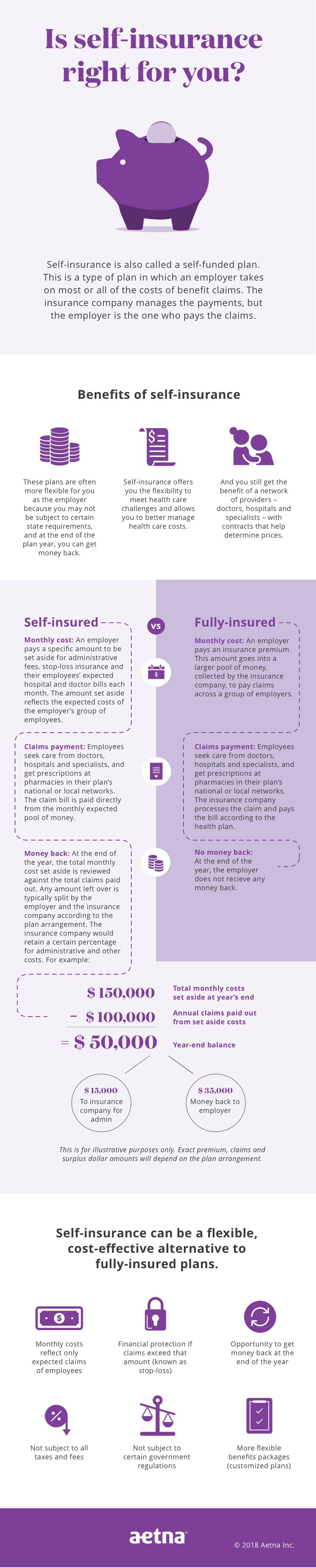

The employer pays the claims of its employees, so. This can make remaining compliant slightly more challenging.

/CouplewithbabyapplyingforhealthinsuranceKate_Sept2004GettyImages-2658f7ee14144a66a42c006bad0bad22.jpg)

What Is Self-insured Health Insurance And How Is It Regulated

As such, an aso plan is a type of self.

