The oasdi tax funds the social security program. The federal government then uses it to develop and fund social security programs.

Why Are Disability Benefits Taxable Disability Benefits Help

Oasdi stands for old age, survivors, and disability insurance.

Retirement survivors and disability insurance taxable. Many people get disability insurance through. Taxable social security benefits include monthly survivor and disability benefits. Survivor, and disability insurance (oasdi) benefits.

The disability retirement pay commenced when her husband became disabled. The d&s plan monthly income survivor benefit is paid from the d&s trust and is in addition to. Social security benefits last as long as you live and increase with the cost of living.

The social security benefit programs are “entitlement” programs. Are long term disability survivor benefits taxable? They do not include supplemental security income (ssi) payments, which are not taxable.

When we have discussed the taxation of social security benefits, we have usually discussed retirement benefits, as you said. That prevents you from being taxed twice. They do not include supplemental security income (ssi).

The d&s plan remains unique in that a monthly income benefit is payable to eligible survivors of pilots who retired from delta prior to january 1, 2008 regardless of the pension benefit election made by the pilot at the time of his retirement. This tax rate is withheld from the benefits of all nonresident aliens, unless you live in a country with which the united states has a tax treaty. I would call the national toll free number and confirm the switch in mailing address:

Social security benefits include monthly retirement, survivor, and disability benefits. § 13.01 overview of taxation of disability benefits. These benefits, including medicare, provide a foundation on which to build a financially secure retirement.savings and pensions are the other two legs of the stool for your retirement plan.

The agency does not discriminate based on the type of benefit — retirement, disability, survivors or spouse benefits are all considered taxable income. The delta pilots disability and survivorship plan is hereby amended and restated effective january 1, 2011. Survivor benefit plan and retired serviceman's family protection plan premium deductions:

Obra 1993 increased the taxable share of social security and railroad retirement tier i The plan is an employee welfare benefit plan as defined in. While disability insurance benefits are meant to replace income, they are not classified as income for the purposes of reporting your taxes.

Rsdi is an acronym for retirement, survivors, and disability insurance. Insurance benefit will not cause that person to be deemed a survivor under section 25. Whether you pay taxes on ssdi benefits depends on what the internal revenue service calls your “provisional income.”

The tax is 30 percent of 85 percent of your benefit (an effective tax rate of 25.5 percent). California does not tax social security income from the united states, including survivor’s benefits and disability benefits. Social security is a federal program in the united states that provides benefits to retirees, their survivors, and workers who become disabled.

Concurrent retirement disability payments (crdp): Crdp is a restoration of your retired pay, not a separate entitlement. The answer to this one is simple.

You should note ssa does use a number of po boxes in jamaica that are very similar to the one you responded to, so it is possibly fine. Retirement, survivors, disability insurance (rsdi) is a federally funded program designed to ensure the continuation of income to those who are disabled, have reached retirement age, or are the surviving dependents of those who qualified for social security disability insurance. Employers collect this money through employees’ paychecks which directly go to the federal government.

Retirement, disability, death or termination of continuous employment in lieu of. The monthly income survivor's benefit: That prevents you from being taxed twice.

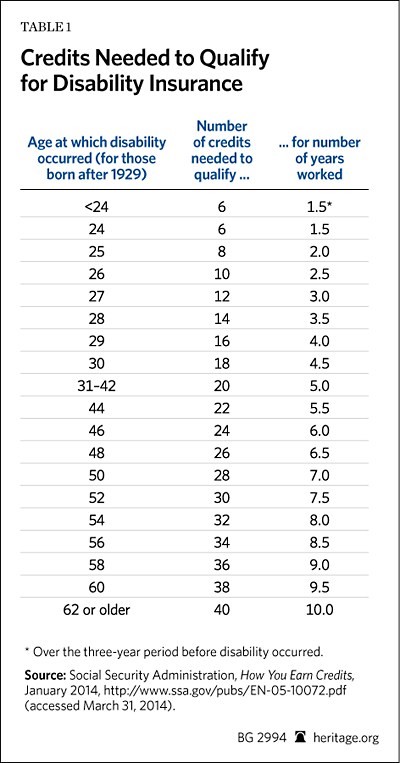

While disability insurance benefits are meant to replace income, they are not classified as income for the purposes of reporting your taxes. Certain government retirees who receive a pension from work are not covered by. To be eligible for rsdi payments, you or the person you are receiving payments through must have worked a minimum number of years and paid fica (federal insurance contribution act) taxes during these years.

However, ssdi is potentially taxable, coming under the same set of tax rules as social security retirement, family and survivor benefits. In that year, shannon received $11,850. But the rules are the same for all payments from social security.

“social security benefits include monthly retirement, survivor and disability benefits,” said bernie kiely, a. Therefore, if your retired pay is taxable so is any crdp payments you receive. Another name for this social security program is, “old age, survivors.

