The minimum coverage requirements are $30,000 bodily injury for each person, $60,000 total bodily injury for all persons in an accident and $25,000 for property damage. $30,000 for bodily injury liability, per person per accident.

Rcw 422060 Effect Of Settlement Agreement Agreement The Covenant Rss Feed

Negotiating a lower value can reduce your monthly payments.

Nc gap insurance laws. If the car is totaled, the acv of the vehicle may be only $25,000. If you are found to be driving in north carolina without sufficient car insurance coverage, you can expect the following penalties to apply: Gap coverage covers the difference between the actual cash value of your car and your loan balance.

North carolina requires that all drivers have liability insurance. Beginning in 2014, the penalty for not having qualifying coverage is $95 per adult and $47.50 per child or 1% of your taxable income; An occupational accident insurance policy (oai) is not a lawful substitute for workers compensation in north carolina.

North carolina motor vehicle law requires that automobile liability coverage be continuously maintained. You are leasing the vehicle, as carrying gap insurance is generally required for a leasing agreement; Your insurer may take into account your car’s acv and your age, state of residence, and previous car insurance claims to set your gap insurance premium.

North carolina department of insurance. This means that your gap insurance will pay $1,500, the difference between the vehicle’s value of $32,000 and the loan balance of $33,500, as well as the $500 deductible. You can request a refund on a portion of your gap coverage from your gap insurance provider if you pay off your loan early.

This coverage helps pay for injuries and damages from a car accident for which you are at fault. The penalty increases annually through 2017 and beyond. This is typically only available for new vehicles.

Instructions for the contractor and insurance agent or. Your gap insurance coverage may pay the remaining $5,500 on the loan instead of having to come up with the money yourself. You may be able to purchase a type of coverage called guaranteed automobile protection (gap).

A gap insurance policy protects buyers and lenders for title defects that may arise just before a real estate closing. North carolina car insurance requirements. A person shall not sell, solicit, or negotiate insurance in this state unless the person is licensed

Covered risk #14 addresses gap coverage for matters occurring after the date of policy but before the insured mortgage is recorded. When you buy a new car, its value begins to depreciate immediately. The insurance requirements and provides a single set of specifications that can be used for most contracts.

As a general rule, a contract is binding as soon as you sign it, and you do not have the right to cancel the contract. Gap insurance policy bridges the “gap” between what you owe on an auto loan and the car’s depreciated value. North carolina penalties for uninsured drivers*.

That means for accidents that you cause your policy pays out up to $30,000 for those you injure, up to $60,000 per accident, and up to $25,000 for damage you cause to other vehicles and property. There is a grace period through march 31, 2014. Otherwise, you can be held responsible for the difference.

$60,000 of bodily injury liability total per. Covered risk #9 concerns creditors’ rights issues, and covered risk #10 is gap coverage for Any and all kinds of insurance and insurers under this chapter.

You have purchased a vehicle that depreciates more quickly than average; Drivers in greenville, north carolina and the surrounding areas should obtain the appropriate types of auto insurance policies that will provide them with financial protection if they are in a vehicle. North carolina law specifies that it is illegal for any lending institution to require the use of any one specific company or in any way limit your choice among approved insurers.

Where an insurance company, as a condition for a loan by such company, of money upon mortgage or other security, requires that the borrower insure either his life or that of another, or his property, or the title to his property, with the company, and assign or cause to be assigned to it a policy of insurance as security for the loan, and agree to pay premiums thereon during the. You have a deductible of $500, so the car accident settlement is $24,500. The tar heel state mandates that drivers carry minimum liability coverage limits of 30/60/25 on their vehicles.

In these instances, the seller is usually required to. Employers who fail to buy workers compensation in nc the north carolina industrial commission is authorized to fine employers who fail to secure workers’ compensation coverage one dollar per employee per day, but not less than $50 per day and not. The minimum liability coverage limits are:

However, in some instances, north carolina law, and sometimes federal law, gives you the right to cancel certain transactions even after you have signed a contract or agreement. This insurance helps you cover the total amount owed on your loan, over and above your insurance coverage, if a car you have leased is stolen or totaled in an accident. In the owner’s jacket, covered risks #9 and #10 are not affected by exclusion #3(d).

This type of policy is not mandatory in north carolina, but when selected by vehicle buyers it can be added to the purchase of new and used cars and. For purposes of this article, all references to insurance include annuities, unless the context otherwise requires. You have rolled over negative equity from an old auto loan into your new one.

A title insurance gap policy provides insurance coverage to the policyholder for title defects that may arise. Gap insurance is generally a flat $400 to $600 at car dealerships when financing, but may be included in lease contracts. Motor vehicle law also requires uninsured/ underinsured motorists coverage.

