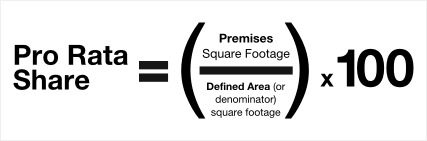

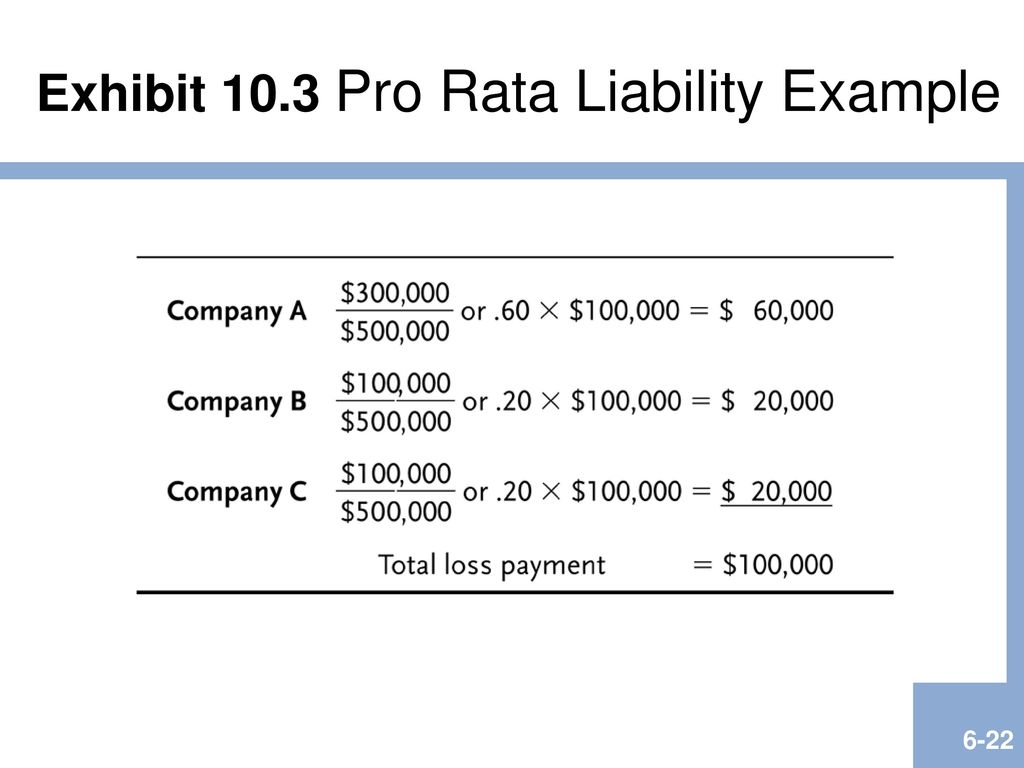

It is a method of assigning an amount to a fraction according to its. Pro rata liability if a loss occurs that is covered by more than 1 insurance policy that was purchased by the insured, then each policy pays a portion of the loss that is proportional to the amount of that policy over the total amount of all policies for the loss —.

Slovenia Papa Inalt Pro Rata Calculator – Photographieetpartageorg

Pro rata means certain total amount (e.g., payment, cost, price, fee) distributed in equal portions or in proportion to some factor (e.g., time period, partial usage or consumption).

Pro rata calculator insurance claims. The default will display short rate factor for a one year policy which is 90% of pro rata factor. First, the insurer doesn't pay an amount that exceeds the loss. Multiply this figure by 23.90 (because you have £23.90 available income).

[show dates with hyphens in between figs] summary of above calculations: The amount of reinsurance written by a reinsurer depends heavily on individual risk characteristics, including the result of a pml and maximum foreseeable loss (mfl) analysis. Second, the insurer pays according to a set calculation.

2.property reinsurance is offered on both a pro rata and excess basis. Use this partial refund calculator to determine refund amounts: To calculate what each creditor will receive, first.

