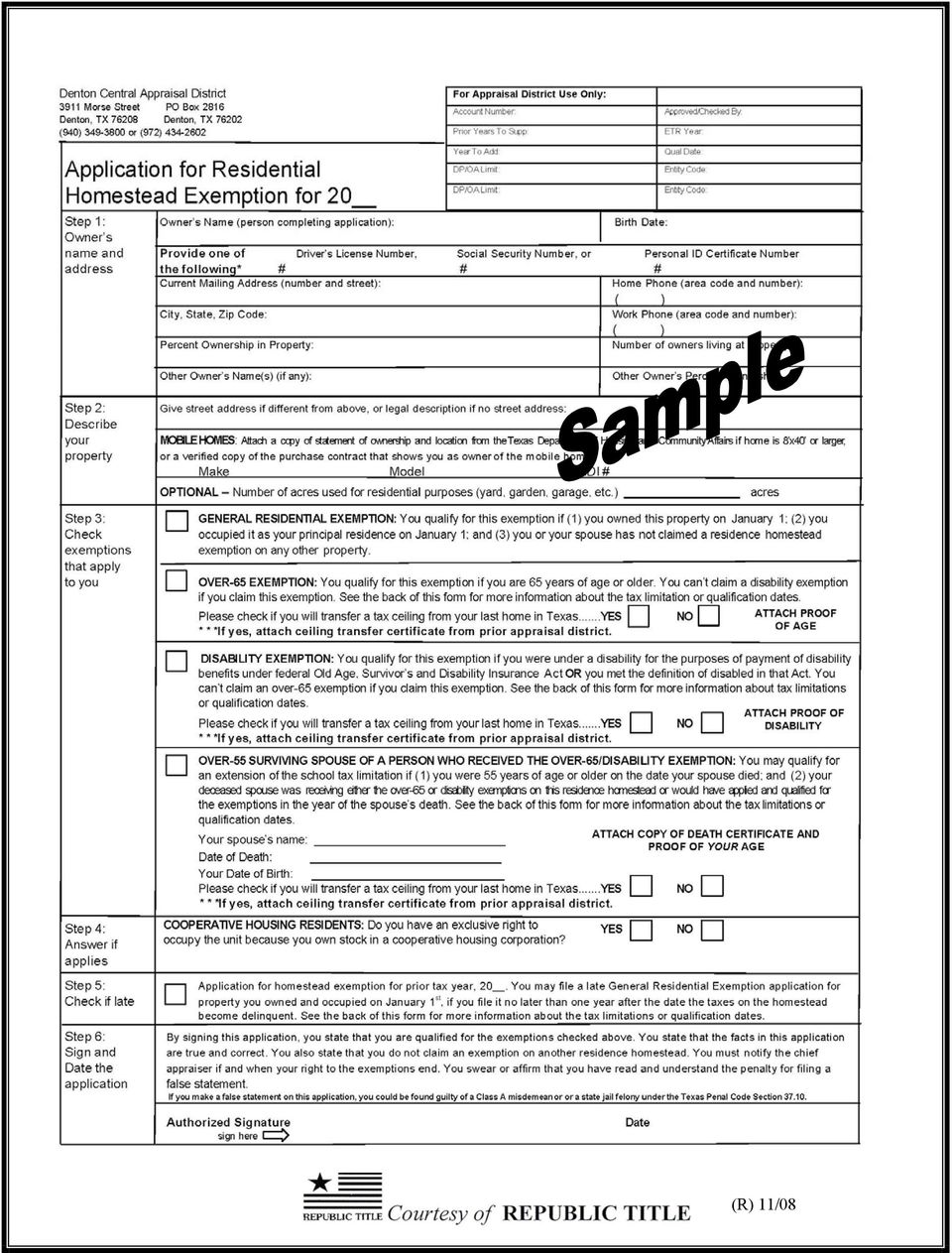

Life estate texas homestead exemption. Although requirements can differ from county to county, most county clerks will require—in addition to the deed and application for homestead exemption—some evidence that the trust meets the definition of a qualifying trust. The surviving spouse may claim exempt personal property described in section 42.002(a), property code. We recently discussed transfer on death deeds in texas.

