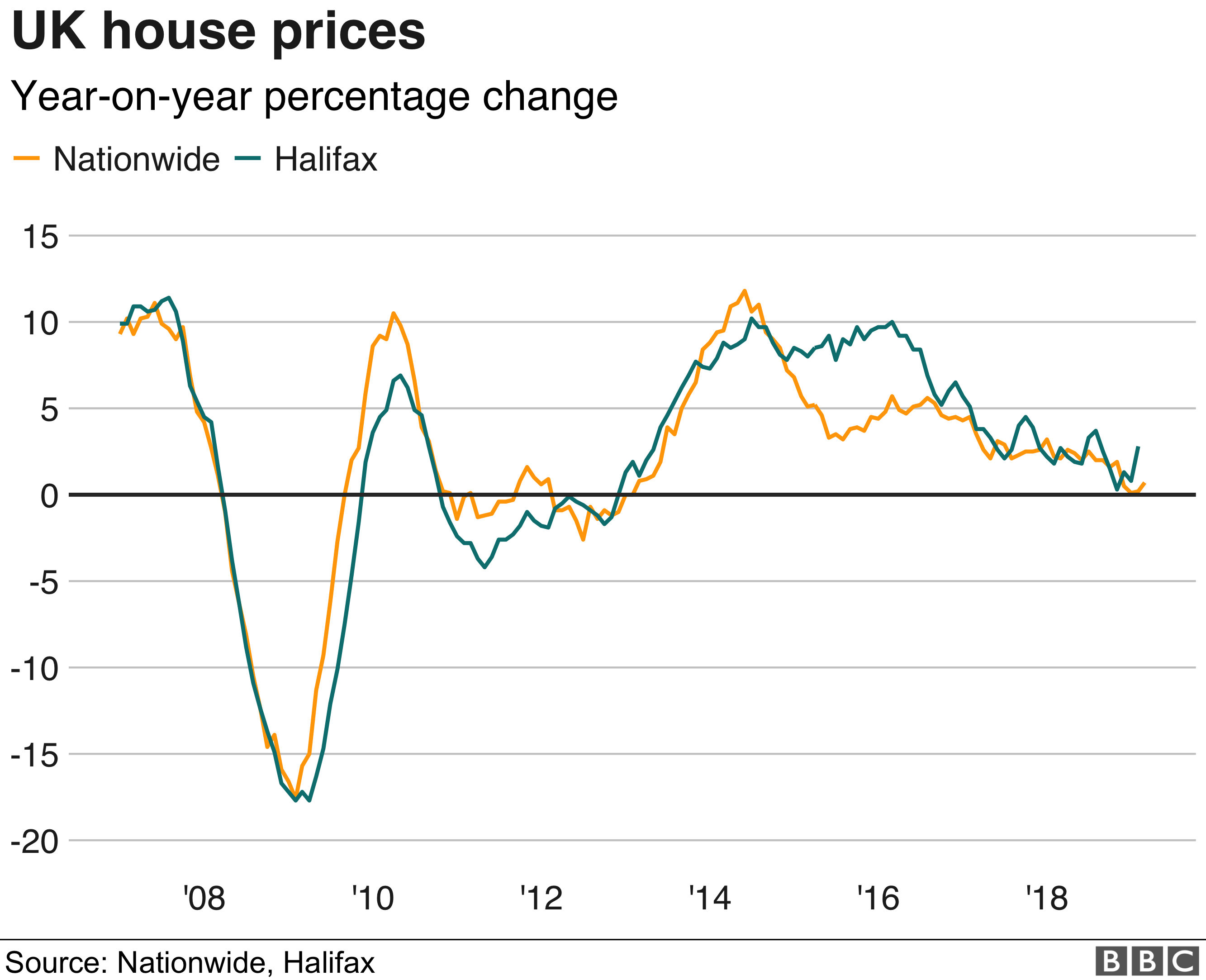

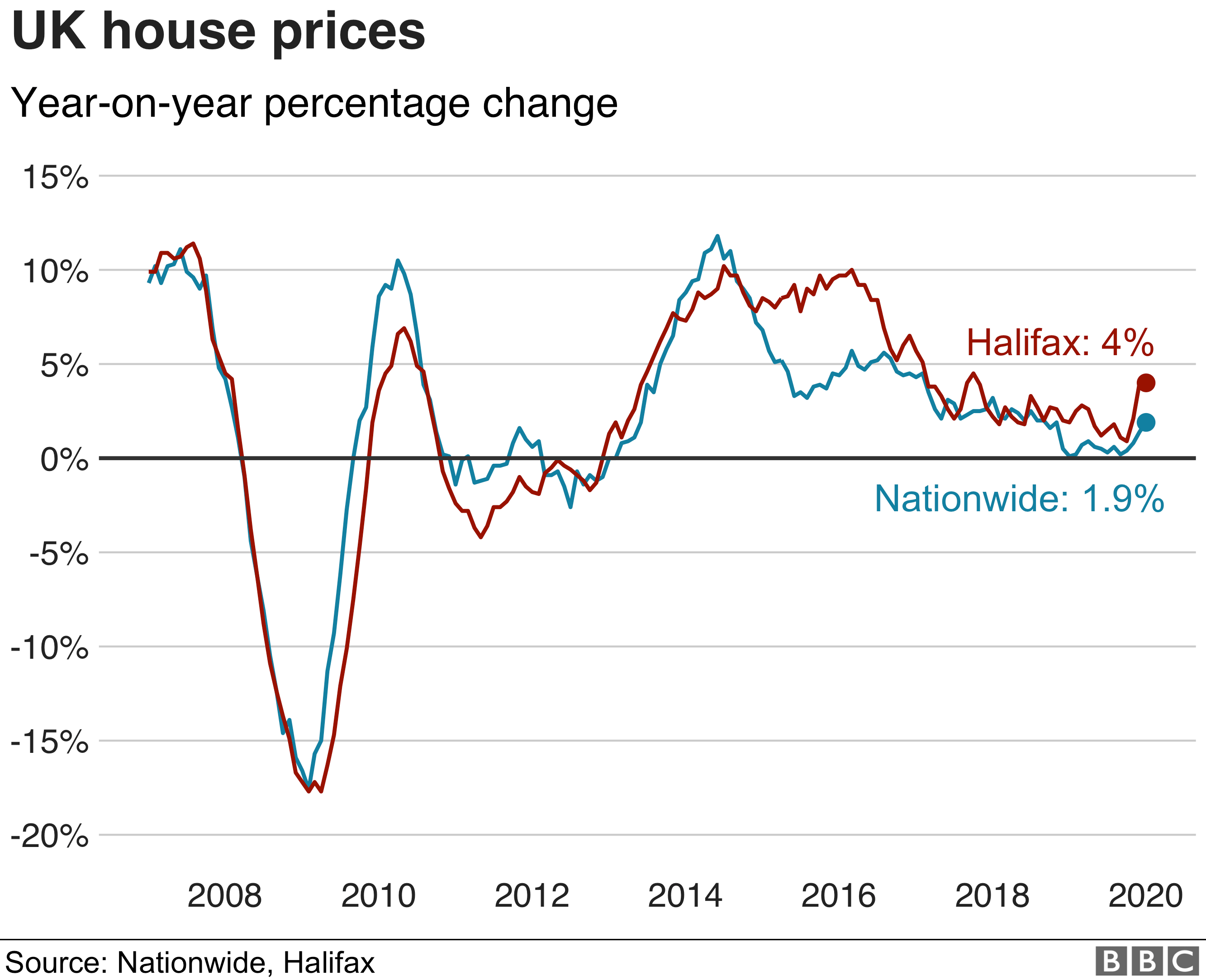

Start now on the uk house price index service. In fact, it was the country’s strongest performance since 2014.