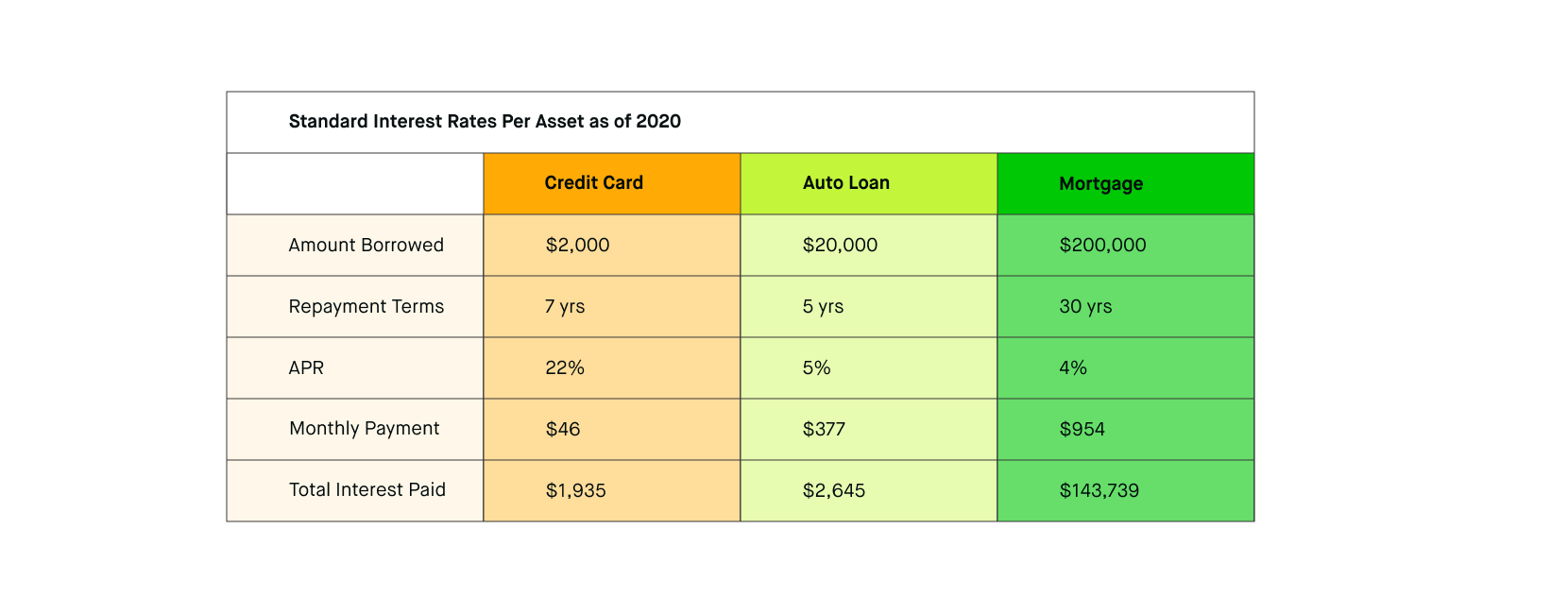

Casepeer calculates the pro rata amount for you. Calculations for pro rata can be used to determine dividend payments, premiums on insurance, or similar situations where an amount is owed or due. (use negative sign if appropriate) just tab to area applicable and enter information blue section at bottom of sheet totals the sum of both calculations.

The parties stipulated to the following damages: The calculations below will show unearned (return premium) factors. No discount of any kind including higher excess discount is to be allowed as these are minimum rates.

