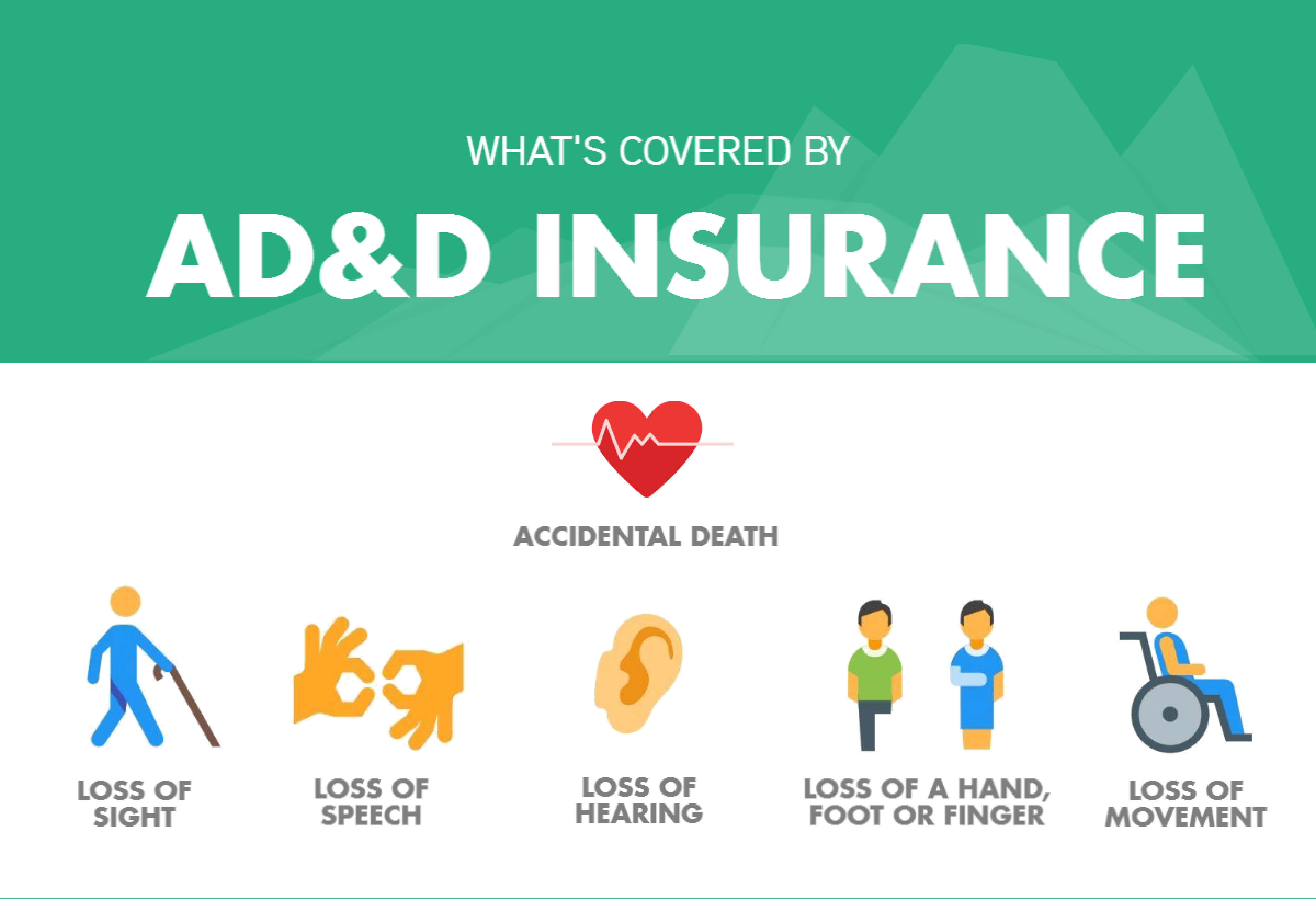

Premiums to buy sufficient coverage as part of a group plan are usually much higher than if you bought it privately. Accidental death and dismemberment insurance provides coverage if an insured is the victim of an accident that causes death, dismemberment or serious disability.