The Recent History Of The London Property Market Fish Need Water

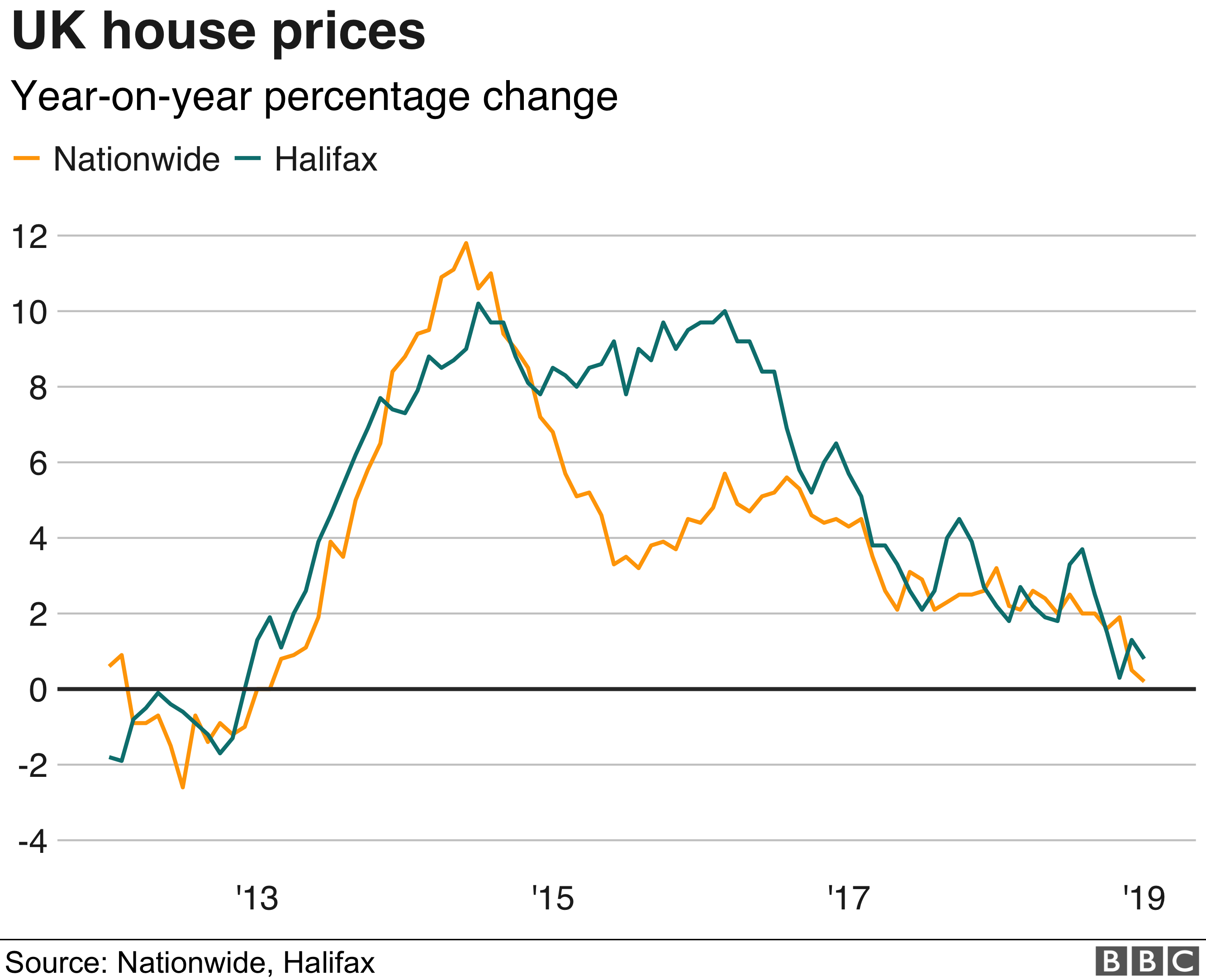

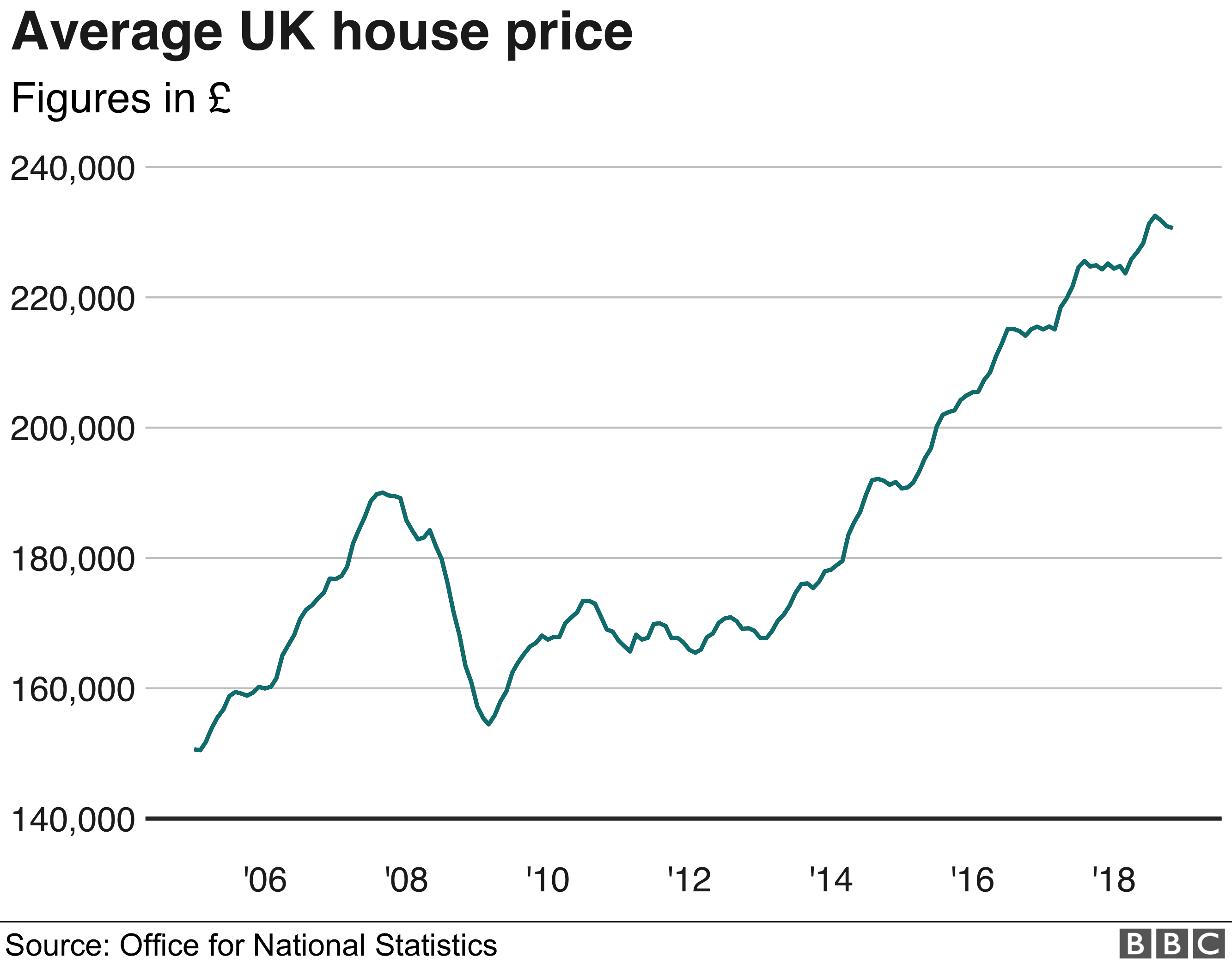

Uk annual house price growth rose sharply to 7.6% in november 2020 annual house price growth, uk, january 2018 to november 2020