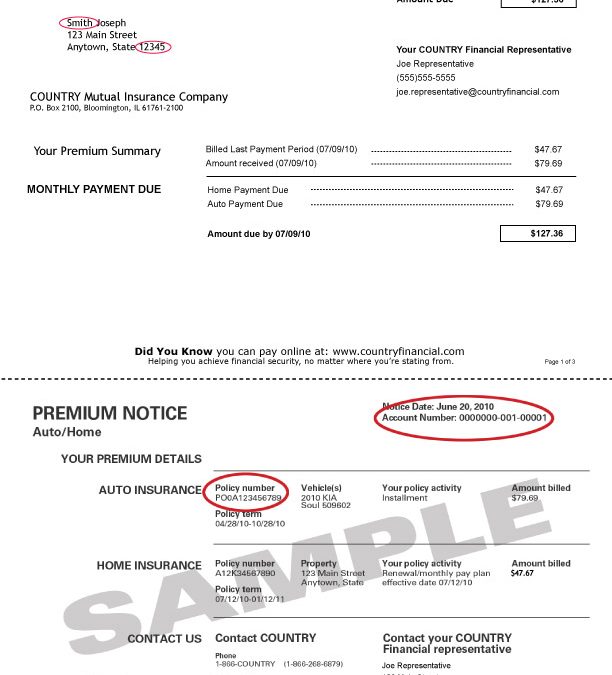

(a) a claimant with an eligible past matrix level vii award for age at the time of revision for $12,500 and a denied matrix level iii claim will receive a pro rata payment of $912.98. Irrespective of the sum insured for car, the following additional rates are to be charged over the car rate: Pro rata is a condition that is applied when the insurer pays a claim to the insured.

Please keep in mind that commonwealth insurance partners, llc has provided calculator as a service to its clients, with no warranties or promise of proper function. Then, multiply that number by each individual bill amount to get each pro rata amount. Supposing that x bought $100,000 for a flood peril on a property that is actually worth $300,000.

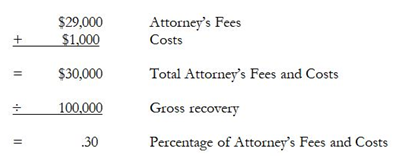

The ostensons made claims against the williams’ um coverage. The trial court granted the ostenson’s motion that the “per person” policy limitations would not apply when dividing the fund. You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills.

