324.023 to maintain liability security for bodily injury or death, or required by s. $20,000 for two or more people for bodily injury liability;

Weird Florida Laws The Law Place

Florida motorcyclists must carry insurance and follow traffic laws.

Motorcycle insurance florida statute. They apply to all motorcyclists in the state of florida. But there are many different types of motor vehicle accidents, as well. Florida motorcycle laws come from state laws.

The most common deadline is four years, according to florida statutes § 95.11(3)(a). (1) a person may not operate or ride upon a motorcycle unless the person is properly wearing protective headgear. 627.733 to maintain personal injury protection security on a motor.

In florida, driving a four (or more) wheeler, you need to have personal injury protection or pip. Currently, the required amount is inadequate. 322.01(25), f.s., so a motorcycle endorsement on your regular operator (class e) driver license is not required per s.

You don’t need motorcycle insurance to ride a motorcycle. Does florida have a helmet law? Motorcycle insurance is required in florida, however, florida is unlike many states in that there are separate insurance requirements for motorcycles and other motor vehicles.

This is a no fault insurance and guarantees payment of up to $2,500 in case of a medical bill claim, filed within 14 days. However, the driver is held financially responsible if charged in a motorcycle crash. Instead, statute 324.021 recommends motorcyclists maintain a different type of insurance that provides financial responsibility in the event of an accident.

However, in florida, motor vehicle insurance laws are very different. Language in florida statutes regulating insurance coverage of motorcycle operators riding without a helmet is vague and difficult for law enforcement to confirm adequate coverage. These include cars, trucks, motorcycles, buses, pedestrians, and even stationary objects.

(1) it shall be a condition precedent to the accrual or maintenance of a cause of action against a liability insurer by a person not an insured under the terms of the liability insurance contract that such person shall first obtain a settlement or verdict against a person who is an insured under. Florida statute 627.727(9) doesn’t mention motorcycles but it applies in some situations, such as where you are on a motorcycle owned by an insured and not covered by the auto insurance policy. Proof of security and display thereof.—.

$10,000 for one person for bodily injury liability; The florida nonjoinder statute provides, in relevant part: 316.211 equipment for motorcycle and moped riders.—.

If the accident resulted in a wrongful death, the statute of limitations is two years from the date of death. Motorcycle laws in florida cover a range of topics including helmet requirements, bike requirements, and rules for using the road. Alpizar law has helped floridians who have been involved in a car accident win personal injury cases for more than 30 years.

It provides coverage under the no fault insurance blanket, for medical bills to be paid, regardless of whose fault an accident was. Chapter 316 state uniform traffic control entire chapter. The key difference between auto insurance and motorcycle insurance in florida is that the law does not require motorcycle operators to carry.

In 2000, with florida statute 316.211, florida made it legal for motorcycle riders over the age of 21 to ride without a helmet under the condition that they held additional insurance. Depending on the situation, the statute of limitations for personal injury lawsuits in florida is usually two, four, or five years. A licensed insurance agent can provide information about insurance options available, but the minimum requirements for motorcycle insurance in florida are as follows:

The motorcycle owner is not required to carry insurance to register a motorcycle. (1) any person required by s. 324.022 to maintain property damage liability security, required by s.

Personal injury protection (pip) is required in florida for drivers of any vehicle with four or more wheels. $10,000 per crash for property damage liability. Equipment for motorcycle and moped riders.

Any driver or passenger of a motorcycle who chooses not to wear a helmet must carry an additional $10,000 in medical coverage insurance. A rider may choose not to wear a helmet when operating a motorcycle only if the rider is over the age of 21 and covered by an insurance policy providing at least $10,000 in medical benefits for injuries incurred as a result of a crash while operating or riding upon a motorcycle. Florida motorcycle insurance requirements are based upon the financial responsibility of the owner against liability.

Section 316.209(3) no person shall operate a motorcycle between lanes of traffic or between adjacent lines or rows of vehicles. If your moped is 50 cc or less, it does not fall under the category of motorcycles by driver license law definition, s. Florida personal injury statute of limitations and car accidents.

Is motorcycle insurance required in florida? The operator of a motorcycle shall not overtake and pass in the same lane occupied by the vehicle being overtaken. Section 316.209(4) motorcycles shall not be operated more than two abreast in a single lane.

(b) notwithstanding subsection (1), a person over 21 years of age may operate or ride upon a motorcycle without wearing protective headgear securely fastened upon his or her head if such person is covered by an insurance policy providing for at least $10,000 in medical benefits for injuries incurred as a result of a crash while operating or riding on a motorcycle. As long as a claim is filed within 14 days of the accident the pip will pay $2500 of the medical expenses.