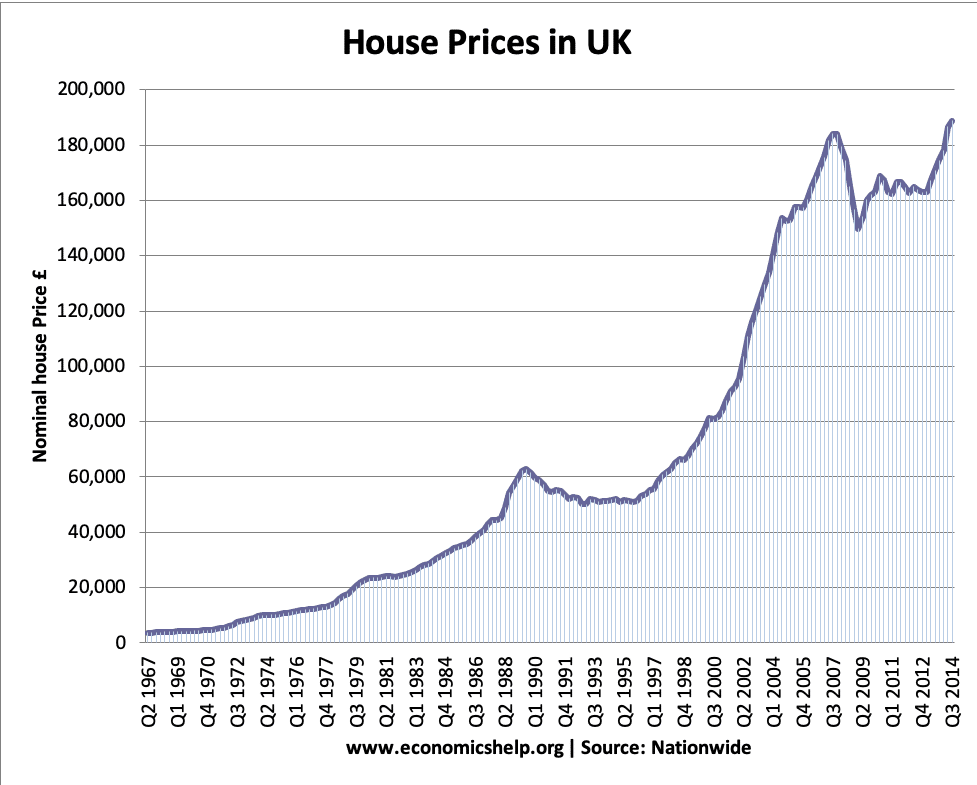

Uk housing market graph. Main factors affecting house prices. The number of new homes built hits a new low. Uk house prices have stayed relatively high (despite recession and credit.

The most striking result of the onset of the pandemic was an almost total halt to activity in newly constructed houses: As the housing market recovers (now being seen in the rising number of mortgage approvals), we can expect real house prices to. Housing completions fell from 46,000 in the second quarter of 2019 to 16,000 in the corresponding quarter of 2020.

