When money leaves a life insurance policy. You also have the option to pledge the policy to bank and borrow against it.

Pin By James On Propagan Life Insurance Sales Insurance Sales Get Your Life

Page 2 of 2 nn0522e (09/2020) title:

Surrender life insurance policy with loan. An examination of life insurance policy surrender and loan activity. If you are considering surrender of a life insurance policy with an outstanding loan balance, or are concerned about the effect of any policy transaction on your estate personal tax situation, you are strongly advised to consult a tax advisor. However, after the first year, it can be partially surrendered.

Second, a policyholder can take a loan against the life insurance policy. The surrender or cancellation of a life insurance policy subject to an outstanding policy loan can trigger a significant income tax liability even if. Can you surrender a term life insurance policy?

While repaying a loan isn't mandatory, any debt. Universal life policies typically include a. Just telling them you want to cancel isn’t enough.

For lapsed policy, the loan allowed is 85%. When you sell traditional investments, you owe taxes on any gain. Stop making the premium payments.

Ad indonesia life insurance deals for expat individuals, couples and families. Can you cash out a whole life insurance policy? Application for a policy loan or withdrawal created date:

A surrendered policy can generally not be restored or put back in force. To initiate the policy surrender process, call your insurance agent and request a surrender form. The minimum surrender value is 30% of total amount of premiums paid excluding the premiums paid for the first year for any endowment policy.

This amount will generally be slightly less than the total amount of cash value in the policy because of surrender charges assessed by. And if the loan balance gets too high, the insurance company will surrender your policy to pay it. To cancel or surrender your life insurance policy, use these steps:

A decision to fully surrender a policy requires careful The manufacturers life insurance company. United of omaha is now required to withhold income tax from all taxable distributions unless you specifically elect not to have these withholding rules apply.

Yes, you can, but the reality is that your term life insurance policy won’t have any cash surrender value. If you need to access the cash surrender value in your policy but want to keep the policy in force, then you can take a loan out from the policy using your accumulated cash value as collateral. Some withdrawals, surrenders, assignments and policy loans from life insurance policies are considered taxable distributions.

People should consider surrendering their life insurance if they no longer need it, or can no longer afford it. Surrendering a term policy essentially means removing the monthly premium from the budget, but unfortunately, not much else. There are two ways to take money out of a life insurance policy while it remains in force.

In universal life insurance plans, the cash value is not guaranteed. Complete the surrender form the insurance company sends you. After paying out the surrender value, the insurance company that provided the coverage is no longer obligated to provide life insurance benefits to the (former) policyowner.

When a policy is surrendered, the policy owner will receive all of the remaining cash value in the policy, known as the cash surrender value. Call your insurance company and tell them you would like to surrender your life insurance policy for cash value. Hence, surrender value of your policy is used to calculate the loan amount you would be eligible for.

Variable life insurance surrender authorization. Let's explore the taxability of these actions. A full surrender is when the policy is cancelled, terminating all insurance coverage.

When a life insurance policy is surrendered, the owner is canceling the policy for the “nonforfeiture value,” a predetermined sum of money (the surrender value). Some withdrawals, surrenders, assignments and policy loans from life insurance policies are considered taxable distributions. Any accumulated policy value, less a surrender charge, loan or accrued loan interest, is typically payable to the policyowner.

Therefore loan value = 90% * surrender value i.e. Ad indonesia life insurance deals for expat individuals, couples and families. Keep this page for your records.

Restructure the life insurance policy with a loan. First, one can withdraw cash through a partial surrender. Search for more papers by this author.

All life insurance policies can be surrendered, but only certain ones will come with a cash value. United of omaha is now required to withhold income tax from all taxable distributions unless you specifically elect not to have these withholding rules apply. If you surrender a life insurance policy, you’ll also owe taxes on the gain (money you made above the amount you paid in).

Hold/the national alliance program in risk management and insurance, college of business, florida state university, tallahassee, florida. This may be a much better alternative than cashing in your policy because your beneficiaries will be able to receive the death benefit protection of the policy. The tax implications of borrowing against life insurance.