What Is An Insurance Binder For Mortgage

Florida Motorcycle Laws Regulations Carey Leisure Neal

What You Should Know About Florida Motorcycle Laws Dolman Law

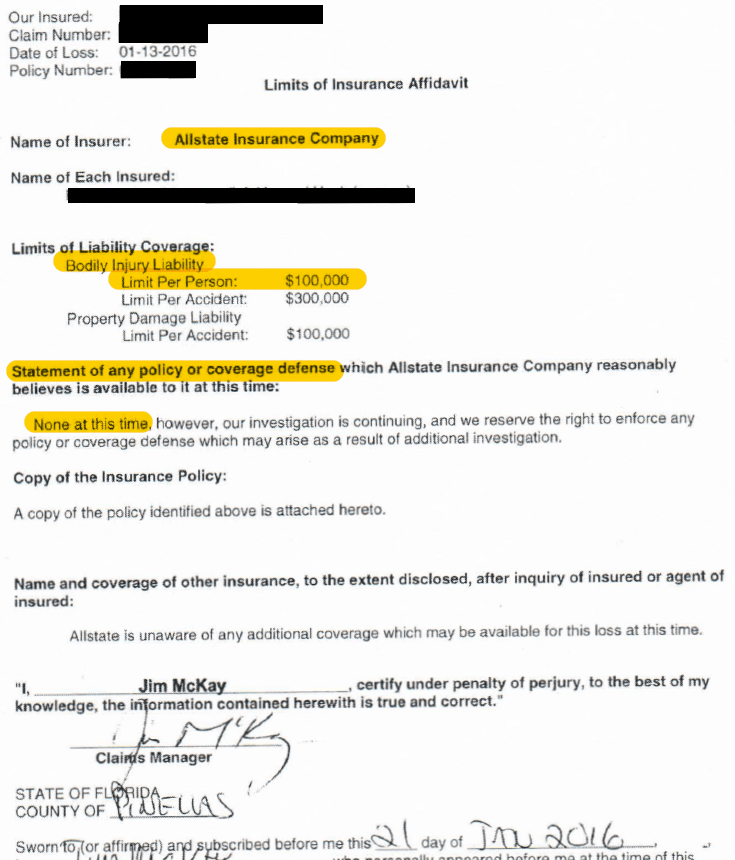

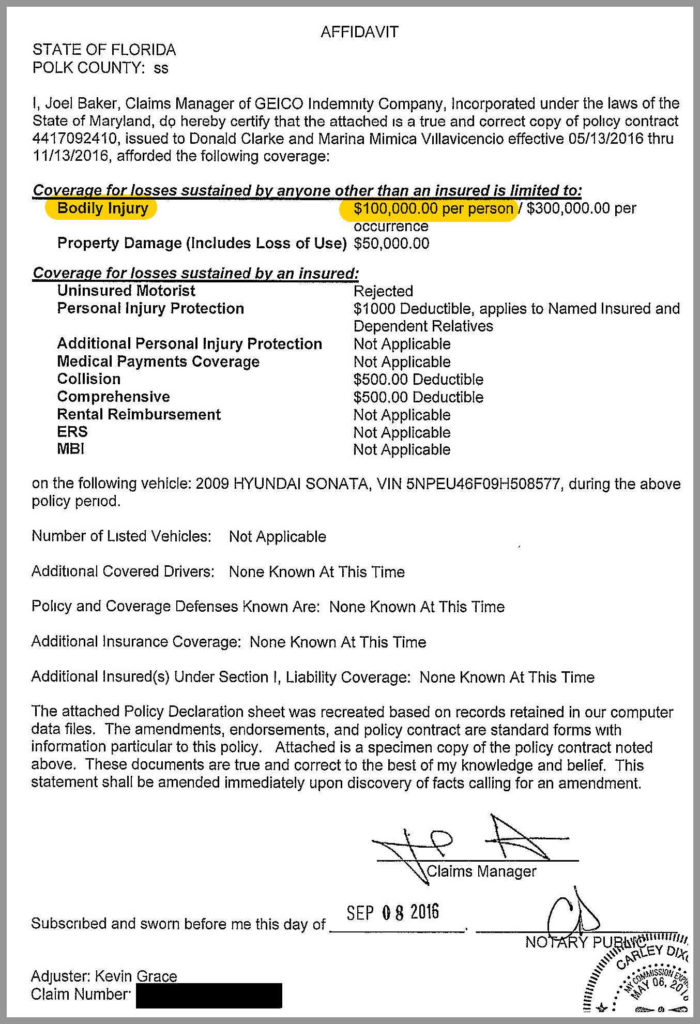

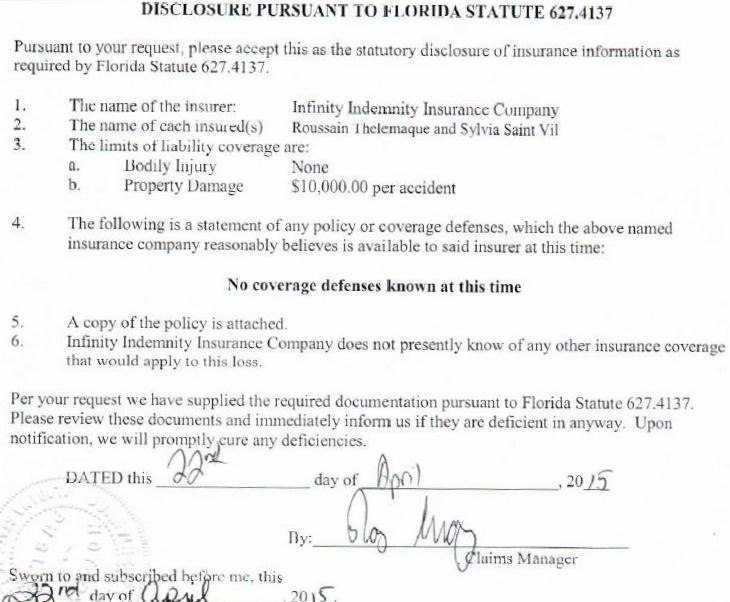

Do Insurers Have To Disclose Insurance Limits Florida Statute 6274137

Do Insurers Have To Disclose Insurance Limits Florida Statute 6274137

Do Insurers Have To Disclose Insurance Limits Florida Statute 6274137

