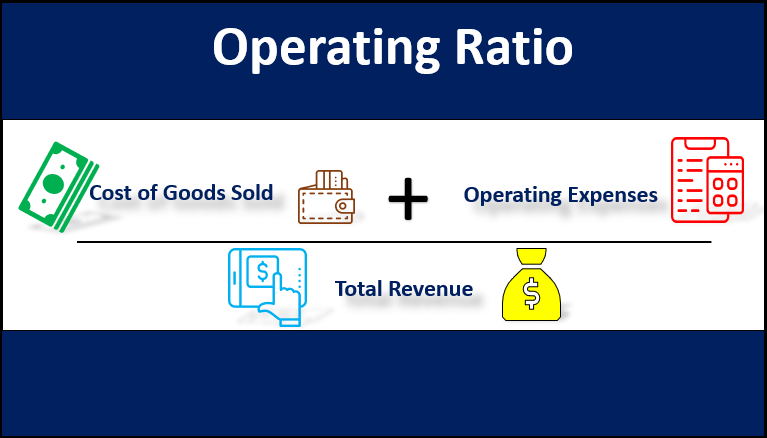

Expense ratio shows what percentage of sales is an individual expense or a group of expenses. The lower the loss ratio the better.

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

What does expense ratio mean?

What is a good expense ratio for an insurance company. According to a june 2016 analysis by willis towers watson, the overall expense ratio for the life insurance industry (excluding aviva life, sahara life and bharti axa life) dropped from 16.3% in. But it also generates $10. This is a cost that the insurer can deduct from your money.

There are two methodologies to measure the expense ratio; High expense ratios can drastically reduce your investment returns. Some expenses vary with the change in sales (i.e variable expenses).

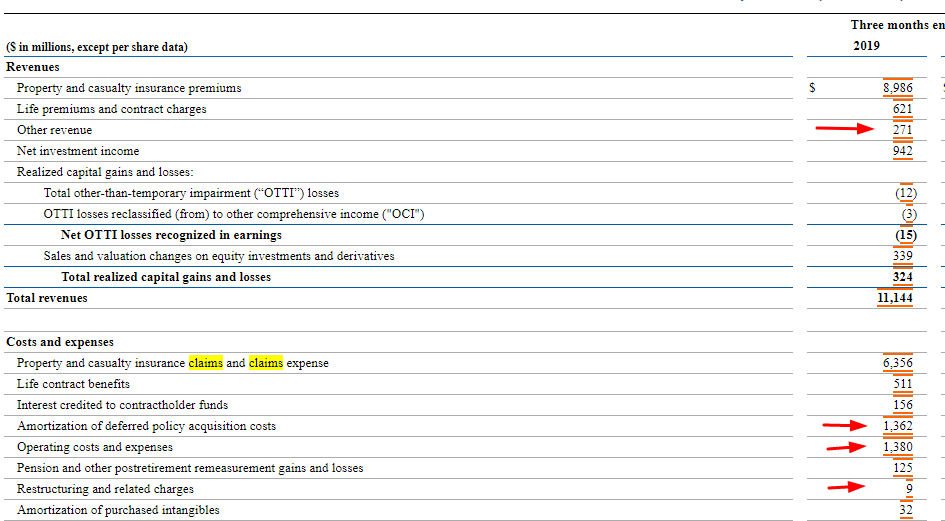

Expense ratio — the percentage of premium used to pay all the costs of acquiring, writing, and servicing insurance and reinsurance. The ratio for such expenses. Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the

