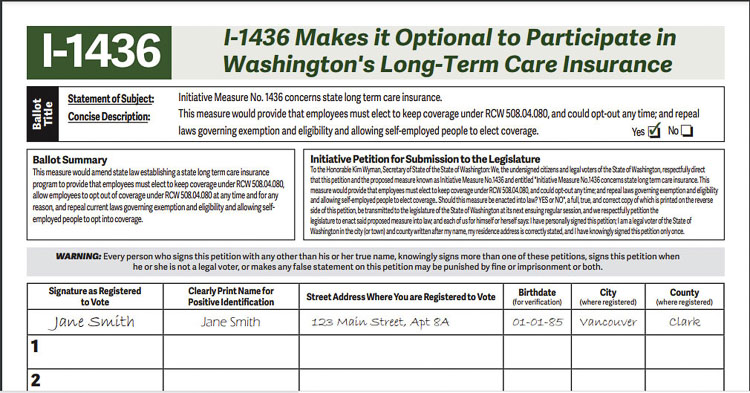

That's right, entirely different insurance products they would have never considered if not for this law. Private insurers may deny coverage based on age or health status.

How Does Auto Insurance Payout Work Auto Insurance Quotes Car Insurance Cheap Car Insurance Quotes

The state had planned to start collecting the payroll tax in january 2022.

Long term care insurance washington state opt out. 1, and state department of social and health services officials tell me an exemption form will be posted online as early as midnight oct. So washingtonians could no longer buy ltci and have not been able to for months. 1 or as late as 9 a.m.

For those who got in before the site crashed, minutes after it opened, i hear it was easy. The current rate for wa cares premiums is only 0.58 percent of your earnings. On the “create an account” page, select the “create an account” button to the right of “wa cares exemption”.

But the best financial route for some locals may be to do nothing at all. On april 14, 2021, the house passed an amendment to the original bill (shb 1323), extending the deadline from july 24, 2021, to november 1, 2021. Opting out means not having to pay a 0.58% payroll tax, which is set to begin in january.

But if you want to opt out, you may have some trouble. I have not had success. The website has been overwhelmed with visitors.

What your peers are reading The only exception is to. The deadline to have one, as mentioned, is before nov.

You must then submit an attestation that. Washington workers have until nov. By benjamin cassidy august 17, 2021.

So where do people turn? The move follows a frenzy of interest in the costly insurance policies prompted by a november 1 deadline to opt out. For someone with annual wages of $50,000, that’s $290 a year in premiums.

Once you’ve logged in and selected paid family and medical leave from your list of services in saw, you’ll click “continue” to proceed to creating your wa cares exemption account. The wa cares fund applies to anyone working in the state so if you want to opt out of the fund since you have private coverage you need.

Kuow – Want To Opt-out Of Washingtons New Long-term Care Tax Good Luck Getting A Private Policy In Time

Federal Long Term Care Insurance Program Military Benefits

New Wa Long-term Care Tax Delayed So Legislature Can Fix It Crosscut

Washington State Long-term Care Act Update – Parker Smith Feek Business Insurance Employee Benefits Surety

Updated Get Ready For Washington States New Long-term Care Program Sequoia

How Making Public Long-term Care Insurance Sort Of Voluntary Created A Mess In Washington State

What You Need To Know About The New Washington State Long-term Care Act – Coldstream Wealth Management

What To Know Washington States Long-term Care Insurance

Aarp Long-term Care Insurance Review – Smartasset

The Washington State Long-term Care Trust Act Opt Out Is Now Available Online – Parker Smith Feek Business Insurance Employee Benefits Surety

Washington Long-term Care Tax How To Opt-out To Avoid Taxes

Despite Reports Washingtons Long-term Care Tax Could Start Jan 1

Washingtons First-in-the-nation Long-term Care Program Starts In January With Opt-out Deadline Soon Local News Spokane The Pacific Northwest Inlander News Politics Music Calendar Events In Spokane Coeur Dalene

Washington State Delays Public Long-term Care Insurance Until April Explores Changes

Long-term Care Income Tax Put On Hold By Gov Jay Inslee Clarkcountytodaycom

What You Need To Know About The New Washington State Long-term Care Act – Coldstream Wealth Management