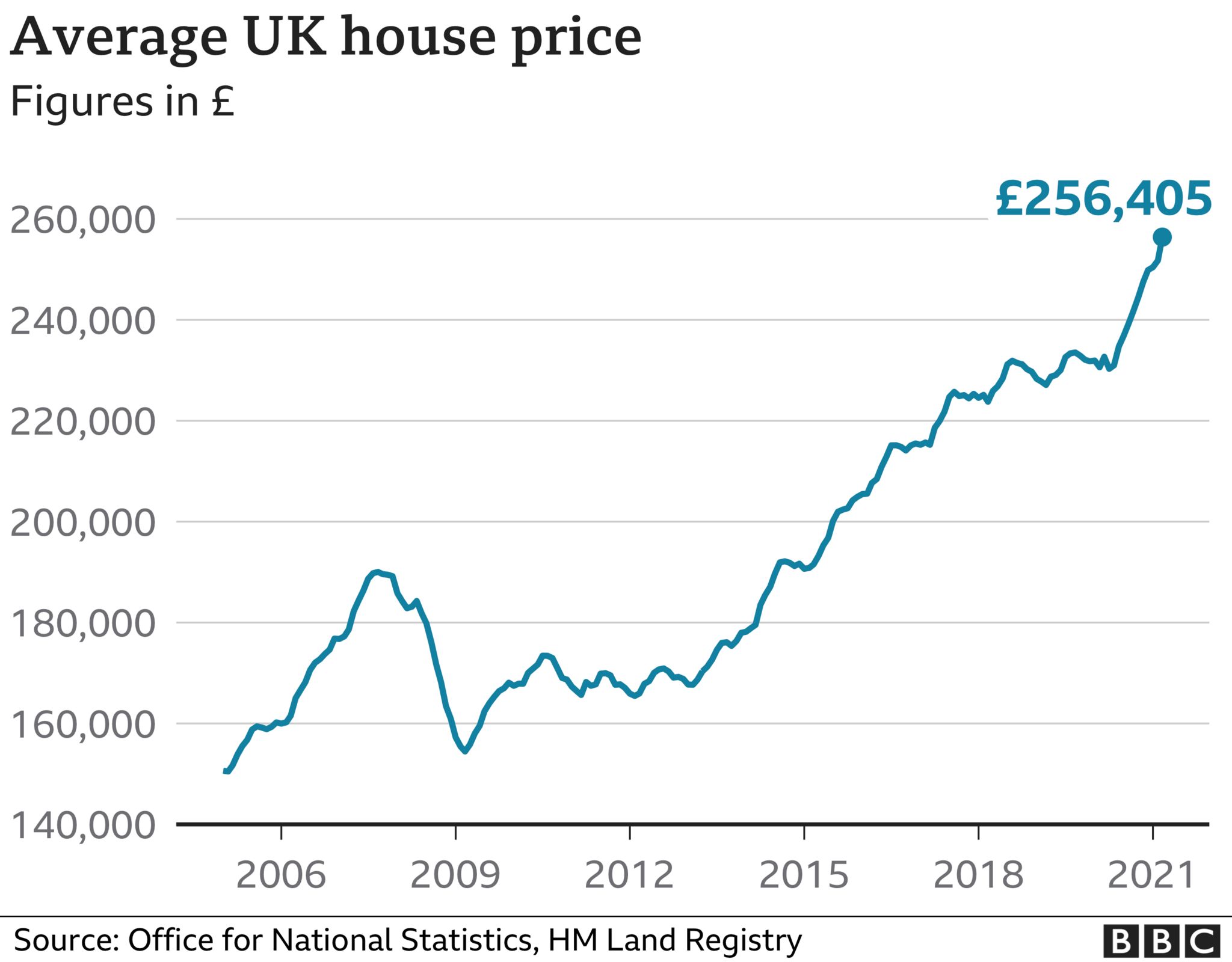

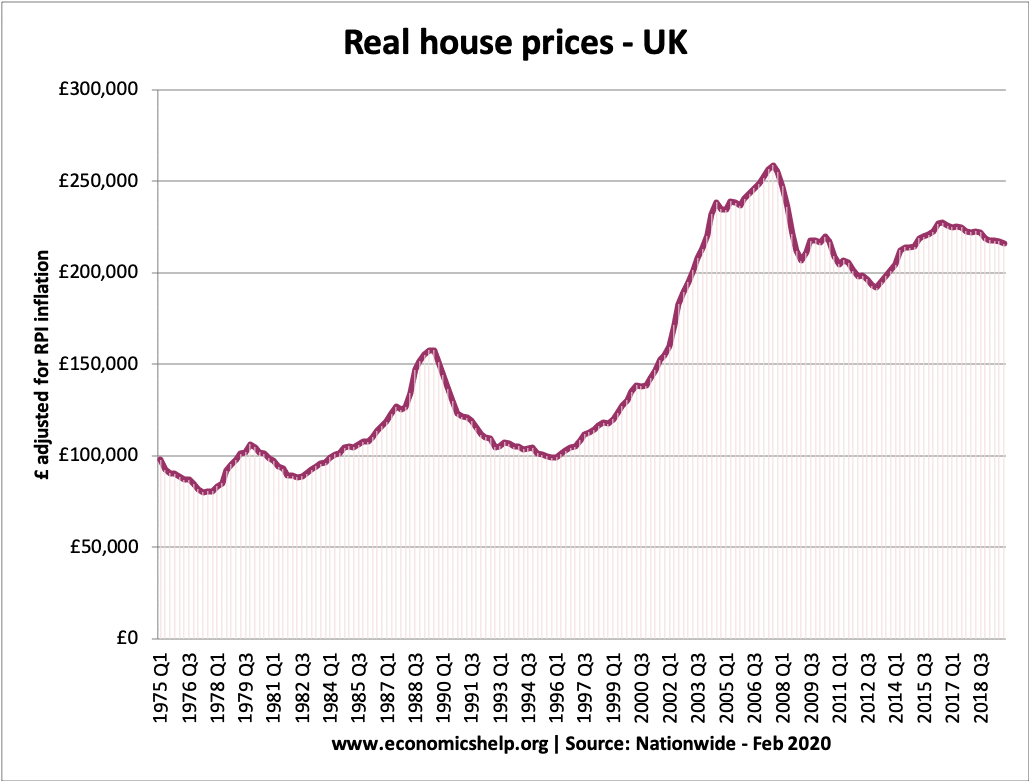

England house prices grew by 13.3% in the year to june 2021, up from 9.4% in may 2021. The property portal’s research forecasts a +3% increase in uk house prices over the course of 2022. This graph is based on the nationwide's data on uk house prices.