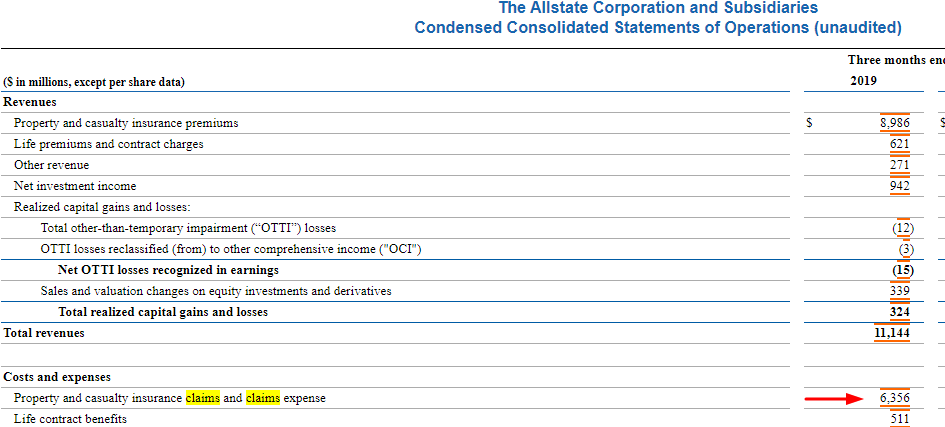

An expense ratio under 100% signifies that the insurance company is either earning or writing more premiums than it is paying out in expenses to. This will include commissions, operational and administrative expenses of the insurance company. Insurance is a commodity product, meaning that insurance purchased from one company is virtually the same as the next (unless your insurer goes broke before you need to.

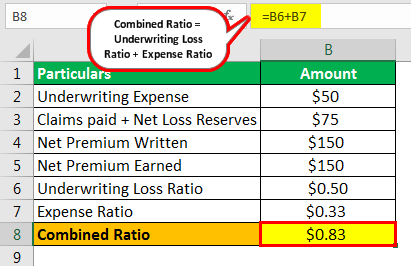

A lower ratio means more profitability and a higher ratio means less profitability. The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on. Insurance companies typically follow two methods for measuring their expense ratios:

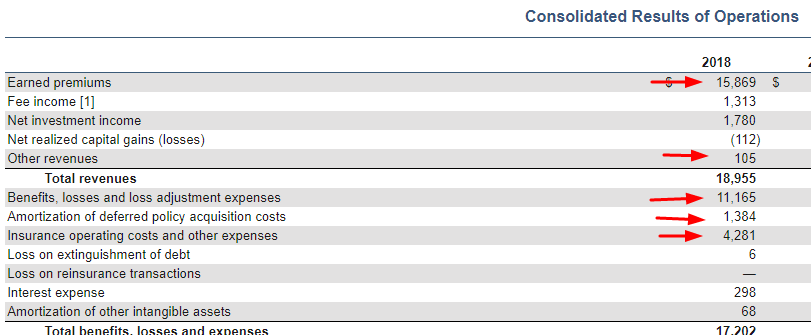

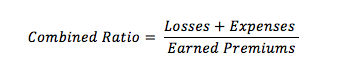

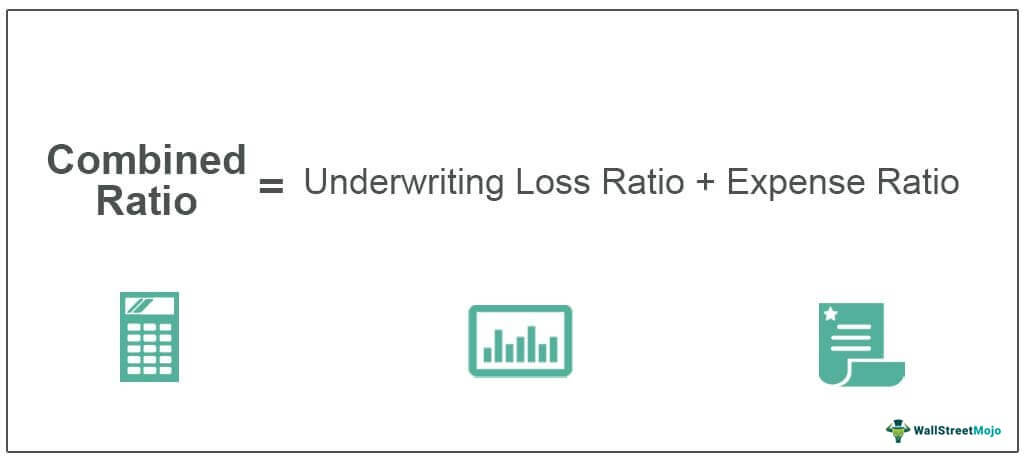

The expense ratio can be used to compare a company’s performance over a period of time. A combined ratio of more than 100% means that an insurance company had more losses plus expenses than earned premiums and lost money on its operations. Health insurance topics about ombudsmen

