If your credit score is between. In this article, we take a look at the leading fintech startups in india that do credit scoring by utilising advanced analytics and ai modelling.

Check Free Credit Score Report Online – Credit Score Creditmantri

If your credit score is 624 and below then it qualifies as a bad credit score.

Starting credit score in india. Faqs on bad credit loans. India has 4 credit bureaus that provides credit scores to individuals viz. While a score between 300 and 549 is deemed to be poor, anything from 550 to 700 is deemed to be fair.

Starting credit score in india. The closer the score is to 900, the better it is considered. Cibil score check your free cibil credit score online.

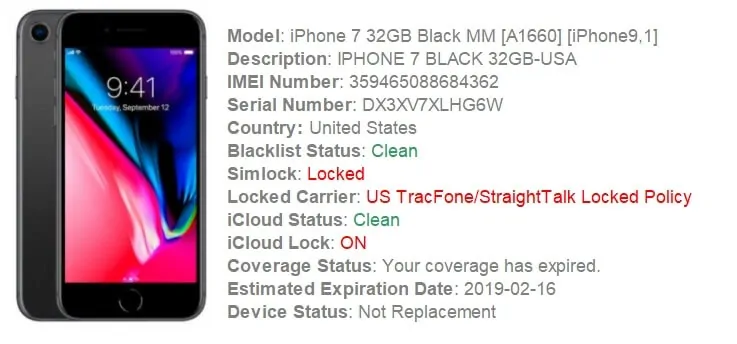

Transunion cibil is one of the four credit bureaus generating reports related to credit scores in india. A score of 0 on a cibil credit report means credit history not available (na) which indicates that the credit history is less than six months which is not sufficient to give a credit rating between 300 and 900. Cibil score is the credit score issued by cibil (india’s first credit bureau) and ranges between 300 to 900.

As we covered in our last post, credit score (cibil score as it is generally referred to) is a score based on the credit history of an individual. Cibil is a representation of an individual’s credit worthiness and is calculated by these agencies after taking into consideration the debt and credit history of an individual. First, start by checking your score regularly.

A credit score will outline your credit history, payment history, and payment defaults if any. Get your free cibil score. Contains your name, date of birth, gender and identification numbers such as pan, passport number, voter’s number.

The higher the score, the higher would be the chances of getting a loan. With discover, for example, cardmembers get a free credit scorecard with your fico® credit score and important information behind it.*. It was granted its license in 2010.

The most common type of credit score is called a fico score. Minimum loan requirements your business needs to have been registered for at least 2 years and you must be able to provide business registration proof. How often are credit scores updated in india?

The amount gets instantly credited to your bank account once it has been approved. Personal loans starting 10.25% apply for an online personal loan at low interest rates and get instant approval. What is considered a good credit score?

Check if you are eligible for a credit card via paisabazaar. What is considered a good credit score? A credit score reflects the borrowing and repayment habits of a person by providing information about the nature of loans (including credit cards) held by him.

However irrespective of the model used credit scores in india range from 300 to 900 and a score closer to 900 (such as 750 and higher) is considered to be a good score. India jumps 79 positions from 142nd (2014) to 63rd (2019) in 'world bank's ease of doing business ranking 2020'. The score is derived using information from all past credit transactions and loans.

Cibil scores range between 300 and 900. Applying for a credit card is the easiest and the most common way to build your credit score on your own. Here are few steps you can take to begin boosting your credit scores.

Instant cash loans or quick loans online in india are generally fast cash loans that can be availed for a short period. Its scoring system is on a scale of 1 to 999, with 1 being the lowest and 999 being the highest. If you have a credit card, you might check with your issuer.

Lendingkart has formed technology tools based on big data analytics which aids. India's largest sme credit marketplace. But don’t be disheartened as everyone starts out with a blank slate when it comes to building a credit score.

Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45% of your number. A score above 700 is generally considered good. It offers businesses a company credit report and a cibil rank.

Instant loan online in india usually start from rs. What credit score indicates bad credit? In this case, it will be impossible for you to avail a loan from a lender.

A score above 750 is considered to be an excellent score. Its scoring system ranges from 300 to 900, with 900 being the highest and 300 being the minimum cibil score. The unsecured credit card is the best option to build your credit score, but beginners usually cannot avail it due to no credit history.

Basically credit score lets the bank know how financially responsible you are.

Free Credit Score Improvement Services In India Apply For Loans Credit Cards

Credit Information Company In India Cic

What Is A Good Credit Score And Tips To Maintain It – Creditmantri

Cibil Score Check Your Free Cibil Credit Score Online

Cibil Score Common Myths Misconceptions – Goodmoneying Content Marketing Credit Score Check Credit Score

10 Must-try Ways To Improve Your Bad Cibil Score

Personal Loan For Low Cibil Score At Lowest Interest Rates

Everything You Need To Know About Credit Score

Cibil Score Check Your Free Cibil Credit Score Online

Everything You Wanted To Know About Cibil Start Saving Money Free Credit Score Credit Score

Cibil Score Check Your Free Cibil Credit Score Online

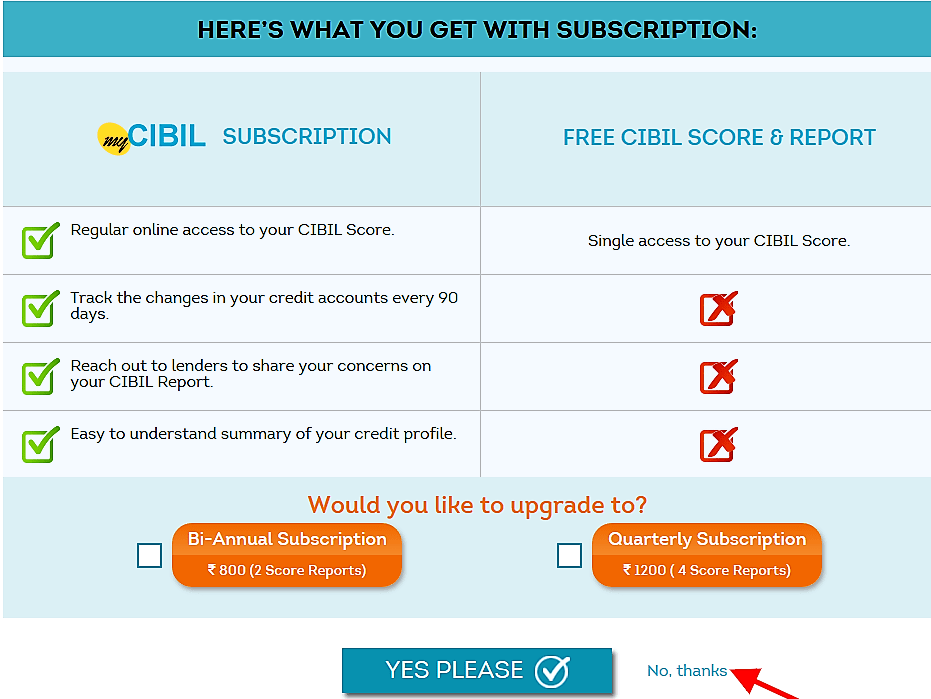

Why Pay For Cibil Report Apply For Free Credit Report Free Credit Score Credit Score How To Apply

Cibil Score Check Your Free Cibil Credit Score Online

Cibil Score For Credit Card Minimum Credit Score Required For Credit Cards

Free Cibil Score Credit Information Company Free Cibil Report 07 Jan 2022

Cibil Score Check Your Free Cibil Credit Score Online

Check Free Credit Score Report Online – Credit Score Creditmantri