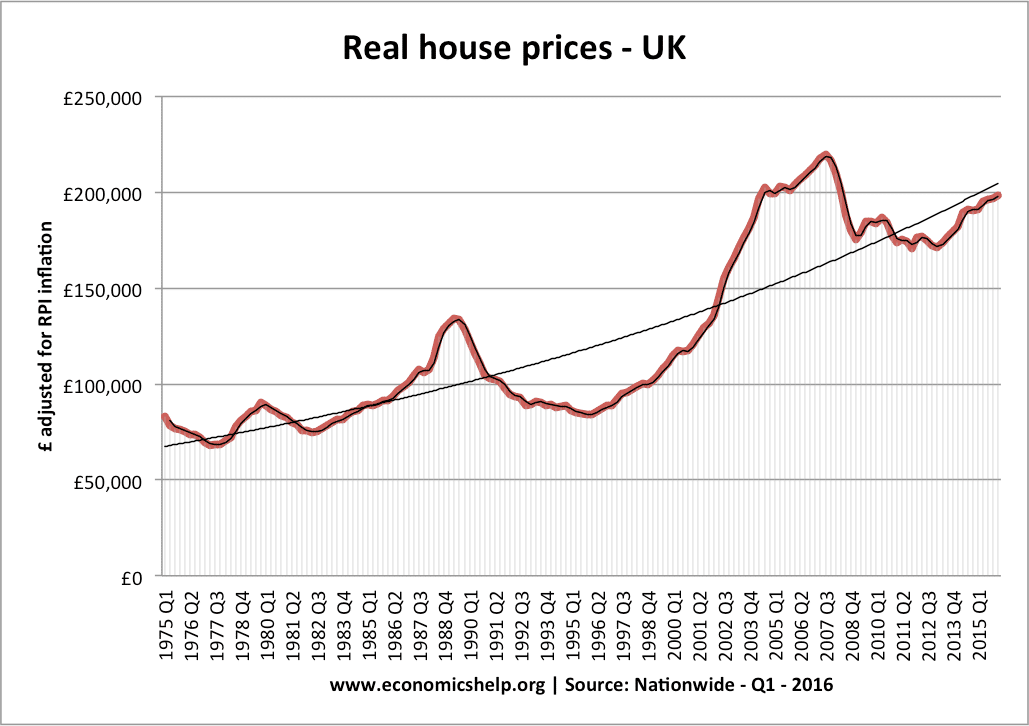

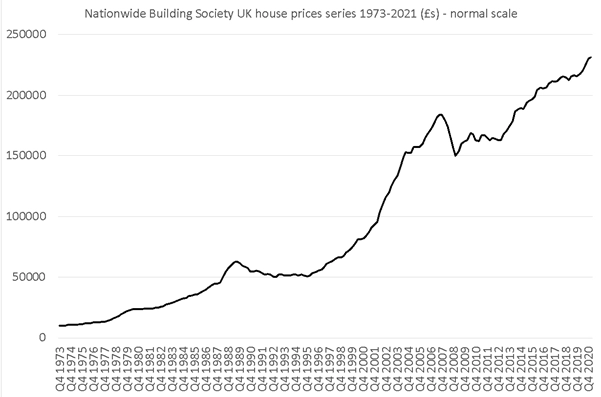

Below is a graph showing roughly the past 30 years of uk house prices, which i’ve compiled using data provided by lloyds/halifax. Ad searching for a house in united kingdom? This graph illustrates actual house prices in the uk since 1975.

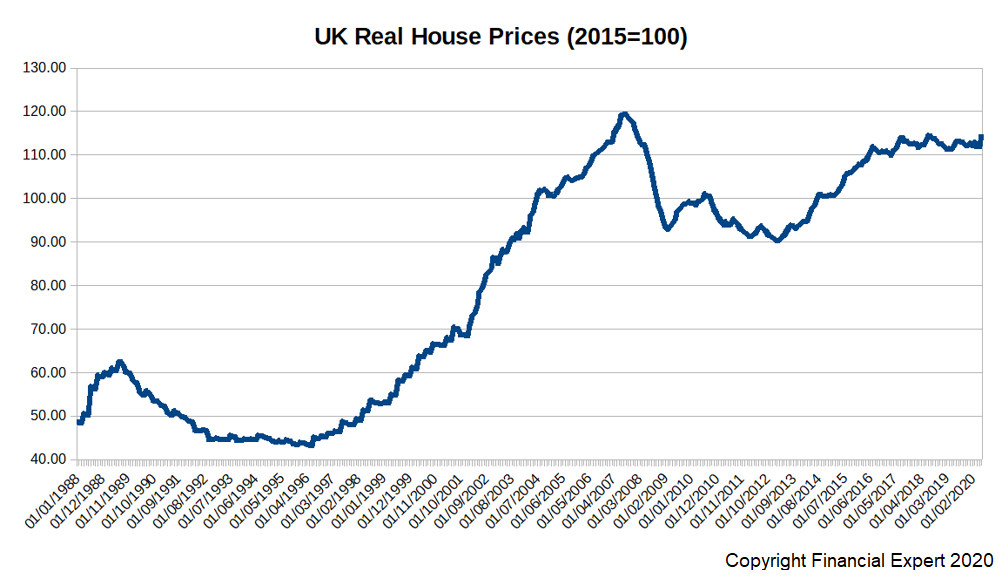

Real uk house prices since 1975. The distribution of housing stock in england in 2019 can be broken down by dwelling age and tenure type. Check uk property price trends.

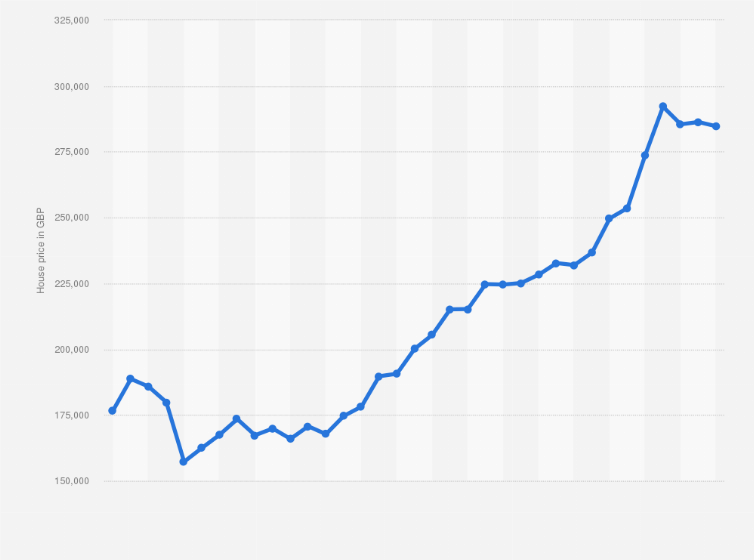

However, a continued low supply will support price inflation. Average house prices increased over the year in england to £248,000 (2.2%), wales to £162,000 (1.1%), scotland to £152,000 (1.5%) and. These prices have been adjusted for inflation, they are the initial prices at which buyers purchased their properties.