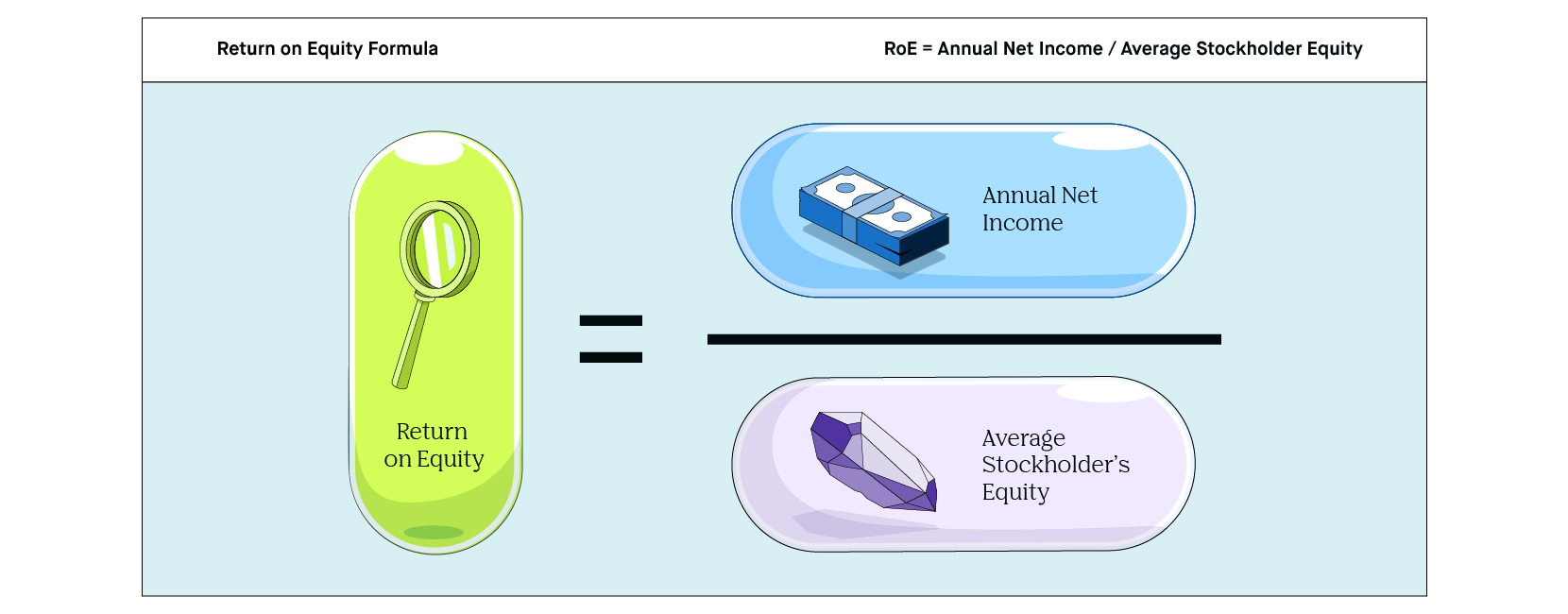

Prorate (verb) prorate means a process of determining and proportionally allocating the pro rata portions as a share of any given whole (i.e., pro rata calculation). Pro rata is the term used to describe a proportionate allocation. The claims processor prepared two sample calculations to illustrate the application of the pro rata share to exemplar claimants:

Insuranceopedia explains pro rata insurance. Casepeer calculates the pro rata amount for you. Pro rata calculation examples 1.

This means you should offer to pay the credit card company £8.12 a month. Check your insurance terms to see what applies to your policy. Then, multiply that number by each individual bill amount to get each pro rata amount.

You can also enter a percentage of your full salary, if your pay is being reduced (e.g. This gives you a figure of £8.12. Medium risks commercial building (restaurant) (100% pml).

Take the coverage written by company a, divide that amount by the total coverage written by all sources and multiply the resulting percentage by the actual loss amount. Pro rata premium calculator #1 pro rata premium calculator #2 no of days $ gst details: Pro rata insurance calculator.the default will display short rate factor for a one year policy which is 90% of pro rata factor.

[ (450/750) * (2000)] / 3 = 400. You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills. Enter months without a leading zero.

Partial (pro rata) refund calculator.

Analysis Of Insurance Contracts – Ppt Video Online Download

Vtg Ronoco Wheel 1-3-5 Year Insurance Policies Pro-rata Short Rate Calculator 1933496840

Vtg Ronoco Wheel 1-3-5 Year Insurance Policies Pro-rata Short Rate Calculator 1933496840

Slovenia Papa Inalt Pro Rata Calculator – Photographieetpartageorg

Vintage 1967 The Ronoco 1 3 Year Calculator Pro Rata Short Rate Factors Wheel 1978575339

Pro Rata Salary Calculator Uk Tax Calculators

Slovenia Papa Inalt Pro Rata Calculator – Photographieetpartageorg

Explaining Employer Lien Recovery In Virginia – Ford Richardson Law

Vintage 1967 The Ronoco 1 3 Year Calculator Pro Rata Short Rate Factors Wheel 1978575339

Calculate Pro Rata Everything You Need To Know Tide Business

What Is Pro Rata – 2019 – Robinhood

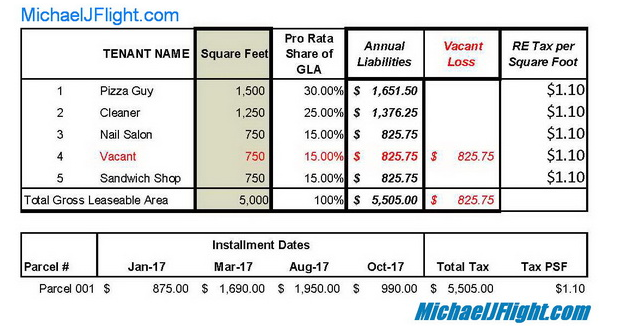

Crc015 Pro Rata – Concordia Realty Corporation

Ch10 Analysis Of Insurance Contracts Ch6 In 11th Ed – Ppt Download

Use Excels Yearfrac Function For Pro-rata Calculations – Youtube

What Is Pro Rata – 2019 – Robinhood