Fema 500 c st., sw washington, dc 20472. National flood insurance program (nfip) contact:

Community Service Letterhead Sample Free Printable Community Service Hours Letter Templates Lettering

California insurance license # 0814761 privacy policy 3785 south 700 east, salt lake city, utah 84106 phone:

Ncip flood insurance payment. The ncip is the most widely known and accepted private flood insurance form, and is accepted by lenders to satisfy the mandatory purchase requirement of flood insurance. The ncip policy form includes such statement confirming that it meets the definition of private flood insurance, and therefore must be accepted by federally regulated lenders. Most inquiries are answered within 5 business days.

Find a flood insurance provider. Purchasing flood insurance is a great way to protect the life you’ve built. You can also contact [email protected].

Please read your billing statement carefully and choose the correct option. This document guides lenders and insurance producers through mandatory acceptance of private flood insurance as satisfaction of the flood insurance purchase requirement. Catcoverage.com is america’s largest private flood insurance facility.

We're sorry but manageflood doesn't work properly without javascript enabled. Flooding is the most common, and most expensive, natural disaster in the united states. If your property has fooded, promptly report the loss to your insurance agent or company.

All that you need to do is complete the quote request form and an agent will. Please enable it to continue. How to file a flood insurance claim may 2020 1.

Poulton associates owns and operates the ncip facility and has been a leader in risk and insurance management since 1989. Fema and its national flood insurance program (nfip) have prepared this document to help you understand your standard flood insurance policy (sfip). Yes no nfip requires 2 homes or two acres to be inundated to trigger coverage.

The ncip only has a 15 day waiting period when insurance is not required by your mortgage company, opposed to the 30 day period required by the national flood insurance program. An insurance adjuster will be assigned to work with you throughout the claims process. Visit floodsmart.gov for more information.

Headquartered in salt lake city, utah, poulton associates provides property and casualty risk placement services in. Is ncip private flood insurance? Lender must accept private flood insurance.

It’s easy to get a quote. Contact the national flood insurance program. Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage.

Maintaining coverage is the most important step you can take to protect against the cost of flood damage. With industry leading expertise in flood and earthquake risk, we offer producers competitive pricing and innovative coverage for their clients located in high and low hazard areas. Please make sure you identify the correct type of payment from the list below.

You can obtain great coverage quickly. Ncip commercial choose 10% or 5%. Yes yes ncip personal choose $1,000 or 5%

Look for renewal reminders from your insurance company and the national flood insurance program (nfip) in the weeks leading up to your policy expiration date. A simple and secure way to make premium payments online. However, every once in a while you may have a lender that is not familiar with the ncip, so below we have gathered a few documents to help you and your client satisfy any questions the lender may have.

You do not have to repay flood insurance payments. Ncip has no such limitations. The maximum limit of homeowners flood insurance available from the government is $250k and more than two properties or two acres of land must be inundated for the government to recognize an event as covered.

A small monthly payment now could save your client tens of thousands of dollars in the event of a flood. I have contacted quite a few veteran insurance professionals who, like me, were not previously aware of the very robust coverage available through ncip but were very happy to learn about it. Yes no coverage ncip personal 5% or choose the greater of $2,500 or 5%.

Do not choose a payment option at random — we want to make sure you receive credit for the money you have paid us. The ncip policy form includes such statement confirming that it meets the definition of private flood insurance, and therefore must be accepted by federally regulated lenders. Most homeowners insurance does not cover flood damage.

Through a single online application, you can access the most private flood insurers available anywhere on the web. Types of payments and payees flood insurance premium payments The national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct.

Contact your agent or lender to renew or update your policy. National flood insurance program forms. Flood insurance and the nfip.

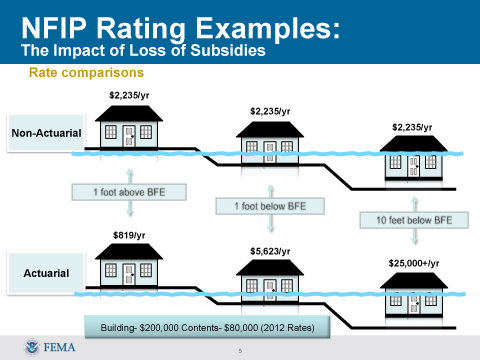

To learn more about your flood risk and flood insurance options, or to locate a provider in your area, call or visit the pages below: This is seen as a subsidy that will benefit only the wealthiest homeowners.

Pdf Monetary Valuation Of Insurance Against Flood Risk Under Climate Change

Pdf Ecosystem Service Assessment Of Tide Estuaries

Spatial And Spatiotemporal Cluster Analysis Of Rates Of Download Scientific Diagram

24 Th India Fellowship Seminar Mandatory Crop Insurance

Ncip Issues Show Cause Order Vs Denr Chief Masungi Operators Jonathan L Mayuga

Helpful Producer Documents Catcoveragecom

Craig Poulton Nciptweets Twitter

Make A Payment – Payments – The Jacobson Agency

Make A Payment – Payments – Infanger Insurance Inc

Make A Payment – Payments – Flood Insurance Guru

Macbeth Theme Analysis Essay In 2021 Essay Research Paper Research Paper Outline

We Are Independent – Hawks View Insurance