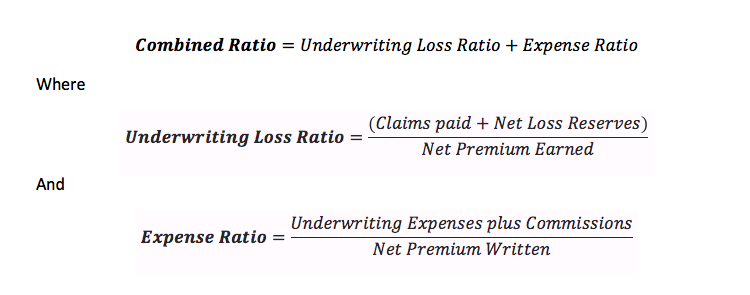

Combined ratio and its relevance: Expense ratio refers to the percentage of premium that insurance companies use for paying all the costs of acquiring, writing and servicing insurance, and reinsurance. Conversely, a combined ratio of less than 100% means that a company had more earned premiums than losses plus expenses and is operating in the black, while a combined ratio of exactly 100% is the.

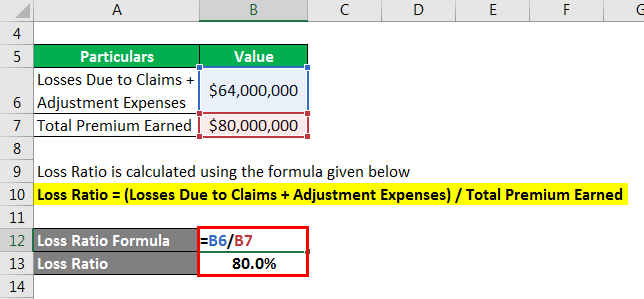

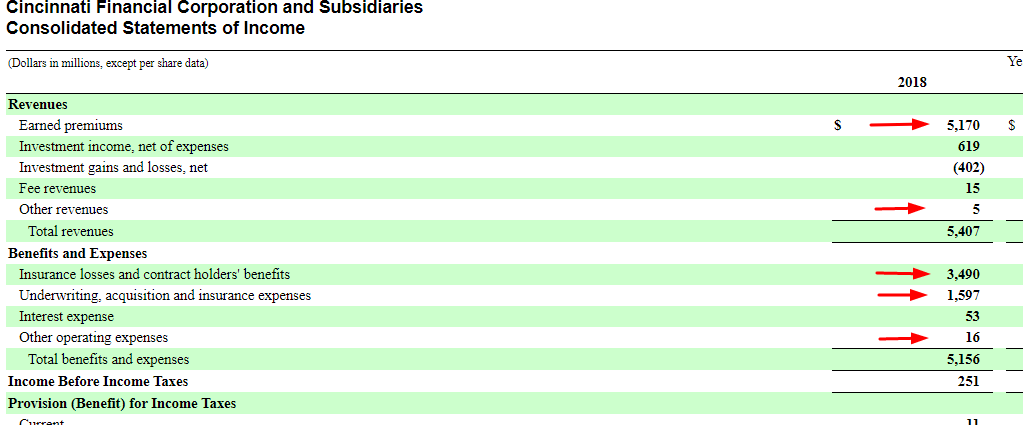

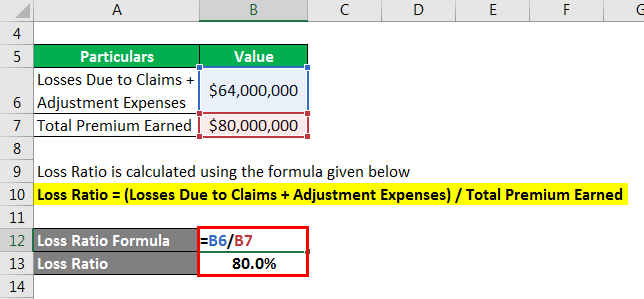

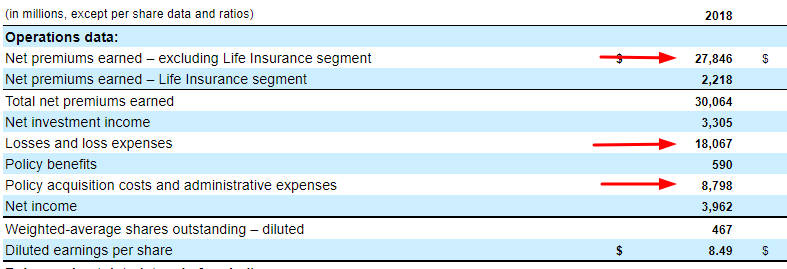

For example, an insurance company realizes $5 million in the underwriting losses from its total insurance policies sold. Analyst must be careful while interpreting expense to sales ratio. Usbr calculates the loss ratio by dividing loss adjustments expenses by premiums earned.the loss ratio shows what percentage of payouts are being settled with recipients.

The remaining 40% of your premium dollar is spent on “expenses” such as claims handling, insurance company filing fees, taxes, overhead, agent commissions, and attorney fees. A trade basis, which is expense divided by written premium and on a statutory basis when the expense is divided by earned premium. Generally, an expense ratio in the range of 0.5% to 0.75% is considered to be a good, low expense ratio for a mutual fund that is actively managed.

A ratio below 100% will mean that an insurance company is earning more revenue from writing premiums than it is shelling out in the form of expenses and vice versa. The underwriting expense ratio is a mathematical calculation used to gauge an insurance company's underwriting success. The expense ratio shows the percentage of the nep paid out in the course of acquiring, writing and servicing the insurance payments, often simplified as 'underwriting expense'.