Under florida law, if you are survived by a spouse and lineal descendants (children and grandchildren), then your spouse gets a life estate in the homestead while your. The right to invoke texas homestead law, if applicable. What about the homestead exemption?

West palm beach, florida 33401. Allowance in lieu of exempt property Palm beach county property appraiser.

The house remains her homestead and is an exempt asset under the. Article 16, section 51 of the texas constitution8 provides: Given that most counties in texas levy taxes at 2 to 3 percent of the property’s value, the $25,000 property tax exemption usually saves between $500 and $750 in taxes.

In order to claim a homestead, the party must have the right of possession in the property. there is no requirement that the property be occupied by the party claiming the homestead right.7 a. A life estate helps avoid the probate process upon the life tenant’s death. This right is still limited by the measuring life.

For example, a life tenant may lease the property for the duration of the measuring life only. Palm beach county property appraiser. Preserving the homestead exemption with living trusts.

• life tenant only entitled to interest on mineral royalties and bonuses. The tax exemption for texas homestead is usually a partial exemption of $25,000 of the property’s value. If you missed that blog post, click here.

The clerk will usually want to see a certificate of trust and a. Real estate center at texas a&m university, helping texans make better real estate decisions. Surviving spouse rights in exempt property.

We argue yes, and texas courts agree. The texas supreme court has held that a homestead is akin to a life estate.[8] therefore, expenses will generally be apportioned on the same basis as if the homestead claimant were the owner of a legal life estate, with the heirs being the remaindermen. Homeowners over 65 qualify for an additional.

Revocable living trusts are a popular estate planning structure in texas, but when it comes to homestead property, owners should be aware that the trust’s language can mean the difference between preserving or forfeiting a homestead’s property tax benefits. Moreover, while the life estate deed allows you to keep your homestead exemption in most cases, it does not allow you to bypass florida homestead laws with respect to devisees: The term “homestead” is often used in the context of the homestead exemption from property taxes, which excludes a specified amount of the appraised value from the taxable value of the home.

This option serves to avoid future probate upon death (at least as to the real estate), give the intended beneficiary some peace of mind. Texas has a long and rich history of protecting the rights of homeowners, and has provisions in the texas property code and the texas constitution protecting the homestead from forced sale by creditors. Another well known protection is the homestead exemption.

Life estates are valuable options for some families seeking to simplify the estate planning process. The texas supreme court reversed the court of appeals holding that allen’s will clearly created a life estate. Most school districts across texas provide that $25,000 of the homestead’s appraised value is exempted.

The texas constitution the homestead exemption originates from the texas constitution. Local taxing authorities may decide locally to offer a separate. Today, we will turn our attention to enhanced life estate deeds, also known as “lady bird deeds.” unlike transfer on death deeds, lady bird deeds (“lbd”) are not a statutory creation, meaning there are no set statutory guidelines regarding these documents.

• life tenant entitled to all royalties and bonuses from homestead property if production was in existence when the life estate came into existence. West palm beach, florida 33401.

All About The Texas Homestead Tax Exemption

Tx Homestead Exemptions With Living Trusts Silberman Law Firm Pllc

Homestead Exemptions By State With Charts Is Your Most Valuable Asset Protected

Texas Homestead Tax Exemption – Cedar Park Texas Living

Homestead Exemption Mysouthlakenews

Voters To Decide On Increase Of Homestead Exemption For Texas Homeowners Woai

Real Estate Talk Can An Individual Holding A Life Estate Claim A Homestead Exemption