Is Motorcycle Insurance Required In Florida – Kem Law Firm

Florida Statute Of Limitations Shiner Law Group Pa

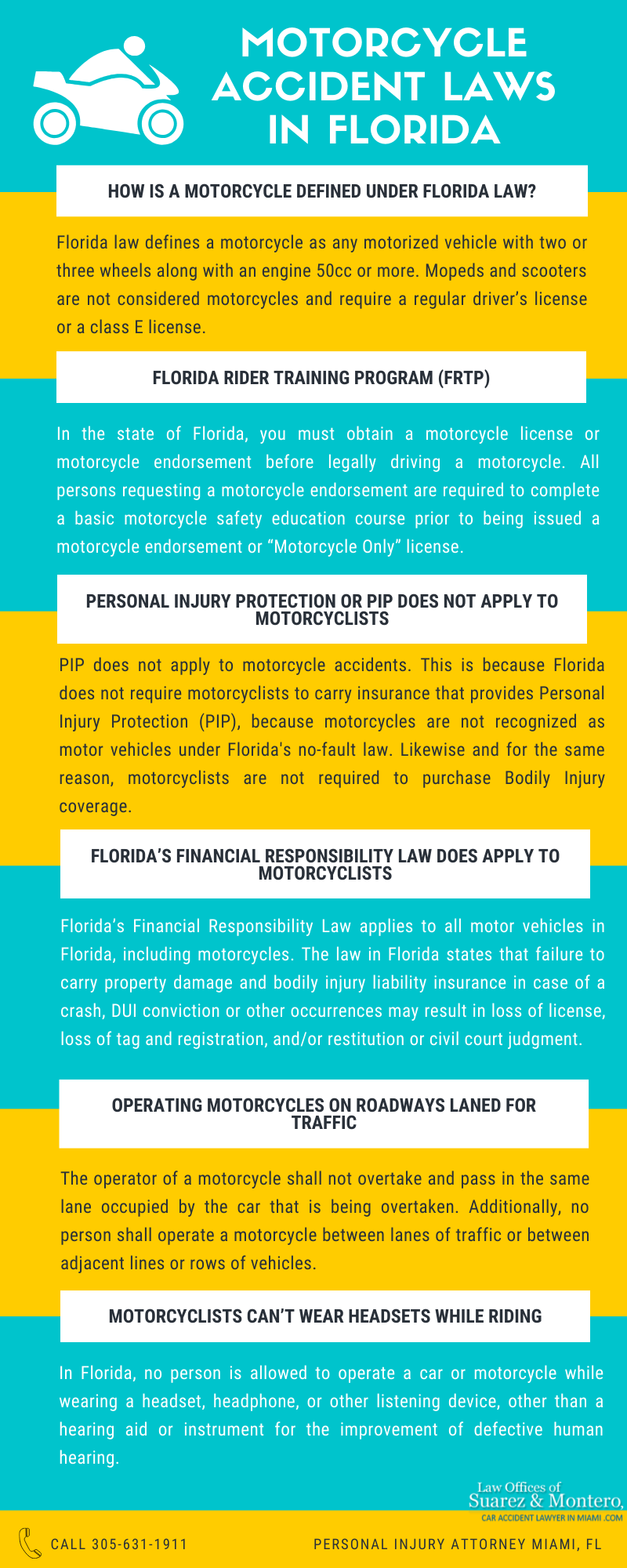

Motorcycle Accident Laws In Florida – Jaime Suarez

Florida Statute Of Limitations Battaglia Ross Dicus Mcquaid Pa

Do Insurers Have To Disclose Insurance Limits Florida Statute 6274137

Policy Positions Ride Smart Florida

Florida Personal Injury Statute Of Limitations Quick Facts

Motorcycle Accident Insurance Law For Florida Residents