12 Ways To Save On Term Life Insurance Insurancecom Term Life Life Insurance Policy Insurance Marketing

Ad&d insurance is generally inexpensive, and it’s common for employers to offer a small policy to their employees as an alternative to life insurance.

Supplemental ad&d insurance worth it. Supplemental ad&d coverage could be a wise investment regardless, but understand that ad&d doesn’t cover you for any type of death or dismemberment. Is supplemental ad&d worth it? Consumers often purchase supplemental insurance through their employers.

Just balance the monthly cost against. Supplement dependent ad&d insurance coverage is designed to protect you against certain financial burdens in the event a coverage. You might and not even realize it.

Is supplemental ad&d worth it? This ad&d premium was very inexpensive through payroll deduction. For example, monthly premiums might start at $4.50 for every $100,000 in accidental death coverage from farmers.

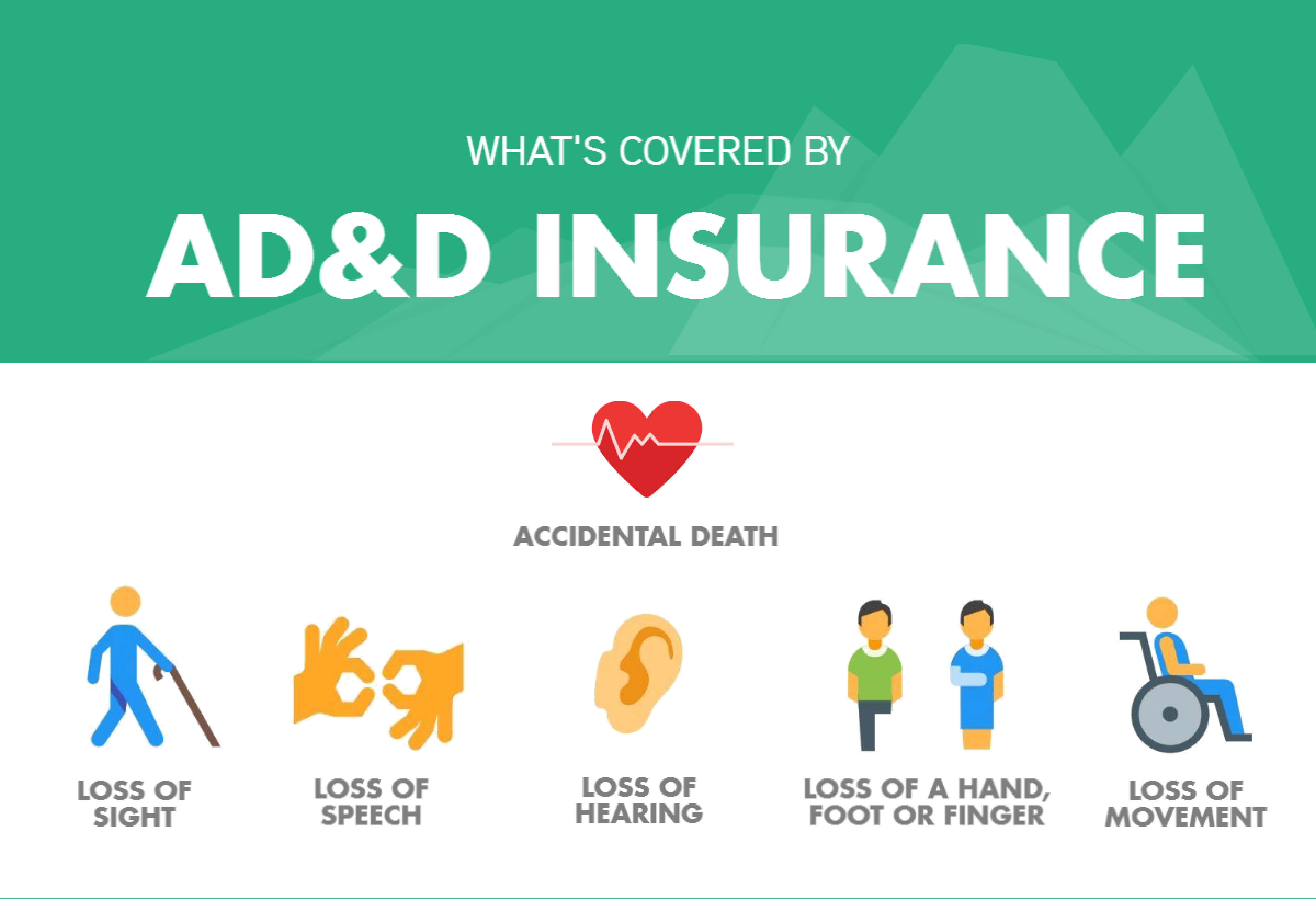

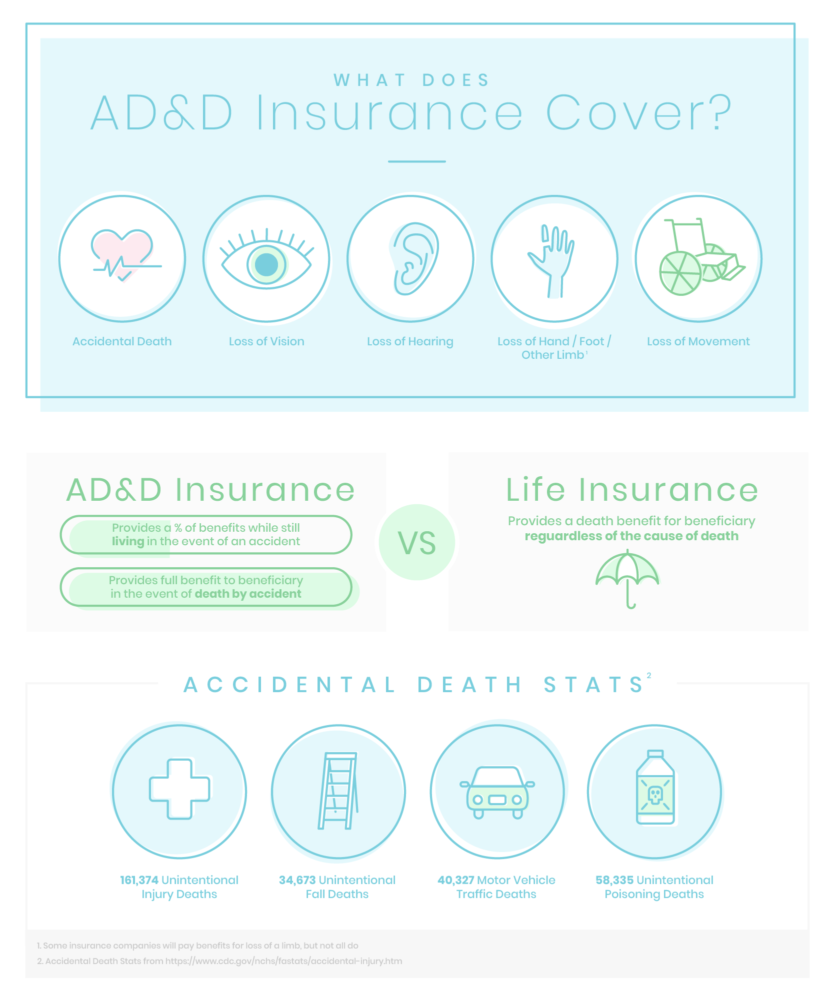

Ad&d insurance pays out if you die or are seriously injured in an accident. It also offers a benefit for a serious injury caused by an accident that. First, the coverage may be a form of accidental death and dismemberment (ad&d) insurance, which only pays the beneficiaries if the employee dies from an accident or loses a limb, hearing or sight as a result of an accident.

The closest alternative to accident insurance is accidental death and dismemberment (ad&d) insurance. Also known as “personal accident insurance” or “supplemental accident. Supplemental ad&d coverage could be a wise investment regardless, but understand that ad&d doesn’t cover you for any type of death or dismemberment.