2022 Texas Homestead Exemption Law Update – Harcom

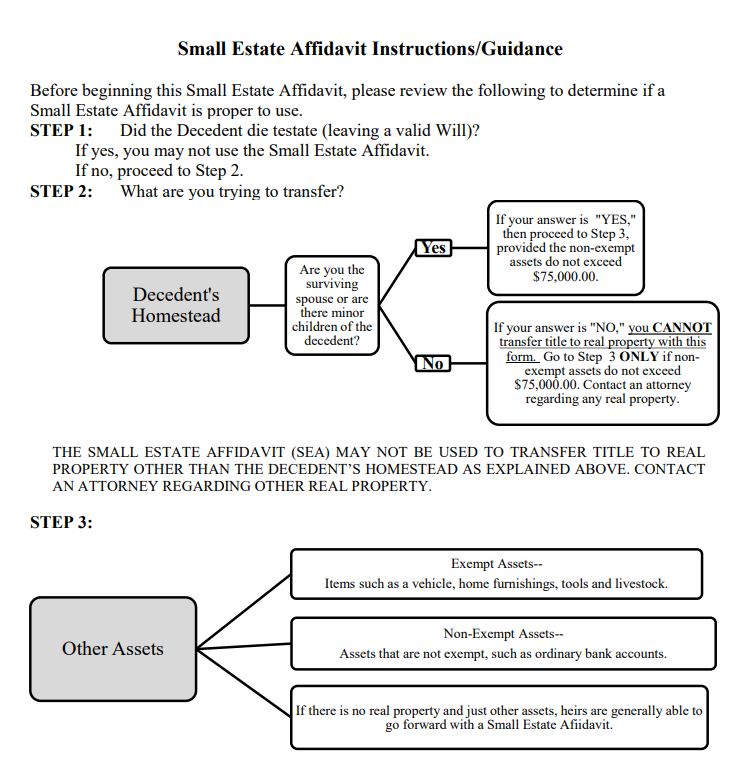

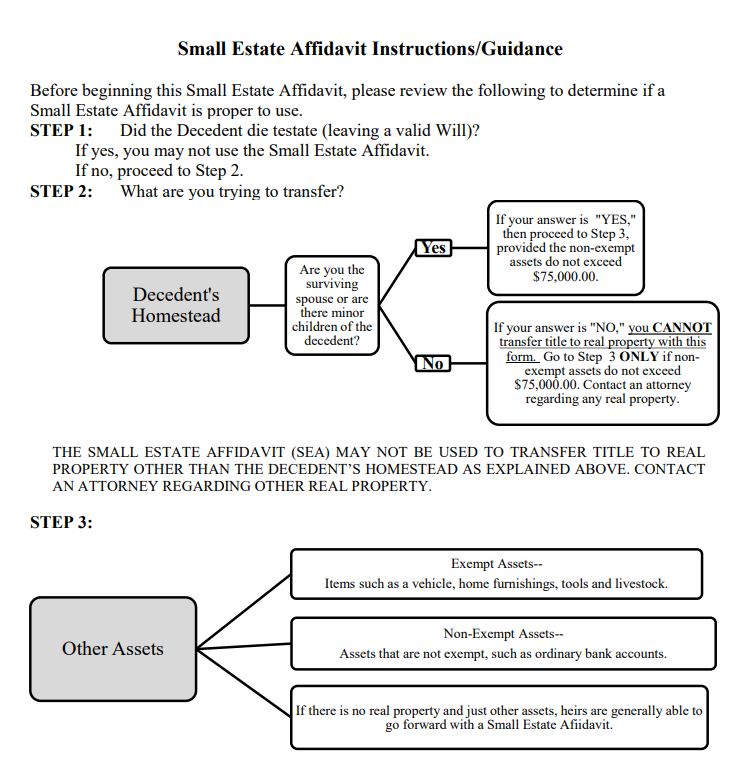

When Is It Proper To Use A Small Estate Affidavit In Texas

Homestead Exemptions May Lower Your Home S Property Taxes – Pdf Free Download

How To File Your 2019 Homestead Exemption – Find Your Dream Home

Homestead Exemption And Other Property Tax Savings – Harcom

Texas Homestead Tax Disabled Veteran Home Exemption Information

What Is A Homestead Exemption And How Do I Apply For One All Your Questions Answered Twelve Rivers Realty