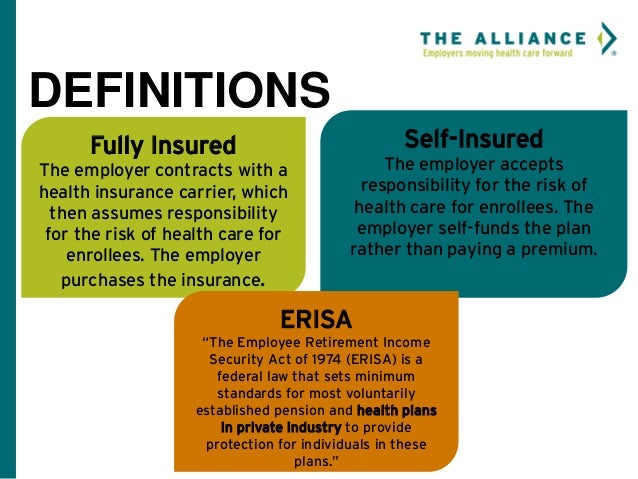

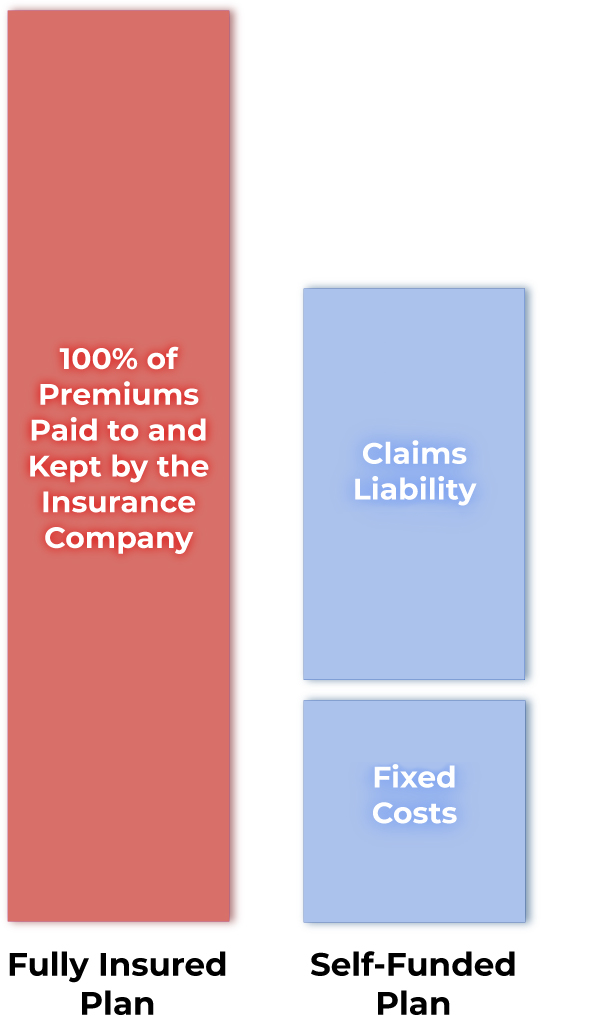

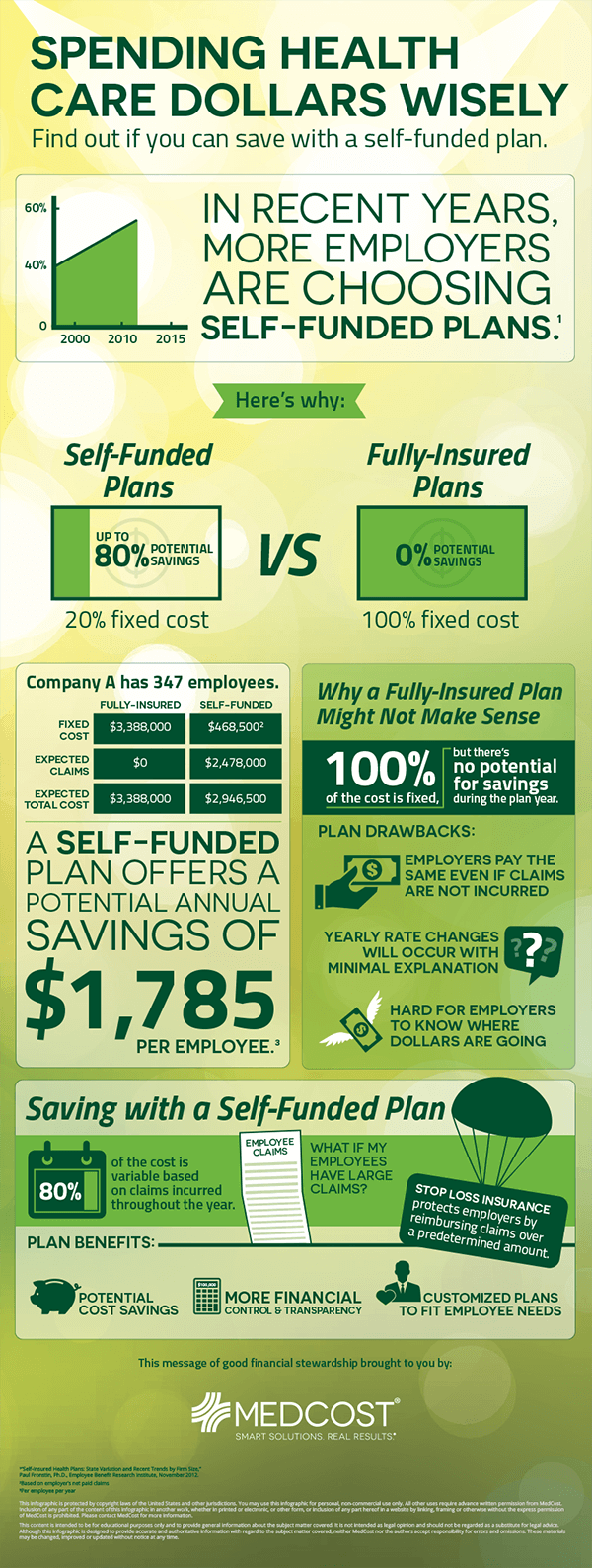

Self funded vs fully insured comparison. However, it is important to note that self funding carries more risk than fully insured plans, along with being accompanied by greater regulations. But, let’s dive a little deeper and explain a little more. With fully insured health insurance plans, profits made by the insurance company are retained by the organization.

Mrioa receives varying types of reviews; The employer has control of what is in the plan document. In aso arrangements, the insurance company provides little to no insurance protection, which is in contrast to a fully insured plan sold to the employer.

So what exactly is the difference between a fully. With fully insured health insurance plans, employers pay an insurance provider in advance to cover projected claims, in addition to the insurer’s overhead and administrative costs. As always, insurance is a balance between costs and risks.

This also lessens the financial strain on employees. The employer pays the premium directly to the insurance company, and the premium is set on an annual basis. Less risk because the insurance company handles the claims;

If employees are relatively healthy and don’t use the health plan very much, the employer’s costs will be lower than if the plan were fully insured. The benefits of this type of arrangement include: One of the biggest differences between fully insured plans and self insured plans is who assumes all the risk.

What is the difference between fully insured and aso? The administrative costs are covered in the premium; The fully insured model may mean that employers pay higher premiums to cover the risks and generate profits for insurance companies.

In other words, benefits are paid through a plan which is funded by employer contributions. With a fully insured plan, the risk falls on the insurance company.

Self Funded Vs Fully Insured Health Plans – Youtube

A Brokers Guide To Self-funding

Aso Vs Fully Insured Health Dental Vision Silverberg Group

Basic Differentiators Between Fully-insured Self-funded Plans Primepay

Fully Insured Vs Self-insured Level-funded Vs Self-funded – What Does It Mean

Fully Insured Vs Self-insured Level-funded Vs Self-funded – What Does It Mean

Self-insured Vs Fully-insured Association Health Plans

Self-funded Insurance Plans 101 Self-insured Vs Fully Insured Health Plans Aetna

Fully Insured Vs Self Insured Vs Level Funded Plans Altura Benefits

Fully-funded Vs Self-funded Group Health Plans Comparison

Guide To Move To Self-funded Health Plan Healthcare Planning

How Does Self-funded Health Insurance Work

Fully Insured Vs Self Insured – Youtube

Self-insured Plans Vs Medicare

Partially Self-funded Health Insurance What It Is Why It Matters And Who It Benefits – Evolution Healthcare

Fully-insured Vs Self-funded Health Plans Infographic Medcost