When a person abandons his life estate, under the laws of texas, all rights and interest in property may be lost, but not the title. Both interests hold title at the same time.

Life Insurance Beneficiary Lawyer Estate Planning Attorney Family Law Attorney Estate Lawyer

If the decedent is survived by a spouse, minor child, or adult child living in the home, his or her homestead and up to $100,000 in personal property specified under the texas property code section 42.002(a) 1 passes free from claims of general creditors of the estate.

Life estate texas probate code. A life state deed is a type of legal document that is used in the united states in regards to the managing of real estate by the owner. This option serves to avoid future probate upon death (at least as to the real estate), give the intended beneficiary some peace of mind. A surviving spouse is also entitled to family allowance for one year payable from decedent’s estate.

(c) except as provided by subsection (d), if the person has no child and no descendant of a child: The descendants are entitled to the remainder interest in that 1/3rd, plus a present possessory interest in the remaining 2/3rd of the separate real property. In texas, no particular or specific words are required to create a life estate, as long as there is clear intent that a life estate be created.

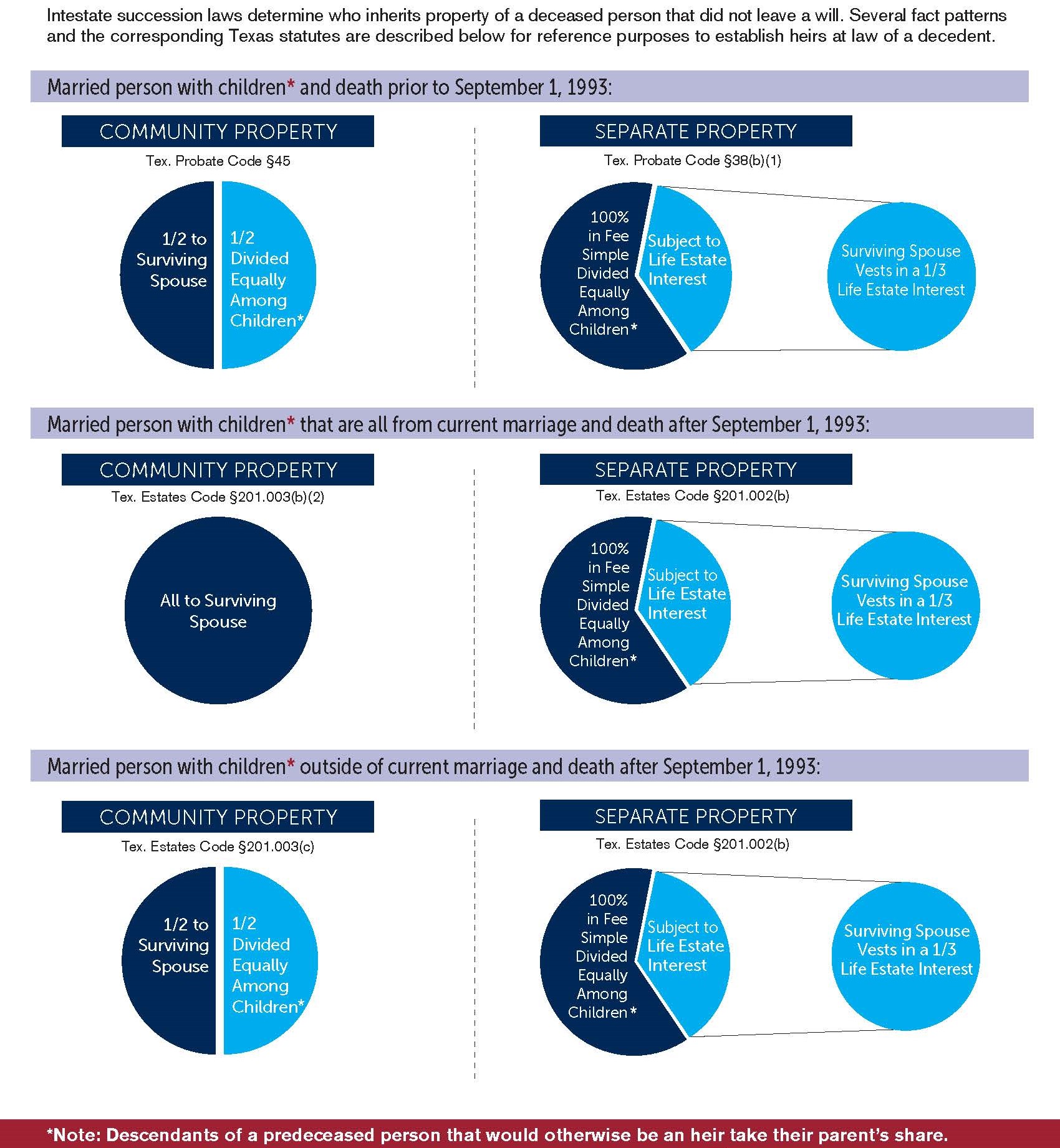

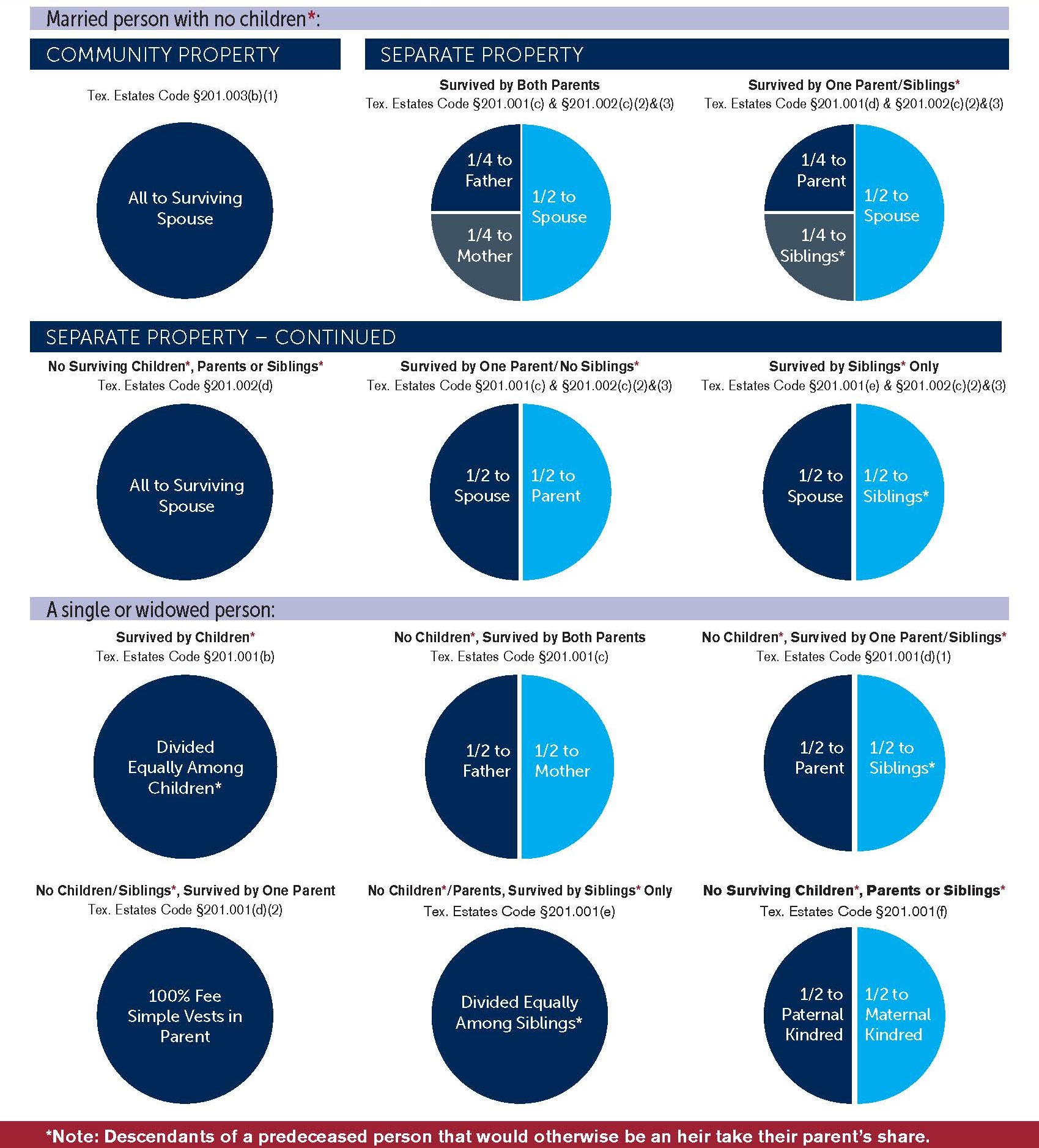

There are no substantive changes in these laws; Texas intestate succession please note: We recently discussed transfer on death deeds in texas.