/GettyImages-175387918-48a0e0c678674c559b2c434679072145.jpg)

Old-age Survivors And Disability Insurance Oasdi Program Definition

Disability Insurance For Doctors White Coat Investor

What Is The Old-age Survivors And Disability Insurance Oasdi Program – 2021 – Robinhood

Life Health And Disability Insurance 2018 Mc Grawhill

Disability Insurance For Doctors White Coat Investor

Median Oopme By Ssdissi Status Age Download Scientific Diagram

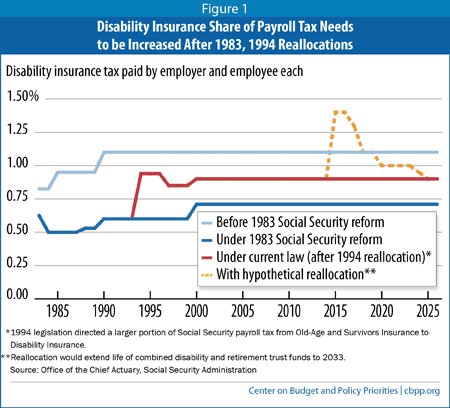

Congress Needs To Boost Disability Insurance Share Of Payroll Tax By 2016 Center On Budget And Policy Priorities

Social Security Disability Insurance Ssdi And Supplemental Security Income Ssi Eligibility Benefits And Financing – Everycrsreportcom

Chapter 18 Social Insurance – Ppt Video Online Download

Does France Tax Us Social Security Benefits

Social Security Benefit Calculation Spreadsheet Social Security Benefits Social Security Disability Social Security

Disability Myths Risks Protection Taxes – Ppt Download

Is Social Security Disability Taxable – Turbotax Tax Tips Videos

What Is Social Security Disability Insurance An Ssdi Primer The Heritage Foundation

Disability Myths Risks Protection Taxes – Ppt Download

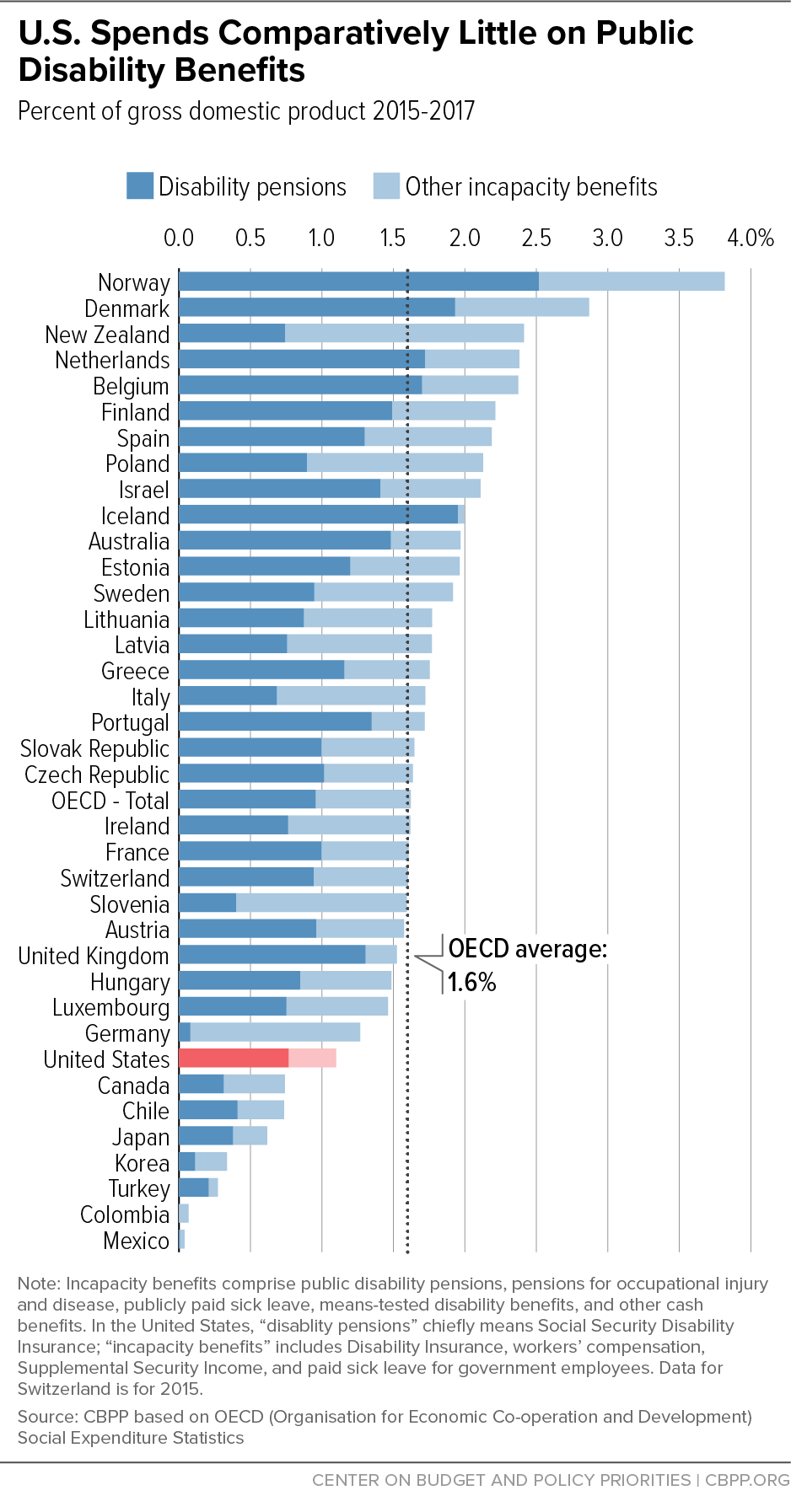

The Facts On Social Security Disability Insurance And Supplemental Security Income For Workers With Disabilities – Center For American Progress

Improving Social Security Disability Insurance With A Flat Benefit The Heritage Foundation