Expense ratio = total fund expenses/total assets under management because the numerator of the expense ratio is total fund expenses, it’s easy to see why actively managed funds come with higher. The expense ratio of an insurance company is management expenses divided by the gross premium. An operating ratio of more than 100 indicates a company is unable to generate profits from its underwriting and investment activities.

The total cost incurred by the company related to selling, underwriting, onboarding and maintaining (i.e., customer service) property and casualty (p&c) insurance policies divided by total p&c premium earned over the same period of time, as a percentage. The trade method, where insurance companies divide their expenses by. Expense ratio greater than 1.5% is considered to be on the higher side.

We get the expense ratio after dividing the insurer’s expenses (marketing, commission, operational expenses, etc.) by the total premiums collected in a given year. Higher loss ratios may indicate that an insurance company may need better risk management policies to guard against future possible insurance payouts.

What Is An Expense Ratio Forbes Advisor

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

Best Health Insurance Companies In 2021 Based On Claim Settlement Ratio

Loss Ratio Formula Calculator Example With Excel Template

/GettyImages-1055247044-11273b0978844d7c96980190d0951498.jpg)

What Is The Expense Ratio In The Insurance Industry

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

What Is Combined Ratio The Motley Fool

What Are Expense Ratios How Do They Work Nextadvisor With Time

Operating Ratio Top 3 Different Examples Of Operating Ratio

Combined Ratio In Insurance Definition Formula Calculation

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

5 Metrics To Evaluate Life Insurance Business

Loss Ratio – Overview Formula Purpose And Interpretation

Loss Ratio Formula Calculator Example With Excel Template

Combined Ratio Benefits And Limitations Of Combined Ratio

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

Combined Ratio – Formula Calculation Example Analysis Definition –