When adjusted for inflation, house prices rose by 5.6% in 2020 from a year earlier. It said the market is being artificially buoyed by the stamp duty holiday. Figure 1 shows the share of newly constructed

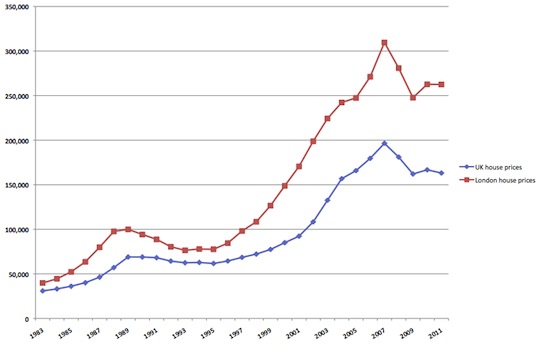

Jll believed house prices would fall 8% within 2020 and that uk new housing starts would fall to 80,000 in 2020. Since the halifax began tracking historical uk house prices in 1983:. B efore you can decide whether you think uk prices are too high, you need to have some notion of where they’ve come from.

As of 2019, more than 3.12 million owner occupied houses were built before 1919. The north west was the fastest growing region with annual growth of 18.6% in the year to june 2021. Despite all the political, health, and trade uncertainties surrounded the uk economy, jll is offered up its housing uk market forecast.

Across the uk, prices increased by £13,000 over the past 12 months. Uk average house prices increased by 2.1% over the year to march 2020, up from 2.0% in february 2020. Yorkshire and the humber leads the way with a 21% rise in asking house prices.

Our house price charts show how house prices in the uk have changed and are changing, illustrated both nationwide and by uk region. House prices are volatile with frequent booms and busts. Buy full freehold houses for £56,000.

House prices have risen nationally by 428%. In 2013 it fell even further to 135,590. Interestingly, every region in the uk has seen an increase in prices in the past year.

This is an increase of 4% to an average house price of £366,000. The number of new houses completed in the uk dropped to 135,990, the lowest figure since 1946. Buy investment property in the uk.

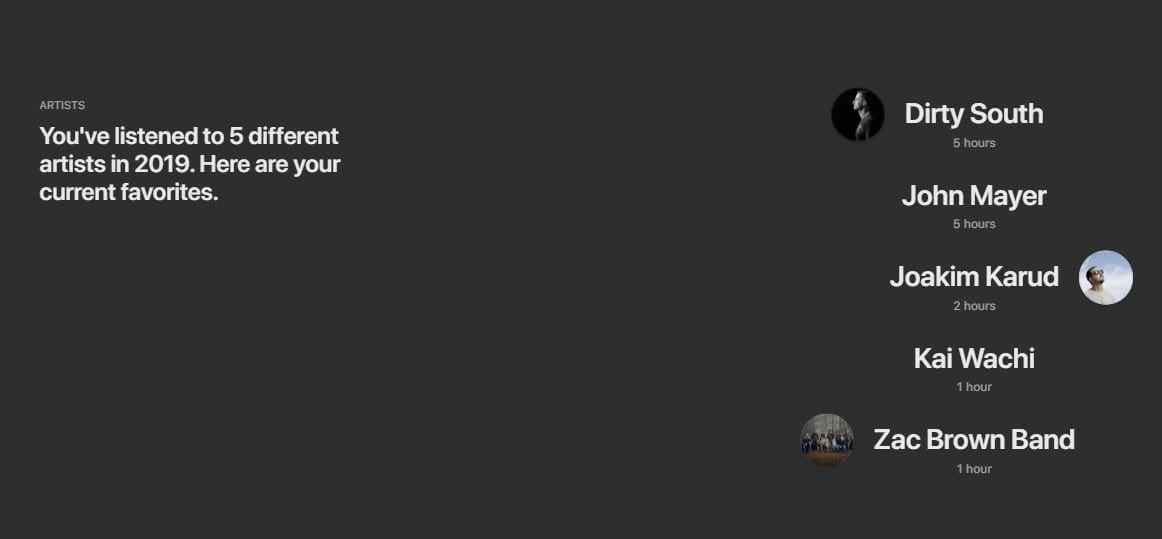

Ad searching for a house in united kingdom? The data goes back to january 2008. Find out property price trends in the uk.

The firm expects the house price gains seen over the past year to bring more sellers to the market in the coming months. This is across a predicted 1.2 million housing transactions. They also previously expected home sales to fall 550,000 from last year’s totals to around 650,000 in 2020.

This graph shows two main features of the uk housing market. In the last year, it was circa 140,000. Housing index in the united kingdom averaged 212.17 points from 1983 until 2021, reaching an all time high of 470.70 points in november of 2021 and a record low of 45.16 points in january of 1983.

This lack of new supply has supported prices. Effective interest rates on individuals’ deposits per cent (not seasonally adjusted) the centre for economics and business research, a consultancy, has predicted a 14% fall in the average uk house price for 2021.

