The premium increases each year during the early years of the contract and remains the same after that time a life policy loan in fl cannot charge a fixed rate of interest higher than Under a graded premium whole life policy?

What Is Graded Benefit Whole Life Insurance

A type of whole life policy designed for people who want more life coverage than they can currently

Under a graded premium whole life policy. Graded premium whole life insurance is life insurance under which premiums increase annually until they reach a particular level, usually after 10 to 20 years, at which time they remain level for the remaining life of the policy. Click to see full answer. Graded benefit whole life insurance is an increasing stepped up premium that as a level death benefit in guaranteed issue policies.

Graded policies (also known as gbls) are whole life policies. It also can be a participating graded premium whole life policy that starts out with a gradual step up in. Ad indonesia life insurance deals for expat individuals, couples and families.

With a graded premium life insurance, you receive a refund plus interest (up to 10% and varies by company) on the premiums paid if there is a death within the graded benefit period. A permanent life policy offers the same death benefit from your first premium payment to the day you die. Whole life insurance, premium paid all at once up front.

Definition of graded premium, whole life insurance. A form of modified life insurance that provides for annual increases in premiums for a constant face amount of insurance during a defined preliminary period, with the purpose of making initial payments more affordable. This ensures that the policyholder will at least get their money back if the policy doesn’t pay out.

This differs from a term policy that ends after a specific period, but it’s also not the same as a whole life policy. Whole life policies for maximum coverage. One of the less known life insurance policies is the graded premium life insurance policy.

Level premium for a stated number of years the increases annually for the remainder of the contract b. Level premium for a stated number of years then decreases annually for the remainder of the contract They pay a lower premium rate that increases gradually over the first three to five years and then remains constant over the life of the policy.

Ad indonesia life insurance deals for expat individuals, couples and families. Coverage under which initial premiums are less than normal for the first few years, then gradually increase for the next several years until they become level for the duration of the policy. Graded premium whole life insurance.

What is the premium in a graded premium life insurance policy? With a modified premium whole life insurance contract, the amount of premium due is lower in the first years of the policy. For example, the death benefit will initially start out at a smaller amount in the early years of the policy, and then over time, the amount of the death benefit will gradually increase.

Decks in nc life insurance exam class (11): After the preliminary period, premiums level off and remain constant. That means they’re permanent policies that don’t expire on a certain date.

A type of whole life policy designed for people who want more life coverage than they can currently afford. Graded whole life policy d. Graded benefit whole life policies are specific products made available to people who cannot obtain coverage through traditional means.

In a traditional whole life insurance policy, premium payments are flat throughout the life of a policy. Click to see full answer. Graded benefit whole life insurance is a permanent life insurance policy.

Modified premium whole life insurance is very similar to basic traditional whole life insurance. Permanent — not term — life insurance can be obtained. A form of modified life insurance that provides for annual increases in premiums for a constant face amount of insurance during a defined preliminary period, with the purpose of making initial payments more affordable.

What is graded premium policy? This differs from a term policy that ends after a specific period, but it’s also not the same as a whole life policy. Graded benefit is a term used largely in final expense and guaranteed issue type policies where the death benefit of the policy is suspended for the first two to three years, unless the death is accidental.

With a modified premium whole life insurance contract, the amount of premium due is lower in the first years of the policy. With a graded benefit whole life policy, the amount of the death benefit in the policy is not the same amount at all times. Which is an accurate description of the premium in a grade premium life insurance policy?

Graded premium life is actually graded premium whole life insurance coverage under which the initial premiums are less than normal for the first few years of. Graded premium whole life insurance.

Permanent Final Expense Whole Life Insurance In 2021 Whole Life Insurance Final Expense Life Insurance