Lics Childrens Money Back Plan Life Insurance Facts Life Insurance For Children Life Insurance Quotes

Features And Benefits Of Loan Against Lic Policy 1the Loan Amount Will Always Be Less Than The Cash Value Of The Policy 2loa Loan How To Apply Apply Online

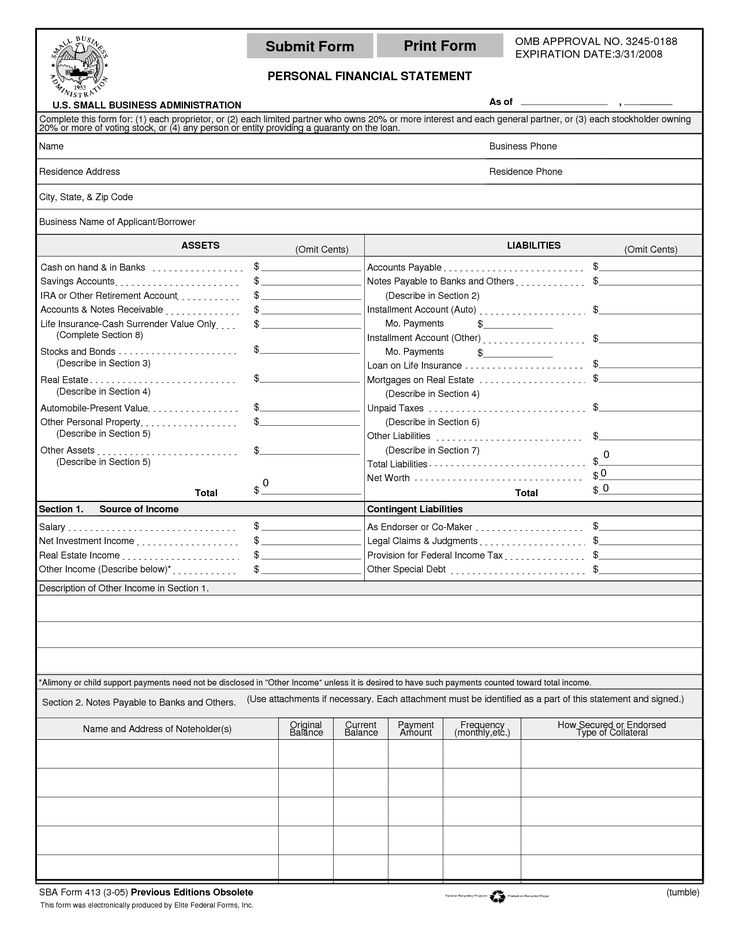

Print Personal Financial Statement Form Print Form Personal Financial Statement Personal Financial Statement Statement Template Financial Statement

Child Education Funds Education Funding Kids Education Tax Return

Services We Provide May I Help You Financial Advisors Travel Insurance

Pin By Mahendra Kapse On Life Insurance Insurance Investments Insurance Marketing Financial Quotes

Surrender Form For Lic Life Insurance Marketing Life Insurance Corporation Insurance Marketing

Sample Letter Format For Surrender Of Life Insurance Policy Life Insurance Policy Insurance Policy Life Insurance

Pin By Harish Shettigar On Cancer Care Cancer Care Life Insurance Marketing Cancer

Pin By Mukul Sarkar On Knowledge Quotes Life Insurance Agent Knowledge Quotes Insurance Agent

Sample Letter Format For Surrender Of Life Insurance Policy Life Insurance Policy Insurance Policy Life Insurance

Lic Jeevan Labh Maturity Plan Lucky Behl Insurance Advicer 9560709202 Royalindiacreditgmailcom Paying

Pin By Harbor Life On Cash Out A Life Insurance Policy Life Insurance Policy Cash Out Life Insurance

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Insurance

9814814004 Life Insurance Quotes Life Insurance Facts Life And Health Insurance

Lic Of Indias New Life Insurance Plans Are Very Popular These Days With Increased C Life Insurance Corporation Life Insurance Marketing Life Insurance Quotes

Life Insurance Is The Best Gift You Can Give Yourself Have You Insured Yourself

Pin By Jona Miguel On Insurance Life Insurance Facts Life Insurance Agent Life Insurance Marketing Ideas