The ncip is the most widely known and accepted private flood insurance form, and is accepted by lenders. The same insurance agent recommended private ncip flood insurance backed by lloyd's of london.

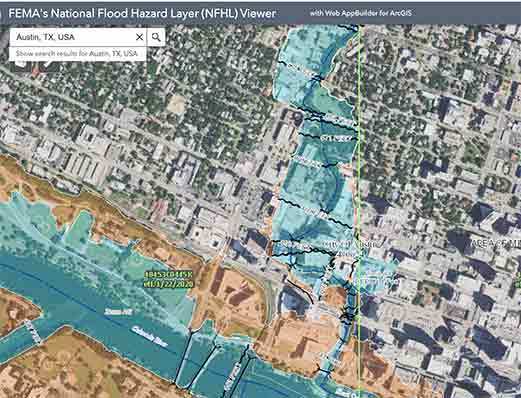

Elevation Certification For Flood Insurance

The ncip policy form includes such statement confirming that it meets the definition of private flood insurance, and therefore must be accepted by federally regulated lenders.

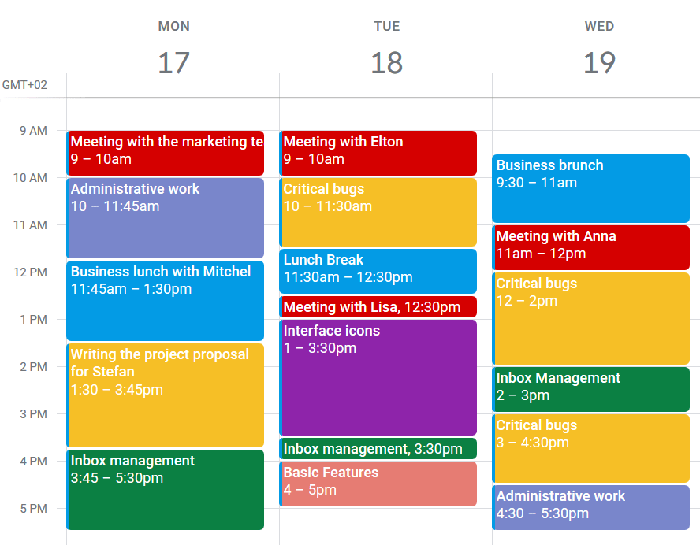

Ncip flood insurance reviews. It offers a wide variety of insurance policies, including flood insurance through the nfip. Fema 500 c st., sw washington, dc 20472. National flood insurance program forms.

Liberty mutual, headquartered in boston, has been in the insurance business since 1912. All that you need to do is complete the quote request form and an agent will. Fema and its national flood insurance program (nfip) have prepared this document to help you understand your standard flood insurance policy (sfip).

Lloyds of london flood insurance started out small in the us. The natural catastrophe insurance program (ncip), available at www.catcoverage.com, says it is providing an online alternative to the national flood insurance program for agents, brokers and. With private flood insurance, your waiting period is typically 15 days, compared to 30 days with the nfip plan.

The federal government’s national flood insurance program costs an average of $700 per year. You can obtain great coverage quickly. This insurance as we understand it, is the only one that refuses to pay out for no reason in new jersey as to.

They sent a claims rep out finally october 5th and i guess that was supposed to appease us. Generally, the higher the deductible, the less you’ll pay in premiums. Catcoverage.com, administered by poulton associates llc, is now the largest facility for world class natural catastrophe insurance offerings, including the natural catastrophe insurance program (ncip), one of the first private flood insurance alternatives to the nfip (national flood insurance program).

Yes yes ncip personal choose $1,000 or 5% Through a single online application, you can access the most private flood insurers available anywhere on the web. Review each section of the application.

I have contacted quite a few veteran insurance professionals who, like me, were not previously aware of the very robust coverage available through ncip but were very happy to learn about it. The natural catastrophe insurance program (ncip) was created by poulton associates, inc. Ncip commercial choose 10% or 5%.

Currently i am paying nfip $6200 premium annually. 1 review of national flood insurance program here we are october 11th. Nfip flood insurance deductibles can range from $1,000 to $10,000 for both the building and contents.

Yes no coverage ncip personal 5% or choose the greater of $2,500 or 5%. Flooding is the most common and costly catastrophe insurance claim in the us, causing billions in economic losses every year. National flood insurance program (nfip) contact:

Private flood insurance covers the amount of insurance you need. The act was a move to finally create a stable, private flood insurance market for property in the us. This company provides insurance brokerage and risk management consulting.

It’s easy to get a quote. Yes no nfip requires 2 homes or two acres to be inundated to trigger coverage. To begin with, the nfip only insures up to $250,000.

Business details location of this business 3785 s 700 e ste 201, salt lake city, ut. 41 days later and still not a dime. Some may acquire nfip policies for less than $400 a year.

You can select between the natural catastrophe insurance program (ncip), with residential and commercial limits of $5 million or higher or our private market. So, you can get $500,000 in coverage for a home through the private market but not through the nfip. Catcoverage.com is america’s largest private flood insurance facility.

Purchasing flood insurance is a great way to protect the life you’ve built. Contact the national flood insurance program. Another advantage of private flood insurance over the nfip is the shortened waiting period.

The quoted rate is staggering lower than my current plan with fema's nfip. Your waiting period is the amount of time it takes for your policy to kick in after the purchase date. Over eight years ago and has saved consumers millions of dollars on their flood insurance policies during.

According to the national flood insurance program (nfip), 90% of. Poulton associates owns and operates the ncip facility and has been a leader in risk and insurance management since 1989. Maintaining coverage is the most important step you can take to protect against the cost of flood damage.

The coverage you get from the nfip and the coverage you get from private flood insurance aren’t the same either. Do federally regulated lenders accept ncip flood insurance to satisfy the mandatory purchase of flood insurance requirement? Is ncip private flood insurance?

Headquartered in salt lake city, utah, poulton associates provides property and casualty risk placement services. The ncip only has a 15 day waiting period when insurance is not required by your mortgage company, opposed to the 30 day period required by the national flood insurance program. However, it may cost more or less depending on your area’s risk level.

Others may have to pay premiums as high as $2,500 a year. Ncip has no such limitations. Time to file for bad faith claims and lawyer.

The ncip policy form includes such statement confirming that it meets the definition of private flood insurance, and therefore must be accepted by federally regulated lenders.

How To Explain Rcbap Flood Insurance To Your Condo Association

Monetary Valuation Of Insurance Against Flood Risk Under Climate Change – Wouter Botzen – 2012 – International Economic Review – Wiley Online Library

News And Articles Catcoveragecom

Pdf Project Risk Management For Sustainable Restoration Of Immovable Cultural Heritage Lessons From Construction Industry And Formulation Of A Customized Prm Model

Pdf Animal Genetic Resources In High Input Systems Meat Production In Pigs

Guide To Flood Insurance Forbes Advisor

Pdf Monetary Valuation Of Insurance Against Flood Risk Under Climate Change

Macbeth Theme Analysis Essay In 2021 Essay Research Paper Research Paper Outline

Nfip Vs Private Flood Which Is Better Flood Insurance For You

Nfip Risk Rating 20 Vs Private Flood Insurance

Nfip Risk Rating 20 Vs Private Flood Insurance