Understanding Whole Life Insurance Dividend Options

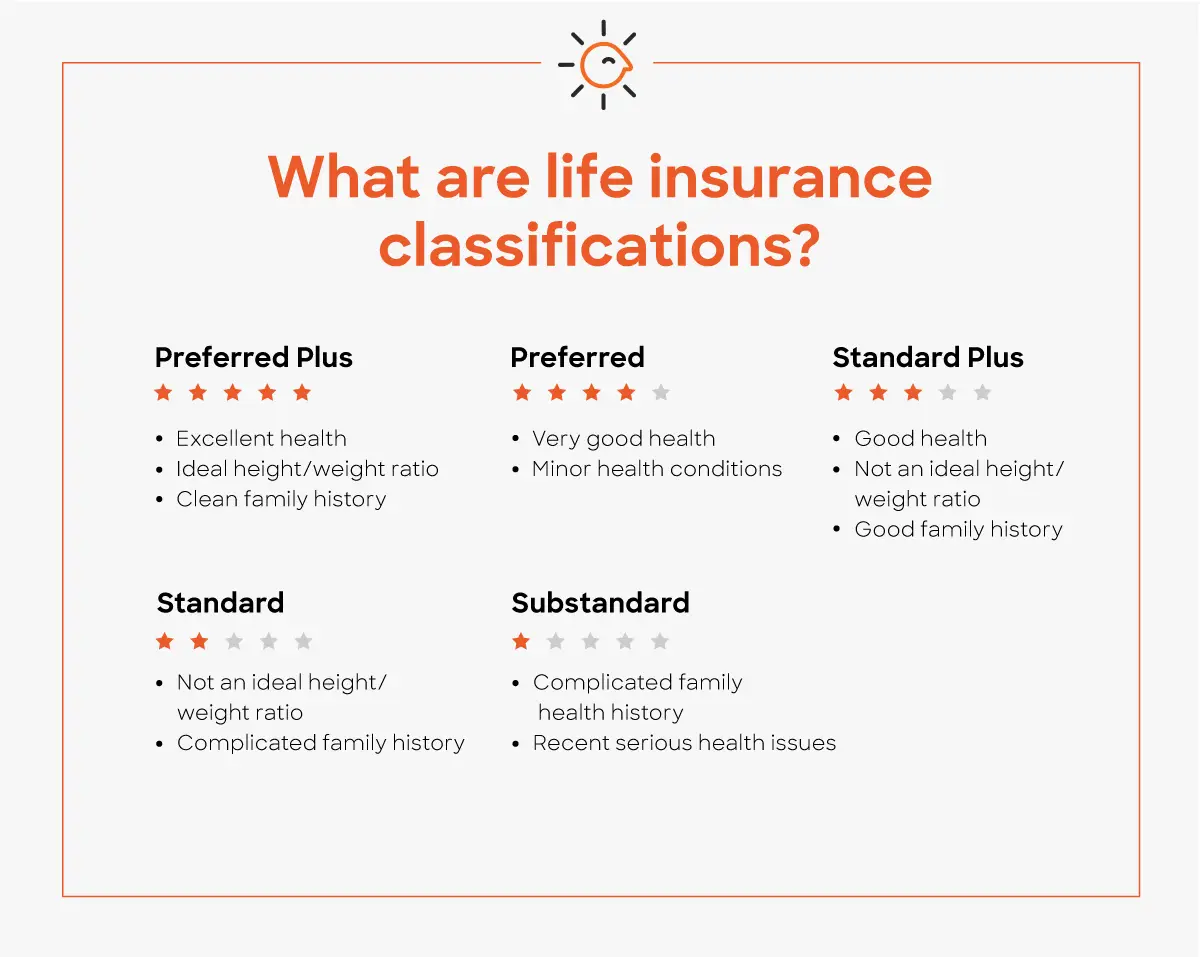

What Are Life Insurance Classifications Policygenius

Good Information On Types Of Life Insurance 6 Types Of No Exam Life Insurance Life And Health Insurance Life Insurance Quotes Life Insurance Agent

34 Whole Life Permanent Insurance

Guaranteed Issue Life Insurance Policies Fidelity Life

Permanent Final Expense Whole Life Insurance In 2021 Whole Life Insurance Final Expense Life Insurance

2021 Guide To Guaranteed Issue Life Insurance

Guaranteed Issue Life Insurance Policies Fidelity Life

Guaranteed Issue Life Insurance Policies Fidelity Life

Guaranteed Issue Life Insurance Policies Fidelity Life

Whole Life Insurance Policies – Online Whole Life Ethos Life

What Is A Graded Death Benefit In Life Insurance Forbes Advisor

What Is A Graded Death Benefit Compare 15 Insurance Carriers