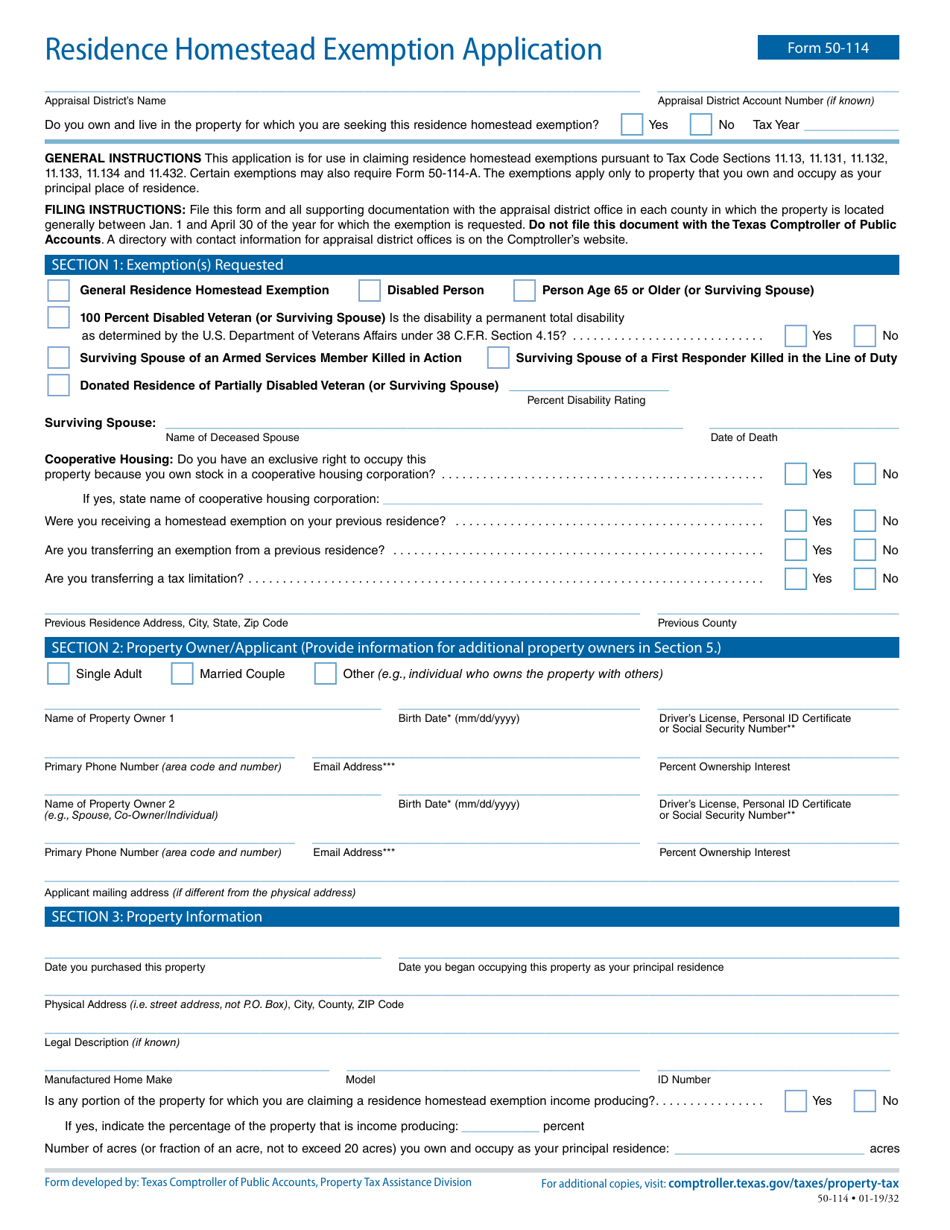

Form 50-114 Download Fillable Pdf Or Fill Online Residence Homestead Exemption Application Texas Templateroller

Homestead Exemptions What You Need To Know Rachael V Peterson – Your Realtor For Life

Homestead Exemption Texas Real Estate Homesteading Homeowner

Homestead Exemption In Texas What Is Homestead Homesteading House Styles