Uk Housing Market – Economics Help

Uk House Price Growth At 14-month High Says The Nationwide – Bbc News

Uk Housing Market – Economics Help

Uk Housing Market Experiences New Year Chill – Bbc News

House Prices Climb At Highest Rate Since Before Credit Crunch – Bbc News

House Prices Post Brexit – Economics Help

Property And Your Portfolio – Qrops News

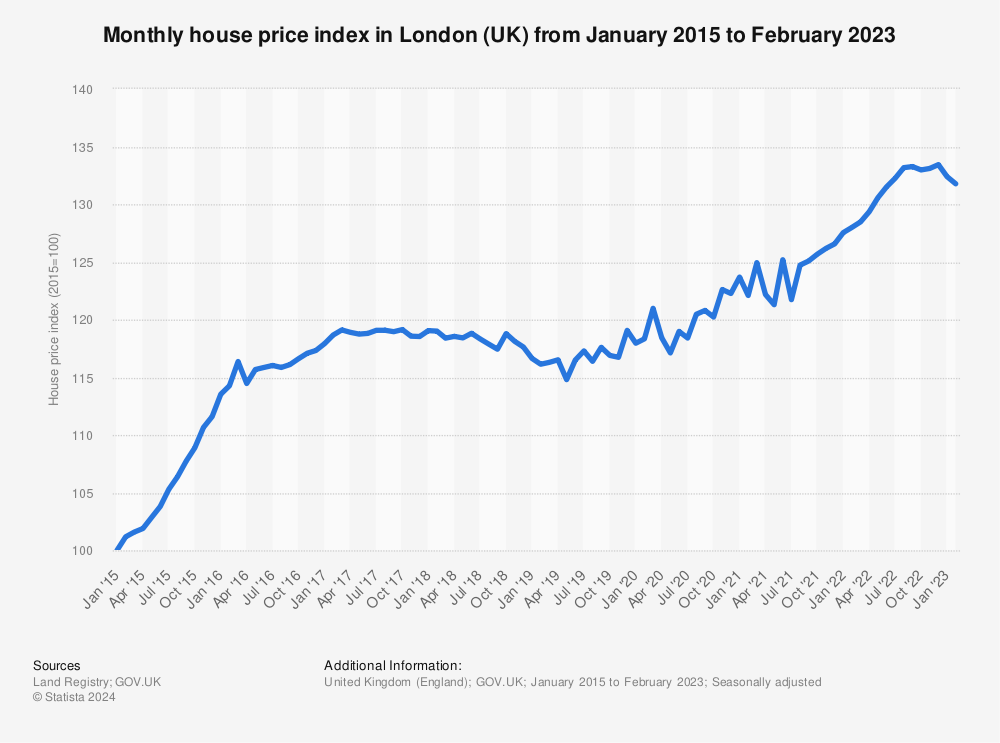

Monthly House Prices Index London 2021 Statista

Uk Housing Market – Economics Help

Historical Uk House Prices – Monevator

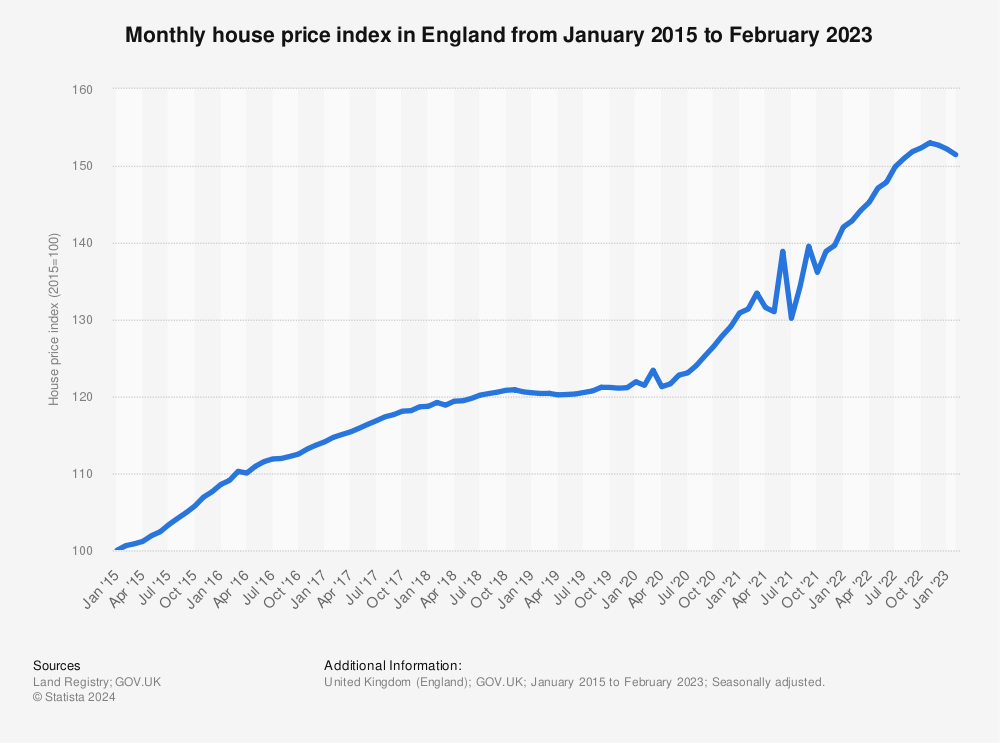

Monthly House Prices Index England 2021 Statista

Housing Market Outlook Worst For 20 Years Say Surveyors – Bbc News

What Does Centuries Of Uk Housing Data Tell Us – Private Investor – Schroders

The Housing Crisis In Charts House Prices The Guardian

Uk Housing Market – Economics Help

Chart Of Real Growth In Uk House Prices – Financial Expert

Average House Price In The Uk 2007-2021 Statista

House Prices Should We Welcome A Crash – Uk In A Changing Europe