Payment protection insurance (ppi) is a form of income protection that covers monthly debt repayments if you’re unable to work. This may be as a result of illness, accident, death or unemployment and will be covered on your policy.

Income Protection Quotes Life Insurance Marketing Life Insurance Quotes Life Insurance Marketing Ideas

Looking into the costs of credit card debt protection insurance, it is based on your card’s monthly balance and typically costs about 10%, or more, a year.

Payment protection insurance companies. These include if you were made redundant or couldn’t work due to an accident, illness, disability or death. Your credit approval cannot be conditioned on whether you purchase credit insurance. 3 with globe life, you can get $50,000 to $350,000 in mortgage protection insurance regardless of your health, as long as you’re between the ages of 18 and 69 years old.

A ppi policy will usually agree to help you meet repayments for a fixed period, usually 12 months, in the event that you fall ill, have an accident, or become unemployed through no fault of your own, depending on your policy. Credit card insurance — also known as payment protection, credit shield or credit guard — is an optional feature that covers your credit card payments if something unexpected happens to you. Payment protection is not insured or guaranteed by an agency of the federal government.

Payment protection insurance (ppi) is insurance that will pay out a sum of money to help you cover your monthly repayments on mortgages, loans, credit/store cards or catalogue payments if you are unable to work. Payment protection insurance can give you peace of mind, by protecting you against financial loss in the event of an accident, injury or redundancy which could put you in a difficult situation. This could be due to sickness, an accident or involuntary unemployment.

If you can’t work because of a covered event, payment protection in most cases will: The offers may come from your lender or from independent insurance companies. Seems like a good idea to sign up for it when you take out a loan, whether it’s a mortgage for a new home or a personal loan to consolidate credit card balances, doesn’t it?

The company has a good better business bureau ranking 2 and a strong financial strength rating per am best rating services. That’s why sefcu offers two types of payment protection to keep you covered in the event of the unexpected. With mortgage protection insurance, if you die, the insurance is paid directly to the lender to pay off the loan.

Independent mortgage payment protection insurance can be arranged by british insurance ltd. British insurance ltd is now one of the uk's leading insurance company to provide mortgage payment protection insurance for the british homeowner. Policies vary but most will agree to help you meet the monthly repayments of a loan or to repay a fixed.

Loan protection insurance is designed to step in and cover monthly loan payments and protect you from default in the event of anything from job loss to debilitating illness and even death. Payment protection (also known as credit insurance) is not a deposit or obligation of, or guaranteed by, dollar bank or its affiliates. Losing your job without it being your fault.

Add mountain america’s payment protection* to your vehicle loan or other obligations and feel secure knowing your loan and family are protected. That differs from traditional life insurance, which makes payment to your beneficiary, and they can allocate the money as they see fit. Whether you are looking to cover your mortgage payments, your loan payments or even your income, there are now.

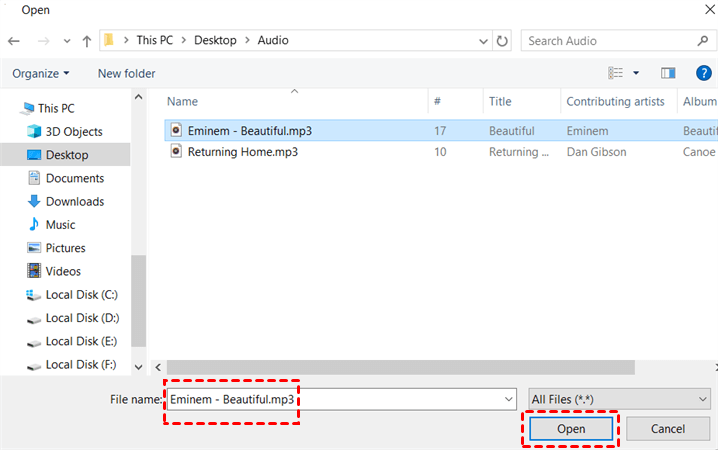

Make your monthly payments or pay off your loans. How does payment protection insurance work? Ppi was designed to cover repayments in certain circumstances where you couldn’t make them yourself.

Payment protection insurance (ppi) covers your monthly debt repayments on things like loans, mortgages and credit cards if you’re unable to work. The best mortgage protection insurance companies of 2022 best for young families: Typically, you can protect up to 70% of your annual income and a ppi policy will provide payouts for up to 12 months if your claim is successful.

Car insurance, homeowner insurance, renters insurance, fraud protection, life insurance, pet insurance, accident insurance, mobile phone insurance and so on. Liberty mutual insurance company is an insurance company which offers coverage for individuals, families, and businesses. While many companies have a $1 million maximum, the doctors company’s cyberguard plus provides cyber liability insurance with.

The Good The Bad Mortgage Protection Insurance Mpi Mortgage Protection Insurance Mortgage Affordable Life Insurance

Is Payment Protection Insurance Worth It Saving Freak Payment Protection Insurance Insurance Protection

Wealth Protection Are You Prepared For A Life-threatening Event

2021 Domiciliary Insurance Market Key Trends And Forecast 2030 In 2021 Life Insurance Companies Global Life Insurance Policy

Pin By Brad Cronin On Insurance Life Insurance Quotes Financial Quotes Life Insurance Facts

Life Critical Illness And Income Protection Insurance Income Protection Insurance Income Protection Critical Illness

Different Coverages For Auto Insurance

Pin By Dr Sanjay Tolani On How To Do Financial Planning Life Insurance Facts Income Protection Life Insurance Marketing

The Way To Choose Life Insurance Personal Insurance Income Protection Insurance Financial Planner

Homeinsuruancebocaraton Payment Protection Insurance Protection Payment Insurance

Critical Illness Cover In The Uk This Infographic Outlines The Critical Illness And Li Life Insurance Policy Life Insurance Companies Content Insurance

Ppi Ericacallen Kiwibox Community Payment Protection Insurance Lending Company Management Company

Pin On Insurance Awareness In India

Life Insurance Companies Offers The Best Life Insurance Policy In India Check Out Various Life Insu Life Insurance Quotes Life Insurance Policy Life Insurance

Life Insurance Converage Life Insurance Marketing Ideas Life And Health Insurance Life Insurance Marketing

Lebih Afdhal Anda Ada Ambil Hibah Daripada Keluarga Terpaksa Gadai Habih Asset Tanggung H Insurance Marketing Life Insurance Facts Life Insurance Marketing

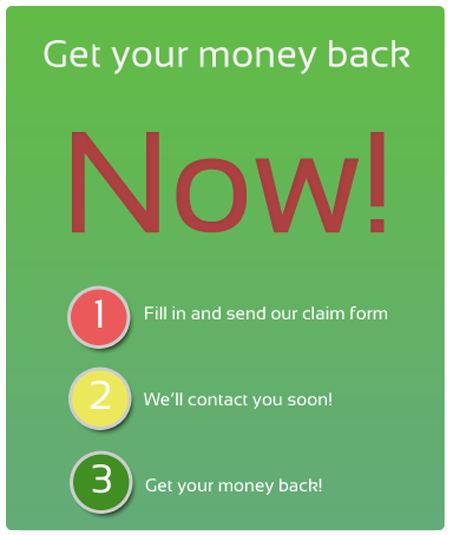

Payment Protection Insurance Site For Void Ppi Victims Reclaim_your_ppi Bank_loan Ppi_reclaim Payment Protection Insurance Mortgage Banker Mortgage Payoff

Ppi Claims Company Payment Protection Insurance Refinance Loans Business