Supplemental ad&d can play a critical role, but it's wise to think of it as added protection rather than solely relying on ad&d coverage. Life insurance provides financial protection for your family and will pay out if you die by accident or illness. Accidental death and dismemberment (ad&d) insurance gives your employees added financial security in sudden and tragic circumstances.

Employers often require you to buy a supplemental policy for yourself before being eligible for supplemental spouse or. How to know if supplemental accident insurance is worth it and whether it’s the same as accidental death and dismemberment insurance (ad&d)? Most people know about supplemental life and ad&d (accident, death, and dismemberment insurance) but forget about supplement life insurance for a spouse or child.

If you can afford it, ad&d insurance should supplement your life insurance policy or you should add on an ad&d rider. Accident coverage is a component of ad&d insurance, but you can also purchase a standalone policy with less restrictions. What is supplemental ad & d coverage?

It’s designed to strengthen and beef up the existing group life insurance that you have in place, by giving you more when it comes to death benefit. The ad&d policy should be super cheap (because they are close to worthless). Pros and cons of accidental death and dismemberment insurance

What does supplemental life and ad&d mean? Supplemental policies for the others in your life may be just as important. Is supplemental ad&d worth it?

Given that illness is the major cause of disability, a disability policy is likely to apply to more situations than an ad&d policy. Think of ad&d insurance as a supplemental policy to your life and disability insurance policies. Some people use ad&d as an alternative to life insurance.

Most accident insurance plans cover some injuries but not others. It’s less expensive than traditional life insurance and does not require underwriting. If you get this coverage for free or your emergency fund is not fully funded then it's worth getting.

Turns out there was also a benefit of 2% of the value per month. What would happen if your loved one died? However, ad&d coverage isn’t nearly as robust as life insurance.

This is a type of policy that pays a benefit if you die or lose a limb in an accident. Supplemental ad&d coverage could be a wise investment regardless, but understand that ad&d doesn’t cover you for any type of death or dismemberment. Accidental death policies are generally much, much cheaper than life insurance because the overall number of deaths via accident is much lower than deaths via other.

The policy stands out for its “increasing benefit,” which means the value of the coverage you buy increases by 5% each year you keep it (up to a total of 50% over 10 years). The policy’s death benefit is paid if death is caused by an accident, such as a car crash, fall, or murder. Supplemental life insurance is additional life insurance you can buy through your employer.

But before offering ad&d coverage, it’s important to understand what ad&d covers and what it doesn’t. Yep, you’ll have to pay for this one. Rates start at $6 a month for $100,000 of coverage from fabric and rise to $30 a.

Ad&d coverage could be a wise investment regardless, but understand that ad&d doesn’t cover you for any type of death or dismemberment.20 мая 2020 г. But, still, if a limited supplemental life insurance policy is pretty expensive, it may not be worth it. Supplemental accident insurance is designed to give you a cash benefit if you have an unexpected qualifying injury.

Supplemental ad&d insurance worth it supplemental insurance works a little differently than a regular health plan, and thats a good thing.;you still pay a monthly premium , and supplemental plans still provide payments via claims.

What Is Add Insurance – Jeanne-m

What Is Add Insurance – Video Library

Accidental Death And Dismemberment Add Insurance

Supplemental Life And Add Coverage Expanded For 2019 Hub

Accidental Death Insurance The 4 Absolute Best Policies

Supplemental Life And Add Coverage Expanded For 2019 Hub

Pin By Good Neighbor Insurance On International Employer Group Insurance In 2021 Group Insurance Insurance Employment

Sebb Supplemental Life Insurance – Youtube

The 5 Best Add Insurance Providers Termlife2go

What To Know About Add Insurance Forbes Advisor

Voluntary Life Insurance The Hartford

Life Insurance Plans American Fidelity

Lifeinsurance Classifications Or Categories Will Vary Slightly By Insurer But In Many Cases There Is Some S Life Insurance Insurance Life Insurance Companies

What Is Considered Accidental Death For Insurance Purposes – Glg America

Term Life Insurance Policygenius

Accidental Death Dismemberment Add – Texas Bar Private Insurance Exchange

What Small Businesses Should Know About Accidental Death Dismemberment Insurance Wallace Turner Insurance