Common phrases indicating the creation of a life estate include “for life” or “until his/her death.” due to the nature of a life estate, a life tenant has certain rights and duties unique to this form of ownership. For the purposes of any instrument that refers to the texas probate code, this code shall be considered an amendment to the texas probate code. However, each of the interests have separate rights of possession.

The two interests becomes the owners of the property. 2 in the event the home is sold, the proceeds of the sale also pass free. Rights of a life tenant.

Buddy_cotten april 8, 2010, 6:34pm #1. A guide to probate and estate planning in texas “texas probate passport” has been prepared to inform the public regarding: If you missed that blog post, click here.

Property that may descend each and every title to every estate of inheritance, real, personal or mixed, owned by the intestate The spouse is entitled to a life estate in 1/3rd of the separate real property. (a) this code is enacted as a part of the state's continuing statutory revision program, begun by the texas legislative council in 1963 as directed by the legislature in the law codified as section 323.007, government code.

Added by acts 2009, 81 st leg., r.s., ch. Just as title to land cannot be abandoned, there can be no gap in the perpetual ownership of the land. A texas life estate deed transfers title of real property into two different interests.

Also known as a “lady bird” deed, the life estate deed is used to define the rights of a real estate or property owner stating that such person will have the right to use and/or sell the property until he/she dies. Title can only be lost by forced sale if a sheriff sells the property because of overdue taxes. We created the ultimate guide to probate in texas to help you better understand texas probate.

The interests created by the life estate deed are: Texas estates code section 353.102. Effective january 1, 2014 code references are to the estate code rather than to the prior probate code.

The probate process in texas can be confusing. The portion of the estates code passed by the 2009 legislature focuses on intestacy, wills, and estate administration. A good idea that often goes wrong.

I'm aware that in texas, a property owner and his/her beneficiaries can avoid probate via an enhanced life estate deed, a.k.a. The most common life estates under the texas probate code occur when a person dies without a will (called an intestate death.) in very specific circumstances, a surviving spouse may have a life estate in the deceased spouse’s homestead,. The court referenced texas property code § 5.001(a) which states that “[a]n estate in land that is conveyed or devised is a fee simple unless the estate is limited by express words.” however, the court noted that a testator need not use any specific words or.

The life estate in texas. (1) what happens legally to the property of a person when he or she dies with a will or without a will (see tab entitled “to will or not to will”); And (2) how the probate process works (see tab entitled “probate.

Process of codifying texas law into 27 codes. Most common are life estates that are set up by operation of law (under the texas probate code) and life estate pursuant to a deed. The 2009 legislature began the process of codifying the current probate code into a “real” code, the estates code.

The guardianship and durable power of attorney provisions were. Today, we will turn our attention to enhanced life estate deeds, also known as “lady bird deeds.” unlike transfer on death deeds, lady bird deeds (“lbd”) are not a statutory creation, meaning there are no set statutory guidelines regarding these documents.

Lady Bird Deed The Hale Law Firm Lady Bird Bird Lady

Paul Horn Law Firm Probate Probate Law Firm Estate Tax

Happy Thanksgiving Web Design Law Firm Website Design Law Firm Website

Isaac Brough Law And Susan Juchau Price Law – Probate Notice Probate Law Charles Law

Do All Wills In Texas Have To Be Probated Probate Living Trust Tax Protest

Texas Estate Planning Statutes With Commentary 2019-2021 Edition Paperback – Walmartcom In 2021 Estate Planning Estate Administration Paperbacks

How To Probate And Settle An Estate In Texas 4th Ed Ready To Use Forms With Detailed Instructions Rolcik Karen 9781572484962 Amazoncom Books

Chris Parvin Is Board Certified In Estate Planning And Probate Law By The Texas Board Of Legal Specialization Httpwwwn How To Plan Estate Planning Pin Map

Why Are Trusts So Expensive Living Trust Probate Republic Of Texas

Missouri Beneficiary Deed Form Quitclaim Deed Wisconsin Gifts Transfer

Estate Planning Attorney Dallas – Probate Law – Plano Denton Addison – 75001 Judith P Ken Personal Injury Attorney Criminal Defense Lawyer Personal Injury

Trust Attorney Northern Va Asset Protection Probate Law Virginia Get Assistance With Estate Planning Estate Planning Estate Planning Checklist How To Plan

Infografis 200120 Plus Minus Omnibus Law Pengetahuan Infografis Indonesia

How To Avoid Probate – People Thinks Its Only For The Rich If You Own Over 25k Cash Then You Mus Estate Planning Estate Planning Checklist Funeral Planning