North carolina’s penalties for driving without proof of insurance. Whichever is higher (up to $285 per family). Gap insurance may also help cover your losses if your vehicle has been stolen.

Contact ncdoi employee directory careers at ncdoi calendar

How To Finance A Bmw In Arden Nc Buying A New Car Is Probably Easier Said Than Done However With The Pros At Bmw Car Finance Car Insurance Mini Dealership

Katarungan Essay Question Paper Essay Common App Essay

Kia Rio 5-door Kia Rio Kia Kia Pride

Risks Of Cloud Computing Pros And Cons Of Cloud Computing Risk Management Cloud Data Cloud Computing

Pin On New Visions Healthcare Blog

How Does A Lapse In Car Insurance Coverage Affect Rates – Valuepenguin

1940 Nc School Bus By Schoolbus159 Via Flickr Nc School School Bus Bus

Forget The Midlife Crisis Are You Due A Midlife Makeover Traveling By Yourself Travel Jobs Travel Industry

Pin By Karamjeet Singh On My Data Bank- Us Medicaid Healthcare Infographics Home Health Aide

Michigan No-fault Insurance Law Overview Michigan Auto Law

Mom And Pop Baby Business Goes Nationwide – Send2press Newswire Baby Planning First Time Parents Babies Are Us

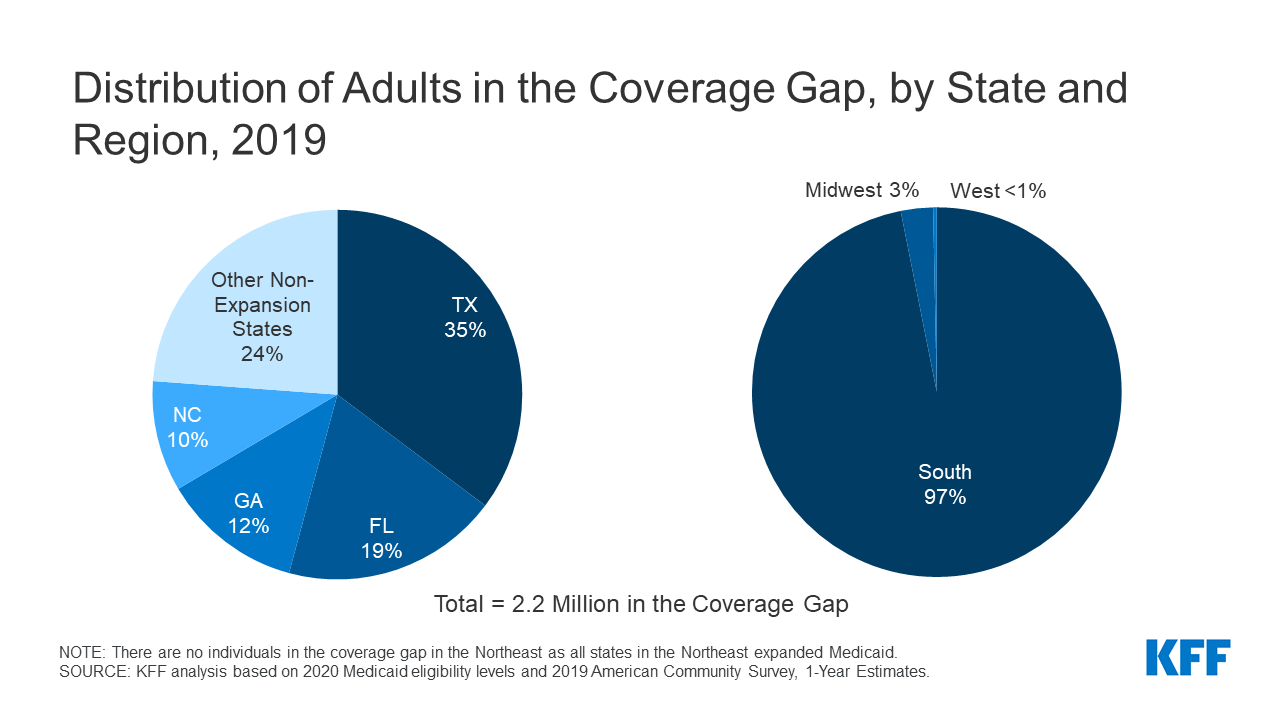

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

Cool Map Of Charlotte North Carolina Map Charlotte North Carolina North Carolina

Motorcycle Security – Foil The Lowlife Motorcycle Riding Gear Motorcycle Safety

Pin On Collection Specialist Adams Evens And Ross

Gap Insurance How Does It Work And Do I Need It – Valuepenguin

Home Twitter Healthcare System Health Care Health Care Policy